2024 Online Retail Report: Focus on The French Market

-

September 18, 2024

DownloadsDownload Report

-

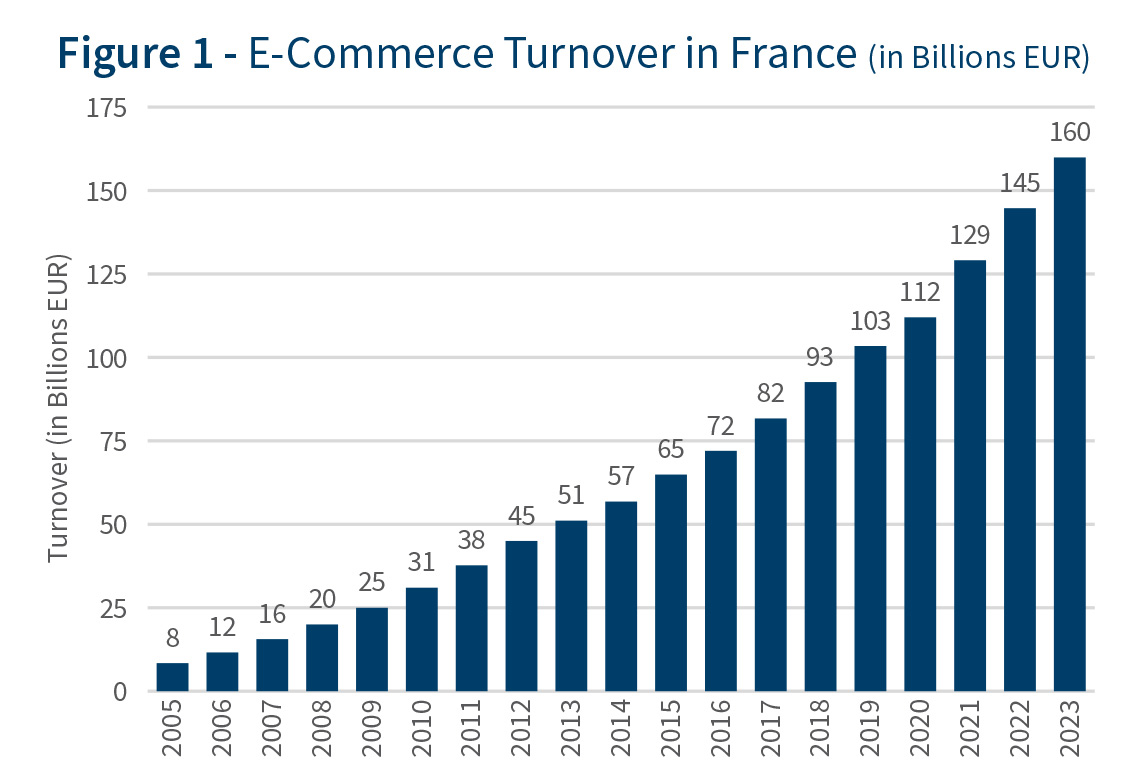

The French online retail market continues to boom, achieving €160 billion turnover in 2023, a 10.5% increase over last year.1 This spectacular growth is mainly fueled by the increase in the number of transactions (+4.9%), as consumers continue to replace store-based shopping with online. Average basket increase is also high in absolute terms (+5.4%) but is mostly explained by inflation over the period (+4.9%).2

In fact, e-commerce is doing so well that it has become the dominating channel for several sectors. Fashion is the perfect example: the majority of clothing purchases are done online — the highest ratio of all sectors.3 Logically, physical fashion stores suffer: the sector is also #1 in terms of bankruptcies since the pandemic.4

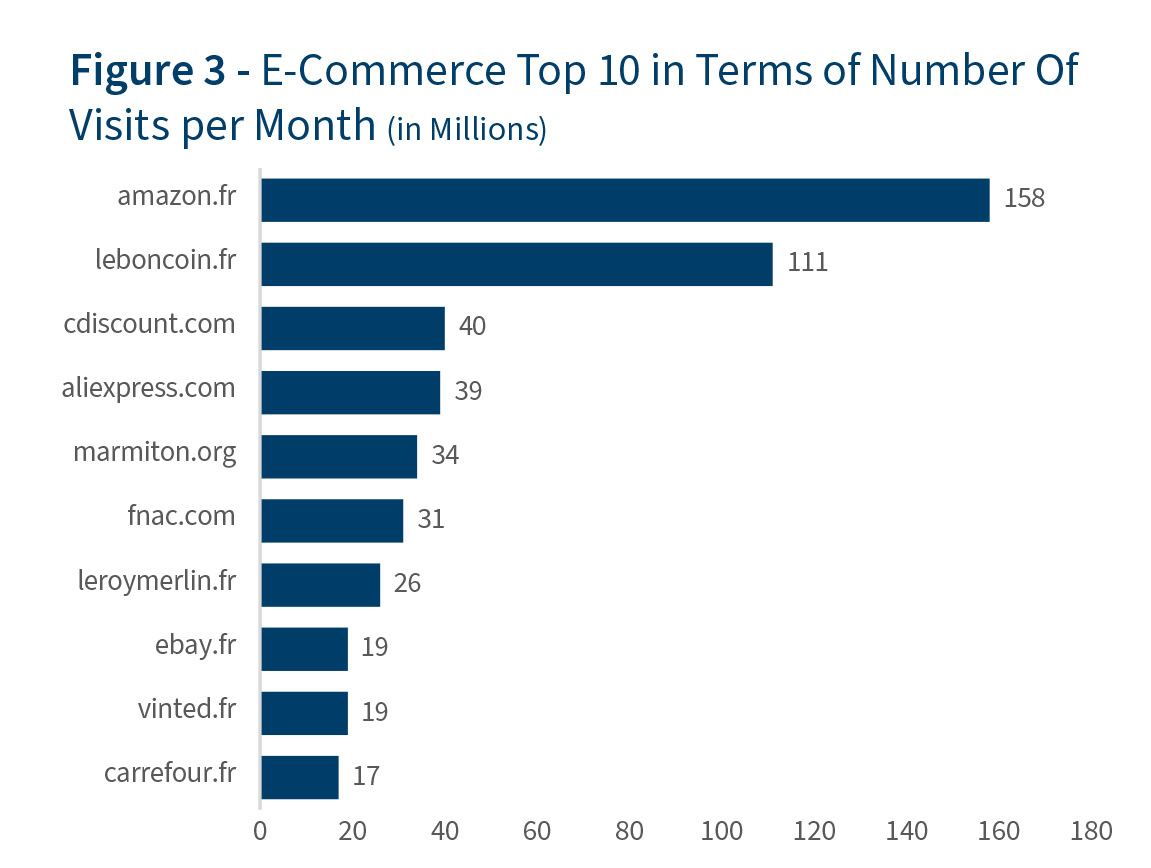

Global giants continue to figure prominently: Amazon is by far the favorite retail platform for the French, with 158 million visits per month.5 Aliexpress and ebay are also among the top visited websites, with respectively 39 million and 19 million visits per month.6 Still, local actors now represent the majority of French e-commerce: leboncoin, a “small ads” platform, is second only to Amazon at 111 million visits. Interestingly, “traditional” retailers (Fnac, Leroy Merlin, Carrefour) have succeeded to appear in the Top 10 list of e-commerce actors.7

Source: Statista8; Fevad9

Source: Statista10

Source: Républik Retail11

Looking ahead, challenges depend on the activity. For goods & products, the challenge will be two-fold: navigating a negative or low-growth environment (-1.5% in 1Q24 YoY) and the explosion of competing websites (+10% YoY).12 For services, e-commerce platforms will need to significantly boost their operational capabilities to handle very high growth levels: +13% in 1Q24 YoY,13 even close to +20% in 2023.14 Regarding goods & products, a key trend right now is second life. Several firms have popped up in this niche, which fits well with today’s concerns regarding circular economy and carbon footprint: more than 80% of online consumers have already bought or sold second-life items online.15 In France, firms such as Vinted, Backmarket and Pixmania are leading the way.

This regional perspective is part of FTI Consulting’s 2024 Online Retail Report series. The main Online Retail Report is available here.

Footnotes:

1: “Bilan du e-commerce en France : 160 milliards d’euros ont été dépensés en ligne en 2023,” Fevad (February 2024).

2: Ibid.

3: “Product and service categories most purchased online in France as of January 2023,” Statista (January 2023).

4: “Défaillances d’entreprises Mai 2024,” Banque de France (May 2024).

5: Dalila Bouaziz, “Panorama de l’e-commerce dans le monde,” Républik Retail (October 2023).

6: Ibid.

7: Ibid.

8: “Chiffre d’affaires annuel du e-commerce en France de 2005 à 2023,” Statista (June 2024).

9: “Bilan du e-commerce en France : 160 milliards d’euros ont été dépensés en ligne en 2023,” Fevad (February 2024).

10: “Product and service categories most purchased online in France as of January 2023,” Statista (January 2023).

11: Ibid.

12: “La croissance du e-commerce demeure robuste au 1er trimestre 2024, soutenue par la solidité des ventes de services et un redressement desventes de produits,” Fevad (May 2024).

13: Ibid.

14: “Bilan du e-commerce en France : 160 milliards d’euros ont été dépensés en ligne en 2023,” Fevad (February 2024).

15: “L’e-commerce, un rôle clé dans le seconde main,” KPMG & Fevad (September 2022).

Published

September 18, 2024

Key Contacts

Key Contacts

Senior Managing Director

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About