Navigating the Next Phase of Electric Vehicle Adoption

-

September 15, 2025

DownloadsDownload Article

-

The pillars supporting the U.S. electric vehicle (“EV”) sector are facing significant strain. Financial incentives, including subsidies and tax credits, have been repealed, while long-standing fuel economy and emissions standards are being reconsidered and redirected toward alternative priorities. Policy volatility, including on-and-off again tariffs and the removal of incentives, is undermining the stability needed for strategic planning. In a short period of time, the discourse has shifted from scaling the EV supply chain to fundamental questions about the sector’s viability. Navigating this period of uncertainty presents substantial challenges across the EV value chain, yet strategic foresight and planning can enable successful adaptation.

Reflections From the Road Traveled

For over a decade, the world’s three largest automotive markets (i.e., China, Europe, United States) have promoted electrification through a dual-pronged approach — incentives to encourage EV adoption (“the carrot”) and regulatory measures to constrain internal combustion engine (“ICE”) vehicle usage (“the stick”). In the United States, this framework has historically meant subsidies to support domestic EV manufacturing and, more recently, consumer tax credits for EV purchases.1 Complementing these incentives have been stringent fuel economy and emissions standards designed to gradually phase out ICE vehicles.2 The passage of the Inflation Reduction Act (“IRA”), along with the latest fuel economy regulations issued by the Environmental Protection Agency (“EPA”), significantly bolstered this policy landscape.3,4

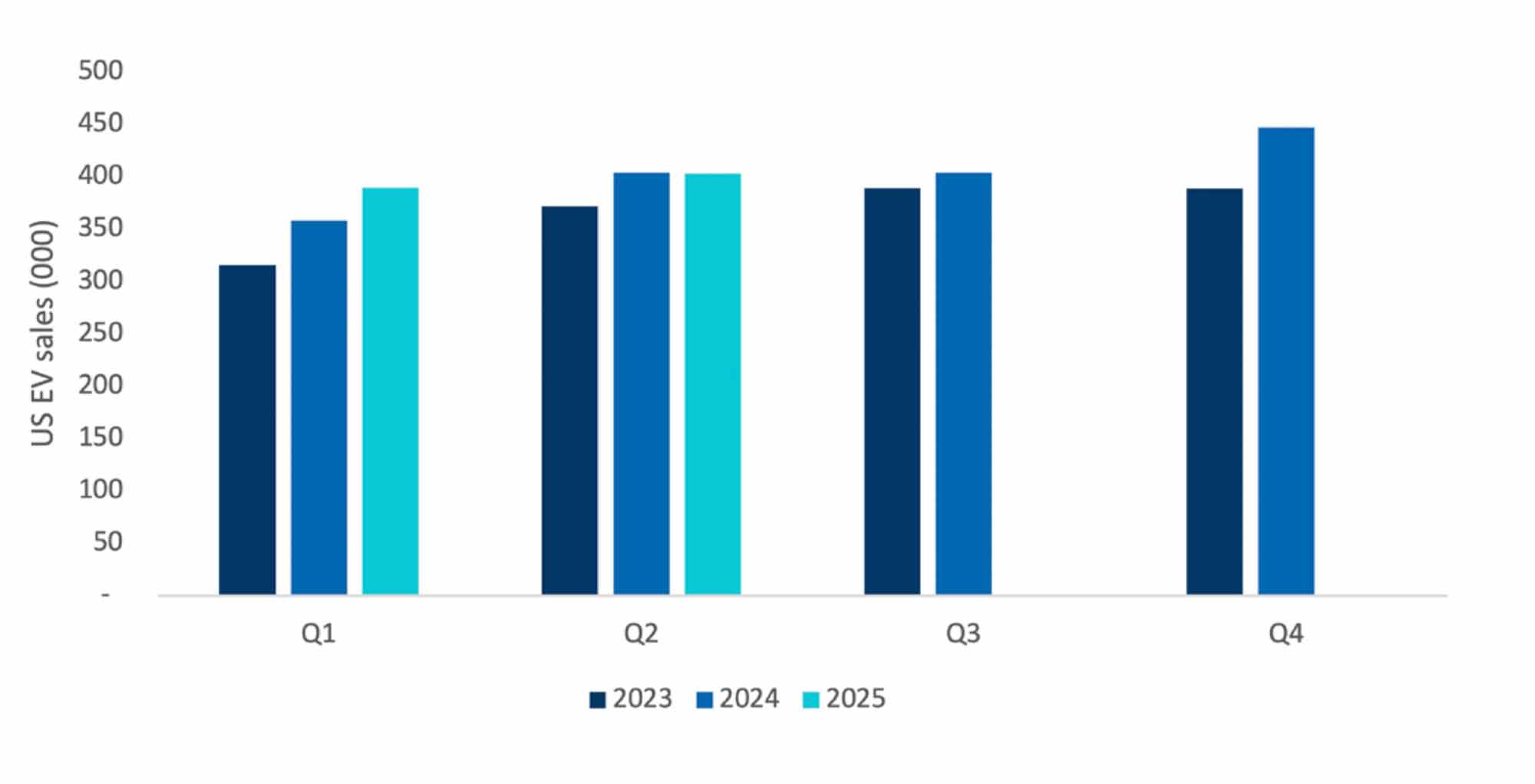

As a result, the first quarter of 2025 showed strong EV market growth, with sales increasing approximately 11% year-over-year, or roughly 10% of total new vehicle sales in Q1 2025. Notably, this coincided with Tesla’s market share declining to about 43% from over 50% in the previous year, signaling a more diversified and maturing EV market ecosystem.5

Hitting the Brakes

The U.S. faces a pivotal moment as both incentives and regulations driving electrification are under threat. Weakening tax credits, renewed challenges to longstanding emissions rules, and volatile tariff policies collectively jeopardize the long-term stability and momentum of the EV transition.

Two key regulatory agencies — the EPA and the National Highway Traffic Safety Administration (“NHTSA”) — have traditionally anchored U.S. fuel economy policy around carbon dioxide (“CO2”)-based emissions standards. These greenhouse gas (“GHG”) regulations have served as the principal mechanism incentivizing legacy automakers to invest in and commercialize electric vehicles. However, under the current administration, both agencies have begun shifting their regulatory focus from GHGs to hazardous air pollutants,6 a subtle yet consequential change. Unlike hazardous pollutants, CO2 is not directly harmful to human health in ambient concentrations but remains the primary ICE emission driving climate change. By deprioritizing CO2 in favor of hazardous emissions, the administration is reducing the emphasis on fuel economy and climate- focused standards and shifting the focus to public health.

The Biden administration established formal fleet fuel economy as well as CO2 reduction targets through 2032. The penalties for not meeting the fuel economy standards have now been set to zero and the EPA has planned to reveal more permissive standards for CO2.7 This regulatory instability is complicating long-term planning, making it more difficult for original equipment manufacturers (“OEMs”) to commit to investment strategies and future product development.

On the incentive front, the IRA was designed to reduce the cost of EV production and ownership, while simultaneously strengthening the domestic supply chain. Key provisions included a $7,500 consumer tax credit for qualifying EV purchases, as well as manufacturing incentives. The IRA also had measures to subsidize EV charging infrastructure, notably mandating the deployment of EV chargers along major national highway corridors.8

Under the One Big Beautiful Bill Act (“OBBB”), the EV charging infrastructure incentives are being sunset by June 2026 and the EV purchase credits by September 2025 — several years ahead of the IRA’s original 2032 end date. It is expected that there will be a temporary surge in EV sales leading up to the September expiration, followed by a decline in sales in Q4 2025. This accelerated timeline is likely to significantly reduce consumer demand, particularly for mass-market and used EVs, which have relied heavily on these incentives to remain competitive with traditional vehicles. The removal of the Qualified Commercial Clean Vehicles Credit further delays fleet electrification, impacting commercial EV manufacturers and infrastructure providers.9

Further complicating the policy landscape, on April 2, 2025, the administration introduced a new wave of tariffs, imposing a 145% duty on Chinese EVs and battery materials in an effort to reduce U.S. dependency on China, which currently controls over 70% of global battery and cell production and over 85% of cathode and anode capacity. Tariffs, primarily used as short-term negotiation tools, undermine predictability and complicate long-term capital commitments. Within weeks, tariff policy specifically toward China shifted repeatedly, including a temporary 90-day pause and subsequent rate adjustments, creating prolonged uncertainty around tariff levels and significantly complicating long-term capital planning.10

The combined effect of recent policy and regulatory changes, along with an increasingly protectionist tariff environment, is expected to substantially impact EV adoption in the United States. Consumer demand for both passenger and commercial EVs is likely to decline, and private-sector investment in EV charging infrastructure is anticipated to contract significantly. Automakers may scale back their EV deployment strategies in favor of higher-margin ICE vehicles, further weakening America’s competitive position in a rapidly growing global market. The effects are already evident, with EV sales flattening in Q2 2025 (see figure 1). Given the current policy environment, FTI has revised its forecast for U.S. EV adoption to below 30% by 2035, down from a 60% penetration forecasted just one year ago.11 Companies founded on expectations of sustained growth now face unpredictable regulatory shifts that outpace their capacity to adapt supply chains and strategic plans, creating persistent uncertainty over long-term strategic planning. Absent corrective measures, this could result in the U.S. falling behind other regions (particularly China and Europe) that continue to aggressively support electrification and battery manufacturing, resulting in economic and strategic disadvantages.

Figure 1 - US Quarterly EV Sales (000) (2023-2025)

Source: FTI analysis based on subscription data from MarkLines Information Platform, A portal specializing in automotive intelligence and data.12

Shifting Gears

This is not merely short-term turbulence, the current environment presents deeper structural uncertainty that is now amplified by the OBBB. The termination of key incentives and weakening of regulatory enforcement mechanisms are placing pressure on the sector and eroding investor confidence, complicating long-term strategic planning across the EV ecosystem. Both new EV companies and established OEMs now face major challenges. Extended planning cycles have been disrupted, likely compelling companies to re-evaluate fundamental business assumptions and potentially slowing innovation, investment and deployment strategies, thus diminishing America’s global competitive advantage in the EV sector.

For the wave of new companies that were inspired by Tesla’s success and the broader promise of electrification, a breakdown in the foundational assumptions underpinning their business models (i.e., strong policy support and market growth for several years) could lead to restructurings, market consolidation and increased risks of outright failures.

For more established players, such as legacy automakers and Tier 1 suppliers, this uncertainty has thrown long-term investment strategies into disarray. General Motors, for example, publicly committed to phasing out its entire ICE portfolio.13

This bold move was echoed by several other OEMs who have redirected the majority of their R&D budgets toward battery-electric and autonomous vehicle technologies.14,15 These commitments are typically aligned with six-year regulatory cycles and twelve-year capital investment horizons. Frequent reversals in federal policy significantly undermine such extended planning, impairing investor confidence, stalling momentum and diminishing the nation’s future competitive edge in the global EV marketplace.

What You Can Do To Steer Through the Uncertainty

Managing Cash To Enhance Liquidity Management

Periods of heightened uncertainty, delayed product launches or reduced sales significantly impact cash flow, elevating the importance of disciplined liquidity management. Robust cash forecasting can offer critical

visibility into short-term financial needs. Identifying levers for unlocking near-term liquidity can significantly enhance financial resilience. Raising additional capital or modifying existing debt instruments may be required to enhance short- to medium-term liquidity. Equally important is preserving strategic optionality, allowing businesses to extend their operational runway and adapt quickly as trade policies and market dynamics continue to shift. Companies can also proactively manage working capital by optimizing inventory levels and accounts receivable terms, ensuring alignment with shifting market realities.

Getting Lean To Optimize Operational Efficiency

Management teams can comprehensively evaluate their organizational structure, resource allocation and core operational processes to strengthen resilience amid persistent uncertainty. This involves evaluating spans of control, identifying redundant roles and addressing underperforming business units to improve efficiency and profitability. Companies can also prioritize digital transformation and AI initiatives and operational analytics to gain deeper insights into performance metrics and streamline decision-making processes.

Ultimately, businesses should clearly define their core competencies, leverage data-driven insights and concentrate resources on operations with clear pathways to profitability and growth to effectively navigate challenging market conditions.

Seize on Strategic Opportunities During Market Consolidation

If a market consolidation phase materializes, companies possessing high-quality assets but lacking sufficient liquidity or financial backing may be compelled to pursue divestitures in order to maintain solvency. Industry participants with strong balance sheets and access to capital can leverage this environment to pursue compelling opportunities to acquire strategic assets. Additionally, companies should remain agile and actively monitor market dynamics to rapidly capitalize on partnership opportunities or alliances that can enhance their competitive positioning and accelerate strategic objectives.

Charting the Path Forward for the Road Ahead

The EV market has progressed through distinct phases. In the early 2010s, EVs remained a niche product, often met with skepticism. Global momentum accelerated as China’s aggressive policy push and Tesla’s early breakthroughs spurred adoption. The COVID-19 era brought unprecedented regulatory and financial support, lowering costs, improving product quality and driving large-scale investment from global automakers. Today, however, the U.S. EV sector faces significant headwinds. Policy reversals threaten to slow progress, while a surge of lower-cost Chinese EV exports is intensifying competitive pressure on OEMs worldwide. These forces are straining the EV ecosystem and could trigger consolidation and market exits in the years ahead.

Despite these setbacks, underlying technological advancements and broader global market trends continue to strongly favor electrification in the long term. We believe that companies must maintain investment in innovation, particularly in battery chemistries, charging technology and integration with renewable energy grids to ensure readiness for the eventual market recovery. Amid escalating headwinds, the question for industry participants is clear: not merely who is best positioned today, but who possesses the resilience required to stay the course and emerge in a stronger position once the storm passes.

How We Can Help

FTI Consulting’s Power, Renewables and Energy Transition Practice (“PRET”) delivers deep industry expertise to support clean mobility’s investors, manufacturers, supply chain participants, municipalities and government agencies. Our seasoned team of technical experts, former executives, regulators and financial advisors provides comprehensive and actionable insights tailored to complex market environments and identify strategic opportunities.

Specifically, PRET assists clients with strategy and go-to-market advisory, market forecasting and competitive positioning, strategic and commercial options evaluation, business plan review, stakeholder engagement, IPO readiness, regulatory and policy support, transaction support and financial due diligence, structured capital raising and de-risking strategies and financial modeling. Our holistic approach and deep industry knowledge equip our clients to confidently navigate the evolving clean mobility landscape and successfully achieve their investment and operational goals.

Footnotes:

1: Credits for new clean vehicles purchased in 2023 or after.

2: “Multi-Pollutant Emissions Standards for Model Years 2027 and Later Light-Duty and Medium-Duty Vehicles,” 89 CFR 27842 (2024).

3: Buckberg, Elaine, “Clean vehicle tax credit: The new industrial policy and its impact” Stanford Institute for Economic Policy Research (“SIEPR”) (August 2023).

4: “The EPA final multi-pollutant rule for light and medium-duty vehicles sends a resounding message about the accelerating transition to electric vehicles in the U.S.,” International Council on Clean Transportation (“ICCT”) (March 20, 2024).

5: Shahan, Zachary, “Tesla Model Y & Model 3 Conine to Dominate US EV Market—But. . .,” CleanTechnica (2025).

6: Domonoske, Camila, “The EPA proposes gutting its greenhouse gas rules. Here’s what it means for cars and pollution,” National Public Radio (July 29, 2015).

7: Raviv, Adam, “Congress Eliminates Corporate Average Fuel Economy (“CAFE”) Penalties for Passenger Cars and Light Trucks,” Sidley Austin LLP (July 8, 2025).

8: House Bil 5376.

9: H.R.1. – One big beautiful bill Act.

10: Tariff Tracker.

11: FTI Consulting employs proprietary forecasting methodologies to estimate EV adoption in the United States. The approach begins with a regression-based model to project global and country-level vehicle sales. These projections are then refined using a qualitative and quantitative assessment of policy and regulatory frameworks, alongside a detailed review of automaker cycle plans, to develop market- specific EV adoption trajectories.

12: FTI analysis based on subscription data from MarkLines Information Platform A portal specializing in automotive intelligence and data.

13: Shepardson, David, “GM still planning to end gas-powered vehicle sales by 2035 – CEO,” Reuters (December 13, 2023).

14: Clean Technica : Mercedes – Last ICE platform 2023.

Related Insights

Related Information

Published

September 15, 2025

Key Contacts

Key Contacts

Global Practice Leader Power, Renewables & Energy Transition (PRET)

Managing Director

Managing Director

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About