- Home

- / Insights

- / Service Sheets

- / Working Capital Catalyst

Working Capital Catalyst

Accelerating Cash Flow, Sustaining Efficiency

-

November 27, 2025

DownloadsDownload Service Sheet

-

Rising volatility, wider bid-ask spreads and tightening funding mean companies without accessible assets are far more exposed to unexpected costs and refinancing risks. Working capital is always on the agenda, but few know how to turn it into immediate value. FTI Consulting’s Working Capital Catalyst (“WCC”) helps organizations unlock 10–20% of trapped cash in weeks and sustain another 40–50% through lasting process discipline.

Get Started | Engagement Options

Two fast-track options let clients quickly assess or act on working capital opportunities:

- Red Flag Assessment (~2–3 Days): Quick scan to identify trapped-cash opportunities and headline benefits.

- Targeted Opportunity (~2 Weeks): Focused deep dive on priority levers that feed into the full WCC program.

From Immediate Cash to Lasting Discipline

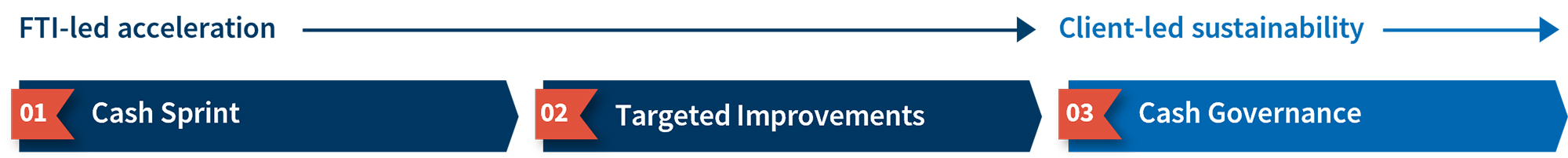

The WCC Framework accelerates cash release using a focused, three-phase model. Through the FTI-led Cash Sprint and Sustainable Improvement phases, companies rapidly release trapped cash and embed process discipline to sustain long-term gains. Then, clients take the lead in Cash Governance to sustain results.

Approach to Rapid, Sustainable Cash Flow

The WCC Framework accelerates cash release using a focused, three-phase model. Through the FTI-led Cash Sprint and Sustainable Improvement phases, companies rapidly release trapped cash and embed process discipline to sustain long-term gains. Then, clients take the lead in Cash Governance to sustain results.

Cash Sprint: Immediate cash release: Unlock immediate cash through high-impact tactical actions across Days Sales Outstanding (“DSO”), Days Payable Outstanding (“DPO”) and Days Inventory Outstanding (“DIO”).

- Execute tactical fixes

- Track weekly benefit realization

Targeted Improvement: Process excellence & embedded efficiency: Design and implement targeted process, policy and system improvements to embed gains and drive ongoing efficiency.

- Standardize workflows

- Embed KPIs and governance

- Enable real-time visibility

Client-led governance & sustainability: Transition to client-led governance with performance monitoring and accountability frameworks.

- Centralize monitoring

- Drive accountability

- Maintain performance discipline

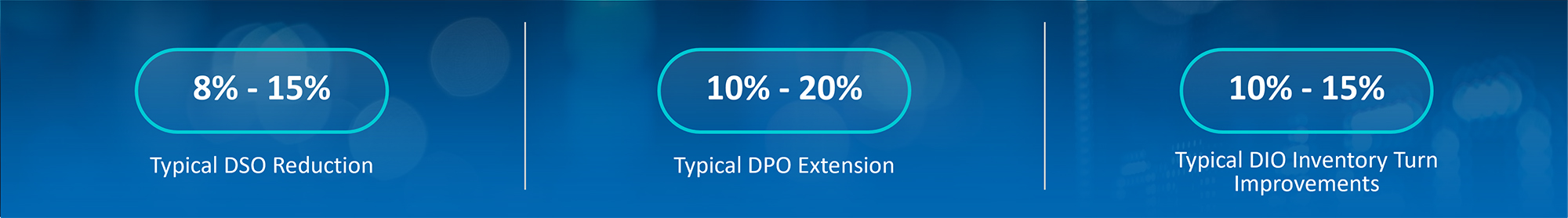

Typical Improvement by Component

Proven Impact: Results From the WCC

Quickly release trapped cash, optimize working capital levers and build sustainable processes that strengthen liquidity, profitability and enterprise value across industries.

DSO

Speed Up the Cash Clock Commercial-to-Cash

Advanced Manufacturing Company – FTI Consulting partnered with a $4B advanced manufacturing company to accelerate the end-to-end lead-to-cash process and improve working capital.

Impact

- Reduced DSO by 13 days, unlocking $130M in working capital (~18% of AR)

- Improved monthly collections efficiency from 80% to 95%

- Established sustainable DSO governance and long-term cash discipline

DPO

Extend Cash, Pay With Precision Procure-To-Pay

Post-Merger Vendor Terms Optimization – Following a major merger, our experts harmonized and renegotiated vendor payment terms across legacy organizations, aligning procurement and treasury functions.

Impact

- Unlocked $215M in working capital through supplier term optimization

- Extended standard terms to 90 days for more than 5,000 vendors

- Established a governance model delivering sustained cash-flow benefits

DIO

Optimize Turns To Unlock Value Forecast-To-Fulfill

Global Technology Distributor – FTI Consulting helped a global technology distributor modernize its fragmented inventory system to unlock trapped cash and improve profitability.

Impact

- Implemented a business intelligence tool to optimize $2B in inventory

- Delivered $1.5B in cumulative working capital improvements, including $250M in Year 1

- Enhanced real-time visibility and inventory governance across the enterprise

Recent Success Stories

- $130M unlocked in AR | 18% reduction in DSO

- $160M in working capital gains through vendor term optimization

- $215M+ inventory reduction realized

- $1.4B achieved in under 12 months

- Collections efficiency improved from ~80% to 95%

- $250M supplier spend leakage avoided

Related Insights

Related Information

Published

November 27, 2025

Key Contacts

Key Contacts

Senior Managing Director

Senior Managing Director

Managing Director