Publishing + Digital Media 2021 Year in Review

-

December 21, 2021

DownloadsDownload Report

-

Friends and Clients,

We’d like to share with you our annual Publishing + Digital Media Year in Review for 2021. Last year we commented on the black swan year that was 2020, and the uncertainty that awaited 2021. With the benefit of hindsight, we can now reflect on the 2021 rebound from the COVID-driven declines, and the seemingly never-ending secular decline of print. However, 2021 provided a couple of surprises, including privacy regulation changes, relaxing of potential FCC regulations, and potentially more mutations of the COVID virus which continue to challenge broader issues of our health and our economy.

As always, we hope you find our comments helpful, and we wish you all the best for a great holiday season and 2022.

The Publishing + Digital Media Team

Lingering impacts of COVID despite moderate recovery

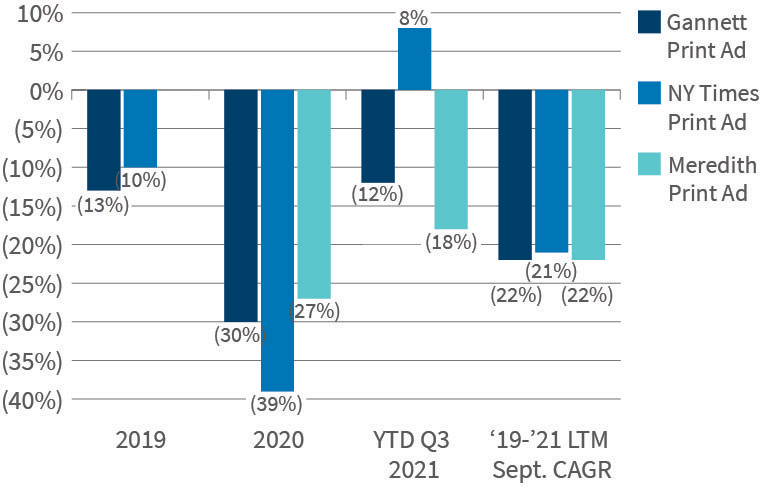

The full impact of COVID-19 to the print advertising business model is starting to become clearer. Based on various public and private sources, we know COVID had a dramatic effect on advertising revenues for newspapers and magazines with print advertising down well over 25% in 2020. In 2021, one area we were watching was the recovery of lost print ad revenue. As shown in the chart below, we can see that the recovery in print ad revenue was minimal. According to information from public filings for three large companies, the two-year CAGR from 2019 to 2021, print advertising was still down over 20%. [Source: Public filings]

Figure 1 - Print Advertising Revenue Trends

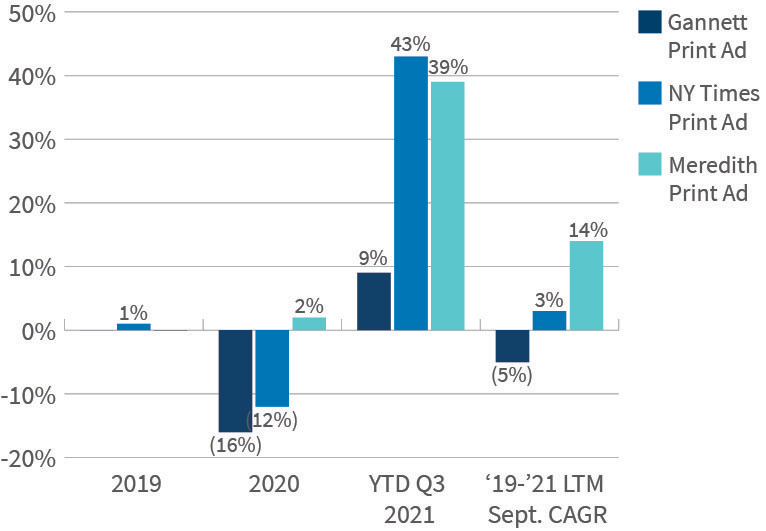

In contrast, at the same time, digital advertising experienced a significant recovery in 2021. The New York Times and Meredith were up 43% and 39%, respectively in YTD Sept 2021, while Gannett grew digital advertising 9% in the same period [Source: Public filings]. Importantly, digital subscriptions continued to be the key growth area for most newspaper publishers. Gannett’s digital subscriber volume is up 46%, and while core news subscriptions have slowed for the New York Times, new digital subscription products are helping to maintain momentum. [Source: Public filings]

Figure 2 - Digital Advertising Revenue Trends

Is the Free-Standing Insert Preprint business [soon to be] dead?

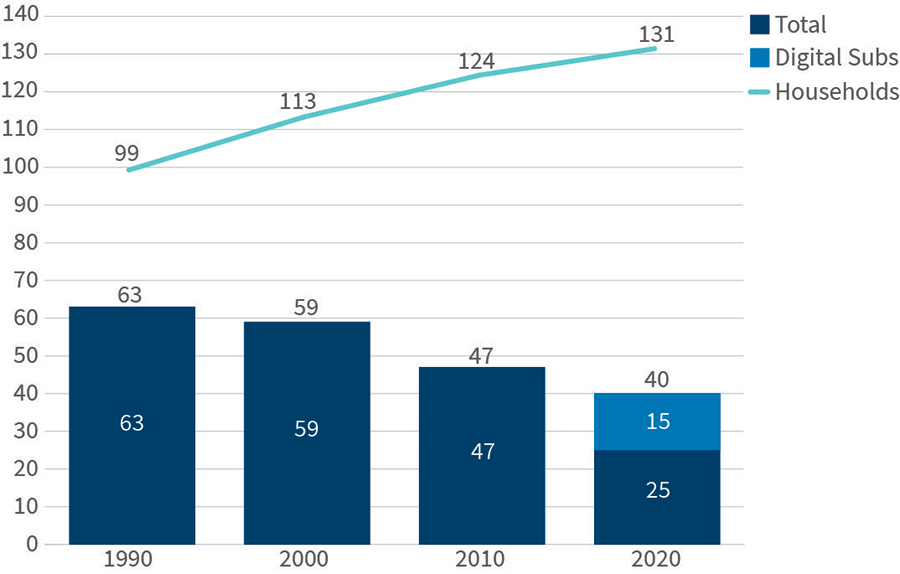

It was not long ago that planning for the Thanksgiving FSI preprint package was a several week project. This year, however, not so much. FSI preprints continue to decline at a rapid rate, fueled by continuing changes in marketing perspectives, continued loss of penetration through elimination of TMC programs and falling daily and Sunday circulation. [Source: Pew Research, Total estimated circulation of U.S. daily newspapers, 2021]

Figure 3 - Newspaper Circulation over Last 30 Years

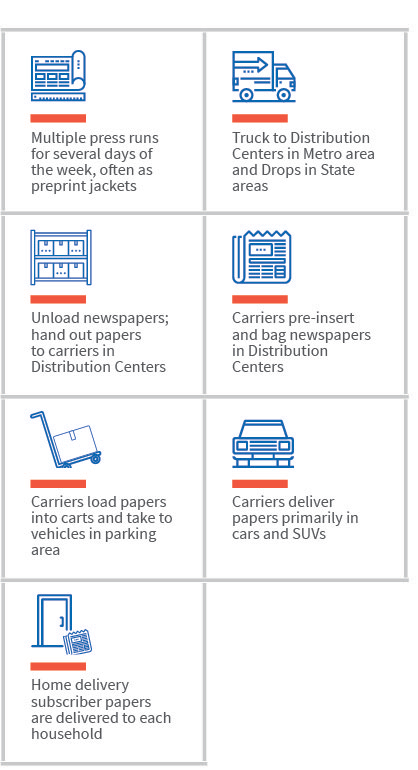

Newspapers built a product plan and fulfillment model to a large degree to accommodate FSI preprints - advanced print runs for inserting jackets, key bundles, multiple truck runs, distribution centers to put multiple parts back together and keep track of zoned products. [Source: FTI Consulting Research, 2021]

Figure 4 - Pre-Print Enabling Operation

So, we ask: Is losing the FSI preprint business good or bad? Well, of course the revenue loss will not be good. Will it be the final change that forces newspapers to rethink how they service loyal readers who are paying more and more for news?

Most believe that printed news today should be about in-depth coverage, analysis, and investigation. Breaking news has clearly moved to the Internet and mobile devices, and consequently, newspapers do not need to produce and deliver printed newspapers the way they do today if there will no longer be FSI preprints. At the very least, now is the time to think more broadly and to reimagine the implication of FSI declines.

What do 2021 trends mean for the print-to-digital transformation timeline?

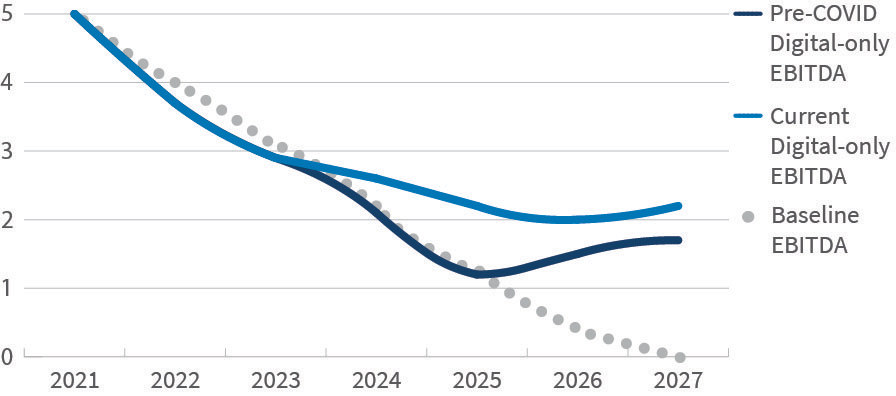

To answer this question, we turned again to FTI’s proprietary Print-to-Digital Model for dozens of publishers to understand when and how publishers should begin to reduce frequency of print editions and eventually move to a digital-only model. What we’ve found is that the print-to-digital timeline has been reduced by approximately two years. Before COVID, for example, a publisher may have optimized EBITDA by moving to digital-only before 2026. Today, we would likely see that publisher ready to shift to digital-only before 2024. FTI research shows that losing preprints faster than we anticipate will again hasten the decline in print frequency.

Figure 5 - Modeled EBITDA

The same findings support rationalization, that is, reductions, in frequency to a Sunday + digital model. In fact, we believe that many publishers may be ready as early as 2022 to shift to significantly reduced print frequencies. The same is true for the frequency of some magazines as print revenues no longer support the revenue they generate. Whatever the details of the timeline may be for a particular publisher, it is essential to get prepared now to become as digitally ready as possible—a critical lever in reducing risk during a newspaper’s print-to-digital transformation. [Source: FTI Consulting Research, 2021]

Digital audience traffic slowed from 2020

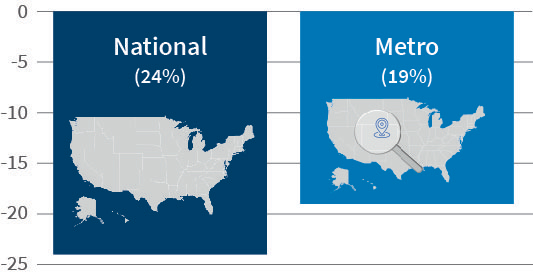

With 2020 being a record news year, it was inevitable that we would see some decline in traffic to national and metro news web sites. If we exclude traffic coming from January 2021 [largely impacted by the events at the capital on January 6th] as well as traffic from November 2020 [impacted by the 2020 election], news traffic is down 24% on average for national news publishers and 19% for metro news publishers. [Source: SimilarWeb, Based on average of 8 national news publishers and 12 metro news publishers, 2021]

Figure 6 - 2021 Decline in Number of Visits

As we take a closer look at the data, we see a clear pattern of decline in traffic that has continued throughout 2021. In September 2021, national news visits hit a two-year low falling to its lowest point since November 2019. While metro publisher traffic tends to be more insulated from the news cycle than that of national publishers, metro publishers have largely followed the same trend with continued declines into 2021. [Source: SimilarWeb, Based on average of 8 national news publishers and 12 metro news publishers, 2021]

Figure 7 - Number of Monthly Visits [Indexed to November 2019]

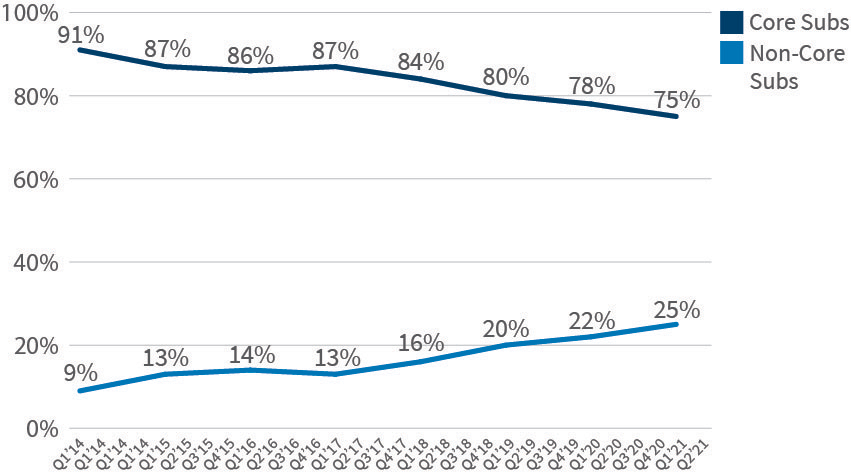

For the New York Times, one strategy to insulate content from the news cycle has been to build up content and subscriptions separately from the core news product. In Q2 2021, non-core news products including crosswords and cooking [and soon, Wirecutter] reached 25% of total digital subscribers to the New York Times digital products. While not every publisher has the resources or scale to build out digital products to the extent that the New York Times has, most news publishers should be thinking of opportunities to expand non-core news content and determine whether there are opportunities to develop new paid digital products. [Source: New York Times public financial reporting]

Figure 8 - More than a quarter of NYT subscribers are now on non-Core News products

Privacy Regulation, cookies, and Apple’s Apps

2021 also saw significant activity from regulators and tech platforms to protect consumer privacy. At the regulatory level, legislation expanded from Europe [General Data Protection Regulation – “GDPR”] and California [California Consumer Privacy Act – “CCPA”] to include more US states, as Virginia and Colorado enacted their own consumer privacy acts. [Source: https://www.natlawreview.com] And although there is no comprehensive federal policy, recent moves at the FTC, including newly approved appointees, point towards more scrutinized data collection and use for digital advertising purposes. [Source: https://digiday.com]

Tech platforms have also been making changes to their operating systems that have wide-reaching implications for digital advertising and data collection. Apple shipped two major iOS updates, including iOS 14.5 [April 2021] which introduced restrictions on cross-app tracking for iPhone users and iOS 15 [September 2021] which will limit data collection for email marketing. [Source: https://www.apple.com]

Finally, Google extended the timeline to deprecate third-party cookies on Chrome from January 2022 until the end of 2023 and has remained firm in its stance on protecting user privacy. [Source: https://blog.google/products/chrome/updated-timeline-privacy-sandbox-milestones/]. The extension gives publishers and marketers breathing room to develop alternative solutions, but there remains no clear winner. And there are a lot of alternatives to consider, including Google’s own FLOC, alternate IDs from The Trade Desk, and in-house solutions ranging from first-party data to contextual. [Source: https://blog.google/products/ads-commerce/2021-01-privacy-sandbox/; https://www.thetradedesk.com/us/about-us/industry-initiatives/unified-id-solution-2-0]

All in all, these privacy-forward changes have created a significant amount of uncertainty around the future of digital revenue as they’re set to impact data collection, which is a key driver for digital advertising and subscriptions businesses, without a clear replacement solution. Publishers should expect to contend with these issues:

Exploring Alternative Targeting Solutions

As third-party, user-level targeting largely goes away, publishers and marketers alike will be searching for alternatives to support performance marketing, such as alternate IDs, contextual, and first-party data. First-party data is set to become a key driver, and publishers who are best able to collect and organize it into usable formats to support advertising performance will be best positioned to capitalize on the market uncertainty.

Rethinking Digital Advertising Mix

With the third-party cookie on browsers and cross-app tracking on mobile at risk given Google and Apple changes, traditional programmatic performance is likely to experience declines. [Source: https://www.apple.com/newsroom/2021/04/ios-14-5-offers-unlock-iphone-with-apple-watch-diverse-siri-voices-and-more/; https://www.apple.com/newsroom/2021/06/ios-15-brings-powerful-new-features-to-stay-connected-focus-explore-and-more/]. Publishers have already started diversifying advertising revenue into channels that rely less on third-party IDs, such as direct sold display, branded content, and sponsored newsletters, which typically use first-party and contextual signals.

Monitoring Performance of Marketing Channels

Targeting and attribution performance on mobile has taken a large hit after Apple’s cross-app tracking limitations. Publishers who have paid marketing as a key acquisition driver for digital subscriptions [or marketing services clients] have already seen jumps in CPMs.

Adjusting Digital CX

Finally, in response to consumer protection legislation and Apple’s iOS updates, publishers will need to receive explicit user consent to collect and use browsing data to support advertising, marketing, and consumer businesses. This may take the form of ongoing prompts [i.e., GDPR] or persistent IDs [i.e., iOS ATT, registrations, etc.], but publishers will need to consider impacts to user experience, traffic, and conversion potential.

Publishing M&A activity accelerated in 2021 as the trend toward consolidation continued

Transaction activity in the newspaper industry reached a record high in 2021. In the last 18 months, three of the last four large public newspaper companies in the US were on track to be taken private by private equity investors. After the sales of McClatchy and Tribune and the attempt to take control of Lee Enterprises only Gannett and The New York Times Company remain as the last two major public newspaper companies as we head into 2022. [Source: Pitchbook and FTI Consulting Analysis, 2021]

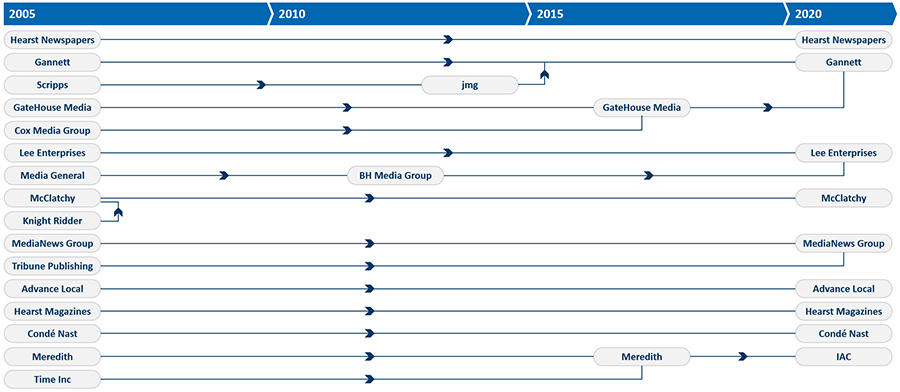

As shown in figure 9, over the last 15 years one-half of the largest publishers have been acquired by others.

Figure 9 - Publishing M&A

The consolidation trend isn’t just affecting newspaper publishers. After a COVID-impacted slowdown in the M&A market, the Publishing industry was red hot in 2021, both with acquisitions of legacy media magazine companies like Meredith, Dennis Publishing and Investors Business Daily, as well as SPAC offerings from companies like Buzzfeed, Complex and Forbes.

We expect to see the trend of consolidation to continue in 2022. While many of the largest targets have already been sold, FTI believes there remain dozens of attractive targets for both strategic and financial targets. Watch for these trends which are likely in 2022:

- Continued focus on scale: In today’s publishing landscape, scale means more than ever. Not only does it provide for more efficient use of operations and technology, but it also is critical to supporting first-party data aggregation and building a sustainable digital advertising business.

- Higher valuation multiples for consumer-driven and recurring revenue models: As we saw in 2021, business models like Politico, IBD and Benzinga can yield premium valuation multiples. These businesses tend to have higher margins than advertising-driven businesses and are less subject to the macro-economic shocks and downturns of the advertising market as we saw during COVID.

- Interest in B2B or specialized vertical publishing: As publishing models have shifted toward consumer revenues, publishers will find that the more specialized and niche the vertical is, the higher is the willingness to pay. More generalized news can provide scale and help act as an audience funnel to “pro” or upmarket products. For example, the Boston Globe has had success with Stat+, a subscription service with focus on biotech, pharma, and life sciences industries.

- Cross-media ownership could be more common: Historically, there have been few synergies between local media outlets across radio, broadcast, and newspapers. Not only did regulatory issues persist, but the legacy costs of these respective outlets led to minimal synergies from a cost perspective. As legacy formats begin to converge toward digital a news publisher can no longer afford to be tethered to a single format. With potential updates to FCC regulations coming, we could expect to see more M&A activity across different local media formats.

What is the future of Local Journalism?

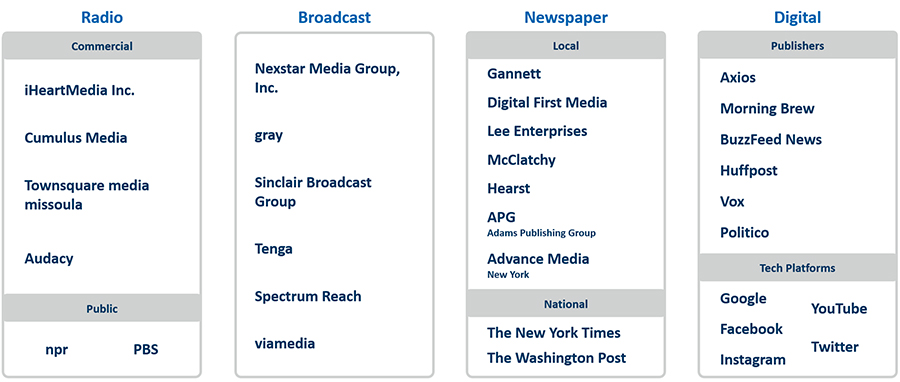

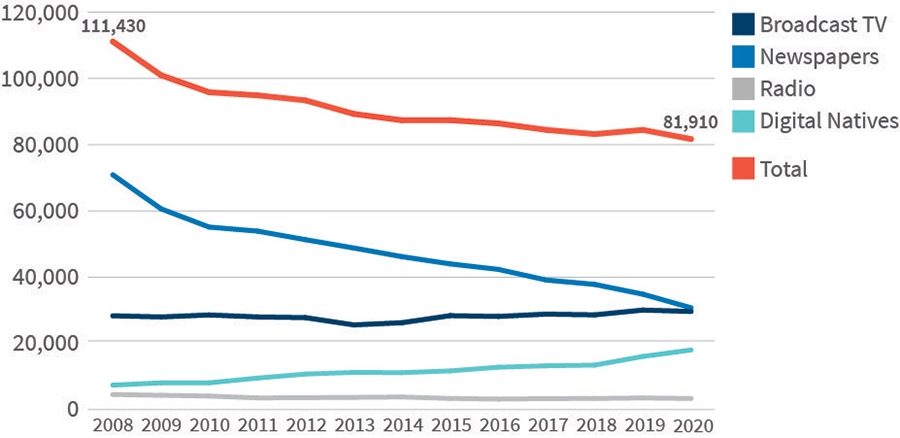

The ecosystem of local news providers looks significantly different than it did 10 – 15 years ago. The number of newspaper publishers has dwindled significantly, with a small collection of corporate chains controlling most markets followed by a long tail of independent metros. Other legacy news providers in radio and broadcast TV, although less severe challenges faced by publishers over the last decade, are beginning to see similar challenges to their advertising business model. All these legacy formats are continuing to experience competition from digital players – both core news publishers [Axios, Buzzfeed News, etc.] and tech platforms [Google, Meta, Twitter] – for news distribution. [Source: FTI Consulting Research, 2021]

Figure 10 – Local News Ecosystem

As local newsrooms continue managing through challenging financials, one avenue that has historically been off-limits may provide a solution: cross-ownership of newspapers with radio and TV broadcasters. Until recently, FCC regulations prevented cross-ownership of multiple news entities in the same metro market primarily as an anti-trust mechanism. However, the FCC reversed the decision [which was upheld by the United States Supreme Court earlier in the year], and now opens the door for potential consolidation. Nobody has yet acted upon the new change – possibly out of caution. [Source: Pew Research Center Fact Sheets for Local TV News, Newspapers, Audio & Podcasting & Digital News, 2021]

Figure 11 – Total Employment in US Newsrooms

The ultimate question at the end of the day, however, should always be: does a given transaction help support creation of a sustainable model for local journalism? To the extent combining newsrooms and support functions from various local publishers can better fund newsroom investment, such transactions make sense. However, if consolidation just leads to further erosion of newsroom jobs and reduces diverse voices and fair and balanced reporting, companies and communities will not be better off.

Trends to Remember About 2021

- Print continues to decline while digital advertising and digital subscriptions are performing well even with smaller digital audiences.

- For newspapers the loss of FSI preprint revenue is going to happen.

- What the big tech companies do regarding tracking and cookies is likely to challenge all publisher’s ability to garner digital revenue, especially advertising.

- The continued march to a digital consumer-led business will continue.

- New partnerships and mergers will increase in local markets.

Related Insights

Published

December 21, 2021

Key Contacts

Key Contacts

Senior Managing Director

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About

![Number of Monthly Visits [Indexed to November 2019]](-/media/a5cae8d20b8c40d0b4b7bf63ea14f7c6.ashx)