- Accueil

- / Publications

- / Articles

- / 2025: Turning the Page or Ripping Up the Book?

2025: Turning the Page or Ripping Up the Book?

-

janvier 17, 2025

TéléchargezDownload Article

-

As dependable in January as New Year resolutions and the College Football Playoff National Championship game, the start of every year also brings a host of predictions from experts and armchair pundits on a variety of topics. This year is no exception.

What are the prospects for a global bird flu pandemic? Ceasefires in Ukraine and Gaza? A Bitcoin blowup or meltdown? A best picture Oscar for “Wicked”? Myriad predictions for 2025 are out there for public consumption, and nobody is keeping score.1 But predictions aside, 2025 feels like it will be a most consequential year for our country and the world. Can’t that be said of any new year? Perhaps, but the potential range of big event outcomes in 2025 seems considerably wider than usual, which can elicit feelings of hope or despair depending on one’s tendency for optimism.

President-elect Trump campaigned on a platform that broadly sought to shake up longstanding institutional norms and traditional governing policies, and nothing he has said or done since his election win indicates that those intentions have changed. That said, nobody has any real clarity yet on exactly how any of this will manifest in 2025 or beyond. The stack of executive orders that President Trump will sign on Day 1 certainly will be the first indication of his governing and policy intentions.

Financial markets and the large business community have taken comfort in his cabinet and advisory picks for key positions on economic policy matters and federal regulatory agencies, particularly his selection of Scott Bessent for Treasury Secretary. Generally, there is a sense that this Praetorian Guard of well-regarded advisors around domestic economic policy will protect it from any extreme or high-risk policy decisions that President Trump might entertain. A growing chorus of the economic punditry have opined that more business-friendly policies under Trump 2.0 will ease business regulations, oversight and tax burdens and unleash the “animal spirits” of corporate decision-makers and market investors. Judging from the many instances of financial market excesses in 2024, we’re not sure that further encouraging investors’ animal spirits is advisable.

President Trump will want to score some quick wins with the business community to solidify his support on that flank, so some measures on that front likely will come early in 2025, provided they can be implemented via executive order. This will mostly consist of undoing many executive actions of the Biden administration that are considered heavy-handed or overreaching by influential business leaders. Economic or tax policy changes requiring congressional approval will incur resistance from Democrats and some Republican deficit hawks and will take longer to get done. A divided Congress, both between and within the two parties, will make passage of major legislation even more unpredictable and difficult if that’s possible. We reiterate that Treasury markets also will impose some discipline on policy decisions that are perceived as materially deficit-widening and debt-bloating. Arguably, we’ve already seen this since September, with 10-year Treasuries moving higher by 100 bps even as the Fed has cut the Fed Funds rate by 100 bps in that time, as credit markets anticipate that a second Trump presidency intent on charging economic growth could be inflationary and won’t likely make meaningful deficit reduction a high priority — certainly not in 2025.

The Year in Restructuring

The past year reminded us that the restructuring landscape is hardly a dried and static canvas. This point was underscored on the very last day of the year when the Fifth Circuit Court of Appeals rejected the validity of Serta Simmons Bedding’s controversial uptier liability management transaction. The court sided with left-behind lenders who contended that the uptier exchange with select lenders violated the provision for the pro rata treatment of lenders in the governing credit agreement. This decision came four years after the liability management exercise (“LME”) was done and more than a year after Serta Simmons emerged from Chapter 11; the case was remanded to bankruptcy court for consideration of minority lenders’ damage claims. While the Serta ruling hinged narrowly on whether the LME conformed with the “open market purchases” exception to the pro rata treatment requirement of the credit agreement, it could have a chilling effect on other potential uptier LMEs that would attempt to exploit similarly worded provisions.

Consequently, clever lawyers and savvy sponsors likely will modify relevant contractual language going forward while lenders, credit investors and their advisors will adjust their negotiating tactics accordingly. Beyond its direct impact, the Serta ruling is also a reminder that the restructuring market remains a vibrant and innovative arena as applications and interpretations of contract law and bankruptcy law continue to evolve. Likewise, the Supreme Court’s June ruling in the Purdue Pharma case against non-consensual releases of non-debtor parties in bankruptcy cases — an accepted practice in some bankruptcy courts even though the bankruptcy code does not expressly permit it — and its likely impact and workarounds in other cases underscore the point that stretching the contours of bankruptcy law and its application is a never-ending exercise in legal creativity.

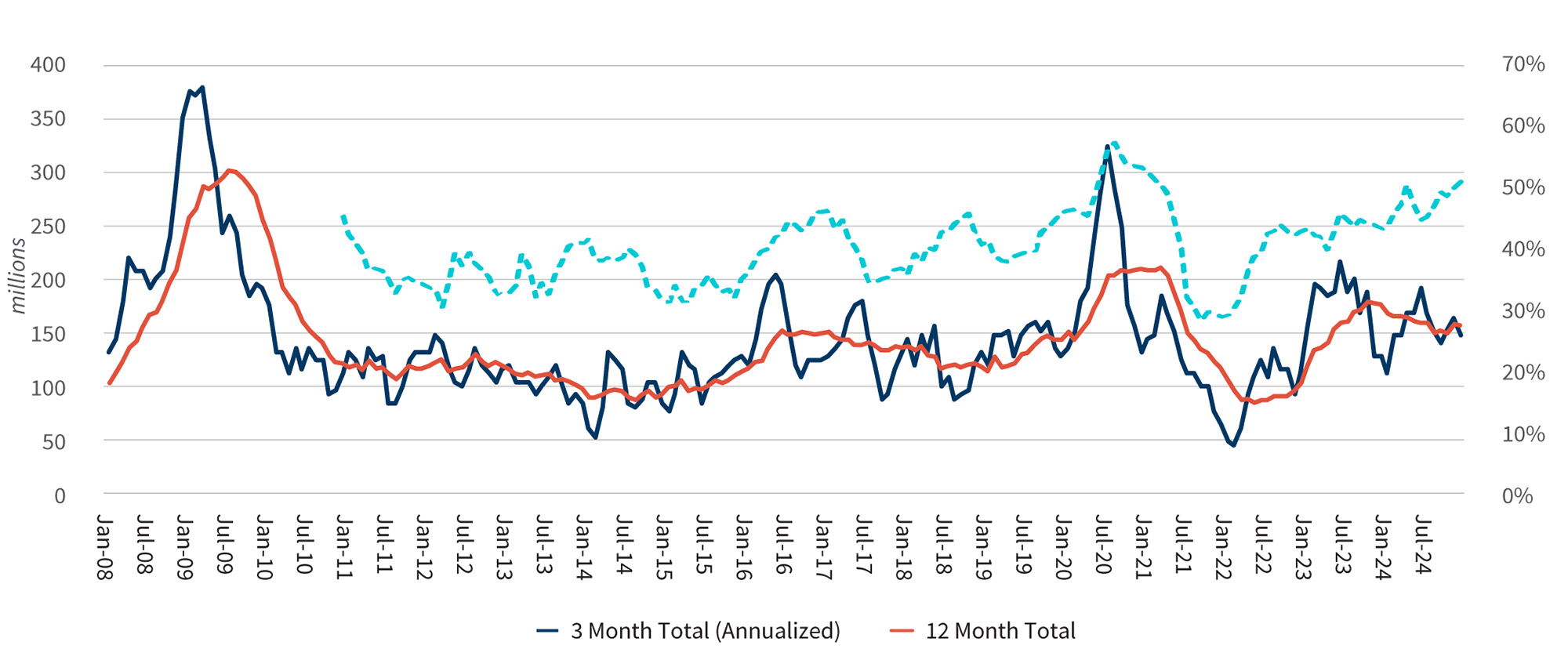

Our preliminary tally shows that 2024 ended with 157 large (>$50 million) Chapter 11 filings compared to 176 in 2023, an 11% decrease (Figure 1). The pace of filings slowed moderately in 2H24, with 72 filings versus 85 in 1H24, a 15% falloff. There were 41 $1+ billion filings in 2024 compared to 31 in 2023. Overall, this ranks as an above-average year for filing activity, though as we discussed last month, it didn’t quite feel like a banner year despite the healthy topline number.

Figure 1 - Large Chapter 11 Filings (>$50 Million of Liabilities at Filing)

Source: The Deal

The consensus among the credit rating agencies is that corporate default activity will moderate in 2025 compared to 2024 levels, though restructuring shops aren’t girding for an acute downshift in activity. One indicator of potential restructuring activity is not encouraging: Our year-end tallies of distressed bonds and loans decreased by 32% and 28%, respectively, compared to the end of 2023, as leveraged credit markets rallied sharply last year and drove down market yields on most speculative-grade debt below distressed thresholds. Furthermore, the distressed debt ratio finished the year near 4.0%, a well-below-average reading. The speculative-grade maturity wall has once again been pushed out, and scheduled debt maturities in 2025 are fairly modest, having decreased to $144 billion currently from $305 billion a year earlier. Leveraged credit investors aren’t worried at all going into the year. A contrarian would like that, but it’s hardly a hopeful sign for robust restructuring activity in 2025.

What Our Experts Are Expecting

Given the wide-ranging opinions on the prospects for restructuring activity and the economy generally in 2025, this year we gave the pen to four esteemed FTI Consulting colleagues to hear their views on relevant matters.

Luke Schaeffer: Senior Managing Director, Strategy and Transformation, Global Leader

Steve Simms: Senior Managing Director, Turnaround & Restructuring, Global Leader

Carlin Adrianopoli: Senior Managing Director, Turnaround & Restructuring, U.S. Leader

Scott Bingham: Senior Managing Director, Transactions, Global Co-Leader

How have your 2025 views on the prospects for the domestic economy, the corporate sector and your business clients changed since the presidential election? On balance, do you think a Trump presidency will be favorable (fewer regulations, lower taxes) or unfavorable (tariff effects, unconventional or disruptive policies) for the corporate sector and the broader economy in 2025?

Luke Schaeffer: My personal view, though not heavily tested with clients but perhaps more evident in their planning activity during the last couple weeks before Christmas, is that Trump is going to be stimulative for the economy, and certainly will create churn. Deal activity is likely to increase, as are growth-oriented investments.

Steve Simms: My personal view is that if the new administration follows through with substantial tariffs and more stringent immigration laws and migrant deportations, this will increase business costs, put upward pressure on product prices and depress consumer spending, which will be harmful for the economy. That said, if President Trump sees that happening, he will be amenable to altering these policies. Above all, he will not want to see the economy falter.

Carlin Adrianopoli: I will stay out of the political side, but in terms of the economy for 2025, I see a more bullish climate than previously. Non-investment grade yields have come down significantly from 2022 levels and are much more manageable for leveraged borrowers, and credit funds and non-traditional lenders are chasing deals and putting money to work. Absent some unexpected macro event changing the business climate, I think we will likely have a stronger economy in 2025 aside from a few challenged industry sectors.

Scott Bingham: Within my realm, I believe that much of the private-equity community stood still in the months leading up to the election, waiting to see the outcome. Now that it has been decided, I believe that the PE community, which has been very slow and cautious for the last 18 months, will again return to deal prominence. This, in part, will be due to fewer regulations and less-intense scrutiny of proposed mergers under a Trump administration. I believe our corporate clients will also be more active in dealmaking, as their balance sheets are strong, while PE sponsors will be looking to sell mature investments in order to generate cash returns to their limited partners.

Are you yet seeing Gen AI have a notable or material impact on the way your clients are doing work? If not, when will that become more evident? There has been some chatter lately that Gen AI tools so far have been overhyped in their disruptive potential for large business. Agree or disagree?

Luke Schaeffer: AI is going to have a material impact on how our clients do work, for sure. Just like digital revolution, that will play out over at least a decade. So it is too early to say that Gen AI is overhyped, although I would say that Gen AI is only a portion of the broader AI and digital revolution and digital transformation.

Steve Simms: I have not seen any real client impacts to date from AI. Nonetheless, I think it is a long-term gamechanger to the way many large businesses currently operate, but not yet.

Carlin Adrianopoli: Recently at a client meeting, I had my first encounter with AI as an implemented business tool, with Microsoft Teams summarising our meeting notes and helping to memorialise To Do lists within the group. It was standard practice for the client to enlist the AI tool for meeting tracking. At FTI, I have been part of a few deals where we have started using AI-enabled software to scrape information from leases and other documents to save time and cost for mass volume data usage and extrapolation. Over time, I would expect to see a shakeout of winners and losers within the AI space itself and among large business users of critical AI tools. You can’t only have winners. Certainly, investments in AI will continue to accelerate across the board in 2025 and beyond.

2024 was a ______ year for restructuring activity. Please provide an adjective that best describes the year and briefly elaborate on that description.

Steve Simms: 2024 was a DECENT year for restructuring activity. I think it was a mixed bag, depending on what type of firm you are. It was a very good year for IBs and law firms that are active in LMEs, but it was a slower year for FAs only modestly involved in LMEs, as there were fewer long-term, in-court bankruptcies than there otherwise would have been.

Carlin Adrianopoli: Yeah, I echo Steve’s sentiments on that one.

Leveraged credit issuance is booming, the Fed will likely cut rates further, and the rating agencies expect default activity to subside next year. Is restructuring activity set up to disappoint in 2025? What could surprise to the upside for our business?

Steve Simms: For these reasons (stated in the question) and the expected continuation of LMEs, I believe 2025 is likely to be no better than last year or slower in terms of restructuring activity. Key things that can change that to the upside are a few large LMEs blowing up, negative impacts on the economy from Trump policies, or a significant increase in geopolitical turmoil.

Carlin Adrianopoli: In terms of surprises to the upside for our restructuring business, healthcare, real estate (especially commercial) and consumer products (retail is challenged again) will continue to see stress in 2025 regardless of Fed actions or any other stimulus, as the headwinds in those sectors are strong and entrenched. Outside of those sectors, there might be more upside surprises if tariffs come into play and supplier cost pressures build and extend beyond the year. But by and large 2025 will not see a strong restructuring market unless a macro-level event(s) upends the current setup, which is not a remote possibility. We are focused on ensuring our win-share is strong relative to the deal opportunities.

The telecom, media and technology (“TMT”) sector uncharacteristically has moved up near the top of the leaderboard in restructurings since 2023. What has caused this? Is it just technology disruption?

Luke Schaeffer: I would say it can almost entirely be characterised as technological disruption across each of the technology, media and telecom structures. The restructurings that we have seen are largely the result of companies not making the turn to the next technological wave. The tech sector is one where companies who didn’t migrate to SaaS or evolve hardware to software are lagging or restructuring. In media, old linear business models that did not transition to digital transmission have faced financial stress and restructuring activity. And in telecom, hardware vendors and carriers who are burdened with significant legacy technology often are the ones facing stress and restructuring. Technological innovation in the TMT sector can turn industry leaders into laggards within a few years.

Leveraged M&A deal volume, particularly LBOs, disappointed in 2024 relative to hopeful expectations going into the year. What is holding it back? Is M&A activity ready to soar in 2025? Does that extend to LBOs?

Scott Bingham: 2024 was a very slow year for M&A deal volume, especially for PE actors. While I am optimistic that M&A activity will rebound in 2025, I don’t think it will be a full sprint right off the starting blocks. I believe a more friendly borrowing environment combined with greater risk tolerance under a Trump presidency and an abundance of mature investments held by PE owners well past their harvest time will encourage stronger M&A activity. These transactions can be done via the IPO market or by selling to corporate buyers, with the IPO market likely to be the preferred route for getting full value in the current environment, provided that equity markets continue to stay strong. In addition, once seller-driven transactions accelerate in volume and a healthy, consistent deal flow is established, it will draw out more buyers and lead to even more M&A activity, as the amount of dry powder held at PE funds is enormous. LBOs should ramp up along with the increase in buy-side activity, especially for mega-size deals. Let’s hope that the strong M&A market projected for 2024 finally shows up in 2025 and beyond.

Footnotes:

1: “The Incredible, World-Altering ‘Black Swan’ Events That Could Upend Life in 2025,” POLITICO (January 3, 2025).

Related Insights

Date

janvier 17, 2025

Contacts

Contacts

Global Chairman of Corporate Finance

Téléchargez

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About