Strategic Use of Purchase Price Adjustments in Share Purchase Agreements: A Forensic Accountant’s View

-

September 10, 2025

-

This article is part of our Lessons Learnt from 10 Years series, marking a decade of Forensic & Litigation Consulting in Australia. Explore how we deliver forensic insights, resolve complex disputes and support clients through critical challenges.

In the dynamic landscape of M&A, the Share Purchase Agreement (‘SPA’) governs not only the legal terms but also the financial outcome of the deal. An underrated (and often overlooked) tool embedded within the many clauses of the SPA is the purchase price adjustment mechanism. It allows the buyer and seller to true up the difference between the target net working capital (or net assets) and the actual net working capital of the target company at completion. However, while helpful, purchase price adjustments are nonetheless a frequent source of post-acquisition dispute that can significantly erode value, for either the buyer or the seller. Often drafted at the eleventh hour, they can have a material impact on the purchase price — we’ve seen cases where the purchase price adjustment has reduced the price paid by 50%.

Given its potential impact, what are some of the strategies for buyers or sellers to use the purchase price adjustment mechanism strategically? How can they ensure they protect the value of the deal and achieve a positive outcome?

The Completion Accounts and Purchase Price Adjustments

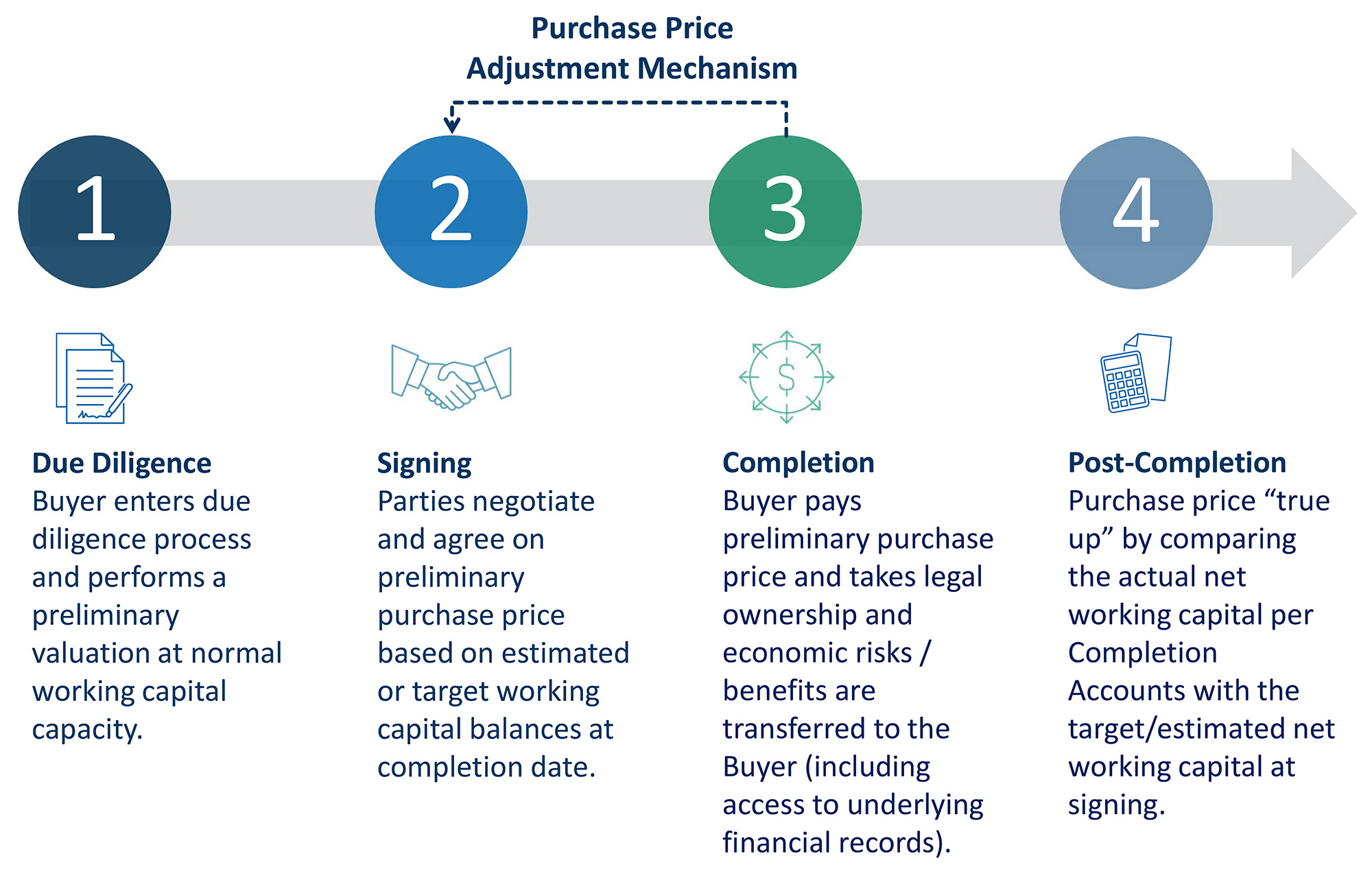

The completion accounts mechanism is a common method to adjust the price that allows parties to agree on a purchase price at the time of signing the SPA (before completion date) and adjust the purchase price for actual cash, debt and working capital transferred to the buyer as of the closing date.

Prior to completion, the buyer and seller negotiate and agree on a headline purchase price based on financial due diligence and valuation principles. Typically, the agreed purchase price will be based on a normalised level of working capital required to operate the business.

The Completion Accounts are prepared as at completion date, in accordance with the requirements set out in the SPA, to be delivered by a specified date following completion. The SPA often allows for an adjustment to the purchase price, calculated as the difference between actual net working capital per the Completion Accounts and the estimated/target net working capital upon which the headline purchase price was based.

The purchase price adjustment mechanism per the Completion Accounts allows the buyer and seller the opportunity to account for changes in working capital between an agreed amount (often as at SPA signing date) and completion date, ensuring the buyer pays for what is actually acquired at completion, compared to the balance anticipated to be transferred at the time of negotiating the deal.

Figure 1 - The Completion Timeline

The Role of the SPA in the Purchase Price Adjustment

The SPA typically sets out the accounting principles, policies and procedures to be applied when preparing the completion accounts for the purpose of calculating the purchase price adjustment. The SPA will typically require completion accounts to be prepared following an accounting hierarchy that is applied in the following order:

- The accounting principles, policies and procedures set out in the SPA

- The accounting principles, policies and procedures used to prepare the reference accounts (e.g., the most recent audited financial statements)

- The accounting standards (e.g., the standards and interpretations issued by the Standard Setter of the relevant jurisdiction)

Tips for the Buyer: Forensic Scrutiny Post-Completion

The buyer pays for what is actually acquired at completion, compared to the balance anticipated to be transferred at the time of negotiating the deal. At completion date, the buyer takes legal ownership of the business and the economic risks and benefits are transferred to the buyer. Given that, the risk for the buyer is that what it has received is not what it paid for. The buyer can use the purchase price adjustment mechanism strategically to its advantage to help mitigate that risk.

The buyer receives access to the underlying financial records and the management of the target entity at completion date. Completion accounts are generally prepared as of the closing date but finalised later (sometimes much later). The period between completion and accepting the completion accounts gives buyers a “hindsight” window to identify issues that were not apparent at signing and address them through the purchase price adjustment mechanism, particularly if limited due diligence was undertaken.

The buyer can rely on the purchase price adjustment mechanism to mitigate its risk further in two key ways. First, by engaging forensic accountants early to provide the Buyer sufficient time to identify gaps (which always exist) between what the Buyer learnt during the due diligence process and what the Buyer received at completion date, the gaps can be aggressed through potential post-closing adjustments. Second, by incorporating the risks and findings from the due diligence process — such as under-accrued liabilities or obsolete inventory — into the SPA completion accounts mechanism, the buyer can adjust later to mitigate the risks identified.

In our experience, common risk areas that should be considered for inclusion in the SPA are:

- Accounts receivable that are not recoverable and not written off (e.g., inadequate provision for doubtful debt)

- Slow-moving or obsolete inventory (e.g., specialised stock that cannot be sold after key customer contracts are coming to an end)

- Stock on hand, and whether a stock count should be performed

- Asset impairment

- Hidden liabilities or contingent obligations

- Unusual contractual arrangements (e.g., multiyear sponsorship agreements for lump sum contributions where the seller has made no payments to date)

- Adequacy of provisions, excess bonuses or non-ordinary costs accrued

- The extent to which subsequent events should be allowed

- Unusual transaction profiles in the months prior to completion with regard to components of working capital (e.g. receipts from customers or payments to suppliers or purchases of inventory)

As it is the responsibility for just one of the parties to prepare the completion accounts, its essential for the other party to conduct a detailed forensic analysis of the accounts. This enables both parties to ensure the completion accounts were prepared in accordance with the requirements of the SPA, the agreed accounting hierarchy and the due diligence process.

Tips for the Seller: Locking in Value

The seller wants to ensure they receive the full value for the business or assets as initially negotiated. To preserve value, the seller can take several steps pre-completion:

- Involving forensic accountants early in drafting the SPA to remove any ambiguity in definitions

- Understanding and documenting any deviations between accounting policies in the SPA, reference accounts and Accounting Standards and how the deviations could impact the measurement of balances included in working capital

- Performing thorough working capital analysis as part of the due diligence process

- Documenting the principles, policies and procedures applied when preparing the reference accounts, particularly those requiring management judgment can highlight and clarify the impact of the policies on the working capital and the purchase price

The Accountant’s Perspective on Drafting the Relevant Clauses

Whether representing the buyer or the seller, a well-drafted SPA is the foundation for a smooth and defensible purchase price adjustment process. Drawing on our experience performing expert determinations in M&A disputes that have arisen from problematic SPAs, we recommend the parties consider the following when drafting the SPA:

- Avoid ambiguity by using clear, unambiguous accounting language (e.g., “earnings” could refer to EBIT, EBITDA, or net profit)

- Clearly define accounting terms that are not defined in the Accounting Standards, like net debt, working capital, cash and completion date

- Understand the target entity’s business, including the judgments applied by management when making accounting estimates and key processes and reconciliations required to ensure the accounts are accurate

- Establish a clear accounting hierarchy that sets out the order of precedence for accounting principles, policies and procedures (including where accounting practices may deviate from policies or Accounting Standards)

- Decide which accounting principles, policies and procedures to apply where there are differences between policies and practices applied in the due diligence process, the reference accounts and the requirements of the Accounting Standards

- Consider if the policies referred to in the reference accounts were actually used in practice

- Consider attaching detailed working capital schedules to the SPA that identify which general ledger accounts should be included or excluded in net working capital

- Address atypical or unusual transactions, such as restructuring, asset sales or carve-outs — the SPA should outline how these will be treated in the completion accounts

To ensure common issues that could overinflate price are identified, the parties should involve an accounting expert with experience in completion accounts disputes early in the process to work alongside the legal experts when drafting the completion accounts accounting principles, policies and procedures.

Conclusion

Purchase price adjustments are a critical bridge between the agreed headline purchase price and the actual value transferred in an M&A transaction. Used strategically, they provide a safety net for the buyer and a validation tool for the seller. However, their effectiveness hinges on drafting the SPA in a manner that incorporates a deep understanding of the underlying business, clear and unambiguous definitions and a forensic-level scrutiny of the target entity’s accounting principles, policies and procedures. Aligning accounting rigour with legal precision will transform the purchase price adjustment process from a risk to be managed into an opportunity for both sides, and will reduce the risk of the buyer and/or the seller being locked into a particular application set out in the SPA that could diminish the value of the deal.

Related Insights

Related Information

Published

September 10, 2025

Key Contacts

Key Contacts

Senior Managing Director, Head of Australia Forensic & Litigation Consulting

Director

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About