How Long Can Housing Prices Defy Gravity?

-

November 16, 2022

DownloadsDownload Article

-

The decision-making process underlying a home purchase ultimately boils down to some basic math, but the dynamics of the housing market as a whole often seem to defy logic. In recent years, pockets of the housing market — a bastion of the American dream for generations — have shown strong elements of FOMO, just like meme stocks and cryptocurrencies, that often seem to ignore some key fundamental considerations. Prior to 2022, nearly everyone had heard stories of homes selling above listing price within hours of hitting the market or selling for all cash or sight unseen. This isn’t normal activity.

To that point, a youngish real estate pundit on TV, recently commenting on the challenges confronting aspiring home buyers with mortgage rates soaring and sky-high prices barely budging to date, suggested that those who find their ideal home should just bite the bullet and pay the asking price or close to it. His logic was that buyers will suffer for a bit but can refinance their mortgage next year when rates are much lower — effectively assuming that all this pesky inflation will be behind us in a year and then the race to low mortgage rates will resume. How presumptuous. But what else would you expect to hear from an older millennial conditioned to believe that all economic or financial pain is short-lived?

As baby boomers increasingly retire and millennials enter their prime working years, a growing percentage of working Americans have come to expect that the benign-to-favorable economic and market conditions that have prevailed for much of the last decade are just the way things are. They conveniently overlook the extraordinary interventions of the Federal Reserve and broader federal government into the affairs of the private sector and markets to prevent or mitigate economic adversity (and, arguably, boost financial markets), or perhaps they assume that such drastic interventions are normal policy actions that can continue indefinitely.

In reality, the U.S. economy has been riding with training wheels since 2010, and the ride gets wobbly whenever the Fed tries to take them off. We’ve hit on this theme for a while and are hardly alone: the massive increase in the size of the Fed’s balance sheet since 2009 via quantitative easing (QE) policy actions — nearly $8 trillion since the Great Recession and $4 trillion just since COVID-19 hit — created an environment of unnaturally low interest rates until recently, and vast amounts of bank reserves that have worked their way into the financial system, leading to unprecedented money creation, pricing distortions and excesses in various markets — and now inflation. The housing market is no exception.

Home prices nationally have enjoyed outsized appreciation since 2019, increasing at a 12.6% CAGR since late 2019, with many major markets showing larger gains. Stories abound of home unaffordability in most major metropolitan and suburban markets, with prices out of reach for many aspiring homebuyers, yet prices have continued to rise. Economists point to a chronic housing shortage caused by years of underbuilding and demographic shifts in the population as millennials, the largest cohort by age, are now all adults looking to put down roots. These trends may be true, but their impacts are slow moving, while it’s plainly obvious that COVID-induced lifestyle changes combined with Fed-induced record low mortgage rates since 2019 were the primary drivers behind this record-size 43% cumulative increase in home prices nationally.

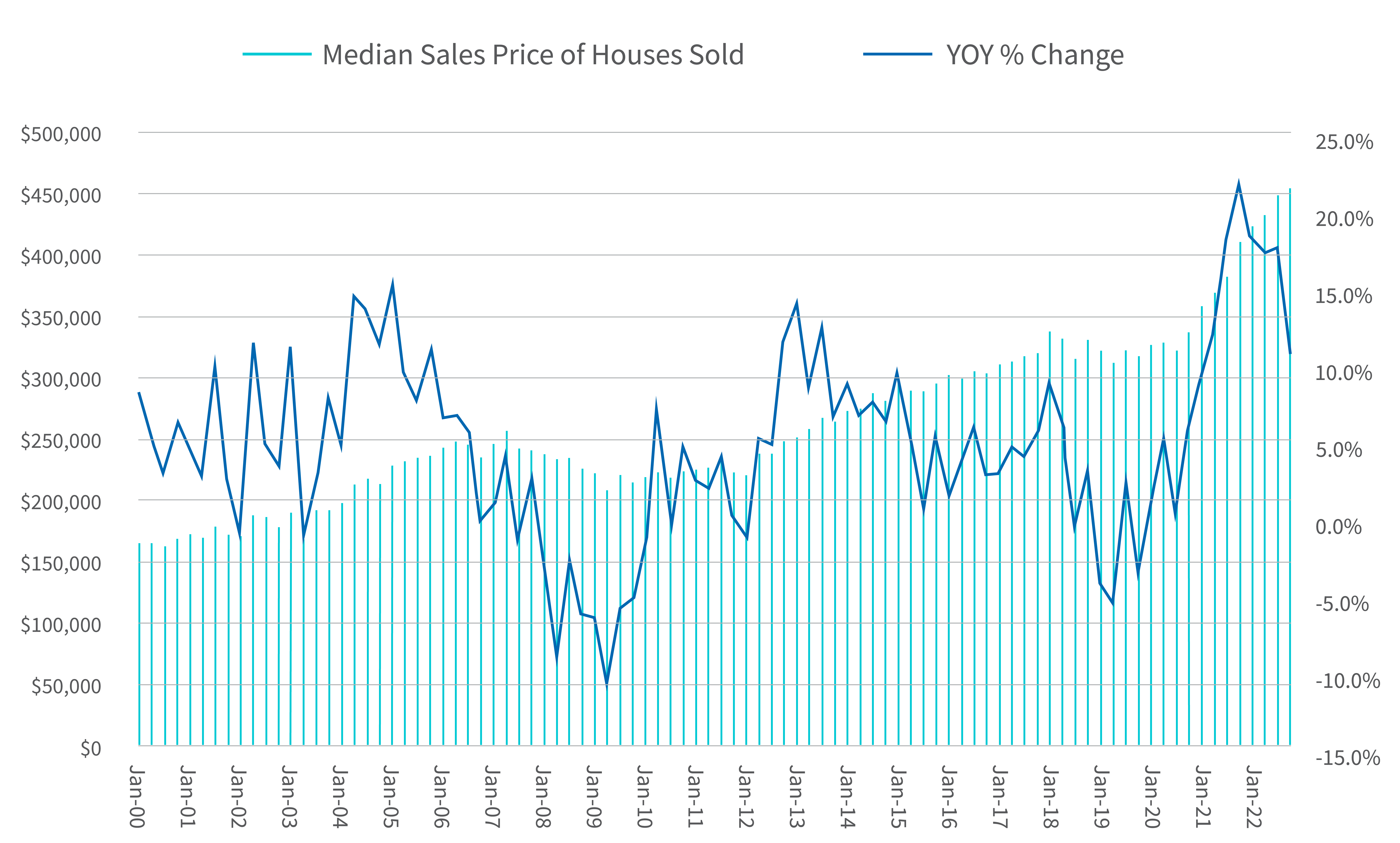

Exhibit 1 - Median Sales Price of Houses Sold

With these underpinnings no longer supporting a robust housing market (a new fixed monthly mortgage payment is 60% higher compared to a year ago), one might have expected home prices to substantially correct, but that hasn’t happened yet. Instead, home sales activity has fallen sharply in recent months, with new mortgage applications for home purchases falling 42% year- over-year (YOY) last month while total mortgage demand fell to its lowest level since 1997.1 In short, transaction activity has slowed to a crawl yet home prices continue to increase on a YOY basis, though price gains (YOY) have decelerated (Exhibit 1), while slight price declines have occurred for three straight months when measured on a consecutive monthly basis. Increasingly, buyers and sellers are stepping to the sidelines, as more buyers are priced out while sellers hesitate to drop asking prices to accommodate the harsh mathematical reality of 7.0% mortgage rates.

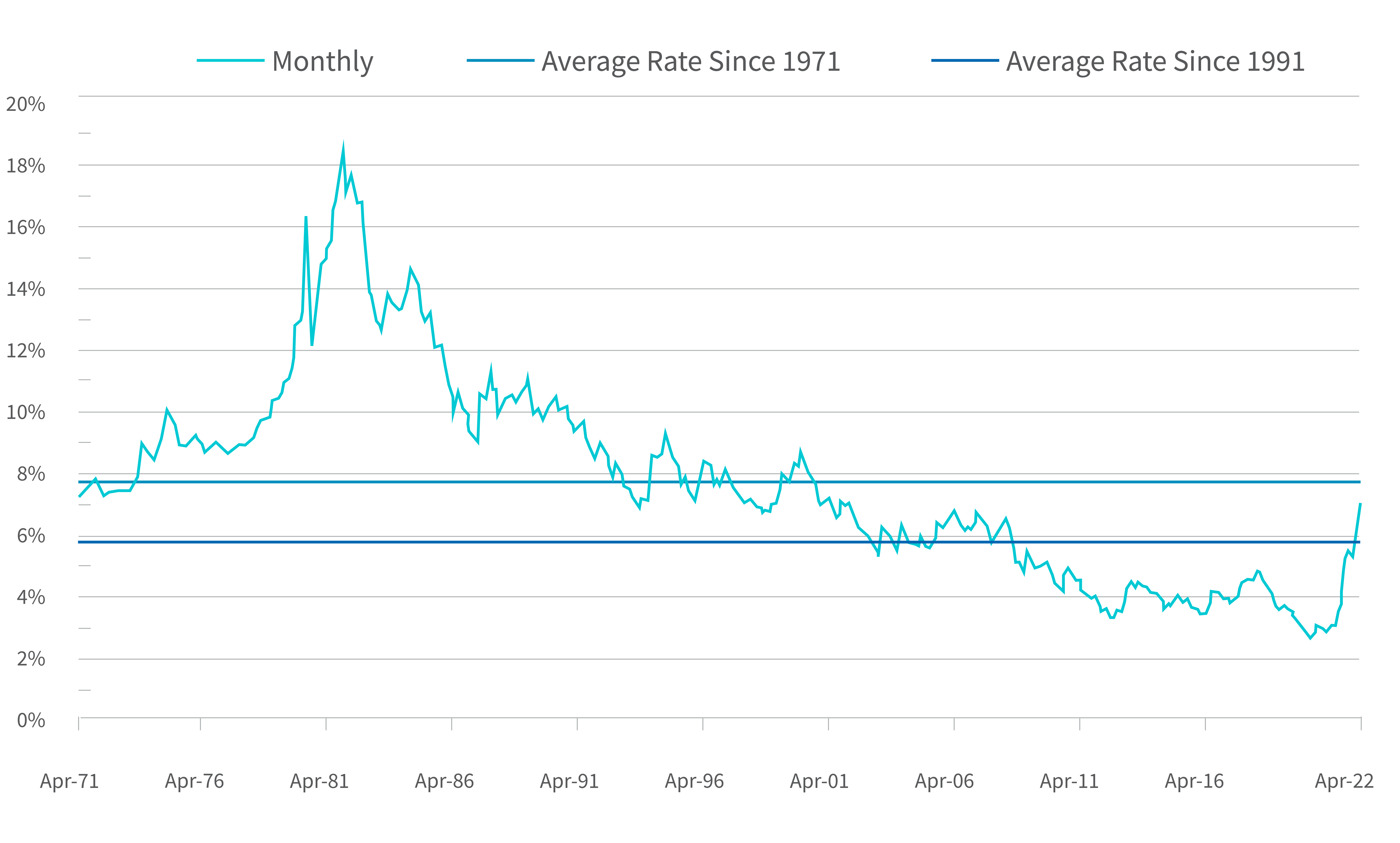

Those who expect mortgage rates to “return to normal” any time soon likely have a distorted sense of what normal is. Historically, a 30-year fixed mortgage rate has averaged 5.9% since 1991 (Exhibit 2) — and that includes ultra-low

Exhibit 2 - 30-Year Fixed Rate Home Mortgage

rates that have prevailed since 2012 due to huge open-market purchases of securities by the Fed under its various iterations of QE. A 30-year, fixed-rate mortgage dipped below 5.0% for the first time ever during the Great Recession of 2009 and eased further over the next decade before moving into the 3.0% range during COVID-19 (Exhibit 2). Consequently, the Federal Reserve now owns nearly $2.7 trillion of agency mortgage-backed securities (MBS)2, representing more than 30% of the entire market, nearly doubling its holdings since the COVID-19 pandemic began. This is a huge subsidy for the U.S. housing market in the form of low mortgage rates. But the Fed’s pivot to quantitative tightening (QT) in June entails a reduction of its massive securities portfolio of up to $95 billion monthly via scheduled securities sales and runoffs, including up to $35 billion per month of MBS, which has barely begun. This about-face, if carried through, will end the Fed’s support of low mortgage rates and put upward pressure on mortgage rates for the foreseeable future, provided it doesn’t buckle to political pressure to ease up again.

Moreover, the notion that high inflation — the primary culprit behind higher interest rates — will be tame a year from now and that interest rates, including mortgage rates, will soon follow remains a leap of faith currently. Strong earnings results for 3Q22 from various consumer-facing companies, including PepsiCo, Procter & Gamble and Chipotle, all tell the same story: shoppers continue to absorb sizeable price hikes despite their complaints about inflation, while the advance estimate of GDP for 3Q22 indicates that real consumer spending remains healthy in the face of inflation. Some prominent bank CEOs, notably Brian Moynihan of Bank of America, have recently reiterated that they see little sign of any notable slowdown in consumer spending3. Collectively these data points indicate the persistence of high inflation despite easing commodity prices and the Fed’s efforts to date, and they increase the likelihood of “higher for longer” when it comes to the Fed’s rate policy posture. While inflation likely will ease from high- single-digit rates in the months ahead as the Fed continues to hit the brakes, there seems to be a general expectation in markets that inflation will approach the Fed’s target range of 2.0%-2.5% in a year or a bit longer. This seems quite optimistic, given inflation’s demonstrated stickiness so far and above- average wage increases that can keep it rolling. There has been little discussion about a scenario of inflation easing but settling into a still-high range, say 4.0%-5.0%, which would be very damaging for the domestic economy and an ongoing challenge for policymakers.

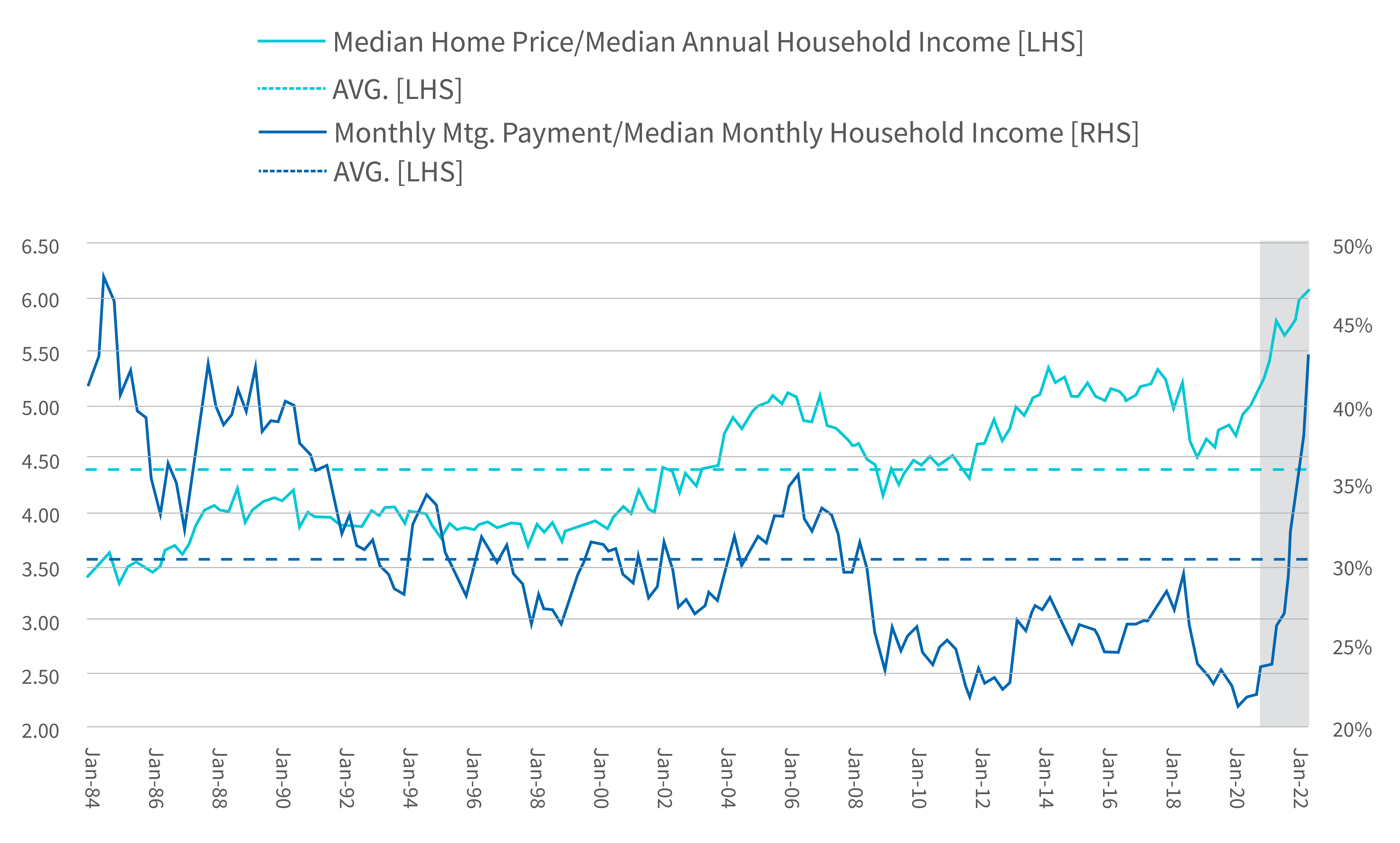

In any case, it easily could be argued that historically low mortgage rates have done little to improve housing affordability; instead, they have just driven up prices for homes that used to be a lot cheaper. This conclusion is evident in a single chart (Exhibit 3) plotting relative home prices (median sales price of homes sold / median annual household income) versus home affordability (monthly mortgage payment / median monthly household income) since 1984. Relative home prices were consistently in the range of 4X median annual income throughout the 1990s and early 2000s before moving to 5X income during the housing bubble of 2004-2007 and towards the 6x range since COVID. Americans have been paying more and more for homes since 2009 relative to their incomes. What makes this tolerable? Low mortgage rates, of course, as monthly mortgage payments relative to monthly income have been steady or lower this past decade even as Americans paid more for homes — that is, until recently (Exhibit 3). But we are now in an “off the charts” moment, with home affordability plunging in 2022 due to the combination of nearly record-high home prices and spiking mortgage rates. Something has got to give, most likely home prices.

Getting back to basic home-buying math, if mortgage rates eventually stabilize near 6.0%, which is consistent with its historical average (Exhibit 2) without the Fed’s helping hand, home prices nationally would need to contract by 23% for home affordability (monthly mortgage payment / median monthly household income) to revert to its long-term average of 31%. Such a correction isn’t savage but would wipe out much of the home price appreciation since COVID-19 struck and, coincidently, is roughly in line with pullbacks experienced in equity markets to date. This is all back-of-the-envelope math and sweeping generalizations about the housing market are usually a fool’s errand. But such an approximation seems reasonable, and it’s up to the pundits to contemplate the impact of such a pullback on consumers and the economy generally, given that most Americans derive much of their personal wealth from the equity value in their homes.

The housing market consists of much more than homebuilders and realtors. Other sectors that depend on a robust housing market include building materials and construction, mortgage financial services, furniture and home furnishings, home improvement and consumer durables. These sectors aren’t necessarily dependent on housing prices per se, but they do rely on robust transaction activity, and any prolonged stalemate or housing slump would be harmful across a wide swath of industries.

Exhibit 3 - 30-Year Fixed Rate Home Mortgage

1: Diana Olick, “Mortgage demand from homebuyers is now nearly half what it was a year ago,” CNBC (October 26, 2022), https://www.cnbc.com/2022/10/26/ mortgage-demand-from-homebuyers-is-nearly-half-what-it-was-in-2021.html.

2: “FEDERAL RESERVE statistical release,” Board of Governors of the Federal Reserve System (October 27, 2022), https://www.federalreserve.gov/releases/h41/ current/h41.pdf.

3: Hugh Son, “Bank of America CEO says latest spending and savings data show that the U.S. consumer is healthy,” CNBC (October 17, 2022), https://www. cnbc.com/2022/10/17/bank-of-america-ceo-brian-moynihan-says-the-us-consumer-is-healthy.html.

Related Insights

Related Information

Published

November 16, 2022

Key Contacts

Key Contacts

Global Chairman of Corporate Finance

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About