Global M&A Q4 2025 Market Update

Focus, Not Frenzy: How a Concentrated Market Sets the Tone for 2026

-

February 16, 2026

-

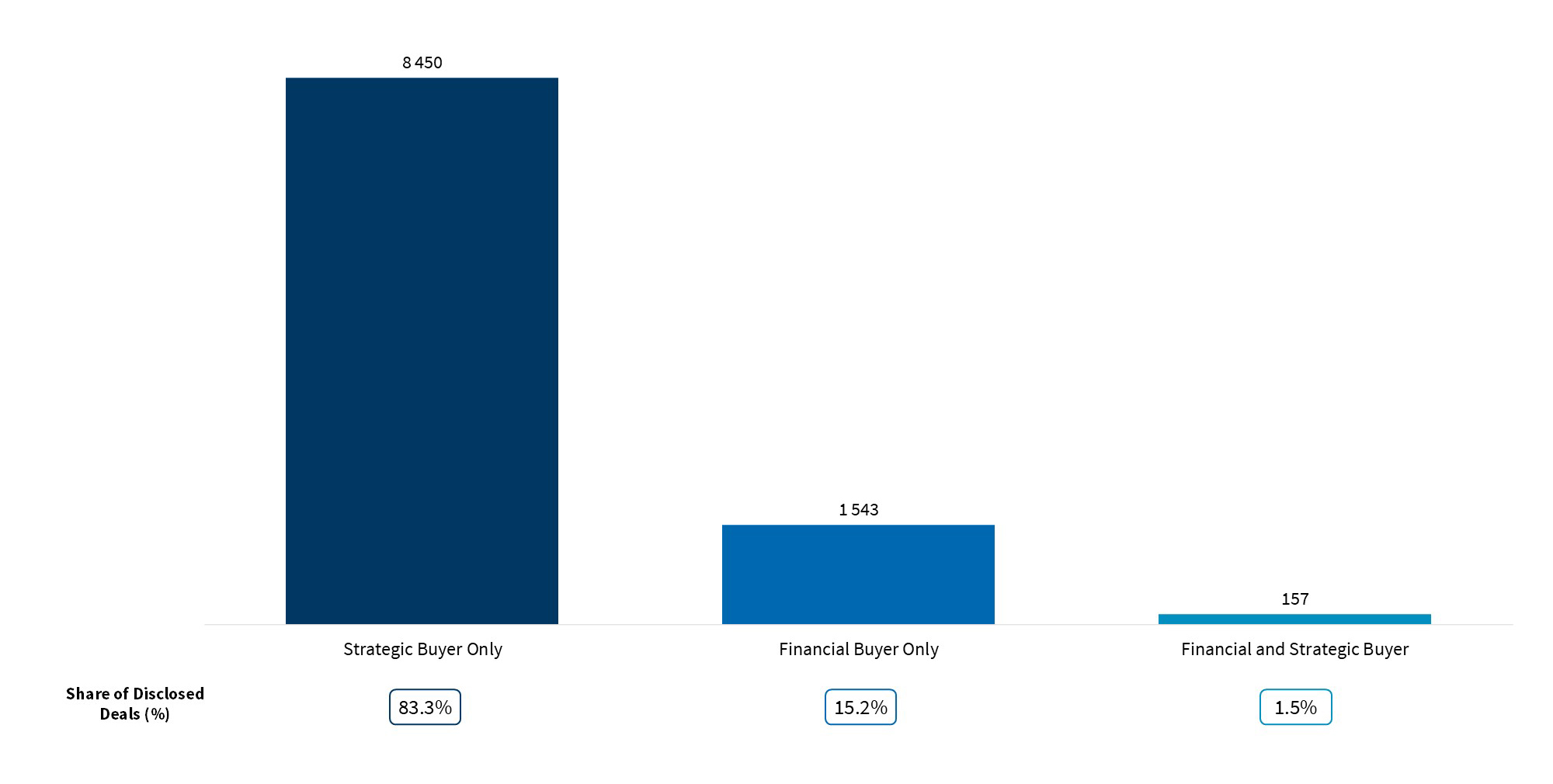

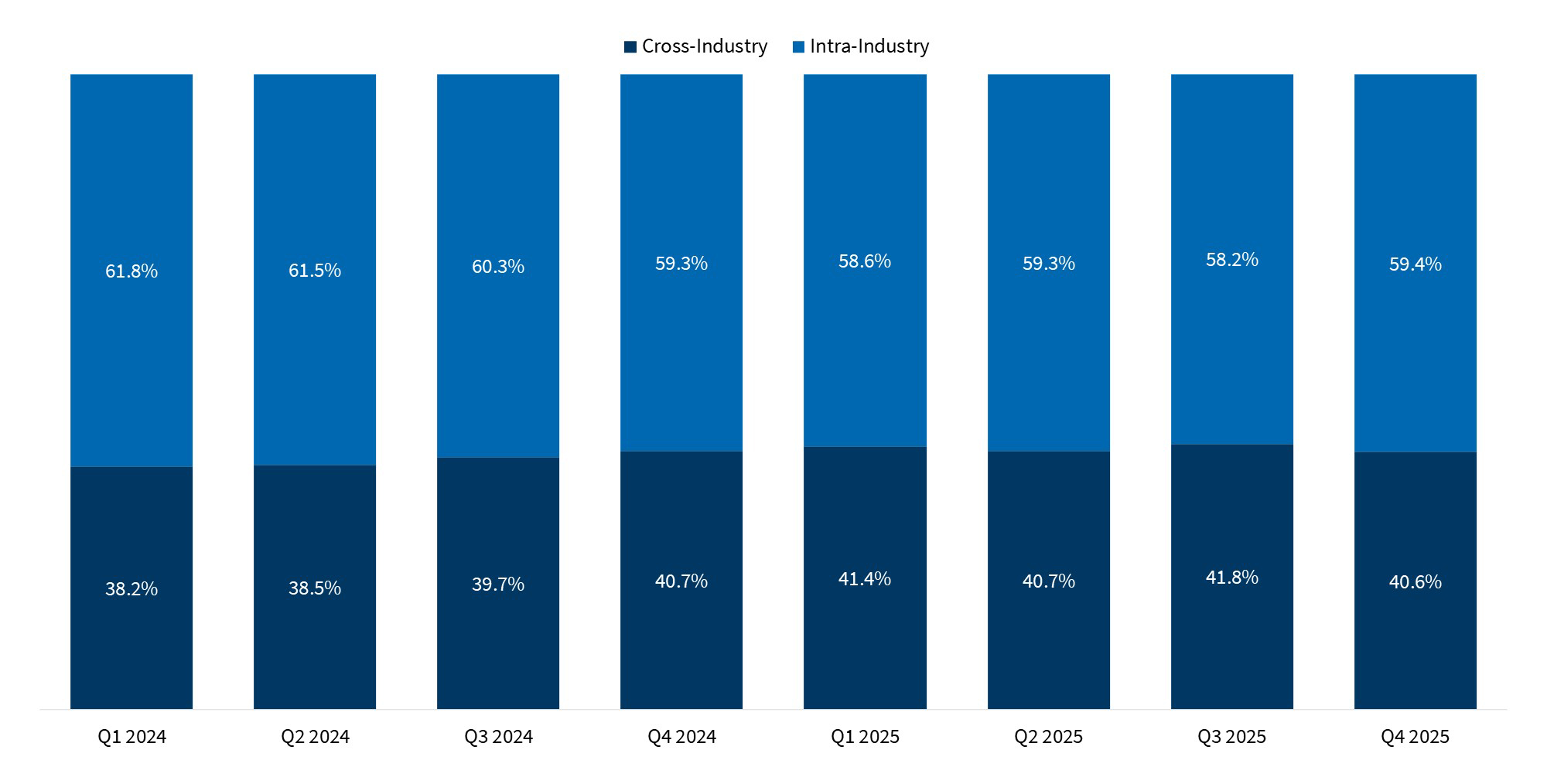

Global M&A activity in the fourth quarter of 2025 reflected a market driven by strategic intent rather than broad-based acceleration. Strategic buyers continued to account for the majority of deal activity globally, and intra-industry transactions remained more prevalent than cross-industry deals, indicating that consolidation and adjacency expansion continued to shape deal rationale.

Disclosed Deal Count by Acquirer Type (#)

Source: Capital IQ, FTI Consulting analysis

Share of Deals by Industry-Relation (%)

Source: Capital IQ, FTI Consulting analysis

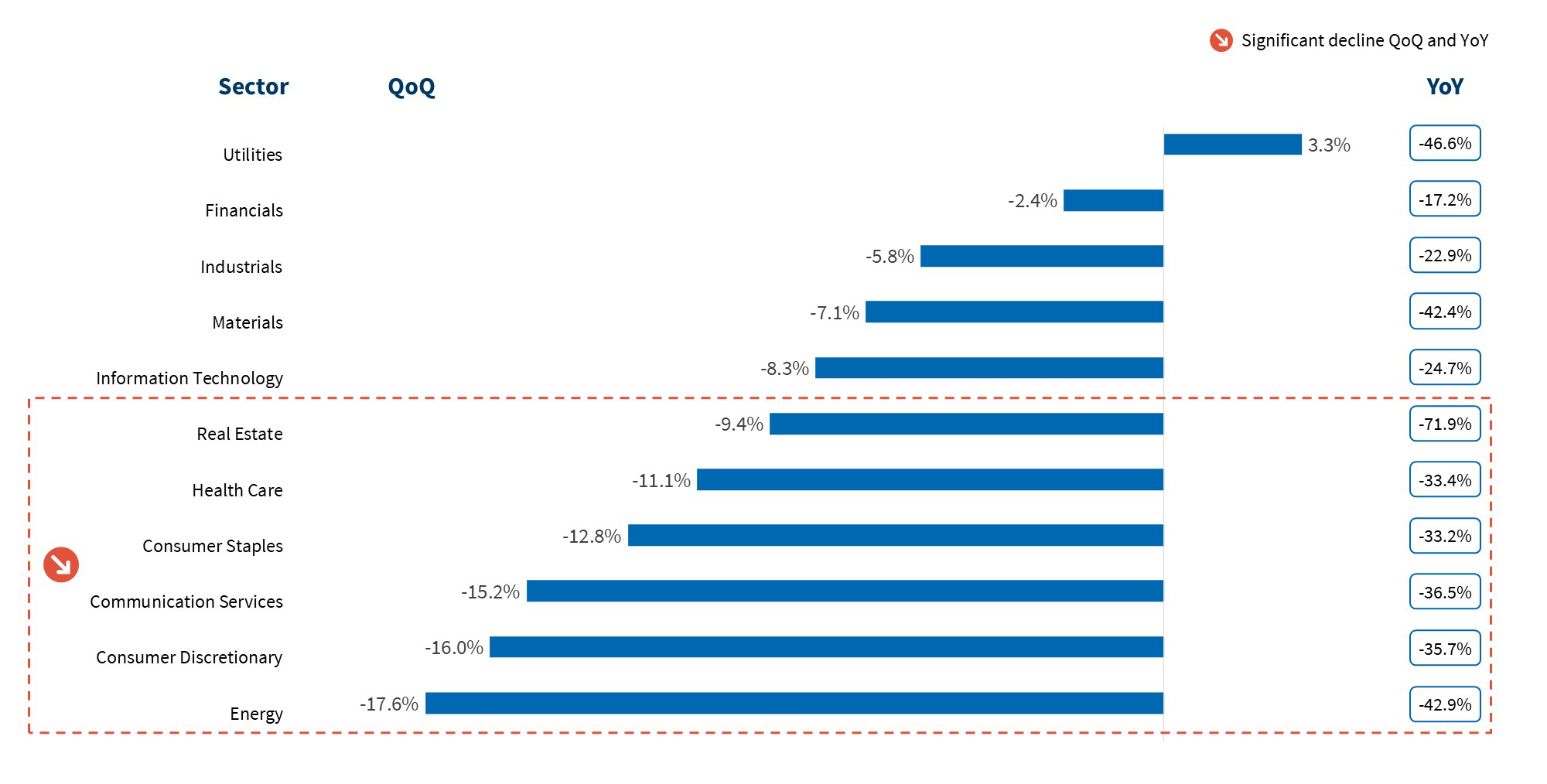

A review of sector-level deal counts in Q4 2025 underscores the uneven nature of activity across industries. While select sectors demonstrated relative stability, several experienced quarter-over-quarter and year-over-year declines in disclosed deal count, reinforcing that activity remained measured rather than broad-based.

Change in Disclosed Deal Count by Sector (%)

Source: Capital IQ, FTI Consulting analysis

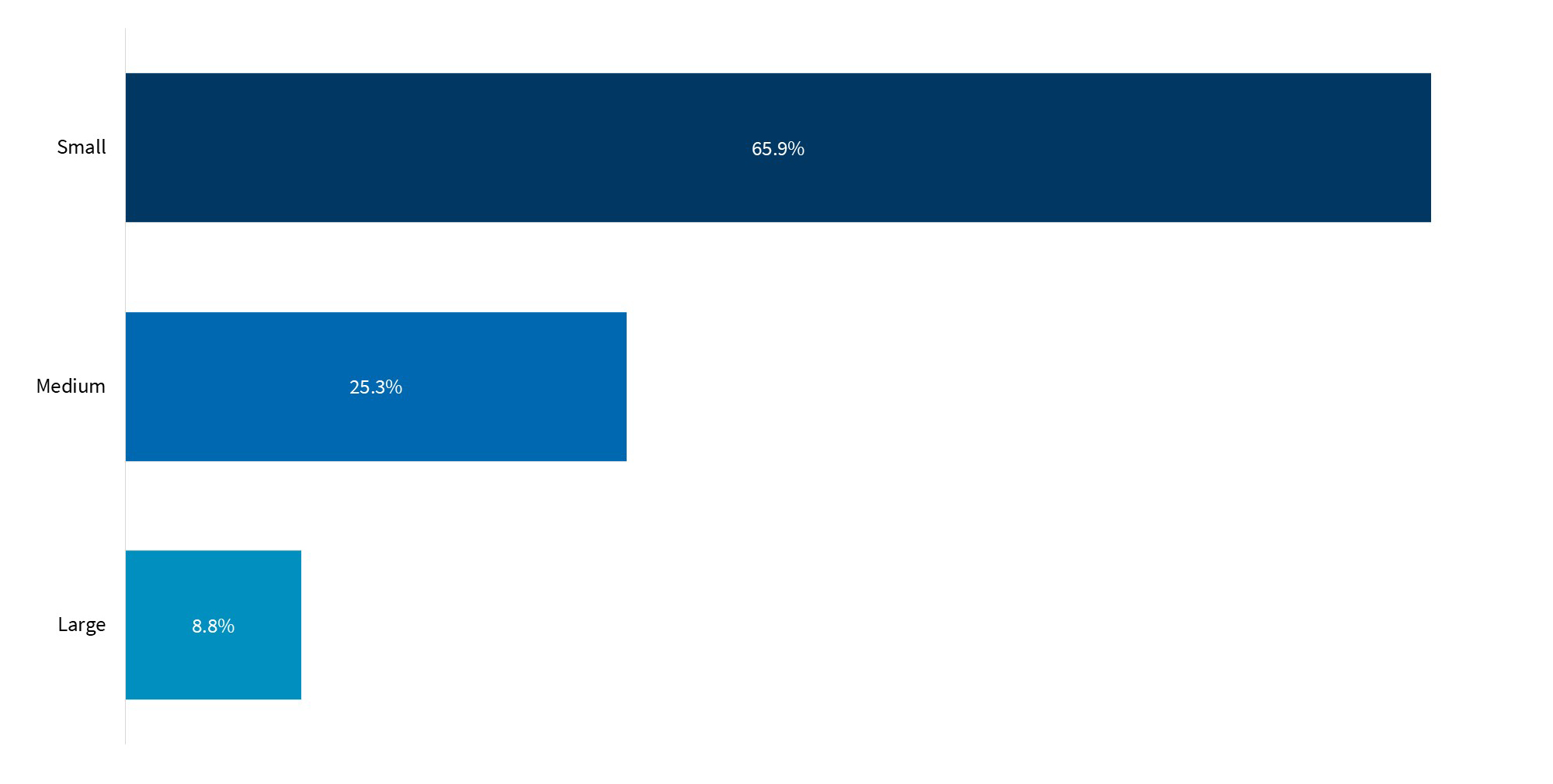

Share of Deals by Transaction Size (%)

Source: Capital IQ, FTI Consulting analysis

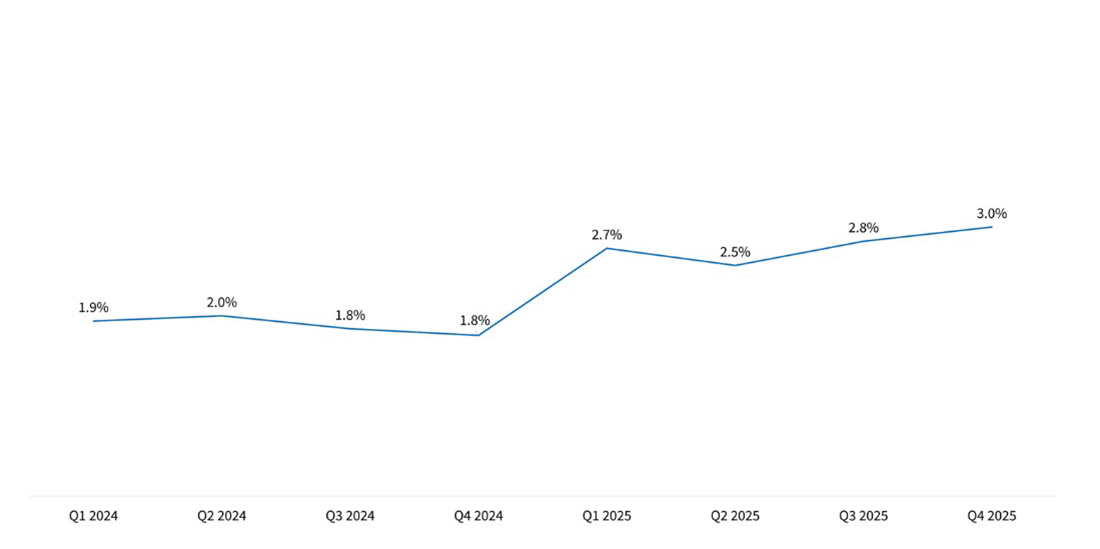

AI-related M&A activity continued to expand globally on a quarter-over-quarter basis. While the global share of AI-related deals remained below that of the United States, the sustained upward trend highlights AI as an increasingly important driver of transaction activity and a defining theme in the current M&A environment.

Share of AI-Related Deals (%)

Source: Capital IQ, FTI Consulting analysis

Top 10 Markets by Count of AI-Related Deals (#)

Source: Capital IQ, FTI Consulting analysis

Looking ahead to 2026, the patterns observed in late 2025 suggest that deal activity will continue to be shaped by strategic repositioning, thematic acquisitions and selective deployment of capital. The persistence of strategic-led transactions, continued expansion of AI-related activity and concentration of deal value in larger transactions provide important context for how the M&A landscape is entering the year ahead.

Published

February 16, 2026

Key Contacts

Key Contacts

Senior Managing Director, Global Head of M&A

Senior Managing Director, Leader of Financial Due Diligence

Senior Managing Director, Leader of Merger Integration & Carve-Outs

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About