Electric Vehicle Total Cost of Ownership: Cost Parity Propelled by Conflict in Ukraine

-

May 04, 2022

DownloadsDownload Article

-

Ten years ago, the nascent electric car industry faced seemingly insurmountable challenges to mass adoption. Today, far fewer doubts remain that electric vehicles (“EVs”) will inevitably become the dominant force in transportation. Current events may ultimately prove to be a catalyst for accelerated EV adoption, as they are reminding us of the geopolitical dependencies of gasoline. Oil prices have soared since the war in Ukraine began, making it more costly for drivers to fill up their vehicles. As a result, what has long been seen as a massive gap between internal combustion engines (“ICEs”) and EVs is quickly fading.

For the first time, analysis suggests that the total cost of ownership (“TCO”) – the total cost to own and operate a vehicle, accounting for inputs such as purchase and fuel prices – for EVs is more attractive than its ICE counterpart. Even so, there are still significant challenges to broader EV adoption, notably: (1) higher incremental purchase price and limited capacity; (2) battery supply chain constraints; and (3) lack of access to reliable charging. Efforts are being made by companies and governments alike to address these current barriers to entry.1,2 Despite these challenges, it is becoming increasingly viable for fleet operators to electrify their fleets. Given the lead time for such investment, fleet operators need to start planning in short order to not fall behind in the electric transition.

Total Cost of Ownership – Analysis

Vehicle electrification has been gaining momentum over the last decade. While the lion’s share of growth has been in the passenger vehicle segment, FTI Consulting envisions medium- to heavy-duty (“HDV”) fleet electrification as one of the most noteworthy trends of the next decade, particularly in Class 7 and 8 vehicles. Commercial fleets – ranging from delivery vans to school buses to garbage trucks – will undergo significant electrification over the next five to 10 years as fleet operators look to cut emissions. Already, purchases of medium- to heavy-duty vehicles are increasing, with buses as a prime example. Given favorable federal and state incentive programs and several at-scale companies like Proterra, Lion Electric and Bluebird, electric transit and school buses accounted for 39% of new EV sales in 2020.3 Other vehicle segments such as freight are seeing similar impetus, as electrification becomes increasingly cost-effective.

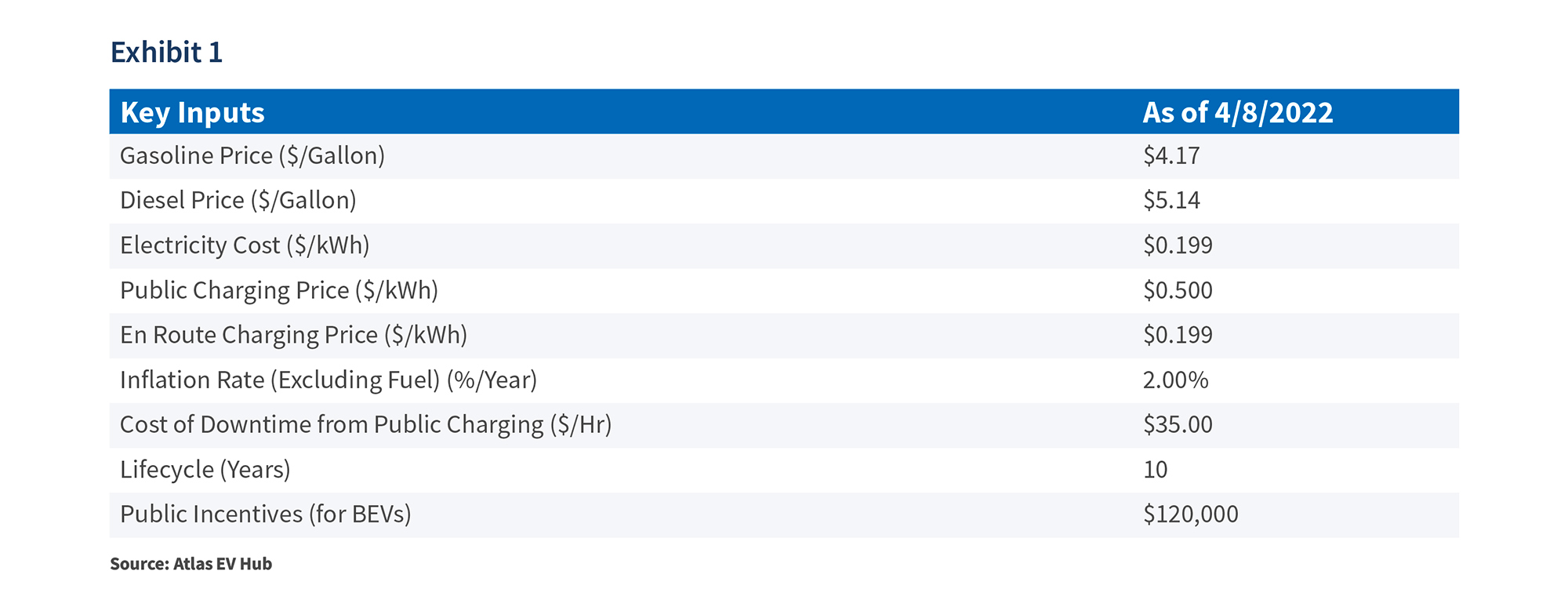

The following analysis examines the TCO, which is presented in cost per mile, for three different HDVs – long-haul freight, garbage trucks and school buses. Varying annual mileage has been applied for each vehicle type (respectively, 100,000, 25,000 and 15,000), given the use case as well as the following assumptions listed in Exhibit 1:

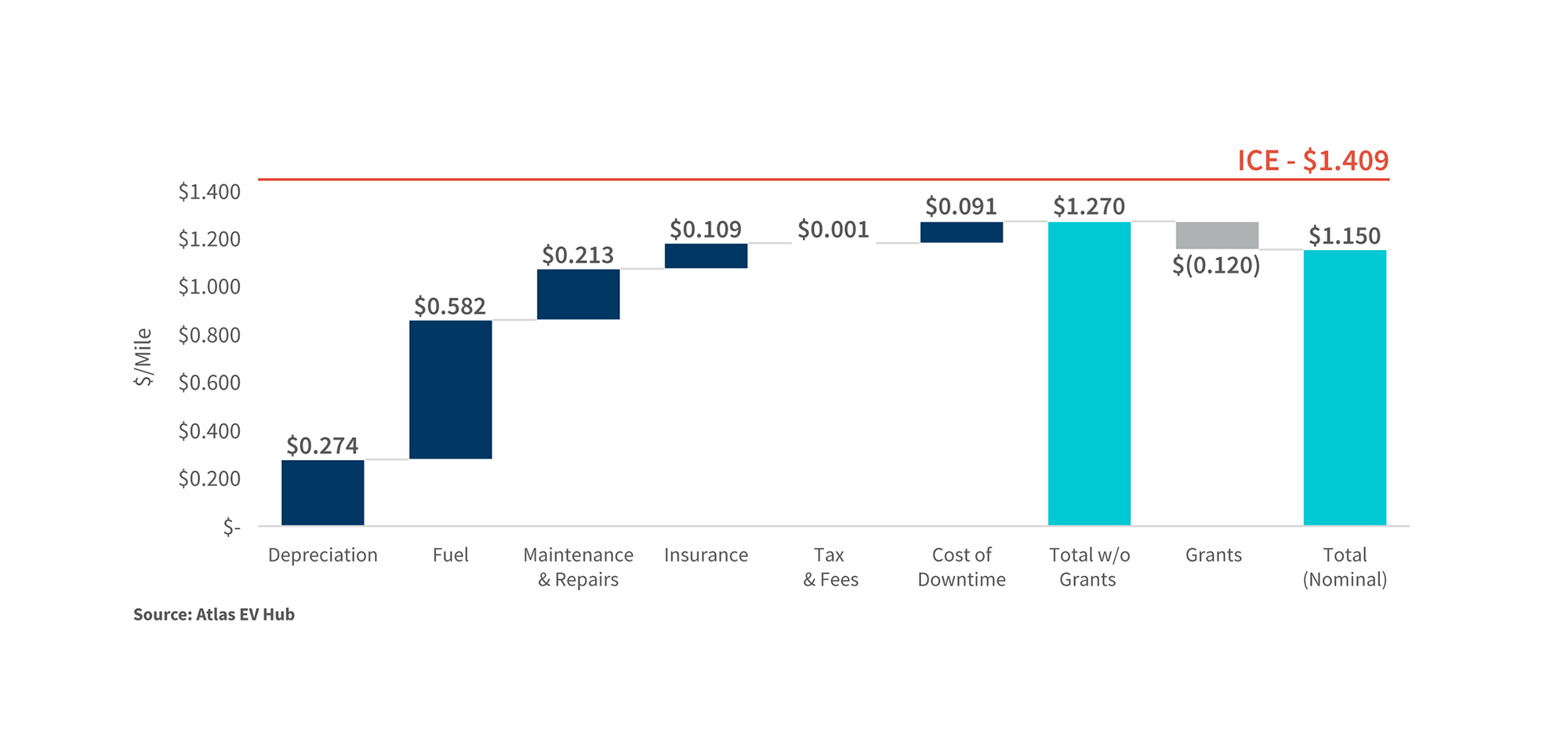

Exhibit 2 – TCO-Freight

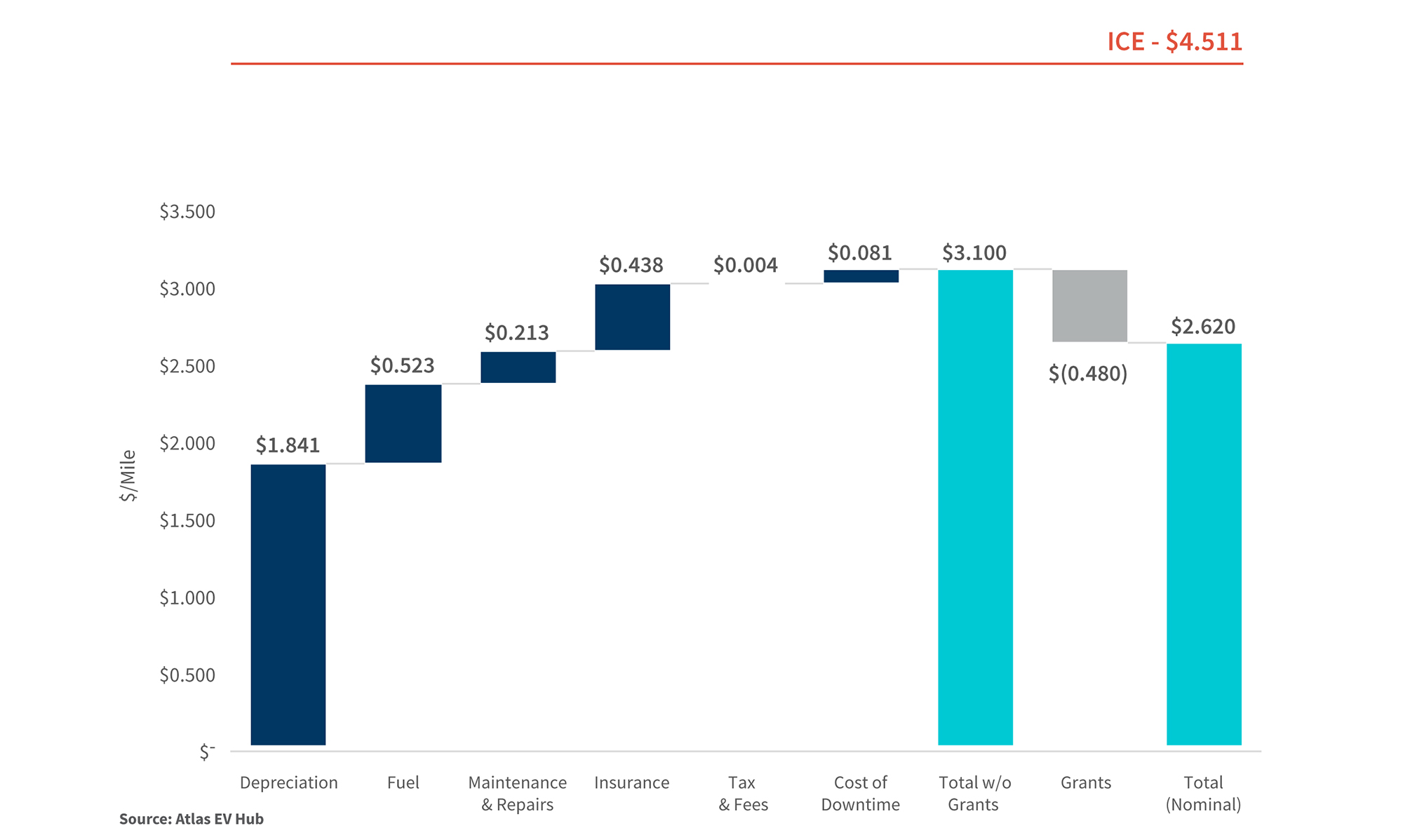

Exhibit 3 – TCO-Garbage

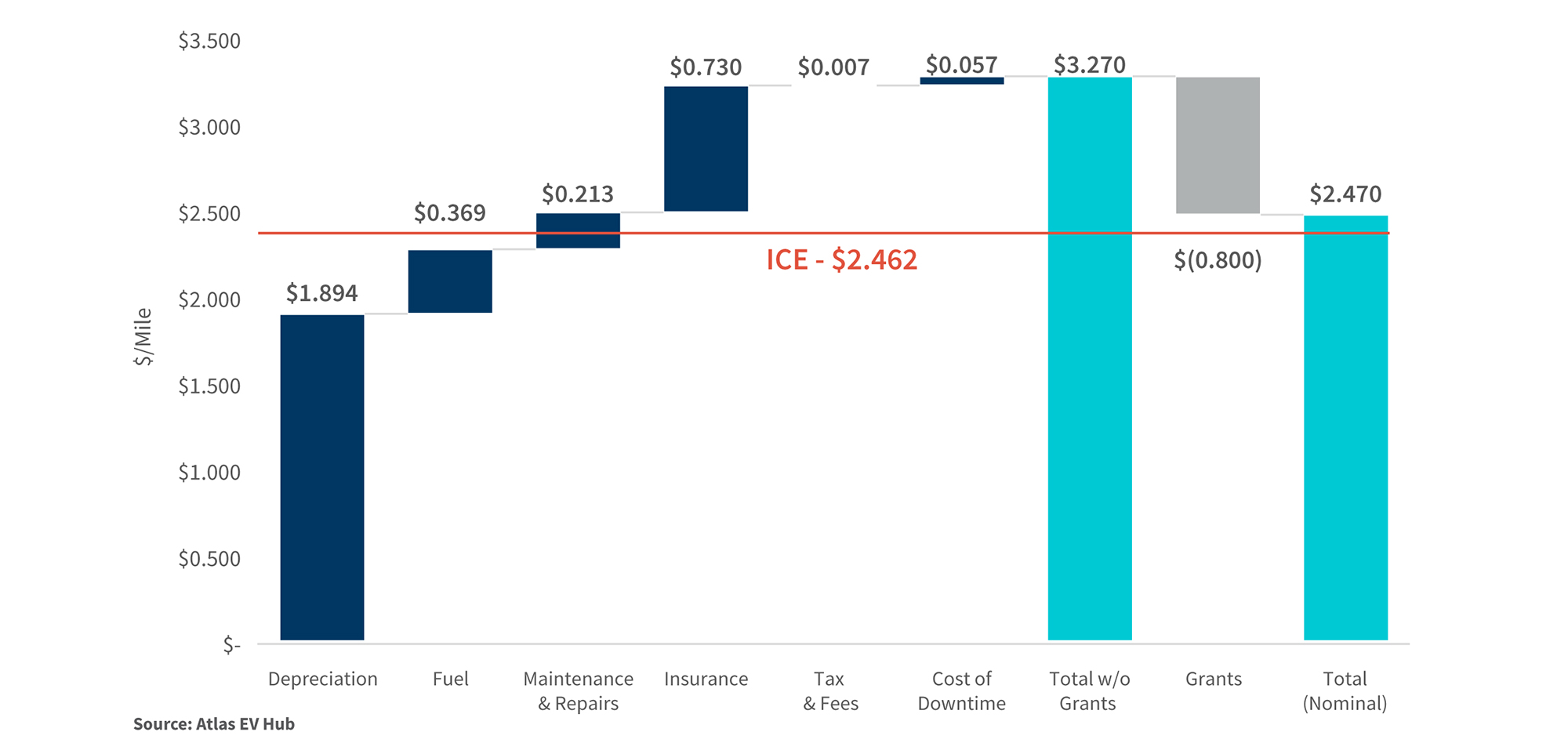

Exhibit 4 – TCO-Bus

For the first time, long-haul freight and garbage trucks have total cost of ownership less than their ICE counterparts. While electric school buses remain more expensive over the lifetime of the asset, the difference is marginal. The results in Exhibits 2-4 demonstrate where EVs have the advantage over ICEs: substantially lower fuel and maintenance costs. Given the ongoing Russia-Ukraine conflict, ICEs are becoming increasingly less attractive as fuel costs rise and become more volatile.4

Thus, it is expected heavy-duty vehicles will undergo drastic electrification this decade. Electric short-haul Class 8 vehicles will be increasingly deployed by 2025 on point-topoint routes where depot charging is possible, and electric long-haul Class 8 vehicles will be favorable to deploy on a TCO basis by 2025. Usage will be highly contingent on the deployment of en-route fast charging. This will represent a seismic shift for commercial fleets and alter business models for fleet operators, as higher up-front costs and lower fuel costs would change capital allocation and financing structures.

As illustrated in Exhibits 2-4, some HDV segments still rely on federal and state subsidies to be cost-competitive. There are state funding programs across the country making it more affordable for fleet operators to switch to EVs, and nearly $3 billion5 has been allocated from the Volkswagen settlement alone. California has been the pioneer in state-level EV funding, having allocated over $1.5 billion in public funding to EV adoption.6 One program that has been integral to the adoption of medium- and heavy-duty vehicles is California’s Zero-Emission Truck and Bus Voucher Incentive Project (“HVIP”), which has helped fund the purchase of over 9,000 clean vehicles.7 The program continues to receive millions of dollars in funding and is prioritizing investment in specific segments, such as school buses and drayage trucks. The state of New York is the next hotbed for public funding, as the governor’s office recently announced a commitment to transition the state’s entire fleet of public school buses to electric.8 Other states with active ports and complex interstate systems, such as New Jersey9 and Texas,10 have programs in place that provide funding to fleet owners seeking to replace their existing diesel-powered fleet.

Even without public funding programs, electric vehicles are more cost-competitive than they have ever been. However, there are still caveats to consider, notably, (1) purchase prices and model-specific battery availability, (2) battery costs and (3) private and public charging deployment and grid integration.

Considerations – MSRP/Fleets

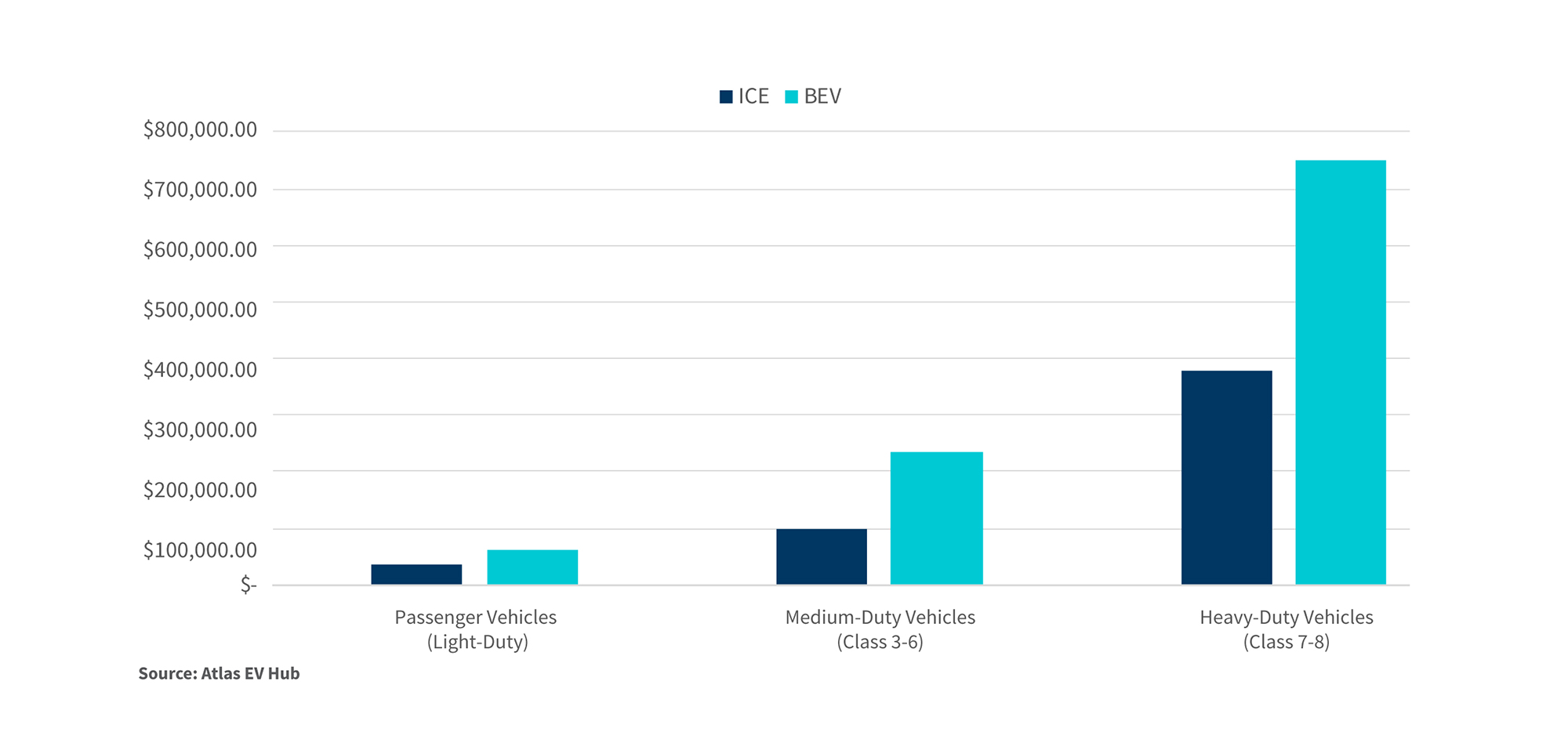

EV prices have come down a long way in the last decade but remain a significant barrier to entry. Exhibit 5 demonstrates the average difference in MSRP across vehicle class. An important caveat to note is that Class 7 and 8 vehicles represent the most diverse class, capturing everything from freight to specialty vehicles such as garbage trucks.11 As a result, prices vary widely, though this price range is observed in both ICEs and BEVs.

Heavy-duty vehicles experience the most significant difference in pricing, which has been a major inhibitor to adoption. On average, a fully electric version is ~50% more expensive. Additionally, current EV supply lags current demand, as most manufacturers face production backlogs. In fact, procuring an EV, whether in the passenger segment or as a heavy-duty fleet operator, carries significant lead time. Limited HDVs are available for purchase at this stage. As manufacturers adjust production to meet demand, prices and lead times will decrease and be on par with ICEs across vehicle segment. This will further accelerate attractive total cost of ownership for EVs.

Exhibit 5 – Retail MSRP (2017 - 2021 Models)

Considerations – Batteries

Vehicle purchase price and competitive TCO is heavily dependent on battery prices. As oil costs have risen in the last two months, so too have battery prices, mainly due to a drastic increase in nickel prices. Nickel has skyrocketed ~60% year to date, with prices climbing as high as $48,000/ton before trading was suspended for several days. Suppliers and OEMs are expected to absorb most of these costs, but it will affect vehicle prices as adjustments are applied. Tesla, for example, recently raised the price of its Model 3 by $2,000.12

The Russia-Ukraine conflict could prove to be a catalyst for greater change in the battery industry. Since 2016, nickel-based batteries have been the dominant chemical composition, with ~80% of EV batteries relying on nickel in 2022. With nickel prices expected to remain high and volatile for the oreseeable future, OEMs will look for solutions to an already complex supply chain, procuring lithium iron phosphate (“LFP”) batteries for EV manufacturing.13

The battery market – and a possible reversion to LFP batteries – will be significantly influenced by the development of a North American supply chain. This would mitigate supply chain woes the industry has been experiencing since before the COVID-19 pandemic. It would also resolve the remaining chemistry and configuration questions, notably: (1) the cost and performance tradeoffs between LFP and high-nickel cathodes; (2) anode evolution and the shift from graphite to higher silicon compositions; and (3) the potential move to solid-state cells with lithium anodes. A fully developed North American battery supply chain may not be far off. The United States is already the second leading producer of batteries behind China and hopes to shrink that gap. OEMs are investing heavily in their U.S. manufacturing capacity, with companies like Toyota14 and Stellantis15 announcing plans to spend on battery plants in the United States. As for nickel supply concerns, critical U.S. allies Canada and Australia boast significant nickel deposits. Though significant challenges will remain, North America’s battery supply chain may mature quickly as OEMs look for substitutes for Russian nickel.16

Considerations – Charging

To successfully deploy a fleet of medium- to heavy-duty electric vehicles, fleet owners and operators must have access to adequate charging networks. Currently, the United States lacks the public charging infrastructure necessary for most potential owners and operators to make the switch to electric. That is quickly changing, in large part due to the Biden administration’s Infrastructure Investment and Jobs Act (“IIJA”). Within the IIJA bill, $5 billion has been allocated to accelerating the deployment of public charging stations across the United States. Much of the funding will specifically target highway corridors, a critical asset for long-haul freight electrification. How the $5 billion is spent, and how fast infrastructure is deployed, will be integral to the speed of electrification.17

Grid reliability and demand management will be among the biggest hurdles to EV adoption for consumer and commercial users alike. Electricity demand will increase with the adoption of EVs, so charging infrastructure will need to be seamlessly integrated into the grid to successfully electrify fleets across the country. Currently, the United States has ~130,000 charging stations.18 The Biden administration has set a goal of 500,000 by 2030.19 To manage this added capacity, charging deployment will need to be strategically planned.

Fleet electrification will require the deployment of both Level 2 and DC fast-charging infrastructure. How these different technologies should be set out is dependent on the use case. Fleets that are capable of overnight charging, such as public buses or short-haul freights with charging depots, will be able to rely on lower-voltage Level 2 charging infrastructure. Alternatively, fleets with less accessibility to overnight charging, such as long-haul Class 8, will rely on DC fast-charging capability. The funding from the IIJA should alleviate charging concerns for the latter. Regardless, a mix of charging technology will be critical to manage local grids.

The primary question fleet owners and operators will have to ask themselves is whether to wait for the adequate deployment of public charging infrastructure or to invest in private charging hubs. The latter, while adding to the total cost of ownership, should be seen as a revenue-generating asset. Using vehicle-to-grid technology (“V2G”), charging hub owners can sell power back to the grid during hours of peak demand. PG&E and GM are partnering to deploy a V2G pilot program to test how the technology can alleviate grid constraints.20 Alternatively, the integration of renewables and battery storage can boost the autonomy and potential revenue of a charging hub. By generating proprietary power, charging hubs face less constraint from grid operators and can off-take excess power during high-demand periods. In the next decade, many fleet operators who build out private charging hubs will leverage renewables and V2G technology to increase revenue that will alleviate high initial capital expenditures associated with fleet electrification.

How FTI Consulting’s Power, Renewables & Energy Transition Team Can Help

Fleet electrification is a complicated decision with long-term implications, heightening the impact on broader business strategy and implementation. Understanding the lifetime cost of an asset is crucial for optimal decision-making. Having the right charging deployment strategy will determine whether the switch is viable and funding tenable. Fleet owners and operators who have a fulsome understanding of the current landscape can capitalize on existing levers to make the switch early and avoid overpaying relative to ICE costs to operate. It pivotal to garner that understanding as soon as possible, as switching to an electrified fleet takes significant lead time and a thorough game plan. It requires engaging automotive manufacturers and dealers, suppliers of charging solutions, local utilities, and possibly even renewable OEMs and suppliers. It is therefore pivotal to have a robust understanding of the complete value chain.

FTI Consulting’s Power, Renewables & Energy Transition professionals have extensive expertise across the renewables and eMobility value chains. Our team has assisted a broad set of mobility industry players on topics ranging from policy evaluations and forecasts to market entry strategy and tactical implementation plans. Our experts analyze public policy and funding opportunities, engage utilities for charging hub deployment, procure renewable assets for charging needs, conduct financial analysis on asset acquisition, facilitate build-versus-buy decisions, advise on M&A transactions, and optimize business operations. Making the switch to electric, and growing the fleet size, requires significant expertise and foresight. We support our clients every step of the way.

Footnotes:

1: “Infrastructure Investment and Jobs Act of 2021.” Alternative Fuels Data Center (November 15th, 2021). https://afdc.energy.gov/laws/infrastructure-investment-jobs-act

2: Michelle Toh. “Toyota is Spending $35 Billion on Electric Cars to Close Gap on Rivals.” CNN (December 14th, 2021). https://www.cnn.com/2021/12/14/business/toyota-electricvehicles-lg-batteries-intl-hnk/index.html

3: Colin McKerracher et al. “Electric Vehicle Outlook 2021.” BloombergNEF. https://about.bnef.com/electric-vehicle-outlook/

4: Bozorgmehr Sharafedin et al. “As Fuel Prices Rise to Record Highs, Governments Look for Solutions.” Reuters (March 10th, 2022). https://www.reuters.com/business/energy/fuelprices-rise-record-highs-governments-look-solutions-2022-03-10/

5: “VW Settlement.” Atlas EV Hub. https://www.atlasevhub.com/materials/vw-environmental-mitigation-fund-tracking/

6: “State Policy Dashboard.” Atlas EV Hub. https://www.atlasevhub.com/materials/state-policy-dashboard/

7: “Incentives for Clean Trucks and Buses.” California HVIP. https://californiahvip.org/

8: Michelle Lewis. “New York State Commits to 100% Electric School Buses by 2035.” Electrek (April 8th, 2022). https://electrek.co/2022/04/08/new-york-state-governor-100-electricschool-buses-2035/

9: “Incentives to Drive Green.” Air Quality, Energy & Sustainability. https://nj.gov/dep/drivegreen/dg-electric-vehicles-affordability.html

10: “Emission Reduction Incentive Grant Program.” Texas Commission of Environmental Quality. https://www.tceq.texas.gov/airquality/terp/erig.html

11: “Making Sense of Truck Classification.” FullBay. https://www.fullbay.com/blog/truck-classification/

12: James Vincent. “Tesla Raises Prices Across Entire Range, With its Cheapest Car Now Starting at $46,990.” The Verge (March 15th, 2022). https://www.theverge.com/2022/3/15/22978817/tesla-ev-price-increase-raw-materials-inflation

13: Jeniece Pettitt et al. “Why the EV Industry Has a Massive Supply Problem.” CNBC (March 8th, 2022). https://www.youtube.com/watch?v=CM1fL5D1_W8

14: Aaron Fowles. “Toyota Charges into Electrified Future in the U.S. with 10-Year, $3.4 Billion Investment.” Toyota (October 18th, 2021). https://pressroom.toyota.com/toyotacharges-into-electrified-future-in-the-u-s-with-10-year-3-4-billion-investment/

15: Fernao Silveira and Shawn Morgan. “Stellantis and LG Energy Solutions to Invest Over $5 Billion CAD in Joint Venture for First Large Scale Lithium-Ion Battery Production in Canada.” Stellantis (March 23rd, 2022). https://www.stellantis.com/en/news/press-releases/2022/march/stellantis-and-lg-energy-solution-to-invest-over-5-billion-cad-in-jointventure-for-first-large-scale-lithium-Ion-battery-production-plant-in-canada

16: Reicelene Joy Ignacio. “Nickel Producers Confident They Can Fill Gap if Russian Supply is Cut Off.” S&P Global (April 1st, 2022). https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/nickel-producers-confident-they-can-fill-gap-if-russian-supply-is-cut-off-69423564

17: “Infrastructure Investment and Jobs Act.” Atlas EV Hub. https://www.atlasevhub.com/materials/invest-in-america-act-h-r-3684/

18: “EV Charging Deployment.” Atlas EV Hub. https://www.atlasevhub.com/materials/ev-charging-deployment/

19: Joann Muller. “Biden Wants 500,000 EV Charging Stations. Here’s Where They Should Go.” Axios (August 6th, 2021). https://www.axios.com/electric-vehicle-charging-stationsequity-1b00f7a6-f87a-4125-9bc0-82399663b345.html

20: “PG&E and General Motors Collaborate on Pilot to Reimagine Use of Electric Vehicles as Backup Power Sources for Customers.” PG&E (March 8th, 2022). https://www.pge.com/en_US/about-pge/media-newsroom/news-details.page?pageID=c77a4e23-f8fc-4774-9786-0dba87a203db&ts=1646754047003

Published

May 04, 2022

Key Contacts

Key Contacts

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About