Vertical Merger Analysis: Assessing the Toolkit

Economic Financial Consulting

-

March 17, 2022

DownloadsDownload Article

-

Vertical mergers are fundamentally different from horizontal mergers on several key points. As a result, assessing the likely effects of vertical mergers are inherently more difficult than horizontal mergers.

What is a vertical merger?

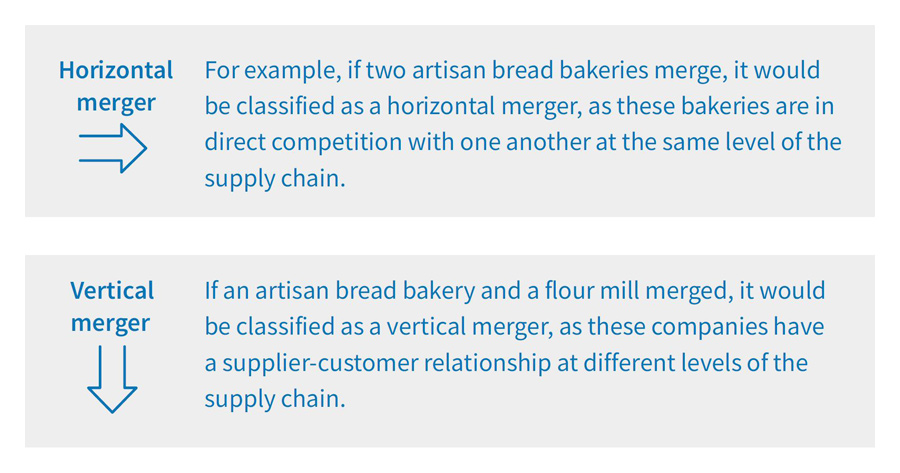

Vertical mergers are the joining of firms that operate at different levels of the supply chain. This is in contrast to horizontal mergers, where parties to the transaction usually operate at the same level of the supply chain and are often direct competitors.

This recent uptick has been mainly attributed to the shift from industrial-focussed economies (i.e., those industries that produce physical products) to knowledge economies (i.e., industries that provide computer-based services)3. In industrial-focussed economies, proposed mergers mostly raised horizontal concerns, while vertical competitive concerns are more prominent in mergers between firms that provide computer-based services in the knowledge economy sphere.

48

Vertical mergers are becoming increasingly prominent all over the world. For example, in the United States of America, there were a total of 48 vertical merger enforcement actions in the 21 years between 1994 and 20151.

How do vertical mergers and horizontal mergers differ?

The assessment of vertical mergers is fundamentally more complex than horizontal mergers. With horizontal mergers, anti-competitive effects are direct because a competitor is eliminated from the market. The effect is therefore immediately quantifiable.

In contrast, potential anti-competitive effects arising from vertical mergers are brought about only in an indirect manner, because the potential competitive effects are related to incentives rather than the direct elimination of a competitor.

As with any merger, anti-competitive effects arise when the competitive constraints imposed on an integrated firm are relaxed post-transaction. In a vertical setting, this results in an increase in the market power of the firms that are merging, increasing their incentive to foreclose (prevent access to the services/goods of the upstream firm) downstream rivals. The effect, however, is difficult to quantify.

Additionally, vertical mergers typically involve significant efficiency gains that result in pro-competitive effects. Perhaps the most distinguishing of these effects is the elimination of double marginalisation. This occurs when a market transaction is substituted with an internal transfer within the boundaries of a firm.4 After the merger, the wholesale price that the upstream firm used to charge to the downstream firm is eliminated and replaced with an internal transfer of the service/good. Mark-up for a product is only added at the downstream level and final prices are lower.

17

The same country saw such actions already totalling 17 in the 4-year period from 2016 to 20202.

Assessing the likely effects of vertical mergers and the economist’s toolkit

The assessment of vertical mergers is more complex than horizontal mergers since foreclosure and elimination of double marginalisation are counteracting. Secondly, these effects occur concurrently and arise from the same source. In other words, the same incentive that results in the elimination of double marginalisation (through the upstream firm eliminating the wholesale price charged to its vertically integrated firm), also drives it to foreclose its downstream rivals.

The anti-competitive effect – the incentive to raise rival’s cost – is difficult to quantify and relies on assumptions about the future behaviour of the firm. On the other hand, the pro-competitive effect – the elimination of double marginalisation - is easily calculated. Overall, quantifying the net effect of a vertical merger remains challenging.

Economists have several tools available to deal with the complexity of mergers in vertically related markets. These include incentive scoring methods and merger simulation models.

Incentive scoring methods attempts to quantify the post-merger incentives of the vertically integrated firm5. For these methods, simple and intuitive formulae are calculated using metrics such as the diversion of sales from the rival firm to the vertically integrated firm and profit margins6. These measures only focus on the anti-competitive effects of a merger, and do not take account of the pro-competitive effects arising from the transaction. Given the significant efficiency gains that normally accompany a vertical merger, it is a significant drawback if a measure does not account for these pro-competitive effects in the analysis.

Vertical merger simulation models, on the other hand, attempt to estimate the full post-merger equilibrium using formal economic models. Its main objective is to provide numerical predictions of net price and quantity changes as a result of the merger. Simulation models take account of both the pro-competitive and anti-competitive effects of a merger. While incentive scoring measures make use of simple and intuitive formulae that result in answers that are easy to interpret, simulation models are more complex. They rely on a system of equations that have to be calibrated to data (either real or simulated), resulting in extensive data and assumption requirements.

The obvious benefit is that practitioners can observe the likely effect on prices and quantities. It is, however, important to also understand their limitations and to ensure that their underlying assumptions are well suited to the case at hand.

1: Salop, S.C., Culley, D.P., 2016. Revising the US vertical merger guidelines: Policy issues and an interim guide for practitioners. Journal of Antitrust Enforcement 4, 1–41. doi:10.1093/jaenfo/jnv033.

2: Salop, S.C., Culley, D.P., 2020. Vertical Merger Enforcement Actions: 1994 — April 2020. Journal of Antitrust Enforcement 4.

3: Slade, M.E., 2020. Vertical Mergers: A Survey of Ex Post Evidence and Ex Ante Evaluation Methods. Review of Industrial Organization, 1 – 19.

4: Perry, M.K., 1989. Vertical Integration: Determinants and Effects, in: Armstrong, M., Porter, R.H. (Eds.), Handbook of Industrial Organization. 2007 ed. North-Holland Publishing, Amsterdam, The Netherlands. volume 3. Chapter 4, pp. 185 – 250.

5: Rogerson,W.P., 2014. A Vertical Merger in the Video Programming Industry: The case of Comcast-NBCU, in: Jr.,.E.K., White, L.J. (Eds.), The Antitrust Revolution: Economics, Competition, and Policy. New York: Oxford University Press., pp. 534–575.

6: Miller, N.H., Sheu, G., 2021. QuantitativeMethods for Evaluating the Unilateral Effects of Mergers. volume 58. Springer US. URL: https://doi.org/10.1007/s11151-020-09805-8

Related Insights

Published

March 17, 2022

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About