- Home

- / Insights

- / FTI Journal

- / How to Maximize Transaction Value When Divesting Your Business

How to Maximize Transaction Value When Divesting Part of Your Business

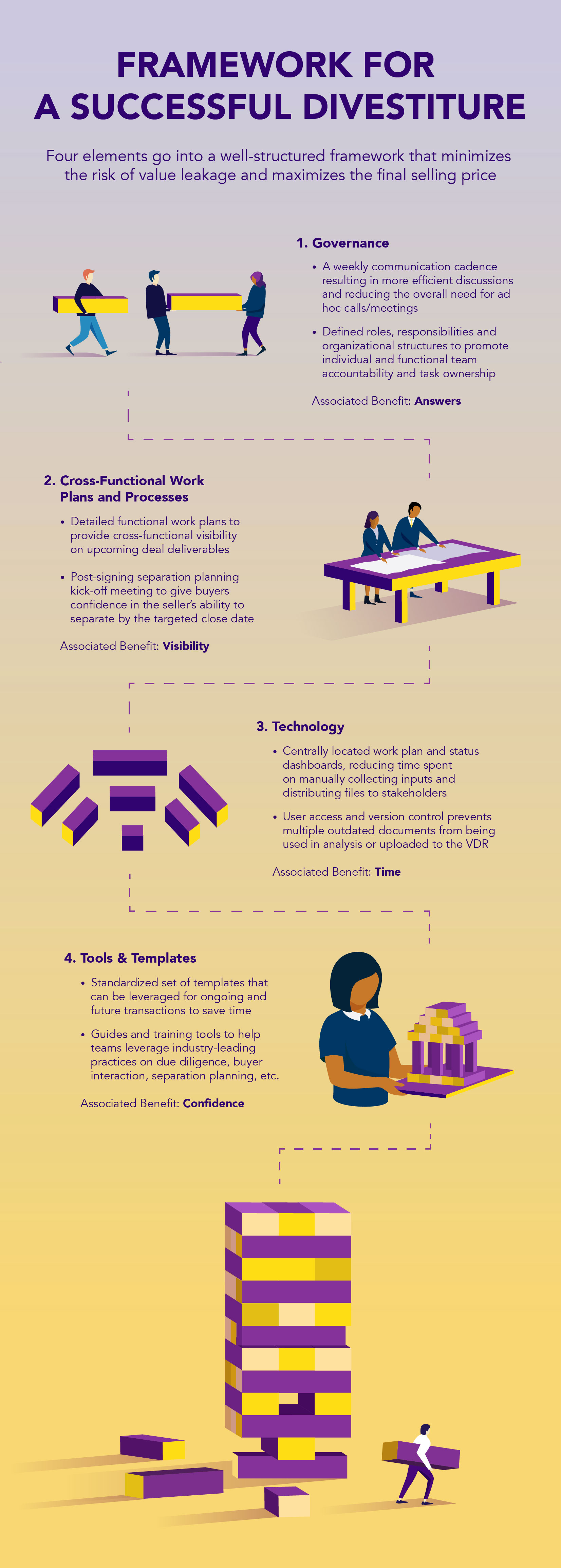

The key is to implement a four-part framework that minimizes “value leakage” before going into the deal.

-

August 20, 2019

-

Corporate M&A activity burned white hot last year, reaching record highs of $1.74 trillion in value in the United States and US$2.5 trillion globally. Although the pace of U.S. deals has cooled slightly this year, the overall value remains stable, with the first quarter of 2019 showing $414 billion in activity.

With such astronomical value comes opportunity. More and more companies today consider transactional activity a viable aspect of their growth strategy — either through acquisition or by divesting parts of their business that do not align with long-term plans.

Most large organizations have corporate development teams expressly for this purpose. They’re staffed with talent bearing investment banking and transactional experience. But with a focus on growth, teams often are not as savvy about the divestiture side as they are about acquisition.

That can result in issues that affect your bottom line. Divestitures, or carve-outs, are intrinsically more complex, which presents a higher risk of missing initial deadlines and extending the time spent on the deal. This in turn increases the amount of “value leakage” that can occur during the transaction. Value leakage, a commonly overlooked metric within a divestiture, is defined as the total value lost from the moment it takes to identify the asset to be sold to the actual sale itself.

The loss of value can be in the form of people, one-time costs and enterprise value.

Building a Framework

The best way to minimize loss is to implement a customized, well-structured divestiture framework that can help companies sell assets more quickly, thus minimizing the risk of value leakage and maximizing the final selling price. Four interconnected areas form the framework:

Governance

Defines the roles and responsibilities of the various stakeholders throughout the divestiture cycle.

In most instances, corporate employees do not possess — or they have minimal — transactional experience. Documenting in detail the role each person has in the carve-out helps address questions each stakeholder may have about their individual responsibilities. Without governance, sellers risk incurring unnecessary costs and missing deliverable deadlines.

Cross-Functional Work Plans and Processes

Provides visibility into the key tasks and work flows within a divestiture life cycle and helps prepare companies for Day 1 more efficiently.

In organizations where corporate employees do not possess divestiture experience but are attempting to manage one, the seller may find itself facing constant fire drills and missed deadlines. More severe consequences can also occur, such as legal risks, which can prove costly and greatly impact the financial aspect of the deal itself.

Another common area sellers often overlook is the management of internal and external communications around the transaction. A planned schedule of communications during each phase is pivotal in relaying the strategic value that the transaction will bring to employees, customers and other stakeholders from both sides.

Technology

Helps streamline communication channels and automate time-consuming manual processes.

During the divestiture life cycle, a web-based project management tool such as Smartsheet can cut down on the time spent on administrative tasks and allow more time for focus value-adding activities. Deal professionals can upload various tools and templates into this environment, including deliverable trackers, work plans, status update dashboards and RAID logs.

Tools and Templates

Provides selling organizations with a starting baseline in developing deal deliverables.

A deliverable gives sellers more time to focus on creating and executing value-adding tasks, such as issue and risk mitigation, and buyer interaction. Tools and templates also instill buyer confidence that the seller is prepared and properly positioned to execute the deal efficiently.

Tools can also come in the form of guides for sellers when performing common transactional activities such as estimating stand-alone and stranded costs or pricing TSAs.

Worth the Investment

Investing time and resources to develop a framework can help fill the gaps organizations may have in their knowledge and capability of the transactional life cycle. Companies should assess where they stand in the process maturity cycle and consider developing a framework tailored to their overall strategies, especially as the transactional activity in the market continues to grow.

The infographic that follows provides more insight into the framework and associated benefits derived in each area.

© Copyright 2019. The views expressed herein are those of the author and do not necessarily represent the views of FTI Consulting, Inc. or its other professionals.

About The Journal

The FTI Journal publication offers deep and engaging insights to contextualize the issues that matter, and explores topics that will impact the risks your business faces and its reputation.

Published

August 20, 2019

Key Contacts

Key Contacts

Executive Vice President

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About