- Accueil

- / Publications

- / Articles

- / How to Establish a Best-in-Class Wealth Management Operating Model That Can Thrive in a Changing Marketplace

How to Establish a Best-in-Class Wealth Management Operating Model That Can Thrive in a Changing Marketplace

-

février 05, 2025

-

Due to sweeping macro trends impacting wealth management (“WM”) firms—including increased M&A activity, fierce competition for assets and talent, a surge in generational wealth transfers, and rising client expectations around data literacy and technology—organizations must proactively invest in key areas to remain relevant or sustain a competitive edge.

WM firms must adapt, align, and integrate innovative technologies, platforms, and business units into their infrastructure and operations to meet evolving client expectations, to drive operational efficiency, and to stay competitive in a fast-changing market. Additionally, these efforts will help ensure continued high quality performance, uphold data integrity, and maintain compliance with increasingly complex regulatory requirements.

WM firms can keep up with these trends and drive successful outcomes by establishing integration readiness – the ability to seamlessly combine or merge with other firms, absorb assets and human capital while maintaining responsive client operations and services – and a best-in-class operating model.

Adapt or Fall Behind the Competition

WM remains a strong growth sector with an increasingly wide range of customers. Increasingly, a digitally savvy customer base offers WM firms an opportunity to become an integral part of their customers’ financial lives at younger life stages. However, growing competition threatens traditionally strong revenue sources and profitability. Established business models tend to be reactionary to changing market forces, making it challenging to address obstacles posed by low-cost, self-directed investing, increased regulatory scrutiny, and talent shortages.

Fintechs and Open Banking are gaining market presence, offering their clients robo-advisors, product and price comparison applications, ethical investing options, and free research. Customers expect digital-first, high-value experiences (e.g., social media modelled interfaces) at a low cost. Moreover, regulators are more aggressively using technology and data analytics to increase customer protections and transparency measures. The warning signals are clear – traditional WM firms must adapt to these forces to stay competitive.

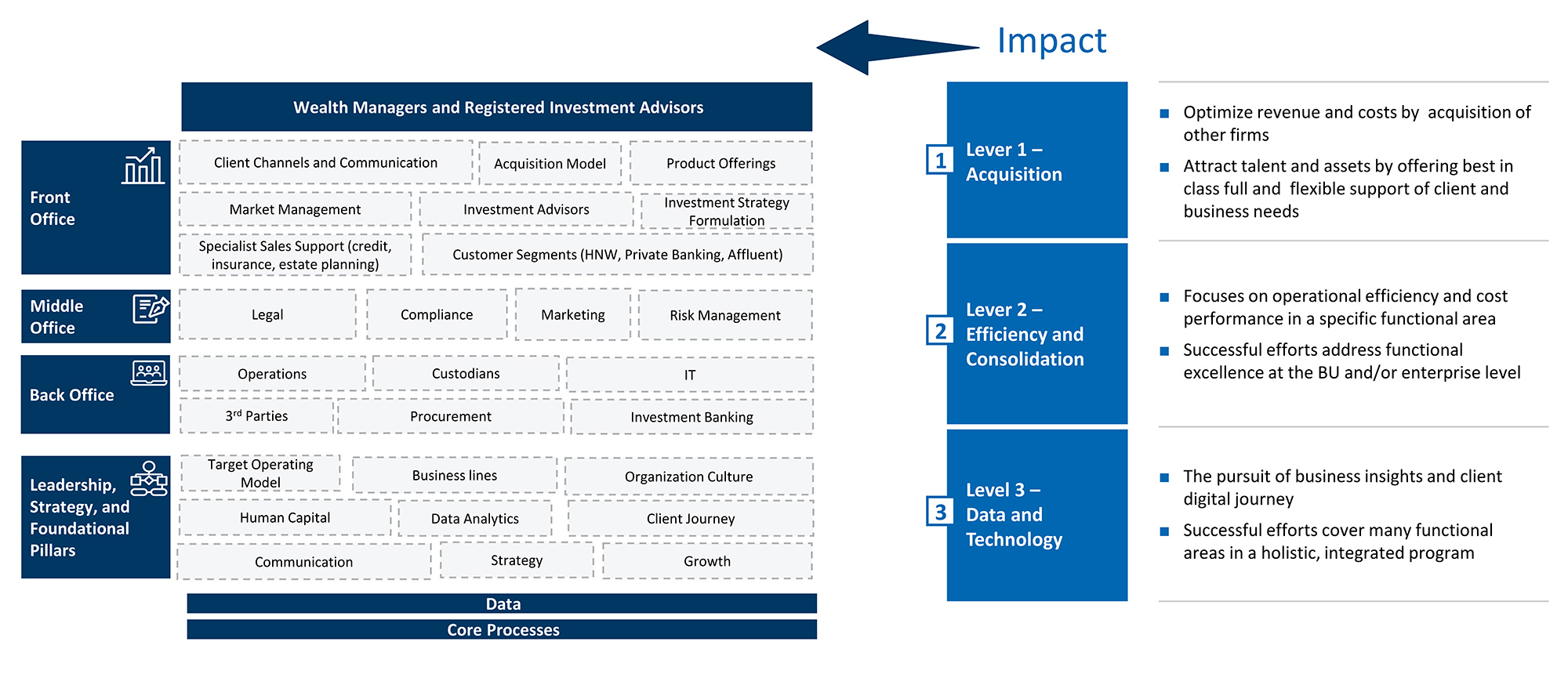

Establish a Level 1 Target Operating Model

WM firms must embrace and develop a lean, agile, and robust target operating model (“TOM”) to connect employees to the customer and their financial journey. The graphic below is a high level illustration of how different levers or factors can fundamentally affect the TOM of an organization and how important it is to constantly assess, adjust and ensure it is aligned across all units and functions.

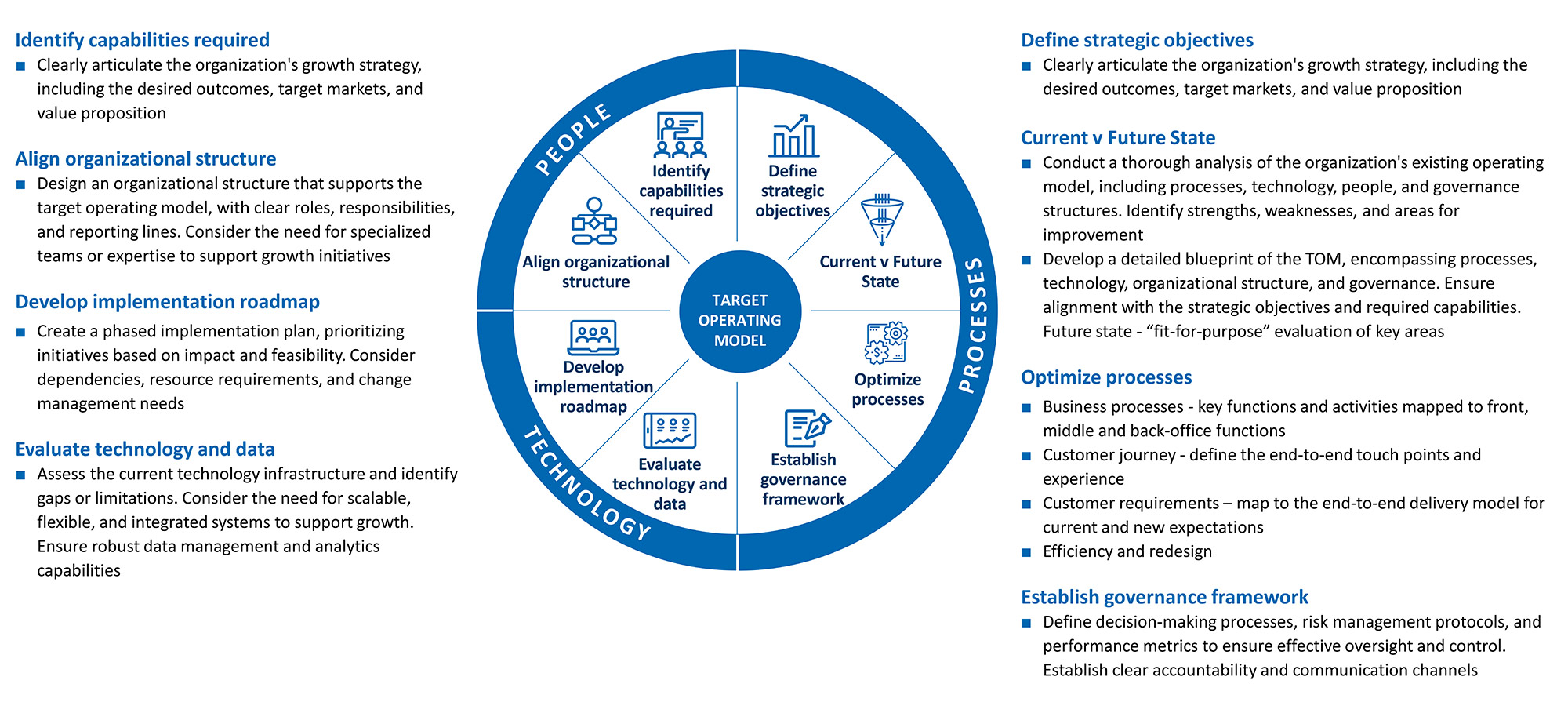

WM firms must understand the key fundamentals to establishing the appropriate TOM for their organization: Do they need a TOM that facilitates readiness for growth by acquisition or by effectiveness? Diving a little deeper on the TOM (below), we’ve highlighted three key aspects of any organization: People, Processes and Technology and their impacts on the TOM.

Target Operating Model Fundamentals

Implementing a new TOM is a significant undertaking that requires careful planning, stakeholder engagement and transformative management decisions. Key stakeholders must be involved throughout the process and communicate the benefits and rationale behind these changes.

Data and technology will continue to grow in influence as drivers for success. Big data and advanced analytics are on the cusp of transforming the WM industry, offering new ways to engage with clients and manage client relationships and risks.

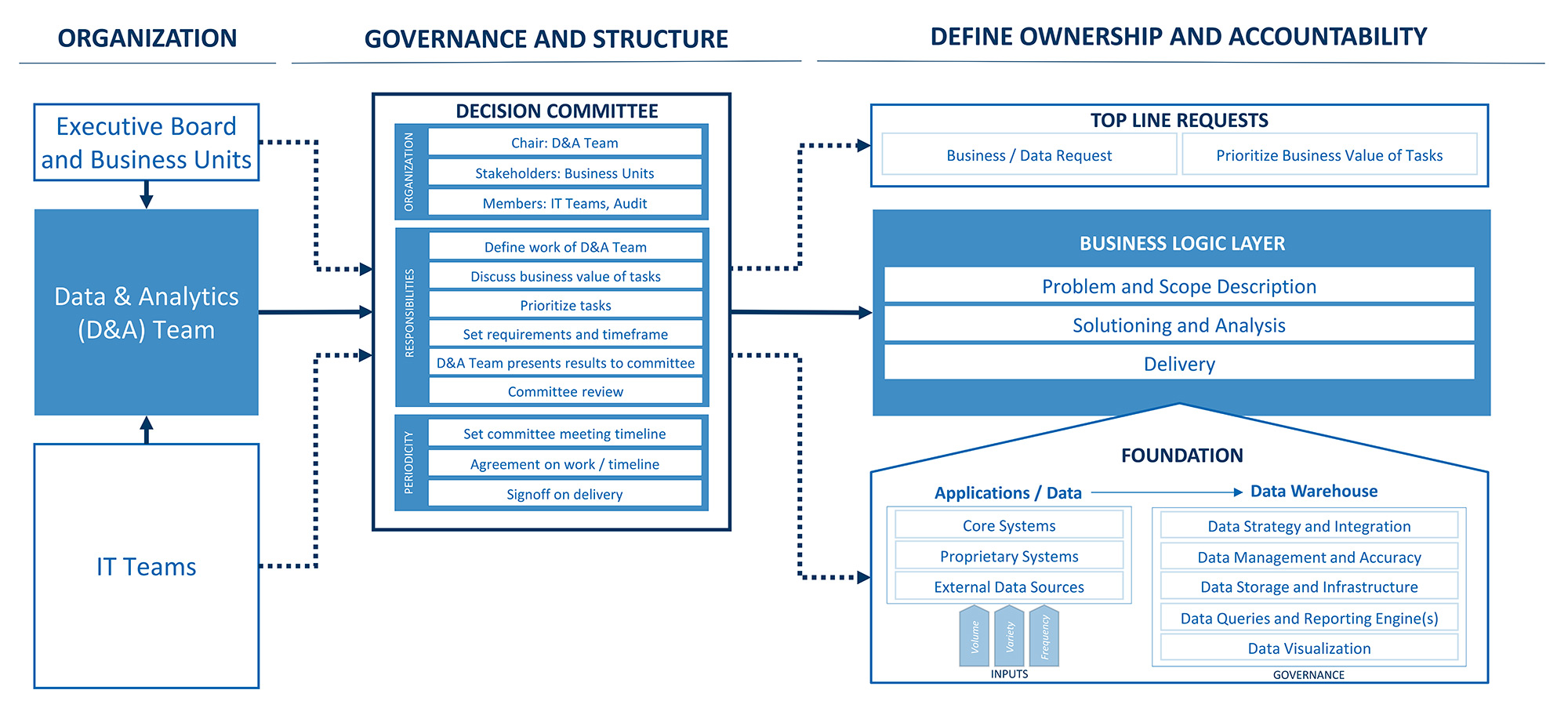

Creating a Level 2 TOM

Level 2 TOMs should be developed around core business functions and help drive and support optimization and effectiveness within and across all business functions. Effective data analytics models are poised to become one of the greatest business drivers in WM.

Operating models transform organizations by establishing an outcome-centric foundation focused on delivering value rather than services.

A defined data analytics (“DA”) model offers the following benefits.

| Business Value | — Forecast and report across service offerings and geographies; 360-degree customer views; rapid test hypotheses — Collect and report on business value-adds (e.g., lead generation, success factors, client journey experience) — Protect the organization and client assets through ability to detect, mitigate, and manage fraud and financial crime risks — Support business through improved data accuracy, access and insights |

| Organization | — Centralize strategy, governance and technology — Optimize the use of analytics talent |

| Process | — Optimize the portfolio by selecting the right set of initiatives, matching WM investment capabilities, appetite for transformation and expected business impacts — The DA team focus must adapt to the evolutions of the business strategy — Follow an operating model that facilitates continuous improvement — DA projects require a continuous cycle of improvement and iterative testing — They impact business processes that also need to be continuously improved — Accelerate the data-driven model to transform business operations from a transaction-driven to an engagement-driven process |

| Technology | — Use digital technologies to transform financial institutions’ business operations, drive top-line growth through improved customer experiences, and increase detection and monitoring of fraud and financial crime — Couple cloud-based data platforms with an analytics-as-a-service operating model to support these objectives |

The following example is a TOM that an organization can use to leverage their own sources and external ones to help drive the business and support growth. To deliver success it is important that the entire organization understand the rationale behind it and develop some “quick-win” projects to prove the value of the changes.

Related Insights

Related Information

Date

février 05, 2025

Contacts

Contacts

Senior Managing Director

Senior Managing Director

Managing Director

Managing Director

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About