Unlocking Enterprise Value Through Strategic Finance and FP&A

How FP&A Turns Financial Insight Into Strategic Advantage in Moments That Matter

-

November 12, 2025

-

How the Strategic Finance Function Becomes a Driver of Enterprise Value

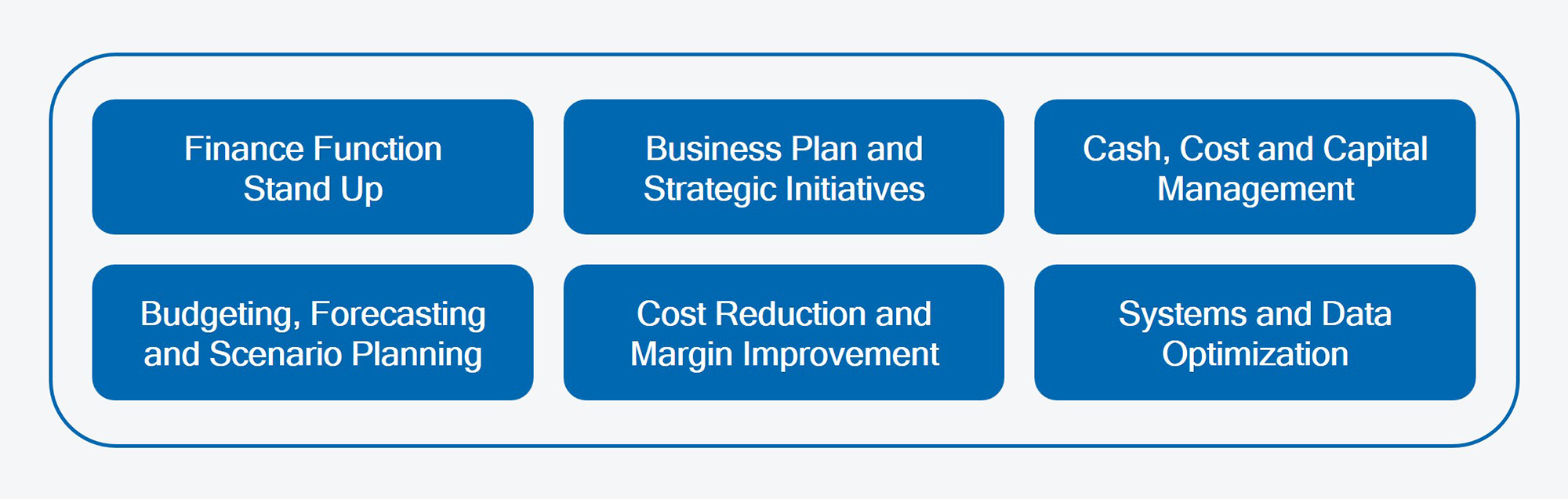

Transactional Financial Planning & Analysis (“FP&A”) is a critical strategic enabler for companies navigating major transactions and periods of change. The FP&A function uses financial data to inform strategy and leverages strategy to deliver measurable business outcomes across growth, efficiency and liquidity. Achieving this requires a strong FP&A foundation built on strategic talent, robust data structures and modern systems that enable the effective delivery of core FP&A services.

Transactional FP&A Services To Drive Enterprise Value

Why This Matters:

A strong FP&A function helps chief executive officers (“CEOs”) and chief financial officers (“CFOs”) make better decisions, faster. It links day-to-day operations to cash flow and enterprise value, so capital goes to what creates the most return. Instead of just reporting results, finance actively shapes them.

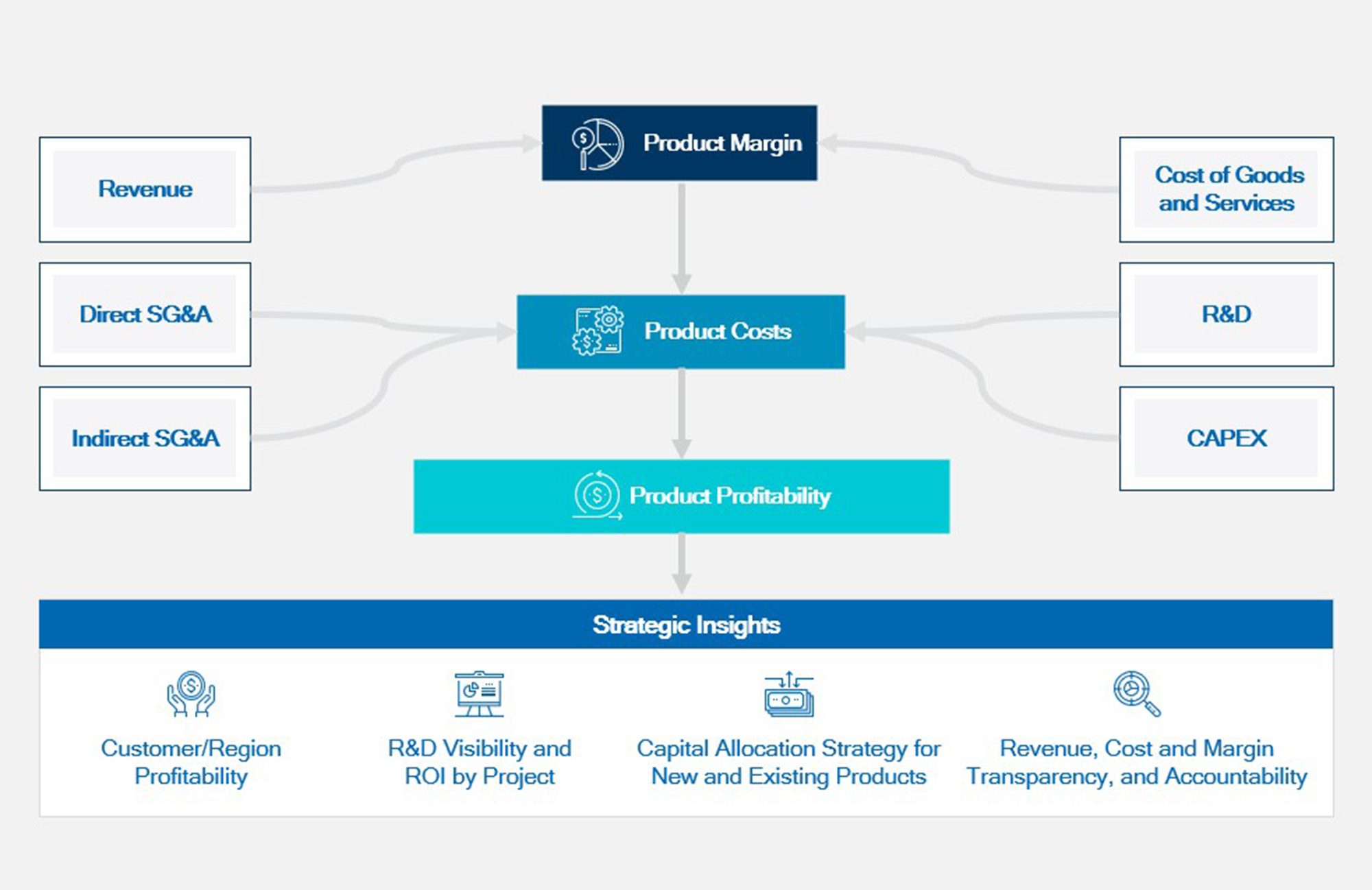

The Importance of Cost & Margin Transparency

The graphics below illustrate that performance visibility must extend to the product, customer and regional level. A structured data and analytics framework enables companies to track product profitability efficiently — capturing both direct and indirect costs, understanding true product-level margins and pinpointing areas of margin leakage. Critical to driving this level of insight is the correct underlying management accounting, with the application of consistent and disciplined accounting policies. With clear transparency into general and administrative costs, cost of goods sold and service delivery costs, companies can pursue targeted cost reduction and margin improvement efforts without compromising growth.

Why This Matters:

Margin transparency helps CEOs and CFOs put capital where it creates the most value. By knowing which products, customers and channels actually drive value, they can reprice, fix or exit what doesn’t — and double down on what does. It also gives them hard facts to drive strategic decisions with the board and investors.

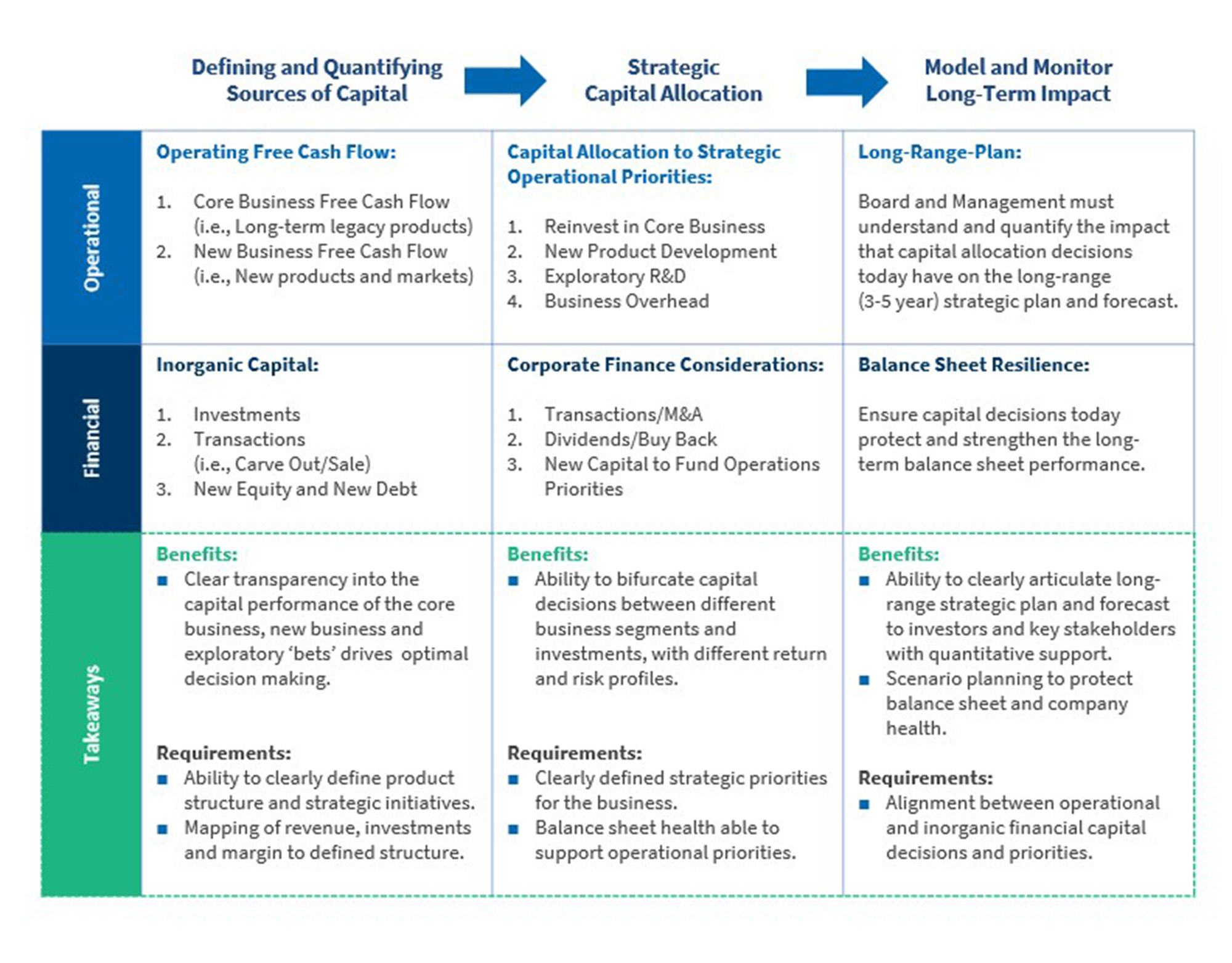

Capital Allocation Transparency

The visuals in this section show how capital is allocated across key priorities: reinvesting in the core, expanding into new products and markets, funding exploratory research and development and managing corporate finance levers such as mergers and acquisitions (“M&A”), dividends and debt. Clear alignment of capital to strategy ensures resources flow to the highest-impact areas while preserving balance sheet strength. Scenario and sensitivity modeling make the trade-offs visible, quantifying how today’s capital decisions influence long-term performance and valuation.

Why This Matters:

Capital without clarity is just spending. A transparent allocation model gives CEOs and CFOs the discipline to balance core reinvestment with high-beta innovation, time funding to manage cash and liquidity risk and a chance to see how today’s decisions translate to long-term shareholder returns. It turns capital deployment into a strategic value-creating process.

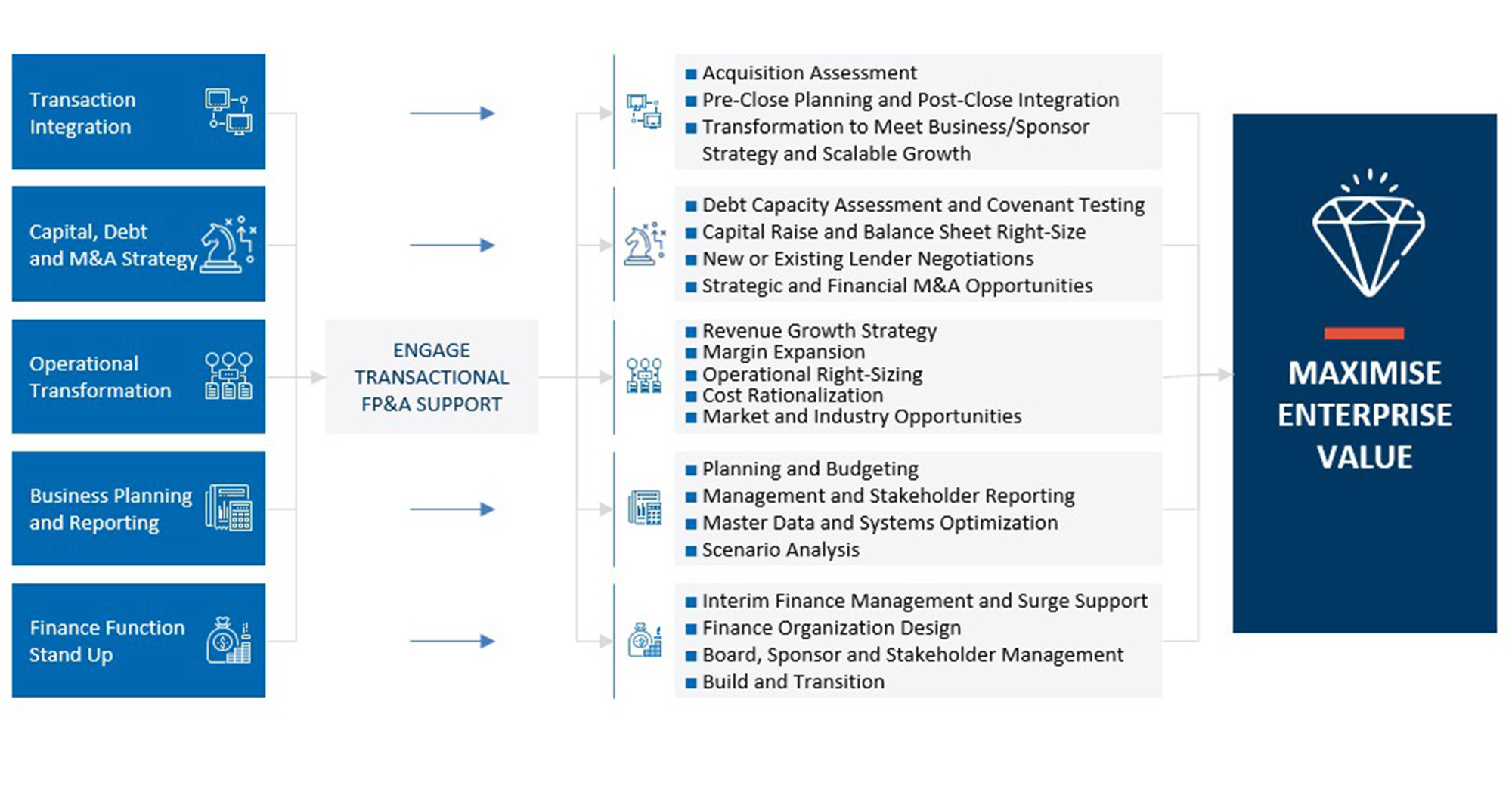

Common Catalyst for FP&A Support

The diagram below highlights that organizations most often seek FP&A support at major inflection points — acquisitions, integrations, operational turnarounds, rapid growth or when standing up a finance function from scratch. In these moments, quickly standing up planning and budgeting frameworks, optimizing master data, enhancing stakeholder reporting and running scenario analyses can deliver immediate value. Interim leadership or surge capacity helps maintain continuity while longer-term capabilities are built.

Why This Matters:

In high-stakes moments — M&A, carve-outs, integrations or rapid scaling — the cost of slow or poor decisions escalates quickly. Transactional FP&A ensures the C-suite, board and sponsors have the insight needed to make the right strategic calls. It also enables CFOs to track post-close performance, model scenarios, protect valuation and accelerate synergy capture. It’s the difference between just closing a deal and realizing its full economic value.

Final Word

In critical moments, FP&A isn’t support — it’s strategy. When finance provides clear visibility into costs, margins and capital decisions, leadership can move with speed and conviction. Organizations that use FP&A to drive decisions — not just report outcomes — turn complexity into clarity and choices into enterprise value. The winners are those that treat strategic finance as a driver of growth and resilience.

Related Insights

Published

November 12, 2025

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About