The UK Hydrogen Economy: Policy Announcements Support a 10GW Ambition

-

June 24, 2022

DownloadsDownload Article

-

10GW Low-Carbon Hydrogen by 2030

The British Energy Security Strategy, published in April 2022, sets out a doubling of the UK’s 2030 hydrogen production ambitions from 5GW to 10GW. At least half of this is to be met by green hydrogen (generated from renewables) whilst the remaining 5GW is likely to be met by blue hydrogen (generated from natural gas with carbon capture and storage) projects such as BP’s 1GW H2Teesside.

As at April 2022, the UK hydrogen project pipeline sat at 20GW consisting of nine CCUS (carbon capture, utilisation and storage) enabled and 39 electrolytic projects. Government subsidies and financial support mechanisms will play a key role in moving these projects from pipeline to production. The £240 million Net Zero Hydrogen Fund (NZHF) is to provide grant funding to support upfront costs of developing and construction of low-carbon production projects whilst the Hydrogen Business Model (HBM) intends to provide a mechanism for ongoing revenue support.

The Net Zero Hydrogen Fund

The NZHF has four strands. Strands 1 and 2 are currently open to applicants: Strand 1 provides support for development expenditure for FEED and post-FEED studies (up to 50% of eligible costs); Strand 2 provides capital expenditure support (up to 30%) for projects that do not require revenue support through the HBM. Strands 3 and 4 are yet to open for application and will support capital expenditure for projects which also require revenue support through the HBM. The scheme will be split between CCUS enabled and non-CCUS enabled projects.

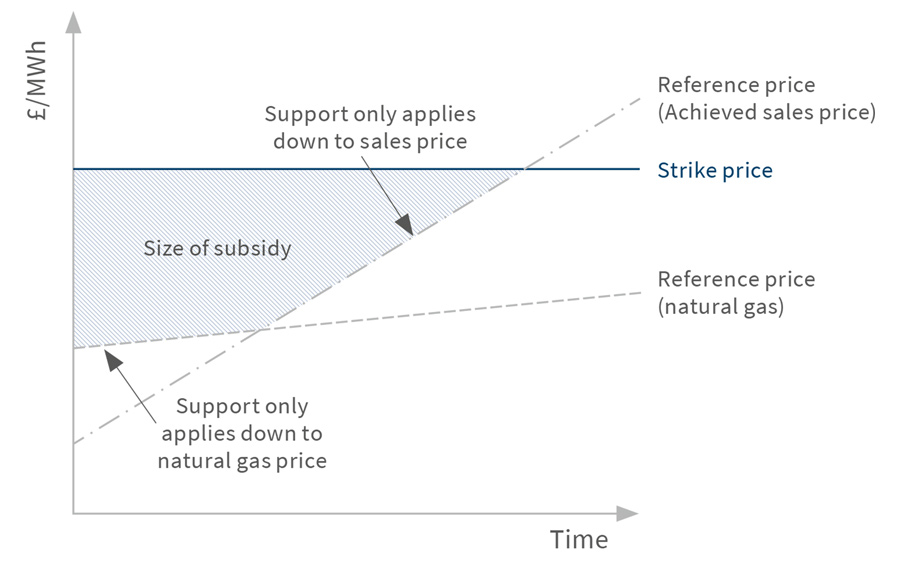

The Hydrogen Business Model

The HBM revenue support model is designed to overcome the cost gap between low carbon hydrogen and cheaper counterfactual fuels while the hydrogen market develops. Similar in principle to the UK renewable power project contract for difference (CfD) model, the proposed terms of the HBM allow the producer to earn a guaranteed return on the costs of producing hydrogen. The mechanism is structured such that, for each unit of hydrogen produced, the producer is paid an amount equal to the difference between: (i) the price the producer needs to cover its cost and an allowed return on investment (the strike price); and (ii) the actual achieved sales price (the reference price). A price floor would be set at the lower of the achieved sales price1 and the natural gas price to prevent the producer from receiving additional support for sales below the price of natural gas.

The indicative HBM heads of terms also include a mechanism to manage volume risk, essentially providing the producer with an additional subsidy per unit of hydrogen sold if its offtake/sales volumes were to fall.2

The HBM provides revenue certainty for producers thus enabling access to lower cost funding sources, potentially including debt markets. Under the HBM, £100 million is to be made available for up to 250MW of electrolytic projects in 2023.

Figure 1 – Strike Price vs Reference Price

The Low Carbon Hydrogen Standard

The UK’s Low Carbon Hydrogen Standard defines what constitutes ‘low carbon hydrogen’ at the point of production. The intent of the standard is to ensure that new hydrogen production supported by the government contributes to greenhouse gas (GHG) reduction targets. Producers are required to prove compliance with the standard which defines low carbon hydrogen as produced hydrogen meeting a GHG emissions intensity of 20gCO2e/MJ (LHV) including emissions from production, associated CCS processes, compression and purification. Emissions associated with electrolytic hydrogen are to include: (i) scope one emissions from off-grid electricity (considered to be zero if off-grid, on-site renewable electricity is used); (ii) emissions of the low carbon electricity source in real-time if grid connected; and/or (iii) actual national grid average GHG intensity per 30-minute settlement period.3

Implications for Producers

Proposed government funding mechanisms are likely to offer electrolyser projects greater revenue support per unit of capacity than blue hydrogen projects, reflecting the current higher levelised cost of green hydrogen (and hence higher strike price under the HBM). Specific levels of subsidy will depend on scale, source/cost of electricity supply, technology solution, location, offtake arrangements, and project timelines.

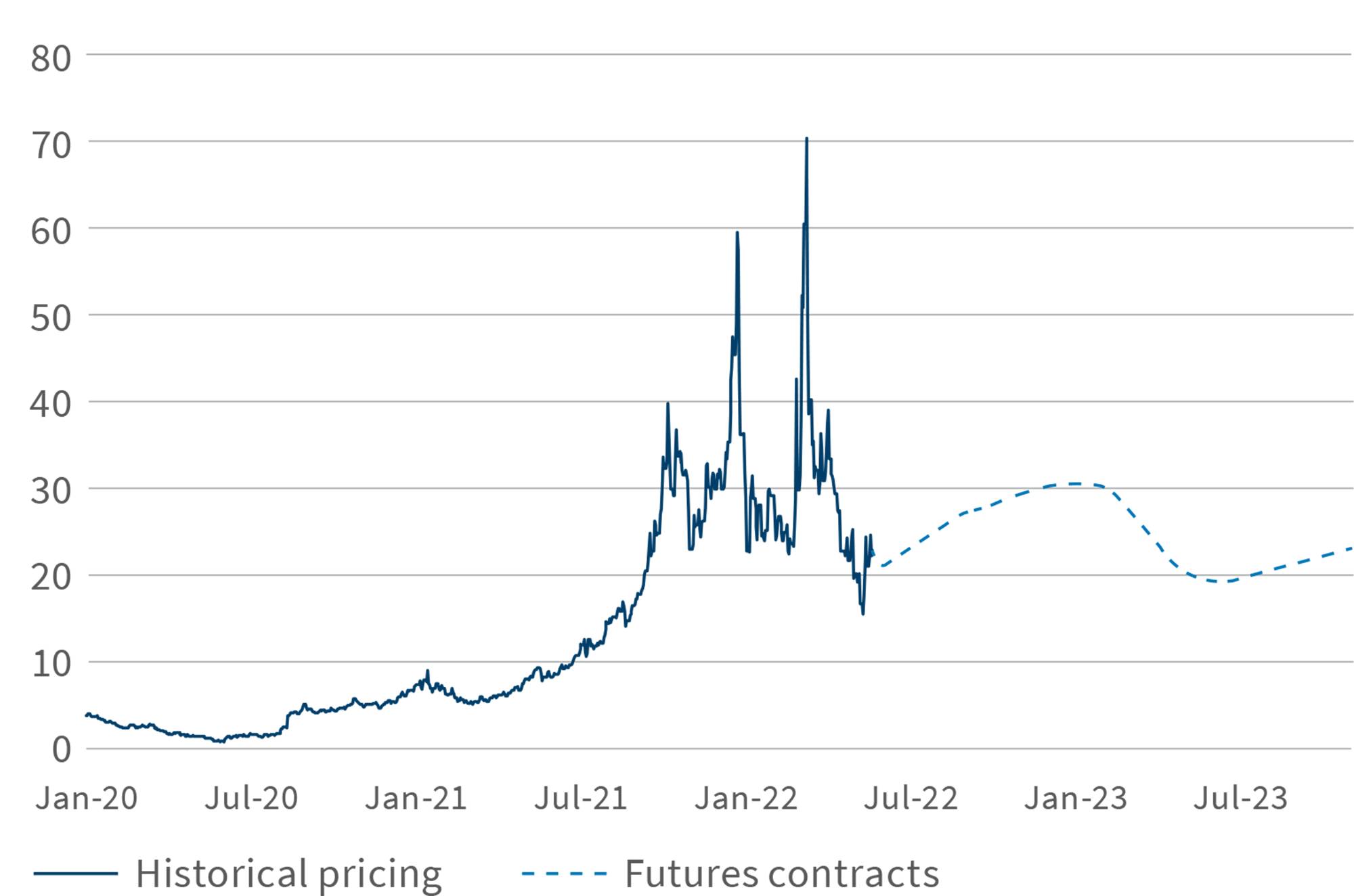

Project developers seeking support will need to manage technology, volume and price risks with specific reference to the HBM. For example, volatility in UK natural gas prices will need to be taken into consideration when assessing the price floor and structuring offtake agreements to minimise price risk. This would apply to blue hydrogen projects as well as dedicated renewable electrolytic projects where natural gas is not used as a feedstock.

Figure 2 – NBP Historical and Future Prices (USD/MMBTU)

Under the scheme, payments are two-way - revenues from hydrogen sales above the agreed strike price are to be paid to the contract counterparty. Capped returns under the HBM add to complexity, and like all interventions, may have unforseen consequences.

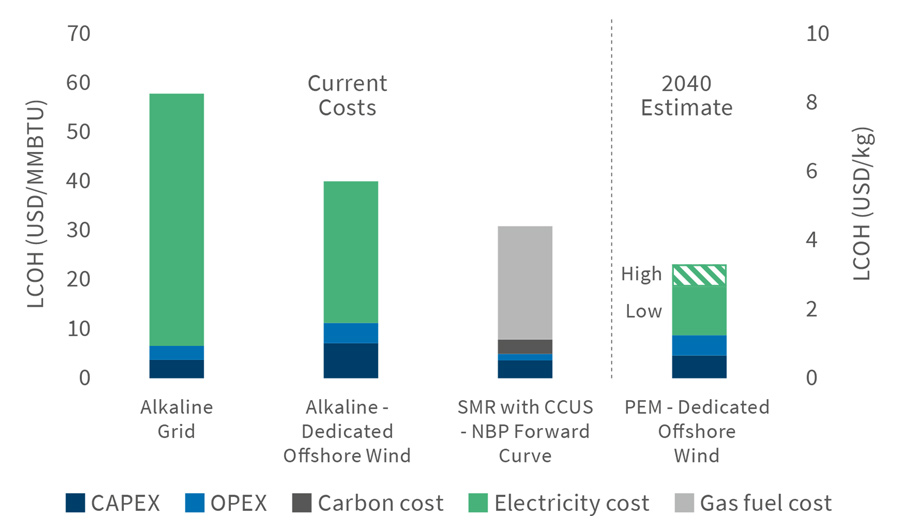

Costs of Hydrogen Generation in the UK

Our analysis indicates that the key drivers of electrolysis levelised cost of hydrogen (LCOH) in the UK are input electricity price and load factor.4 For steam methane reformation (SMR) with CCUS, the key drivers are natural gas prices, carbon prices and carbon transmission and storage. Based on current capital costs as well as existing futures prices for wholesale electricity, NBP gas and carbon, we estimate that blue hydrogen at $4.50/kg is currently around 50% cheaper to produce than UK based green hydrogen (grid connected).5 However, as electrolyser costs and the levelised cost of electricity (LCOE) from offshore wind fall from current estimates of £57/MWh towards £20/MWh to £30/MWh, we see the potential for green hydrogen to become cost competitive.6

Significant investment in the scaling-up of electrolyser technologies will be required for green hydrogen (typically at the 25-50MW scale) to be able to compete with world-scale SMRs (up to 3,000MW). Recent geopolitical events have led EU host governments to expand funding available for green hydrogen technologies given gas supply uncertainties. There is also increasing recognition of the potential balancing benefits of adding rapid response electrolysers to a renewables dominated grid.

LCOH of UK Hydrogen Production, Current vs 20407

Implications for Disputes

With an increasing number of projects moving from the conceptual phase to commercial demonstration and ultimately full-scale development, combined with substantial private and government investment, we see potential for disputes to arise around: (i) evolving technologies; (ii) licensing and regulation; and (iii) supply / offtake agreements.

Alkaline electrolysers and SMRs are mature technologies that have been successfully deployed for many decades. However as companies seek to reduce production costs, improve efficiency / flexibility, and extend operational lives, pioneering technologies are emerging, and there is scope for disagreement as performance issues emerge. If technology does not work as intended there are likely to be resulting time and cost consequences.

As with traditional fossil fuel projects, major hydrogen projects will most likely require environmental impact assessments, licences, planning consents, and land-use agreements. Delays navigating licensing and regulatory requirements can lead to disputes along the contractual chain.

Contractual disputes may arise from power purchase agreements and hydrogen offtake agreements. Producers and end-users will need to carry out extensive due diligence to ensure reliable sources of electricity and hydrogen supply, respectively.

World Hydrogen Summit 2022

The 2022 World Hydrogen Summit in Rotterdam was attended by governments, national oil companies, integrated oil and gas majors, technology providers, electrolyser manufacturers, service companies, and a wide-range of end users. We list six observations below:

- technology is not seen as a key risk to adoption, with many green hydrogen project developers choosing proven solutions such as alkaline electrolysers whilst newer technologies are validated;

- some industrial end-users are willing to pay for higher-cost green products (fuels, fertilisers, steel) where the societal benefits are evident;

- the integrated majors view blue and green hydrogen as complementary, each playing a different role, whereas electrolyser manufacturers see blue hydrogen as a short-term transition fuel that will help stimulate hydrogen demand;

- government regulation and funding is seen as instrumental to the creation of regional hydrogen hubs and ultimately a globally traded commodity;

- governments are focussed on aspirational GW ambitions. However, industry see the need for mid-sized (50-250MW) production facilities to successfully commence operation before government aims/targets can be taken seriously; and

- location of green hydrogen projects is seen as key to take advantage of: (i) low-cost electricity supply; (ii) access to water; and (iii) proximity to end-users. For example, coastal green ammonia plants are likely to emerge on major shipping routes and within the solar belt.

Footnotes:

1: A price discovery mechanism is to be introduced to enable the true price of hydrogen to emerge over time and to integrate a market benchmark price into the reference price.

2: The precise sliding-scale mechanism to be introduced is yet to be determined.

3: UK Low Carbon Hydrogen Standard

4: Our analysis considered alkaline electrolysis and polymer electrolyte membrane (PEM) electrolysis.

5: Analysis based on forward prices as at the end of May 2022; prices are currently volatile and may not reflect reasonable long term expectations.

6: Current estimate is from UK BEIS 2020 electricity generation cost report. Long-term forecast is for 2040 from ENTSOE’s 2022 ten-year network development plan.

7: Our current estimate assumes alkaline electrolysis is used, while our 2040 estimate assumes PEM electrolysis is used.

Published

June 24, 2022

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About