- Home

- / Insights

- / FTI Journal

- / Time Consider Bringing Supply Chain Home

Is it Time to Consider Bringing Your Supply Chain ‘Home’?

-

August 01, 2022

-

Now more than ever CEOs and Supply Chain leaders are considering de-risking their supply chains through “nearshoring” or “onshoring” closer to home.

Almost every industry, from agriculture to apparel, from healthcare to hospitality, is feeling the impact of supply chain issues. But it’s not just the movement of goods from point A to point B that’s concerning business leaders. Factors such as quality control, ethical sourcing, and international competition are also top of mind, compelling many to take a deep look at options for de-risking their supply chains.

Among those options is nearshoring and the related onshoring. Nearshoring brings business processes geographically closer to home — often to a country just across a shared national border. Onshoring relocates operations inside the domestic borders of a company itself.

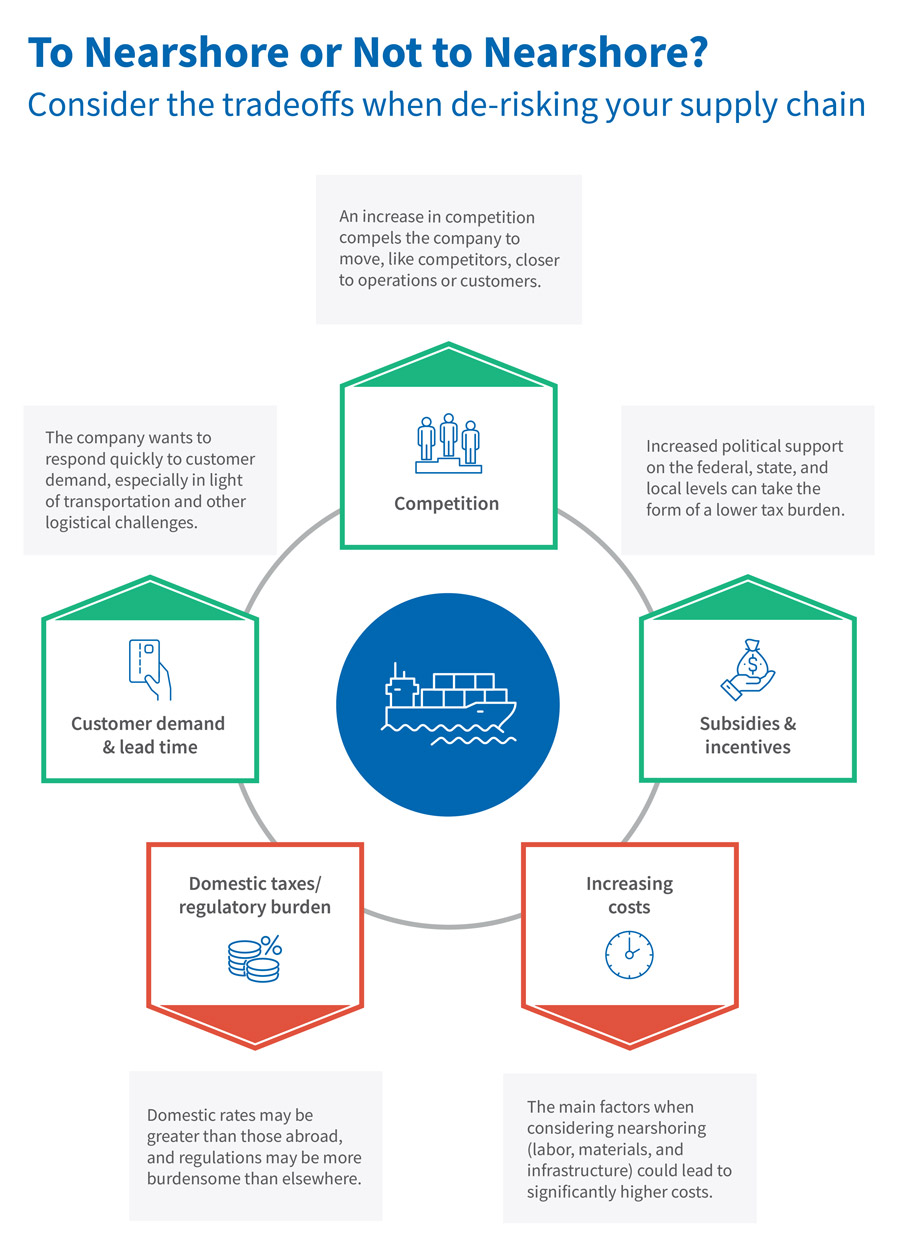

While many industries could benefit from either approach, every company must consider certain tradeoffs when weighing whether to “stay or go.” Those tradeoffs primarily involve issues related to infrastructure, labor, materials and of course costs.

Let's look at sourcing materials. It’s no secret that transoceanic shipping costs have risen dramatically since the start of the pandemic. Experts blame capacity and demand imbalances resulting in severe port congestion amongst other bottlenecks and do not expect relief soon.1 Elsewhere, ongoing geopolitical unrest is disrupting reliable sourcing. Attention on public health in the downstream supply chain is also an issue.

When it comes to labor, wage rates and the quality of talent can vary widely from region to region. A location’s infrastructure, such as roads and transportation, is another tradeoff.

Reasons to Relocate

The advantages common to nearshoring and onshoring options are many, however. Proximity to customers, which typically improves speed to market, stands out. This is increasingly critical as more consumers demand quick and personalized service from vendors.

Relocating near or onshore also enables companies focused on ethical or sustainable sourcing to monitor more closely third and fourth-party vendors and potentially meet their ESG values or goals. That’s not inconsequential with customers and employees becoming more vocal about labor conditions and environmental issues.

Meanwhile, some industry leaders and policymakers in the United States with an eye on international competitors are taking an active role to encourage more onshoring of certain products. One example is semiconductor chips, a good the federal government deems a “strategic resource” for the country’s economic prosperity and national defense. According to the U.S. Commerce Department, only 12 percent of global semiconductor production takes place in the U.S. — down from 37 percent in 1990 — compared to more than 70 percent in Asia.2

The U.S. government has proposed subsidizing onshore chip manufacturing to level the playing field against global competitors that receive state funding, such as South Korea, Taiwan, and China. The hope is to increase domestic production of chips and avoid future shortages, such as the one that began with the pandemic and is still contributing to the scarcity of everything from automobiles to laptops.

Auto manufacturers like Ford have also made strategic choices and investments in onshoring. The company’s recent $11.4 billion investment in electric vehicle and battery production in Tennessee and Kentucky reverses a corporate stance from as little as two years ago to keep its sourcing abroad.

Are there other caveats to relocating? Of course. Finding reliable manufacturing or logistics partners can be challenging. And cultural differences can also come into play.

Like all important business decisions, it’s important to assess all factors before committing to a new way forward. The infographic that follows offers a quick glance at some of those factors.

Footnotes:

1: IMF data, March 28, 2022, https://blogs.imf.org/2022/03/28/how-soaring-shipping-costs-raise-prices-around-the-world/

2: U.S. Department of Commerce, April 6, 2022: https://www.commerce.gov/news/press-releases/2022/04/analysis-chips-act-and-bia-briefing#

© Copyright 2022. The views expressed herein are those of the author(s) and not necessarily the views of FTI Consulting, Inc., its management, its subsidiaries, its affiliates, or its other professionals.

About The Journal

The FTI Journal publication offers deep and engaging insights to contextualize the issues that matter, and explores topics that will impact the risks your business faces and its reputation.

Published

August 01, 2022

Key Contacts

Key Contacts

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About