Strategic Hedging Amid Interest Rate Shifts

-

September 12, 2024

DownloadsDownload Article

-

Since the Federal Reserve first raised the federal funds rate by 25 basis points in March 2022, culminating in its final increase to a target range of 5.25-5.50% in July 2023 (a cumulative increase of 5.25%), investors and businesses have been primarily concerned about the potential for further rate hikes and their impact on fixed income portfolio valuations and borrowing costs.

More recently, however, market believe that inflation may be under control and is pricing imminent interest rate cuts. The future interest rate environment remains highly uncertain with increased volatility. As a result, investors and portfolio managers need to carefully assess their portfolio valuations, risk profiles, and hedging strategies, which may necessitate rebalancing due to changes in the interest rate regime. Below, we will discuss various interest rate hedging techniques using linear instruments as well as options-based hedges, articulating the benefits and drawbacks of particular methods.

Interest Rate Regime Shift

We illustrate market expectations regarding potential significant changes in the interest rate environment with the following two examples.

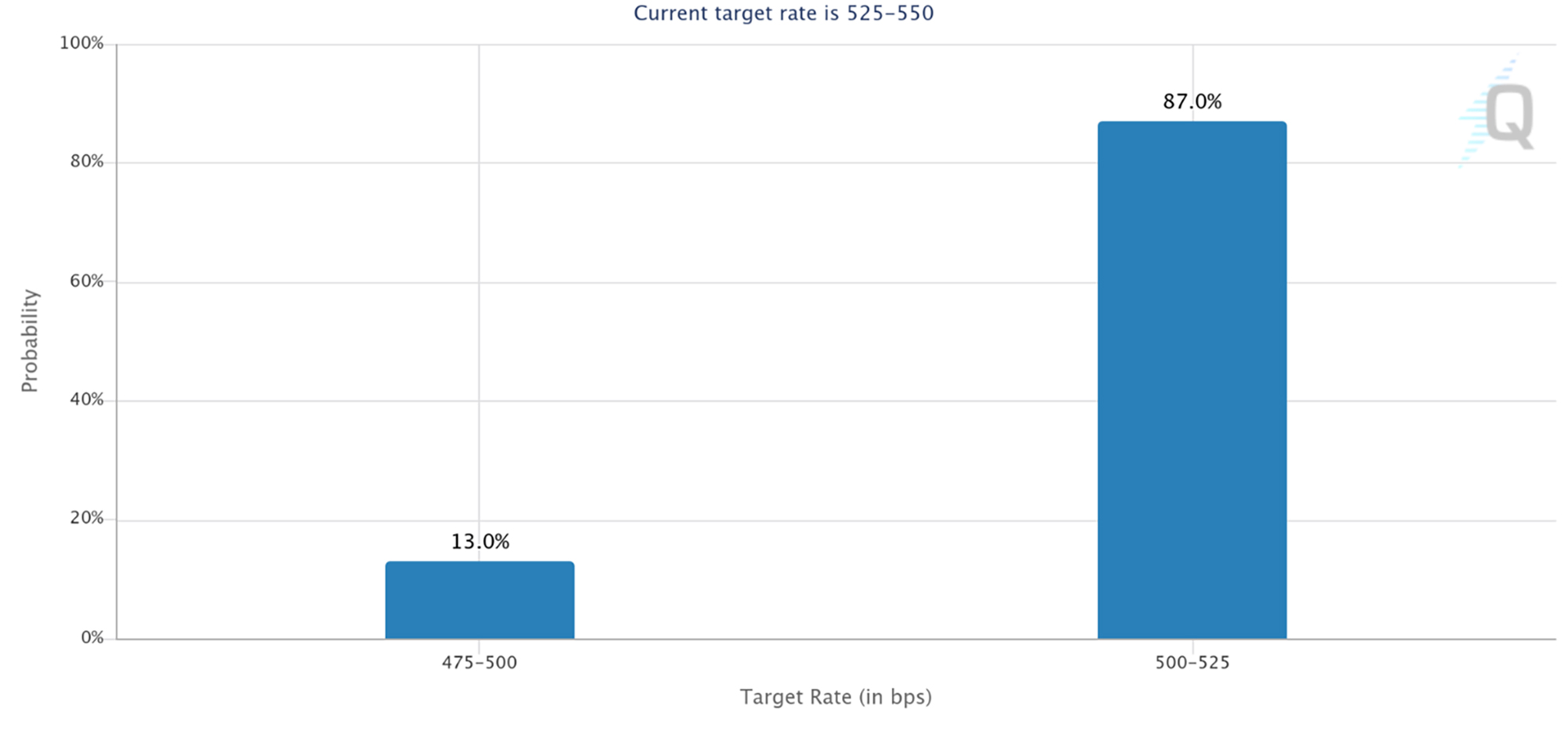

- CME FedWatch1 tracking the probabilities of changes to the Fed rate, as implied by 30-Day Fed Funds futures prices:

Target Rate Probabilities for 18 Sep 2024 FED Meeting

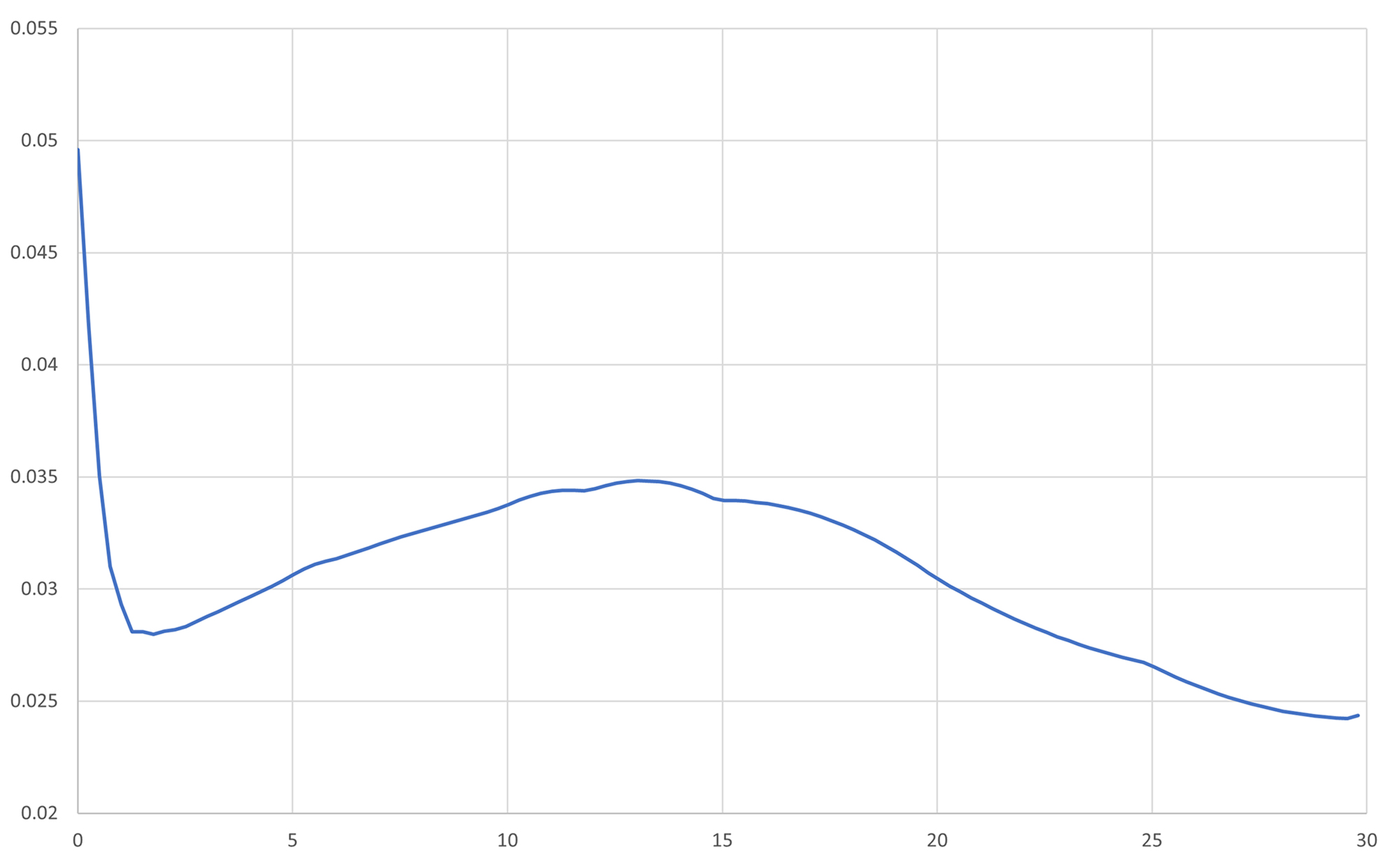

The chart illustrates that market expectations indicate a 100% certainty that the Federal Reserve will cut rates during the next Federal Open Market Committee (“FOMC”) meeting, scheduled for September 17-18, 2024. - Three-month forward SOFR rate curve, bootstrapped from market quotes of SOFR swap rates, shows a pronounced inversion at the short end. This suggests that the market anticipates short-term rates will decrease to the 3-3.5% range within the next two years.

Forward 3M SOFR

Looking ahead, the markets price in steady declines in yields this and the next year, potentially normalizing from the current inverted yield curve on the short end to a steepening one. However, if inflation remains elevated for the next few quarters, markets could remain in a higher interest rate environment longer than expected.

Hedging Interest Rates Risk

Before selecting and implementing a hedging strategy, it is essential to complete the following steps:

- Identify the underlying market risk factors affecting the portfolio.

- Assess the portfolio’s risk profile.

- Analyze the potential impact on income, consider hedging costs, and evaluate the effectiveness of the hedge.

Below we provide a brief overview of liquid listed and OTC interest rate derivatives, which can provide a hedge against the changes in the rates environment.

Linear Instruments

Interest rate futures: Three-month SOFR futures2 are the most liquid linear instruments for hedging USD short-term interest rates across the forward curve, although their liquidity diminishes beyond the initial five years. An alternative to SOFR futures is 30-Day Fed Funds futures.3 While less liquid, these offer a broader perspective on market expectations regarding the future direction of Fed monetary policy. Entering into an interest rate future position gives the future holder a direct exposure to the forward rates on the specific part of the curve; buying / selling a future creates a long / short position on the forward interest rates. Buyer of the future gains if the rates “sell off” (rise) and the seller would benefit if the rates “rally” (fall).

Interest rate swaps: These over-the-counter derivative instruments allow institutions to hedge their interest rate exposure over a longer time horizon. The most common type of swap is a fixed-floating plain vanilla swap that involves paying fixed coupon and receiving floating interest rate payments (payer swap) or vice versa (receiver swap). For fixed income portfolio it is possible to construct a hedge using payer swaps virtually offsetting the interest rate exposure. However, this also eliminates any upside in the portfolio if rates decrease. For instance, if you hold a fixed coupon bond, you receive fixed payments in the form of coupons. By entering into a swap where you pay a fixed rate and receive a floating rate, you can effectively mitigate interest rate risk. This hedging strategy essentially transforms your bond into a floating rate note.

Bond futures:4 These listed derivative instruments allow investors to manage exposure to U.S. Treasury notes and bonds. US Treasury Bond futures are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration. Alternatively, investors and institutions may consider hedging with yield futures,5 which provide a more straightforward approach to mitigate exposure to U.S. Treasury yield curve. However, these instruments are fairly illiquid, and investors must roll into a new contract after of the current future expiration.

Vanilla Options

In this section, we explore hedging strategies utilizing liquid interest rate vanilla options, including both listed and OTC options. These options-based hedges enable portfolio managers to mitigate interest rate exposure when rates move adversely, thereby protecting the portfolio from potential losses while preserving the potential for upside gains. This is somewhat similar to purchasing put option protection for a long equity portfolio. However, it is worth noting that purchasing options requires a payment of the option premium and can be costly, so, optimally, the options may be used in combination with linear instruments.

Listed options: The most liquid option instruments in this class are SOFR and bond future options that are essentially options on the previously described three- month SOFR and bond futures, respectively.

OTC options:

- Swaptions: These options give the swaption holder the right, but not the obligation, to enter into swap with a fixed coupon rate (strike) and a certain tenor specified by the swaption contract on the option expiration date. The payer swaption will be exercised if the effective swap rate on the expiration date is higher than the strike; thus, payer swaption can interpreted as a call option on the swap rate and as a put on a bond with the same tenor and fixed rate. Conversely, the receiver swaption is a put option on the swap rate and a call on bond.

- Caps and Floors: These derivative contracts are series of call and put options (caplets and floorlets respectively) on the underlying rate. Cap / floor tenors vary from 1Y to 30Y without any loss of liquidity. Currently, the most commonly traded instruments in this category are compounded OIS and also term (1M and 3M) SOFR rate caps and floors. These instruments can serve as effective hedges against adverse forward rates moves.

Exotic Options

There are various exotic interest rate options traded in the over-the-counter (“OTC”) market, each designed for different purposes, such as hedging or speculating on future changes in the interest rate curve. While a comprehensive discussion of these options is beyond the scope of this analysis, two specific types may be relevant for hedging in the scenarios we anticipate:

CMS (constant maturity swaps) spread options: These options are based on the difference between two forward swap rates and a predetermined strike. For example, the payoff of a 10Y2Y CMS spread option depends on the spread between the 10-year and 2-year swap rates on the option’s expiration date. CMS spread options are particularly useful for hedging against changes in the yield curve’s shape, such as its normalization or steepening.

Bermudan swaptions: A Bermudan swaption allows the holder to exercise the option on multiple pre-specified dates, providing more flexibility compared to standard swaptions. For instance, agencies and MBS portfolio managers might use Bermudan swaptions to hedge prepayment risks. If the Federal Reserve cuts rates, prepayment speeds could increase, but the timing and magnitude of such changes remain uncertain. Bermudan swaptions offer a flexible tool for managing these risks effectively.

Conclusion

In the current interest rate environment characterized by heightened uncertainty and increased volatility, effective hedging strategies are essential for mitigating risk and protecting portfolio value. By understanding and using the appropriate hedging instruments, investors can navigate the evolving interest rate landscapes. It is crucial to continuously assess market conditions, re-evaluate risk profiles, and adapt hedging strategies accordingly to safeguard against adverse rate movements while positioning portfolios to capitalize on potential opportunities.

Published

September 12, 2024

Key Contacts

Key Contacts

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About