FCA Launches Consultation on Motor Finance Compensation: What Does it Mean?

-

October 09, 2025

-

The Financial Conduct Authority (“FCA”) has published its consultation on a proposed industry-wide motor finance compensation scheme.1 In designing the scheme, the FCA has sought to balance several objectives: providing timely and fair redress to affected customers, safeguarding the integrity of the motor finance market and ensuring the scheme is practical and operationally efficient. The result is a standardised methodology designed to apply across millions of historic motor finance agreements, facilitating a high degree of automation in the redress process, but also presenting a significant data and coordination burden between lenders and dealerships.

The consultation is open for six weeks and feedback is sought by 18 November 2025. Subject to the outcome of the consultation, the FCA plans to publish final rules in early 2026. The FCA has also proposed to extend the time for responding to paused complaints until 31 July 2026. This would allow those complaints to be considered under the redress scheme by that date.

Extending Beyond Discretionary Commission Arrangements

The proposed redress scheme will cover all regulated motor finance lending taken out between 6 April 2007 and 1 November 2024. Customers would be presumed to have been treated unfairly and eligible for redress if their case involved one or more of the following arrangements and they had not been provided with adequate disclosure about the arrangements at the time of sale:

- A Discretionary Commission Arrangement (“DCA”).

- A high commission arrangement, where commission was equal to or more than 35% of the total cost of credit and 10% of the loan.

- A tied arrangement2 with the dealer which gave a lender exclusivity or a first right of refusal.

This broader scope means that certain non-DCA lending (such as Revenue Share of Advance) could be eligible for redress if they meet the criteria for high commission or involved a tied dealer arrangement. The approach reflects the Supreme Court’s decision in Johnson v FirstRand Bank Limited (“Johnson”),3 which found that unfairness can arise even without a discretionary commission where there was insufficient disclosure of the commission arrangements which involved high commission levels and tied dealer relationships.

Lenders may rebut the presumption of unfairness in limited circumstances, such as where they can evidence that the disclosure of the arrangement is adequate and, for DCA cases, that the broker selected the lowest available rate at which no extra commission was earned.

The FCA has proposed that for the purposes of the scheme, “adequate disclosure” means clear and prominent information about the relevant arrangement was provided to the customer before they entered into the loan agreement. Such disclosures could have been provided either through pre-contractual documents or verbal communication. Information hidden in small print or embedded within lengthy terms and conditions is unlikely to meet the threshold for adequate disclosure under the scheme unless the attention of the customer was drawn to it.

In setting out its expectations for the specific disclosures required for each type of arrangement, the FCA has also indicated that simply disclosing the bare fact or possibility of commission (for example, that commission “would”, “may” or “typically” be payable) would not have been sufficient to constitute adequate disclosure.

Proactive Customer Contact Exercise

Under the FCA’s proposals, lenders will be required to identify affected customers, whose agreement featured one or more of the three arrangements and adequate disclosure about the arrangements had not been provided, and inform them of their potential eligibility for compensation.

The FCA proposes a hybrid approach combining opt-in and opt-out features to ensure broad participation while maintaining customer engagement:

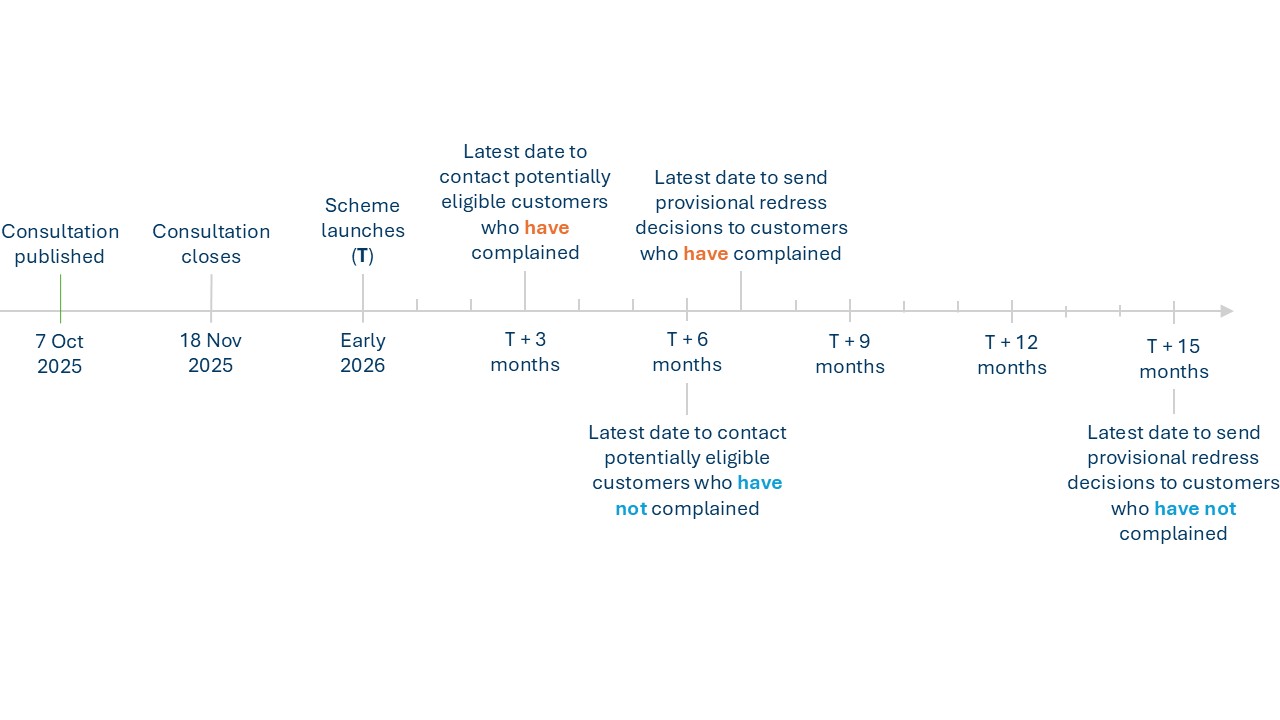

- Customers who have already complained will need to be contacted within three months of the start of the scheme and will be automatically included in the scheme unless they opt out.

- Customers who have not previously complained will need to be contacted within six months of the scheme’s start and invited to opt in.

Customers who are not contacted could request for their case to be reviewed if the request is made within one year of the scheme’s launch.

The FCA has stated that while some consumers may choose to be professionally represented by Claims Management Companies or law firms, the scheme is designed to be simple and free to use — and it expects all parties to work constructively to ensure fair, timely redress.

Implementing customer contact exercises can present significant operational challenges. Lenders will need to locate, verify and contact large numbers of customers across a 17-year period, often using legacy systems and incomplete records. Customers will have changed addresses, contact details or vehicle ownership, meaning firms will need robust tracing processes and data-matching capability to ensure communications reach their intended recipients. The FCA’s consultation acknowledges these complexities and invites feedback on how firms can best balance inclusivity, fairness and efficiency when executing the customer-contact and response process.

Calculating Redress

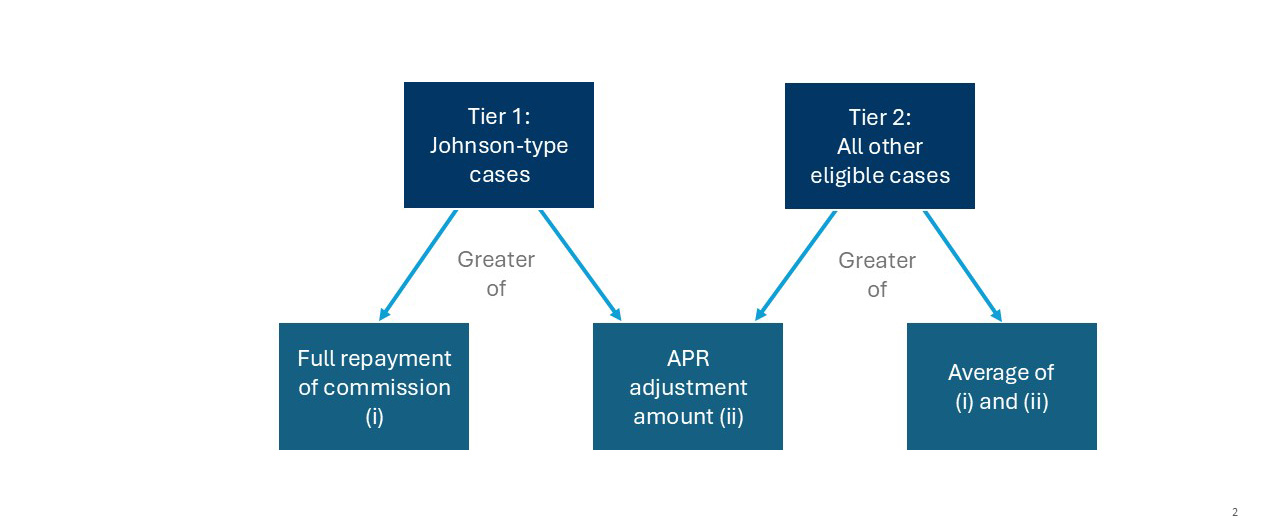

The FCA has proposed a two-tier framework for calculating redress.

Tier 1: Johnson-type cases

For cases involving inadequate disclosure of a high commission arrangement where the commission exceeds 50% of the total cost of credit and 22.5% of the loan amount and the arrangement is tied to the dealer (commonly referred to as “Johnson-type” cases), the proposed redress is the greater of:

- The commission paid to the dealer, and

- The difference between the actual loan cash flows and the cash flows that would have arisen assuming a market-adjusted APR had applied (“APR adjustment amount”). The market-adjusted APR is derived by multiplying the actual APR by 0.83. If the transaction involved a DCA and the minimum commission-paying interest rate was higher than the market-adjusted APR, that minimum DCA APR should be used instead.

The APR adjustment amount serves as a modelled loss estimate, comparing what a customer actually paid with what they would have paid under a fairer loan.

Tier 2: All other eligible cases

For all other cases eligible for redress, the FCA proposes compensation based on the higher of:

- The average of the commission paid to the dealer and the APR adjustment amount, and

- The APR adjustment amount.

In all cases, simple interest will be added to the redress amount. This interest is calculated using the annual average Bank of England base rate plus 1%, applied from the date of overpayment to the date the compensation is paid.

Timeline

The timeline below illustrates the FCA’s proposed sequencing under the proposed redress scheme, showing the latest dates for lenders to contact customers to inform them of their potential eligibility for compensation – both those who have already complained and those who have not – together with the point at which provisional redress decisions are due to be reached.

Managing the Data Challenge

Delivering the scheme consistently will depend heavily on the availability and quality of data. Lenders will need to determine whether they can access the information necessary to assess cases accurately, trace customers effectively and evidence compliance with the scheme rules.

In many cases, critical data, particularly evidence of point-of-sale disclosures, will need to be sourced from dealers and brokers. Given that some transactions may date back more than a decade and involve third-party intermediaries, firms may face challenges in retrieving complete and reliable records.

Lenders will be expected to take practical and proportionate steps to address any data gaps. Where internal records are incomplete, lenders may need to draw on credible evidence from third parties such as brokers, dealers or other finance intermediaries to verify agreement details to confirm eligibility. Although the FCA’s consultation does not explicitly refer to the use of customer-supplied data, similar redress exercises, including PPI and other consumer-credit remediation programmes, have accepted such evidence where firm data was missing or incomplete.

To support assessments of adequate disclosure, lenders could use indicative records, such as documentation from other customers in sufficiently similar circumstances, to reduce reliance on dealers and brokers.

Preparing for FCA Oversight

The FCA will proactively supervise lenders’ compliance with the compensation scheme on an ongoing basis.4 Firms will be monitored to ensure that they take appropriate measures to inform customers that they may be eligible for redress, interpret and apply the scheme rules as intended and consistently and deliver redress in line with the scheme’s objectives.

Customers dissatisfied with their case outcome may appeal to the Financial Ombudsman Service (“FOS”), which will apply the same scheme rules when reviewing cases.

This level of scrutiny means redress programmes must be built for transparency and explainability, not just technical accuracy. Firms should design end to end auditability, from data ingestion to calculation and customer communication. Clear documentation of rule interpretation, edge cases, and treatment of vulnerable customers will be essential, supported by real time management information (“MI”) and second line oversight to respond to FCA and FOS challenge.

Revisiting Provisioning and Disclosure

In light of the FCA’s consultation, firms are expected to reassess their financial provisioning and ensure that market disclosures remain accurate. This will require running fresh scenario analyses using the FCA’s proposed redress methodologies, stress-testing assumptions about customer engagement, and modelling delivery timelines and operational capacity.

All firms should review their capital buffers, access to liquidity and any covenants that could be triggered by redress liabilities. It is essential to document the rationale behind key assumptions and engage early with auditors and boards to ensure that provisioning decisions are robust and defensible under scrutiny.

What Should Firms Do Now?

Whilst the FCA's Dear CEO letter acknowledges that issues will arise in the redress process, it emphasises the importance of accurate, swift and robust responses to their requirements and set out five high-level expectations for firms participating in the redress scheme.5 We have outlined seven recommended actions that provide a more granular roadmap to help firms operationalise these expectations across data, governance and customer engagement, reflecting the practical complexity of implementation:

- Consolidate agreement data for all regulated motor finance contracts entered into between 6 April 2007 and 1 November 2024 into a standardised data model. This should include commission structure, loan terms, disclosure practices and other factors relevant to scheme eligibility and rebuttal. AI and leading technology tools can efficiently automate data extraction from legacy PDFs and scanned documents.

- Assess data quality and completeness, particularly for older agreements. Engage brokers and dealers early to obtain missing information and confirm disclosure practices, ensuring data lineage and reconstruction logic are clearly documented.

- Run diagnostic analysis to identify agreements potentially in scope for redress based on scheme criteria, helping to prioritise operational planning and engagement strategies.

- Segment the customer population to distinguish between complainants and non-complainants, as each group will follow different timelines and outreach requirements once the scheme is live.

- Verify and enrich customer contact data, with a focus on non-complainants. Firms should ensure they can support the FCA’s proposed proactive engagement model, including tracing capabilities for hard-to-reach customers.

- Design the end-to-end redress process, including redress calculation logic – based on reliable data with reasonable clearly articulated and defensible assumptions – case management systems, audit trails and management information reporting frameworks. These should be consistent and support real-time challenge from internal and external stakeholders.

- Assign clear Senior Manager accountability for scheme implementation, supported by strong second and third-line oversight to ensure readiness, consistency and responsiveness to FCA supervision.

The FCA’s consultation marks a pivotal moment for the motor finance sector. Firms now have a short window to stress-test their data, infrastructure, customer journey design and provisioning assumptions. Those who start early will be better placed to respond confidently, not just to the regulator, but to customers, dealers and shareholders alike.

Footnotes:

1: FCA Consultation Paper 25/27 (October 7, 2025)

2: Tied arrangements refer to contractual relationships between a lender and a broker, such as exclusivity agreements or rights of first refusal, that may restrict the broker’s ability to offer finance from other lenders.

3: UKSC/2024/0158

4: Supra, footnote 1

5: “Motor Finance Commission Redress: Action We Expect Firms to Take Now,” FCA (October 7, 2025)

Published

October 09, 2025

Key Contacts

Key Contacts

Senior Managing Director, EMEA Head of Financial Services, Forensic & Litigation Consulting

Senior Advisor

Senior Managing Director

Managing Director

Senior Director

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About