The Rise of the Operator-Investor in Asia

Numbers Tell the Story: The End of Passive Real Estate

-

November 10, 2025

-

Commercial real estate investments in Asia Pacific rose 23% year-on-year to $131 billion in 2024,1 this headline figure conceals a more challenging reality ─ that the traditional real estate model no longer works.2 Investors seek higher margins and tenants expect more from their properties than ever before. A widening performance gap between sophisticated operators and passive owners is reshaping returns.

This is not cyclical volatility that is due to change, it is structural. Evidence from ANREV’s recent Investment Intentions survey highlights a decisive shift in investor strategy. For the first time, investors ranked data centres as their preferred sector, displacing logistics. This marks a shift from quality previously defined only by location towards assets now being defined by their performance complexity, resilience and operational excellence. Capital flows reflect this as fundraising for APAC-focused real estate funds fell by 53% in the course of two years (2022-2024) signalling investor scepticism toward passive strategies that struggle in a high-cost environment.3

Three structural changes have fundamentally altered the risk-return balance:

- The End of Low Cost Money: The era of low interest rates that masked operational weaknesses is over. With Australia's cash rate at 3.85%4 and Singapore maintaining its long-term policy of currency appreciation5, leverage is no longer a substitute for value creation. Assets must now deliver operational improvements to justify their debt service - a marked departure from the financial engineering playbook that dominated the last decade.

- The Tenant Power Shifts: Tenants today demand integrated services, rather than space alone. A pharmaceutical distributor leasing cold storage no longer just seeks a room held at 2-8°C, they require integrated services, such as real-time auditable temperature and humidity data, end-to-end traceability for regulatory compliance and value-added services such as blast freezing, relabelling and integration with last-mile refrigerated transport. The lease now represents a guaranteed outcome of product of integrity, rather than simply a space for use.

- The Mainstreaming of Operational Assets: Formerly “alternative” investments ─ data centres, cold storage, senior living and other asset types are now becoming mainstream. These asset classes are operationally intensive by design, as the premium lies not in concrete and steel but in the integration of services, brands and platforms that operate them.

Adapting to this increasingly competitive landscape should not just be seen only as survival, it is an opportunity to create differentiated and long-term value. Industry leaders who take this opportunity to shift and adapt are likely to find themselves in a stronger position.

Where Value Is Created

The added value in operational real assets is tangible and measurable in sector-specific performance metrics. The data clearly shows that operational excellence, not passive ownership, results in superior returns.

Healthcare - The Stability Premium: The operator-investor model’s strongest case is its ability to deliver superior risk-adjusted returns. Eurazeo analysis illustrates this: while a standalone healthcare Operating Company (“OpCo”) might target a higher average IRR of 17.1%, volatility reduces a Sharpe Ratio of just 1.24x. By contrast, the Holding Company (“HoldCo”) – an integrated OpCo and Property Company (“PropCo”) structure ─ achieves a Sharpe Ratio of 2.74x, more than double the stability while delivering a solid 14.8% IRR.6 This stronger risk-adjusted profile stems from eliminating the landlord-tenant conflict, enabling capital to be deployed strategically to enhance the business rather than simply maintain the property.

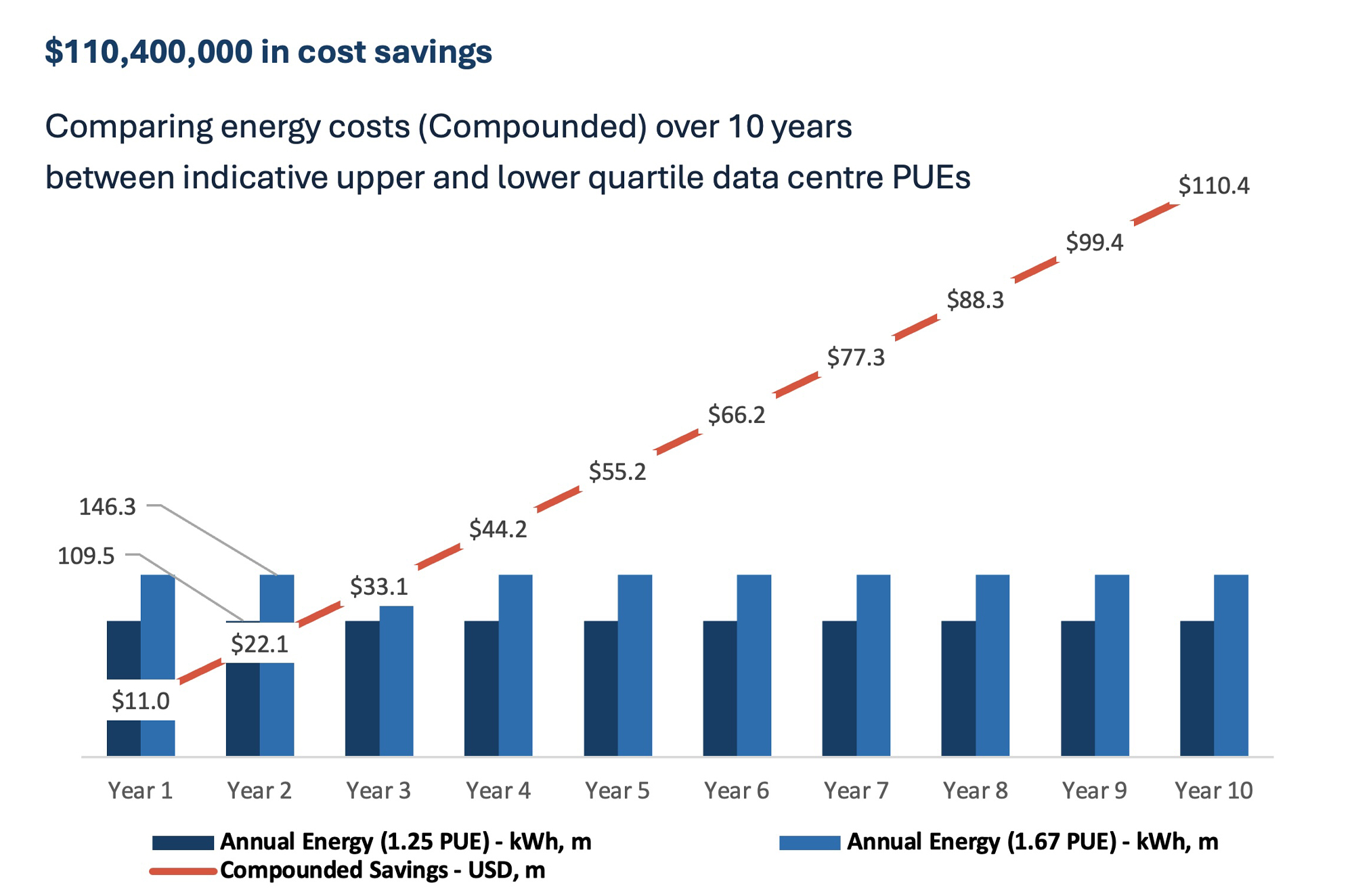

Data Centres - The Efficiency Advantage: In the data centre space, operational efficiency translates directly into financial outperformance. Consider a 10MW facility in Singapore (at $0.30/kWh) operating at a Power Usage Effectiveness (‘PUE’) of 1.25 compared with the industry average of 1.67. The calculation shows a striking value differential, the savings could exceed the construction cost of many facilities. This operational premium cannot be realised through passive ownership, where operational optimisation is not a constant priority.

Source: FTI Consulting

Cold Storage, High-Stakes Precision: In pharmaceutical cold storage, temperature deviations can destroy entire product batches worth billions of dollars.7 While insurance may cover product losses, facilities often lose clients permanently after temperature failures. Leading operators use internet of things (“IoT”) sensors, wireless sensor networks (“WSN”) and predictive analytics to achieve temperature precision that conventional facilities cannot match.

The financial impact is immediate. Operators who guarantee temperature precision provide not just space but risk mitigation. This operational superiority commands a significant premium, with sophisticated facilities achieving rental rates 30-50% higher than conventional storage facilities — reflecting the value of risk mitigation to tenants.8

Self-Storage - The Algorithmic Edge: Self-storage has evolved from a passive real estate model into a sophisticated, data-driven business, with the main value driver now the revenue management system, rather than the physical asset.9 Advanced operators use dynamic pricing algorithms that adjust rates in real time based on unit mix, local demand signals and customer behaviour to simply filling units and run complex yield-management operation. We believe that these systems generates rapid ROI through optimised occupancy and maximised revenue per available unit, creating a significant competitive moat.

The New Competitive Advantage

In our experience, successful operational platforms share several defining characteristics:

- Integrated Platforms: Firms combining development, ownership and operations under one roof are leading the market.

- Technology as a Core Competency: Technology is no longer just an enabler; it is a major driver of value. Applied effectively, it cuts costs and frees capacity to support growth.10

- Deep Sector Expertise: Specialists with deep expertise in a single sector consistently outperform generalists.

- Platform-Scale Economics: Deploying technology and negotiating service contracts across large portfolios creates both cost and performance advantages.

This strategic shift is reshaping capital allocation across Asia Pacific. China’s private equity deal value declined from nearly 40% of Asia Pacific buyout deal value pre-pandemic to just 27% by mid-2024.11 This reflects more than risk mitigation, it signals a decisive move to operational quality.

In a sustained high-interest-rate environment, institutions must secure assets capable of delivering higher yields and inflation-hedged income. This has driven a pronounced shift from passive traditional real estate to operational sectors. Here the pull factor becomes clear, capital is gravitating towards markets with robust operational ecosystems. Japan has become a leading destination for data centre platforms12, while Australia’s life sciences and senior living sectors are attracting record investment.13

This is not a story of capital fleeing uncertainty, it is capital actively pursuing superior returns by building, scaling and backing expert operational platforms. In this new environment, the operator-investor is not an alternative, it is the core strategy.

The Path Forward

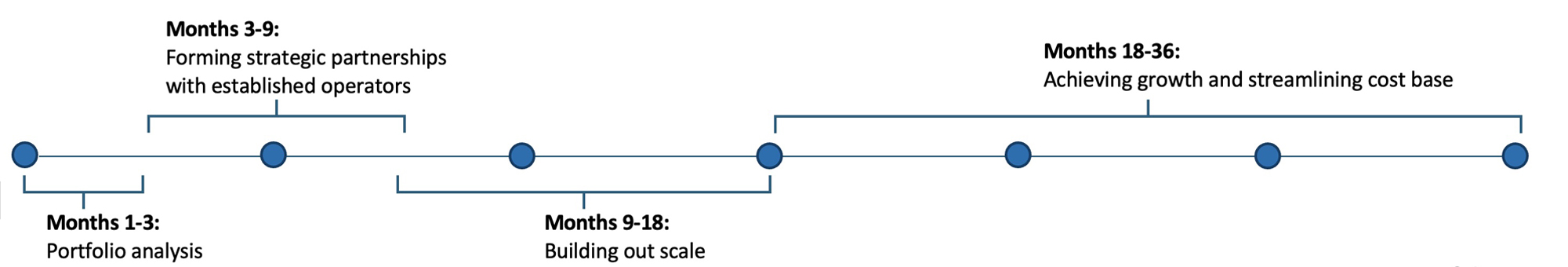

The transition to operator-investor model requires a fundamental strategic shift, beginning with senior leadership commitment and evolving through a deliberate, multi-year journey:

Source: FTI Consulting

As one asset manager observed, while the last cycle’s returns were driven by multiple expansion, “…operational improvements - not market factors - can account for the majority of value created within a private equity portfolio.”14

The passive approach that once delivered reliable returns has lost its effectiveness in today’s challenging environment. Those willing to embrace the complexities of the operator-investor model will be better-positioned to secure the superior, resilient returns that define the next era of real asset investing. Those unwilling to adapt risk falling behind as the market rewards operational expertise and strategic innovation.

Senior leaders must challenge legacy mindsets and invest in operational excellence, technology integration and sector specialisation. By proactively forging new partnerships and building platform-scale capabilities, investors can position themselves at the forefront of Asia Pacific’s real estate transformation, turning complexity into a durable competitive edge and helping portfolios generate robust long-term value.

Footnotes:

1: Peck, Andrew, “Asia Pacific records $131 billion in commercial real estate investments in 2024,” JLL (January 28, 2025).

2: “InFocus: Essential insights for navigating today’s complex markets,” MSCI Research & Insights (2025).

3: Caillavet, Christopher, “Global Real Estate Capital Raising Down More Than Half From 2022 Peak: ANREV,” Mingtiandi (April 28, 2025).

4: Gerlach, Stefan, “Reserve Bank of Australia: A rate cut now looks likely,” EFG Investment Insights (August 7, 2025).

5: “What is MAS’ monetary policy framework and its rationale?” Monetary Authority of Singapore (2025).

6: Eurazeo, “Beyond Ownership: The Growing Allure of Operational Real Estate,” Eurazeo (2024).

7: Veerina, Mahesh, “Pharma Supply Chain Failure is a $35 Billion Problem,” SupplyChainBrain (June 9, 2022).

8: Liu, Yvonne and Jimmy Chan, “JLL forecasts Asia Pacific cold storage investment to cross USD2 Billion by 2030,” JLL (January 4, 2024).

9: Worsdale, Kenneth, “State of the Industry: The rise of self-storage in Singapore,” Singapore Business Review (April 21, 2015).

10: “2025 Private Equity Value Creation Index: Recalibrating Value Creation Levers,” FTI Consulting (2025).

11: Yeh, Daniel, “Rising tides: Asia Pacific PE market grows in the face of global uncertainty,” White & Case M&A Explorer (June 23, 2025).

12: McGown, Justin, “Ares spots data centre opportunities in Japan with $2.4bn fund close,” Infrastructure Investor (June 16, 2025).

13: “High-quality senior living a resilient investment underpinned by long-term demand,” SC Capital Partners (May 2022).

14: “Private Equity Investing: Improving Operations to Create Value,” Brookfield Asset Management (August 2023).

Published

November 10, 2025

Key Contacts

Key Contacts

Managing Director

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About