Harvesting the Learning Points on Relevant Alternatives and Valuation from the ED&F Man Group Restructuring Plan

-

June 30, 2022

DownloadsDownload Article

-

Overview

ED&F Man is a global soft commodities trader with annual revenues of c.$7 billion. The Group had undertaken a refinancing in September 2020 via a Scheme of Arrangement which addressed $1 billion of debt maturities at that time. However, the Group faced subsequent challenges due to significant volatility in coffee and sugar pricing which had implications for the level of capital required to operate the business.

To address the capital constraints caused by material increases to market prices, and other capital structure challenges, the Group proposed a Restructuring Plan.

There were five classes of Plan Creditors, each of which voted in favour of the plan at a level well above the 75% threshold other than the Secured Tranche B Creditors (“B Facilities”). The B Facilities voted c.70% by value in favour of the Plan, and therefore the court was required to consider cross-class cram down.

The Group debt included RCF, A Facilities and B Facilities totalling c.$1.5bn. The Group’s capital structure also comprised borrowing base facilities, securitisation facilities, and a combination of local secured and unsecured bilateral debt at operating subsidiary levels.

The court sanctioned the Plan at a hearing on 23 March 2022. Given the cross-class cram down conditions, the FTI Consulting analysis on the Relevant Alternative and the Plan Outcome were key components of the evidence considered by the court.

A. The court must be satisfied that, if the Plan were to be sanctioned, none of the members of the dissenting class would be any worse off than they would be in the Relevant Alternative.

B. At least one class who would receive a payment, or have a genuine economic interest, in the event of the Relevant Alternative, has voted in favour (i.e., met the 75% approval threshold).

Relevant Alternative: whatever the court thinks is most likely to occur if the Restructuring Plan is not sanctioned.

Identification of the Relevant Alternative

The judgment reflected that the directors are normally in the best position to identify what will happen if a Restructuring Plan fails — particularly where this appears to be a rational and considered view.

Therefore, it remains appropriate when preparing Relevant Alternative analysis, and the Entity Priority Model (“EPM”) which underpins this, to place some reliance on the views of directors.

Nevertheless, we consider that it remains appropriate when preparing such analysis to continue to test scenario assumptions to ensure that they do appear to be rational and considered. There should continue to be robust debate on the Relevant Alternative between directors, the company legal and financial advisors, and the team instructed to undertake the Relevant Alternative analysis. This will assist in achieving a considered view.

Scenario Outcomes

It should not be assumed that a going concern share sale scenario should always yield a better outcome than a liquidation scenario.

Figure 1

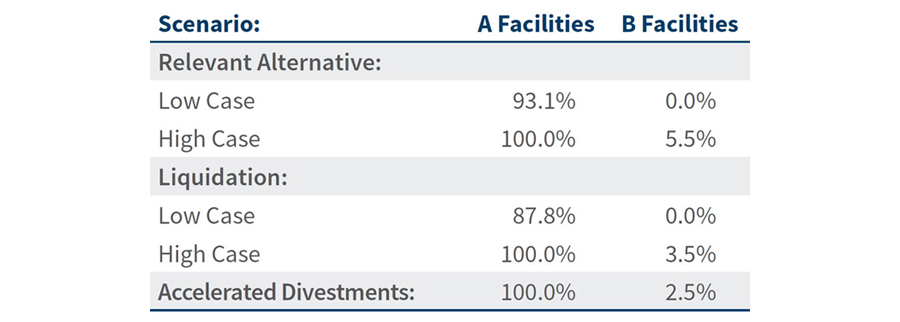

In this case, the Relevant Alternative was a liquidation of the Group’s Commodities Trading business (other than its North American MLP business), whilst pursuing share sales of the Group’s remaining legacy assets and the brokerage division.

The Liquidation scenario was as per the Relevant Alternative, other than the North American MLP business was also assumed to be liquidated. The Accelerated Divestments scenario reflected a series of going concern sales across the whole Group.

The Accelerated Divestments scenario resulted in lower outcomes than the Liquidation scenario and the Relevant Alternative.

The differing treatment of unsecured local debt on a share sale assumption versus a liquidation assumption was a material driver of lower recoveries to the B Facilities in an Accelerated Divestments scenario versus the other scenarios. This arose due to the extent of debt-like adjustments of unsecured debt on a share sale valuation assumption. Whereas such debt ranked as unsecured within the individual entity level waterfalls in the EPM for the Relevant Alternative analysis – often alongside guarantee claims where entities were obligors of Group debt.

As well as resulting in lower recoveries to A and B Facilities, the Accelerated Divestments scenario was also considered to be highly challenging to implement in the event of a failed sanction hearing.

Plan Outcome

In contrast to the Relevant Alternative, the Plan Outcome analysis indicates the recoveries to the Group’s stakeholders assuming the Restructuring Plan is successfully implemented. The Plan Outcome analysis comprised an enterprise valuation of each of the non-core assets and the Commodities Trading division, which were then flowed through the Group’s financial model, reflecting the timeline of disposals or refinancing, to determine the profile of debt repayments.

The need for detailed Plan Outcome analysis work may in part depend on the outcome in the Relevant Alternative. If the Relevant Alternative outcome for the B Facilities had been nil, there may not necessarily have been a need for the Plan Outcome analysis. The outcome of the Restructuring Plan would likely meet the “no worse off” test in such circumstances.

In this case, because the High Case Relevant Alternative outcomes did show value for B Facilities, the Plan Outcome analysis was important as a comparator for the “no worse off” test. The Plan Outcome analysis indicated that Tranche B2 debt (the portion of the B Facilities not subject to elevation arising from provision of new money) would likely receive recoveries of approximately 40%.

Timing of Recoveries

In addition to comparing the total dollar outcomes under the Relevant Alternative and the Plan Outcome, it was necessary in this case to also consider the timing of recoveries.

Assuming sanction was granted, it was anticipated that the Group’s non-core assets would be sold between 2022 and 2024 and that an M&A process for the Commodities Trading divisions or refinancing event would occur in 2026, ahead of upcoming debt maturities. This timetable informed the Plan Outcome analysis, and the B2 Facilities were not anticipated to receive a return until 2026.

In the Relevant Alternative, the timing of distributions to creditors would depend on several factors including i) the nature of the asset and timetable to realise; ii) complexity of the entity and potential for long-dated matters to be resolved prior to final dividends (e.g., litigation, tax); iii) jurisdiction; and iv) ranking of the claim in the relevant entity.

In this case, the Relevant Alternative recoveries to B Facilities would be paid at the end of the waterfall after Borrowing Base, RCF and A Facilities. In that scenario, distributions were estimated to be paid to the Security Agent from over 40 insolvency estates of the Group’s c.200 entities. It was estimated that recoveries may flow to B Facilities three to five years from the commencement of the Relevant Alternative scenario, i.e., within a similar timeframe as to the B2 Facilities on the Plan Outcome analysis.

The impact of the timing of recoveries on interest accruals was also assessed in relation to both the Relevant Alternative and the Plan Outcome.

—Mr Justice Trower

Disclosure Levels

Both the Relevant Alternative Report and the Plan Outcome Report were disclosed in full to all classes and to the Court. This open approach with full detail of assumptions and careful analysis of the resulting outputs was praised by Mr Justice Trower. It is clear that the courts expect to see an appropriate level of detail, particularly in cases where cross-class cram down is in-point, and not simply a high-level summary of the key outputs.

Materiality

In addition to level of disclosure, materiality levels were also a key consideration throughout the analysis. In cases with potential cross-class cram down, the materiality threshold may be lower than otherwise. However, the cost and demands on management time should also be proportionate. With approximately 200 legal entities across the Group, the assessment of any particular asset category between obligor and non-obligor entities provided an important steer on materiality to focus on the assumptions which impacted the relevant outputs for the Plan creditors.

Impact of the Restructuring Plan

The sanction of the Restructuring Plan facilitated:

- successful refinancing of c.$1.5bn of debt facilities;

- reorganisation of the Group, including a ringfencing of its Commodities Trading divisions;

- raising an additional c.$300m of new money; and

- amendments to the articles of association.

The new money is expected to support the Group in operating in the higher volatility commodity price environment. The Restructuring Plan included an elevation mechanism for those creditors participating in new money, which comprises a borrowing base facility, a margin line facility and trade instruments facility.

Published

June 30, 2022

Key Contacts

Key Contacts

Senior Managing Director

Senior Managing Director

Senior Managing Director

Managing Director

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About