Perspective on Transactions Activity in the Chemicals Industry

-

February 17, 2023

DownloadsDownload Article

-

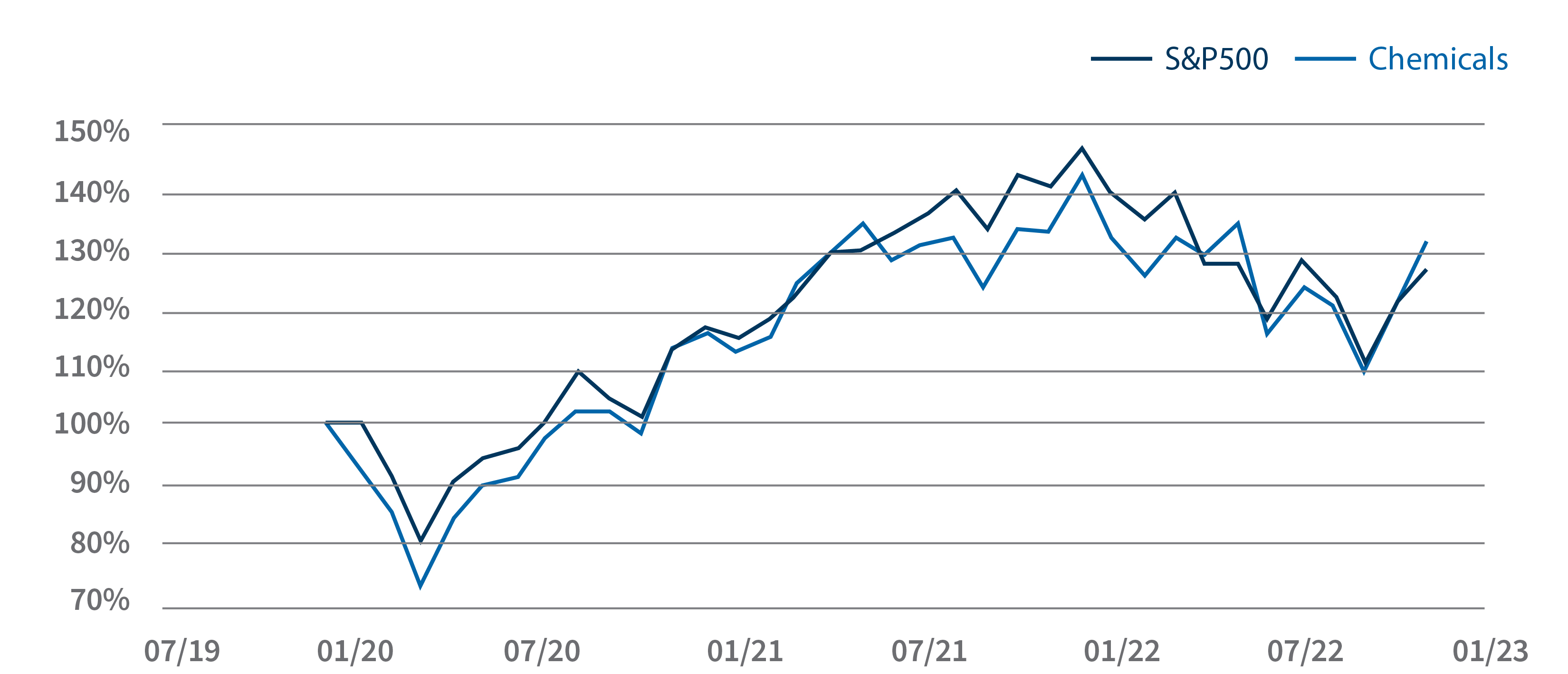

In the last three years, the S&P 500 Chemicals Index has tracked closely with the broader S&P 500 Index. We expect the chemicals component to be more resilient than the broader market index in the near term because it has recovered from a period when it lagged the broader index and investors look for an area to invest in with stability and broad exposure. We will discuss recent developments that will influence expected M&A activity in the chemicals industry going forward.

Figure 1 - S&P 500 vs Chemicals

Source: FTI Consulting, Inc.

Chemicals Industry M&A Trends

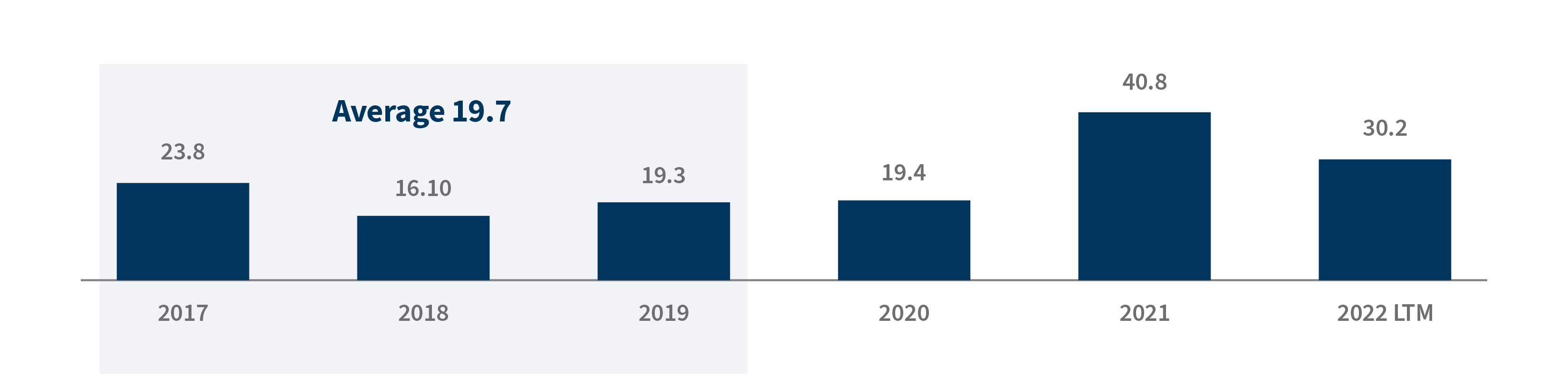

From 2017 to 2019 , the total value of M&A transactions larger than $25 million in the North American Chemicals sector averaged $19.7 billion annually. Although 2020 total deal value was nearly equal to its pre-COVID years, total deal value spiked to $40.8 billion in 2021 as the economy recovered from COVID-19. However, 2022 LTM figures have declined by 26%, largely because of higher interest rates and volatile financial markets.1 Though we don’t anticipate deal activity returning to its 2021 peak, transaction activity should remain robust given the amount of investment capital available to pursue deals. This will be coupled with an appetite to invest in established, stable industries critical to supporting broad components of the economy,including, but not limited to energy, food, construction and semiconductor manufacturing. Additionally, the North American geography for the Chemicals industry is favored due to feedstock cost advantages as well as flexibility (i.e. ability to switch between ethane, propane, butane, etc.). Of particular importance for the Chemicals industry is the value that can be generated from carve outs as large firms look to sell off pieces of their business.

Figure 2 - Chemicals Industry Total M&A Deal Value ($B USD)

Source: FTI Consulting, Inc.

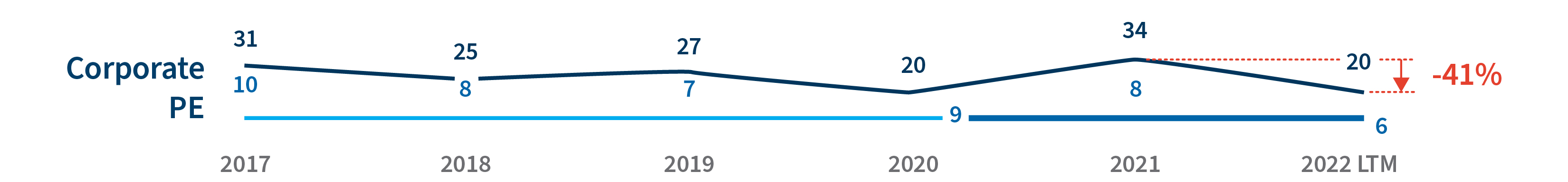

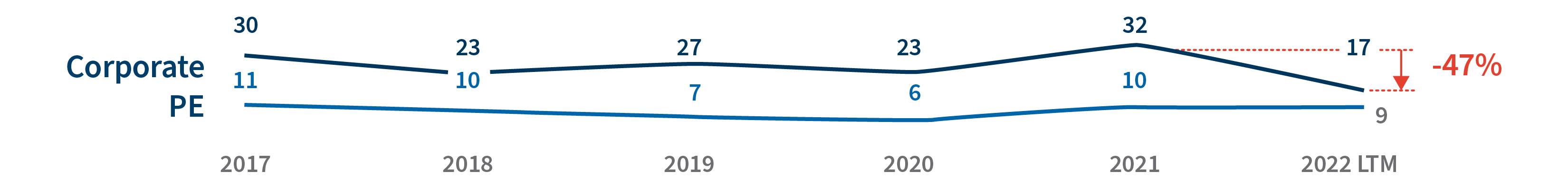

From 2021 to 2022, corporate-buyer deals have dropped by 41%; similarly corporate seller deals have dropped 47%.2 Although the number of deals by private equity has remained flat, we expect private equity activity to increase, since these entities have huge sums of available capital to deploy, an example of which is the private equity interest in Braskem. We anticipate corporate entities to be cautious in the near term.

Figure 3 - # of Deals by Buyer Type

Source: FTI Consulting, Inc.

Figure 4 - # of Deals by Seller Type

Source: FTI Consulting, Inc.

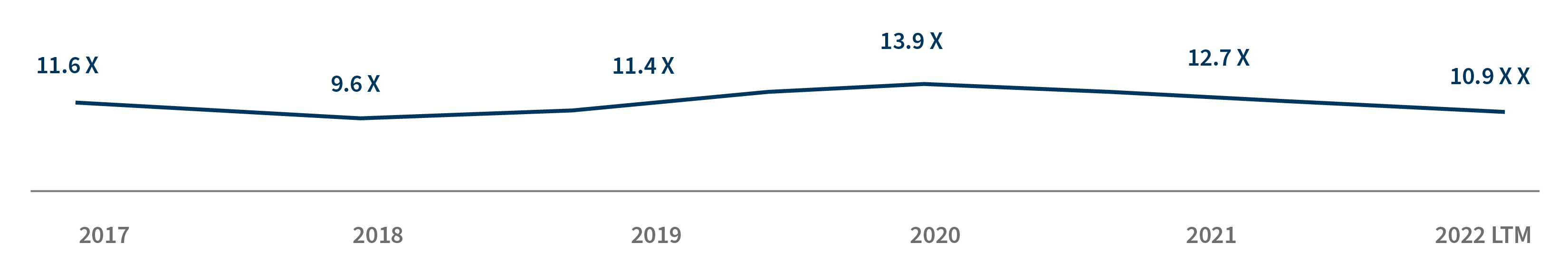

Multiples on deals in 2022 have begun to decline relative to the previous three years.3 As we expect corporate entities to be less active in pursuing deals, private equity entities may feel compelled to pursue transactions as a result of declining multiples.

Figure 5 - Implied Enterprise Value to EBITDA Ratio

Source: FTI Consulting, Inc.

Chemicals Industry Influences

Several important influences have developed during the COVID-19 pandemic and subsequent recovery.

- Ukraine War: As a result of sanctions imposed on Russia, Europe has reduced imports of oil and gas from Russia, thereby increasing price volatility. Chemical manufacturers have shut off some production because of energy costs as well as increases in other raw material costs. There are instances of factories relocating to other geographies, such as Africa and the Middle East. High energy prices have had a negative impact on the European economy, increasing the likelihood of further manufacturing shutdowns. To mitigate supply reduction from Russia, Europe is consuming more offshore gas. This will mitigate price volatility to the extent that the region does not experience a cold winter. Although gas storage is currently at capacity, a prolonged cold snap will result in higher prices as stored gas is depleted.

- Strong U.S. Dollar: The historically strong U.S. dollar is impacting trade between regions. It is much more expensive for Europe to import products from the U.S. than it has been historically. Furthermore, the strong U.S. dollar is making it more economical for the United States to import from Asia. However, this is complicated by China’s prolonged COVID-related shutdown.

- Regulatory concerns: There has been intense scrutiny on mergers, particularly focused on potentially monopolistic deals, by the Biden administration and the DOJ. For instance, DuPont did not include the Delrin business, a subunit of the Mobility and Materials (M&M) business unit as part of its M&M business unit sale. Although regulatory complexities may complicate deals, they create additional opportunities for carve-outs.

- COVID: While certain regions of the world have largely recovered from the pandemic, the demand for cleaning agents remains high. High demand for cleaning agents is expected as COVID-19and related variants linger across the globe. Regions (mainly China) that have not recovered from the pandemic and are still experiencing lockdowns continue to see suppressed economic activity. In the case of China, production of goods is down, causing regions that import goods from China to consider alternative sources.

- Logistics: There continues to be volatility in shipping availability and rates. Ocean shipping rates have been declining while rail and trucking rates are still increasing. Depending on the market, manufacturers are losing margin to distributors. Many are reconsidering their distribution strategies to recapture margin.

- ERP Systems: Many transactions in the chemicals industry involve companies that have different versions of SAP. The process of consolidating SAP systems in a chemicals merger is usually expensive and time consuming because of the complexity of manufacturing/plant integration, global nature of the industry, regulatory requirements and business complexity. In a typical merger, synergies are expected soon after a deal closes, but it can often take up to two years to integrate SAP systems.

- Venezuela sanctions: In light of the Ukraine war and OPEC’s recent production cut, sanctions have been relaxed on Venezuela. Chevron has a six-month permit to receive oil from Venezuela. Alternative oil supply will be a boon to the chemical industry in both the United States and Europe.

Key Takeaways

Although deal activity in the chemicals industry won’t surpass activity levels of 2021 that followed the pandemic, we expect the chemicals component of the S&P 500 to outperform the broader index as investors favor stable, broadly reaching industries in the advantaged region of North America. We expect private equity entities to pursue more transactions than we have seen in the last several years due to potential declining multiples and readily available cash, thereby allowing chemicals to outperform the greater market and sustain continued transaction activity.

Future discussion will focus on the following:

- Private equity activity in chemicals industry

- Due diligence considerations for chemicals industry

- Business unit approach for chemicals megamergers

- Chemical industry value-creation opportunities

Footnotes:

1: Capital IQ.

2: Ibid.

3: Ibid.

Related Information

Published

February 17, 2023

Key Contacts

Key Contacts

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About