Recovery of Unabsorbed Head Office Overheads

-

February 21, 2022

DownloadsDownload Article

-

Delays are common-place on construction projects throughout the world and may be caused by various factors such as constructive changes, differing site conditions, construction sequence or the parties’ slow responses to requests.

Delays may lead to an increase in the cost of carrying out the work and contractors will often seek an adjustment to the contract to compensate them for both the time and cost impacts. Most forms of contract allow the contractor to claim for loss and/or expense and the heads of such claims will usually include, amongst other things, for the valuation or assessment of head office overheads.

A common and consistent issue that both contractors and sub-contractors face when valuing prolongation claims is the valuation of head office overheads.

What are head office overheads?

Head office overheads exist because the business exists and are simply described in the publication ‘Calculating Construction Damages’ as being “…actual cost, which is an essential part of the cost of doing business”.1 Typical examples of such head office overhead costs are:

- Executive and administrative salaries;

- Head office rental;

- Insurances;

- Utilities expenses;

- Stationery, photocopying and similar expenses;

- Legal and accounting expenses;

- Advertising and recruitment costs; and

- Human Resource costs.

The full list is more encompassing than the above and contractors will often prepare detailed accounts that establish the normal costs involved in running their business on an annual basis. Assessment of head office overhead recovery

There are two common methods/approaches which the assessing party may utilise when undertaking the valuation of head office overheads that result from a delay to a project:

- Loss of Opportunity; or

- Additional overheads actually expended.

The ‘actual cost’ approach is traditionally less popular because the records necessary to support the claim are seldom available. For example, very few contractors and sub-contractors require staff based in head office to complete detailed timesheets for the time allocated to each project.

An ‘opportunity’ based claim arises on the theory that, because of a delay, the contractors’ or sub-contractors’ organisations have lost the opportunity to earn head office overhead (and profit) contributions elsewhere. This has become the ‘normal’ basis of claims for head office overhead because it is the simplest to calculate. A case often referred to by contractors when including a claim for overheads by use of a formula method is J F Finnegan v Sheffield City Council.2

In the above case, the Judge, Sir William Stabb QC said:

“It is generally accepted that, on principle, a contractor who is delayed in completing a contract due to the default of his employer, may properly have a claim for head office overheads during the period of delay, on the basis that the work-force might have had the opportunity of being employed on another contract which would have had the effect of funding the overheads during the overrun period”.

In 1983, in Tate & Lyle v Greater London Council,3 a claim was advanced by simply adding a percentage to the overall claimed cost. This approach was rejected by The House of Lords’ judgement, an abstract from which states:

“While I am satisfied that this head of damage can properly be claimed, I am not prepared to advance into an area of pure speculation when it comes to quantum. I feel bound to hold that the plaintiffs have failed to prove that any sum is due under this head”.

Based on the above, it is probable that a simple ‘percentage-based’ approach will not succeed.

At the time of the Tate & Lyle case there were already in existence a number of formulae that could have been used in the pursuit of a reasonable valuation of head office overheads. Textbooks will often refer to three main formulae to ascertain a representative value for head office overheads, these being:

- Hudson Formula;

- Emden Formula; and

- Eichleay Formula.

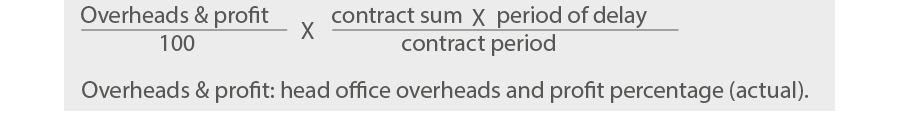

The Hudson formula was first published in the tenth edition of ‘Hudson’s Building and Engineering Contracts’ in 1970. The formula has since been incorporated into the Society of Construction Law Delay and Disruption Protocol, and is based upon the following formula:4

Hudson Formula

The usual practice, when bidding for a project, is to add a single percentage value to cover the Overheads and Profit. However, unless separately identified, this single percentage will often include elements of risk, contingency, head office and site overheads and profit and therefore does not accurately represent a provision solely for head office overheads.

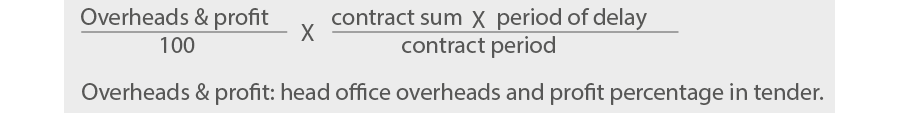

From the Hudson formula came the Emden formula - an improvement on Hudson in that the formula was based upon the actual head office overheads cost and not a theoretical percentage.

To establish the actual head office overheads, reliance was placed upon audited accounts of the contractor or sub-contractor. This is favourable to most as, unlike Hudson, it relies on audited and published data to correlate actual cost impacts. The Emden formula is presented as follows.5

Emden Formula

The Emden formula has found support in certain cases such as Beechwood Development Company (Scotland) Limited v Stuart Mitchell T/A Discovery Land Surveys6 in which Lord Hamilton stated:

“There is no practicable means of assessing this loss other than application of a formula utilizing the percentage of the pursuers’ turnover represented by overheads and profit”.

Further, the availability of audited annual accounts is helpful as this enables an assessment to be based upon actual data to establish a reliable head office overhead percentage.

Hudson and Emden both rely upon the ability of the pursuing party to prove that there has been a loss ofopportunity. This is seen in Mr. Justice Akenhead’s ruling in Walter Lilly v Mackay7 in which he states:

“it is necessary for the contractor to prove on a balance of probabilities that if the delay had not occurred it would have secured work or projects which would have produced a return (over and above costs) representing a profit and/or a contribution to head office overheads.”

The premise for the adoption of both Hudson and Emden formula is that a loss of opportunity can be proven. Should it not be possible to prove such a loss, this may lead to Hudson and Emden being inapplicable.

In the United States, the Eichleay formula is more extensively used and most commonly on contracts with the Federal Government. In Capital Electric Co.8 the Eichleay formula received criticism when Judge Lieblich stated:

“...after publication of this opinion, that the Government will never again go along with any payment to a contractor for “extended overhead” nor will it ever again agree to the application of the Eichleay formula to any overhead calculation in a construction case. Whether distinguished or overruled, those prior decisions will be dead letters hereafter.”

However, the Federal Circuit reversed Capital Electric and reinstated the contractor’s right to recover home office overhead using the Eichleay formula.9

This formula, as shown below, is a three-step calculation where each step is dependent upon the previous:10

Step 1: establish the head office overhead costs attribute to the contract as follows; divide the final contract sum (excluding the claims for head office overhead) by the total revenue for the contract period, then multiply the result by the total head office overhead costs incurred during the actual period of performance of the contract.

Step 2: divide the figure resulting from Step 1 by the number of days of actual performance of the contract, to establish a daily rate.

Step 3: multiply the figure resulting from Step 2 by the number of days compensable delay.

The Eichleay method of valuation is useful in establishing the unabsorbed head office overheads specifically related to the contract by apportioning the actual total head office overheads to the contract based on the revenue of both the contract and the business.

Summary

Notwithstanding the above, it is acknowledged that in the United States and Canada there are at least six other formulae not considered in this article that have been adopted to assess unabsorbed head office overheads, these being Allegheny, Canadian, Carteret, Ernstrom and Manshul. This shows that there is no one approved formula for calculating a contractor’s loss.

To reiterate the comments of Lord Hamilton, “There is no practicable means of assessing this loss other than appli-cation of a formula” … Just be sure to choose the right one!

This was excerpted from the December 2021 Edition of thePulse, our quarterly newsletter which provides interesting and topical articles from our Construction Solutions team and other leading industry and legal writers from around the APAC region.

Footnotes:

1: Schwartzkopf, William, John J. McNamara and Julian F. Hoffar. 1992

2: J F Finnegan v Sheffield City Council [1989] 43 BLR 124

3: Tate & Lyle v Greater London Council [1983] 2 AC 509

4: Society of Construction Law Delay and Disruption Protocol 2nd Edition, Appendix A

5: Society of Construction Law Delay and Disruption Protocol 2nd Edition, Appendix A

6: Beechwood Development Company (Scotland) Limited v Stuart Mitchell T/A Discovery Land Surveys [2001] CILL 1727

7: Walter Lilly & Co. Ltd v Giles Patrick Cyril Mackay & DMW Developments Ltd [2012] EWHC 1773 (TCC)

8: Capital Electric Co. v United States, GSBA Nos. 5316, 17, 83,3 BCA 16.548

9: U.S Court of Appeals for the Federal Circuit – 729 F.2d 743 (Fed. Cir. 1984)

10: Society of Construction Law Delay and Disruption Protocol 2nd Edition, Appendix A

Published

February 21, 2022

Key Contacts

Key Contacts

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About