Activists’ Lack of Recent Success: Causes and Implications

-

August 25, 2022

-

In the 2021 and 2022 proxy seasons, shareholder activists taking proxy contests all the way to a vote have won at least one board seat far less often than during the previous four years. Why is this the case? One reason is that influential proxy advisors Institutional Shareholder Services (“ISS”) and Glass Lewis (“Glass Lewis”) each have been much less likely to recommend that shareholders vote for the activist slate. This shift by ISS and Glass Lewis appears partly due to broad macro factors. At the same time, those proxy advisors’ recommendations have offered specific critiques of activists’ campaigns that suggest how activists can alter their approaches to achieve more success.

FTI Consulting examined proxy contests in which the underlying campaign sought board seats at U.S. companies with market capitalizations of at least $100 million and where ISS and Glass Lewis published voting recommendations. From 2017 through 2021, each year saw between 12 and 15 such proxy contests; the first half of 2022 had 14 contests. While small sample sizes in any year can magnify differences in results, a longer-term look suggests a definite trend.

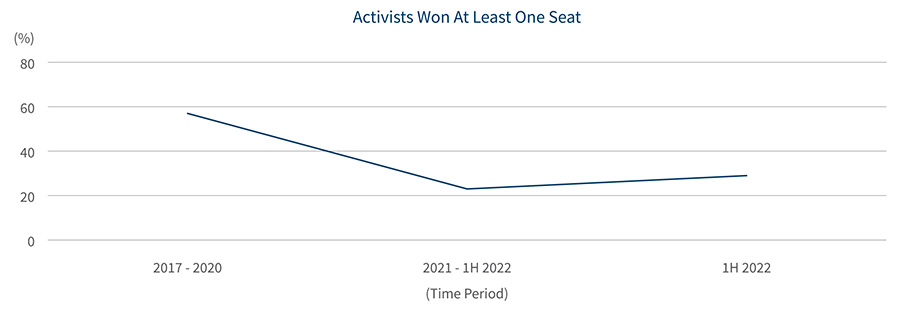

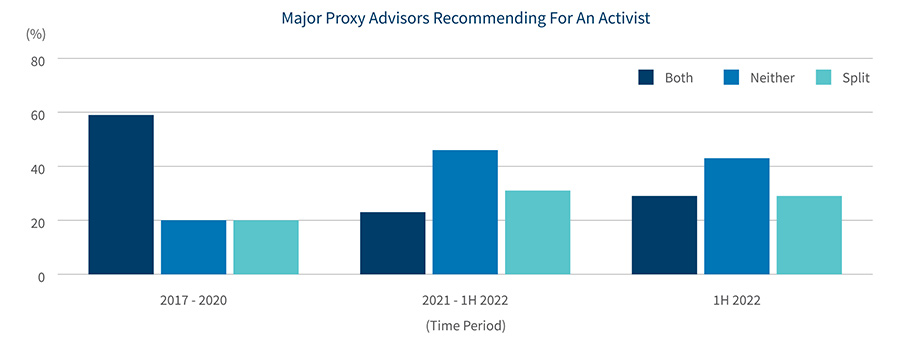

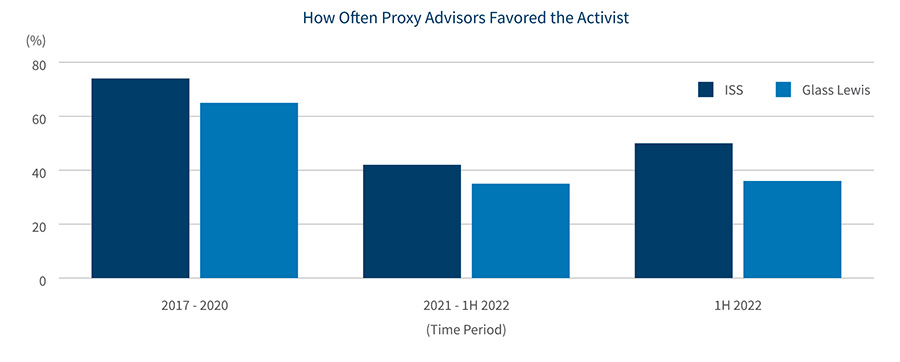

From 2017 through 2020, activists won at least one board seat in 57% of these contests. That figure falls to 23% since January 1, 2021, including 29% during the first half of 2022. From 2017 through 2020, ISS and Glass Lewis both recommended that shareholders vote on the activist proxy card in 59% of situations, a figure which has plunged to 23% since 2021 began.

Sources: Company and activist press releases and SEC filings, media reports, ISS and Glass Lewis reports

Since 2017 began, ISS has been slightly more inclined to recommend for an activist than has Glass Lewis. ISS and Glass Lewis had opposing recommendations 20% of the time between 2017 and 2020, and 31% of the time since 2021 began.

An activist almost always needs both ISS’s and Glass Lewis’s support to win a contest. Over the entire period, in only two of 80 situations did an activist obtain a board seat while winning the endorsement of just one proxy advisor, and no activist won a board seat without at least one endorsement. However, when an activist received support from both ISS and Glass Lewis, it almost always won at least one seat.

Factors impacting activist success rate

There are many potential causes of the significant decrease in activists’ success rate with proxy advisors and shareholders. Some could include:

- The generally strong stock market of 2021 and early 2022 made it harder to persuade proxy advisors and investors that companies required outside-directed changes;

- COVID-19 related disruptions in demand, the labor force and supply chains resulted in proxy advisors and investors granting management and directors more latitude;

- Companies have recognized more clearly when they are likely to lose a proxy contest and are more willing to settle, rather than risk a vote;

- Companies have been more effective in articulating their defense cases to proxy advisors and investors; and

- Activists have targeted companies with a smaller need for change, made less persuasive cases for change, or nominated directors who were viewed as less qualified for the situation.

One factor that does not appear to account for the change in results is the experience of the activist. In any given year, both experienced activists and newcomers run contests. Since the start of 2021, several well-known activists have run unsuccessful proxy contests seeking board representation, including Ancora Advisors,1 Legion Partners2 and Macellum Capital.3 At the same time, newcomers like Engine No. 14 and Voss Capital5 have won seats through contests.

Another potential explanation could be that corporate-backed political pressure on proxy advisors has influenced them. However, the timing does not align. Maximum political pressure occurred during the Trump Administration, as the SEC discussed and then put into place increased regulations on proxy advisors.6, 7 The Biden Administration has reversed some of those increased regulations.8 If proxy advisors had adjusted their recommendations due to political pressure, that would have happened prior to 2021, rather than thereafter.

One other possibility is that ISS and Glass Lewis might have made changes to the criteria by which they evaluate proxy contests. However, that seems highly doubtful. As described in their analysis of proxy contests, ISS and Glass Lewis have maintained the same publicly disclosed definitions and metrics upon which they judge contests.9 The personnel on ISS’s and Glass Lewis’s teams have remained largely consistent from a few years ago, when recommendations were more likely to favor activists.10 A more likely explanation is that relative to the companies’ cases, the activists’ cases simply have not been as convincing as in previous years.

How activists can improve future campaigns

Looking at proxy advisors’ recommendations on a case-by-case basis brings into focus specific items that have worked against activists, suggesting how activists can improve future campaigns. Activists did not have success against companies which were targeted by activists the prior year, suggesting that proxy advisors and investors considered it too soon to evaluate whether any changes made were sufficient. Proxy advisors thought activists were seeking more board seats than were warranted, based on the magnitude of the company’s issues. ISS and Glass Lewis at times deemed the skills and backgrounds of dissident nominees as being not particularly relevant to the situation, a criticism they also applied to companies.

Naturally, companies have benefited from proxy advisors’ generally favorable recent recommendations. However, macro conditions and a change in how shareholders vote are likely to result in greater challenges for companies. The recently more volatile stock market, along with continued high inflation and recession concerns, are apt to offer activists a broader selection of targets than in recent years. The September 1 implementation of universal proxy cards11 should reduce an activist’s cost to run a proxy campaign and inspire more campaigns.12

Going forward, the use of universal proxy cards will mark a major change in U.S. shareholder activism. The strategies and tactics that activists and companies pursue have continuously evolved since shareholder activists became prominent in the 1980s.13 Thoughtful activists will examine the activist community’s lack of success over the past two years and examine why proxy advisors failed to recommend for so many activists. As activists absorb and implement those lessons, they are likely to adapt and achieve increased success in winning future proxy contests.

Kurt Moeller is a Managing Director in FTI Consulting’s Activism and M&A Solutions practice. From 2017 through 2020, he analyzed and made shareholder voting recommendations on proxy contests and contested mergers at ISS.

Footnotes:

1: Blucora Shareholders Shoot Down Activist’s Bid for Board Seats, AdvisorHub, (April 22, 2021), https://www.advisorhub.com/blucora-shareholders-shoot-down-activists-bid-for-board-seats/

2: Scott Deveau, Activist Legion Partners Loses Bid to Revamp Genesco Board, Bloomberg, (July 20, 2021), https://www.bloomberg.com/news/articles/2021-07-20/activist-legion-is-said-to-lose-bid-to-revamp-genesco-board

3: Kohl’s Shareholders Re-elect All Directors at 2022 Annual Meeting, Press Release, Kohl’s website, (May 11, 2022), https://investors.kohls.com/news-releases/news-details/2022/Kohls-Shareholders-Re-elect-All-Directors-at-2022-Annual-Meeting/default.aspx

4: Jennifer Hiller, Svea Herbst-Bayliss, Engine No. 1 extends gains with a third seat on Exxon board, Reuters, (June 2, 2021), https://www.reuters.com/business/energy/engine-no-1-win-third-seat-exxon-board-based-preliminary-results-2021-06-02/

5: Griffon Corporation Announces Preliminary Results of 2022 Annual Meeting, Press Release, BusinessWire, (Feb. 17, 2022), https://www.businesswire.com/news/home/20220217005659/en/Griffon-Corporation-Announces-Preliminary-Results-of-2022-Annual-Meeting

6: Statement Announcing SEC Staff Roundtable on the Proxy Process (July 30, 2018), https://www.sec.gov/news/public-statement/statement-announcing-sec-staff-roundtable-proxy-process

7: Rob Lando, Jason Comerford, Jie Chai, U.S. securities law developments in 2020, Osler.com, (Dec. 8, 2020), https://www.osler.com/en/resources/regulations/2020/u-s-securities-law-developments-in-2020

8: SEC Adopts Amendments to Proxy Rules Governing Proxy Voting Advice, Press Release, SEC website, (July 13, 2022), https://www.sec.gov/news/press-release/2022-120

9: Based on analysis of ISS reports from December 2017 and May 2022, and Glass Lewis reports from September 2020 and May 2021.

10: Based on search of current employment status for ISS and Glass Lewis professionals on LinkedIn.

11: SEC Adopts New Rules for Universal Proxy Cards in Contested Director Elections, Press Release, SEC website, (Nov. 17, 2021), https://www.sec.gov/news/press-release/2021-235

12: Patrick Gadson, Universal Proxy Cards Will Produce More Fights, CorpGov, (March 2022), https://corpgov.com/universal-proxy-cards-will-produce-more-fights/

13: The Evolution Of Shareholder Activism, Bloomberg, (Feb. 20, 2015), https://www.bloomberg.com/professional/blog/shareholder-activism/

© Copyright 2022. The views expressed herein are those of the author(s) and not necessarily the views of FTI Consulting, Inc., its management, its subsidiaries, its affiliates, or its other professionals.

Related Information

Published

August 25, 2022

Key Contacts

Key Contacts

Managing Director

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About