Private Equity Value Creation

Bridging Valuation Gaps With Focus on Profitability

-

October 02, 2024

DownloadsDownload Report

-

Due to elevated interest rates, the disconnect between borrowing costs and price multiples has led to valuation discrepancies between buyers and sellers in the private equity market. This has subsequently reduced the number of transactions, and funds are increasingly unable to divest assets and return capital to investors.

As portfolio companies remain unsold, the exit market continues to decline and dry powder continues to accumulate. To reverse this trend and move past the ongoing economic uncertainty, funds will need to fully embrace value-creation plans and organically drive valuation multiples. With the Fed’s recent half-point interest rate cut, the market may slowly come back but funds will need to stay ahead of the curve.

At FTI Consulting, our clients have emphasized EBITDA expansion through targeted near-term top-line and cost improvements over sole focus on revenue growth in the current macro environment. As a result, we’ve worked alongside clients to implement various value-creation programs in the last 18 months. We expect continued focus on profitability/EBITDA improvement programs as funds look for creative ways to drive activity within the current deal environment.

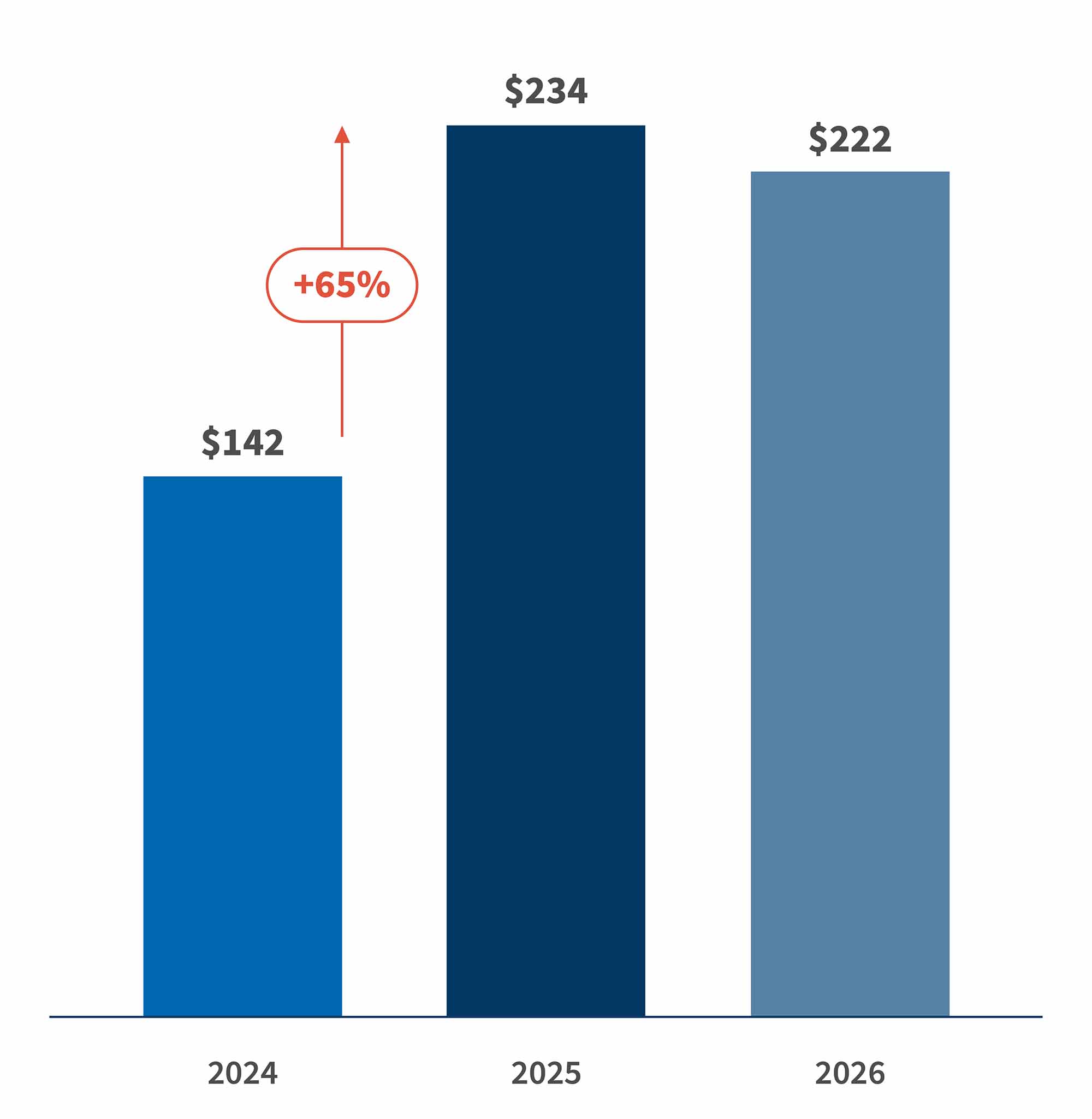

U.S. private equity debt is projected to have $234 billion worth of maturities in 2025, a 65% increase from 2024 (Figure 1).1 This will result in an increase in refinancings during a period of elevated interest rates, driving higher debt costs and lower valuations. Simultaneously, funds are increasingly returning less capital to investors, via historically low DPI: some of the largest PE funds have seen a nearly 50% drop in cash distributions compared to 2021.2 Understandably, investors are placing greater emphasis on DPI, with many planning to reduce fund investments should they see a prolonged reduction in this metric.3 Some LPs, such as sovereign wealth and pension funds, have explicitly requested that private equity funds release and return capital tied up in older investments.4

Figure 1 – NA Private Equity Debt Maturity ($b)

Source: LSEG LPC

In addition to looming debt maturities and historically low DPI, dry powder overhang by vintage continues to grow year-over-year. This growth has led to record levels of accumulated capital, and given the typical five-year investment cycle, pressure to deploy has never been greater. The current amount of unused capital is nearly $1 trillion (Figure 2),5 representing significant opportunity cost.

All three factors — debt coming to maturity, low DPI and large dry powder — are set to create a showdown between funds and LPs as fund managers seek to deploy capital in a valuation-challenged environment while LPs grow frustrated with the lack of cash returns.

Figure 2 – U.S. Private Equity Dry Powder – Overhang & Accumulation ($B)

Source: Pitchbook - “Q1 2024 US PE Breakdown”

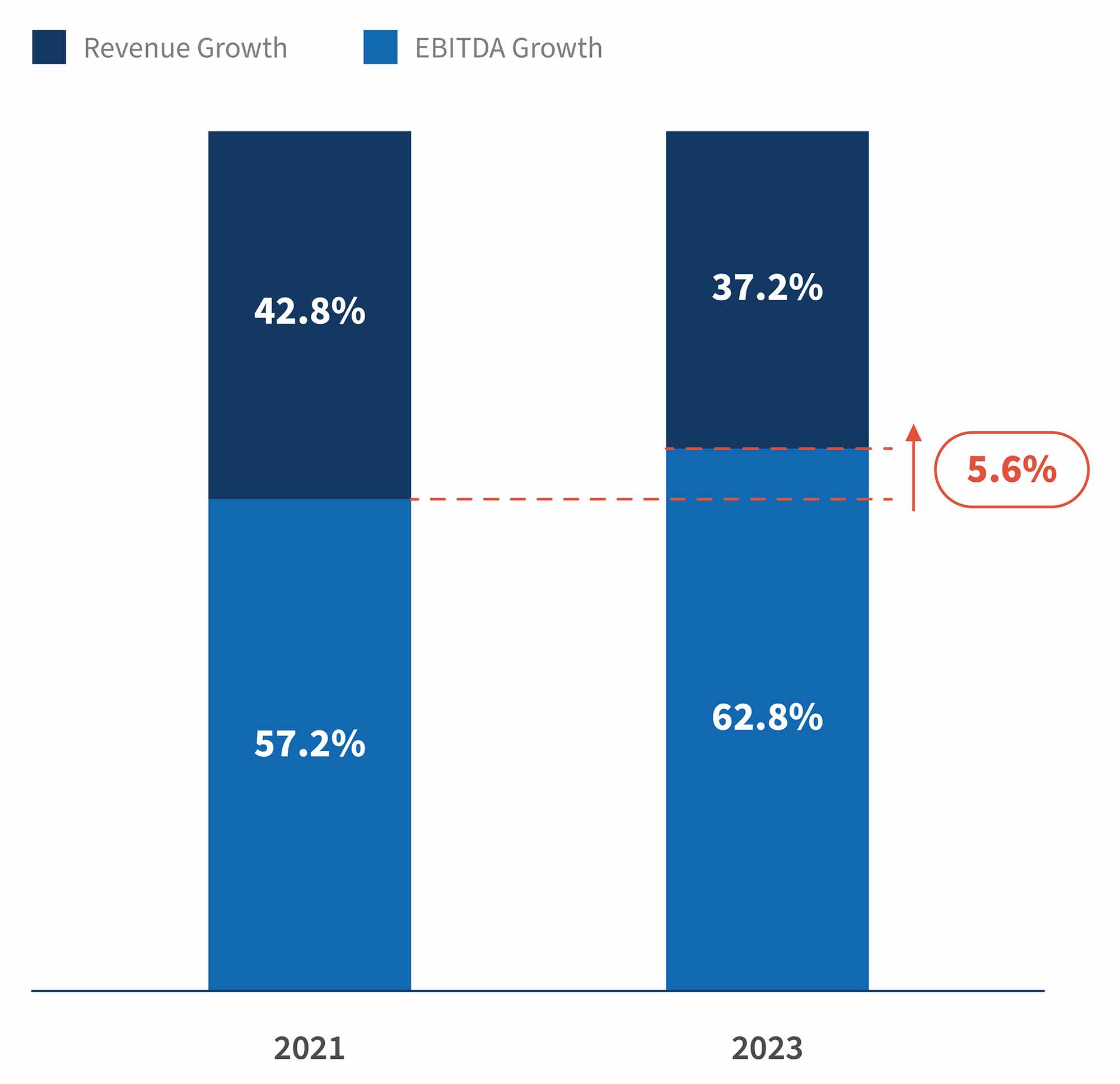

Within the technology sector, a popular metric in the last several years has been the Rule of 40, where the sum of a company’s year-over-year revenue growth percentage and EBITDA margin percentage should ideally exceed 40% for a healthy business. In the peak ZIRP (Zero Interest Rate Policy) environment of 2021, valuations soared primarily based on revenue growth potential. However, with tightening macroeconomic conditions and elevated interest rates, the Rule of 40 data has shifted to emphasize a greater focus towards profitability versus pure revenue growth. When we compare public and private technology companies from 2021 to 2023, the EBITDA percentage contribution to the Rule of 40 shifts from 57% to 63%, demonstrating a notable prioritization of profitability as valuations prove more challenging (Figure 3). We have observed a similar pattern among our most recent set of technology clients, where the median EBITDA contribution to the Rule of 40 stood at 60%.

As the constrained deal environment persists, funds should assess their exit strategy, informed by expectations on interest rate cuts and the performance of their portfolio companies. Companies looking to exit in the near-term can leverage tactical revenue levers such as upsell, cross-sell, revamped product positioning & pricing, and customer retention plays, as well as targeted cost optimization initiatives. Companies with longer-term exits will have more flexibility to consider broader transformation programs that comprehensively address all growth and cost levers.

Figure 3 – U.S. PE Information &Amp; Technology Companies Contribution to the Rule of 40

Source: FTI Consulting analysis

In the tech sector, PE-backed companies are placing more emphasis on carving out non-core business areas and acquiring targeted add-ons to strengthen the attractiveness of their technology platforms and core recurring business and associated growth.6 Operators are anticipating that when the market becomes more active, these smaller tactical deals will maximize returns when companies are sold.

Regardless of when funds exit, the future economic picture remains unclear and will continue to dampen both the current and future outlooks for portfolio companies. Value-creation plans are becoming table stakes for funds looking to exit their investments, return capital to their LPs, and realize returns.

Footnotes:

1: NA Private equity debt maturity, LSEG LPC, 2024.

2: Odeh, Layan, et al. “Private Equity Payouts at Major Firms Plummet 49% in Two Years.” Bloomberg.com, 21 February 2024.

3: Benitez, Laura, et al. “$8 trillion private equity industry faces ‘real cultural change’ as sources say investors are pulling funding amid a deal apocalypse.” Fortune, 16 January 2024.

4: Benitez, Laura, et al. “Large Backers of Private Equity Are Asking For Their Money Back.” Bloomberg.com, 11 January 2024.

5: PitchBook, “Q1 2024 US PE Breakdown”, 2024.

6: Piscopo, Sal. “Where Are The Deals Happening In Private Equity And Tech M&A In 2024?” Forbes, 30 May 2024.

Related Information

Published

October 02, 2024