2026 Sets Up To Be a Make-or-Break Year for the Economy

Restructuring Activity Will Be Fine Either Way

-

January 22, 2026

-

Something we can all agree on regardless of political persuasion, business profession or general life outlook is that 2025 defied and humbled economic naysayers, whose predictions of business contraction, financial market crashes, global trade wars and perhaps widening geopolitical conflicts or social order breakdowns arising from controversial or unconventional domestic and foreign policy actions under Trump 2.0 were errant. Those dire predictions underestimated the resilience of the U.S economy and financial markets’ unwavering faith in the most pro-business administration in decades. Yes, there were some white-knuckle moments, particularly in the two-month period following Liberation Day, and a large percentage of Americans remain highly dissatisfied on many fronts — economic1 and otherwise,2 but the center held in 2025 and financial markets continue to behave as if these are normal times. Were the skeptics wrong or premature? It will take another year to know, as the downstream effects of unconventional policy decisions will take a while longer to course through a $30 trillion economy. It is too soon to conclude that the cumulative impacts of tariffs and trade policy disruptions, immigration crackdowns on labor markets and worker shortages, federal agency cuts and layoffs, untamed federal spending and an unrelenting affordability challenge for most households won’t derail domestic economic performance. However, their negative impacts to date have been manageable overall, and that itself has been surprising to advocates of orthodox governing and economic policies.

As we said often in 2025, sufficiently strong headline numbers for the U.S. economy and roaring financial markets concealed worrisome fissures beneath the surface, and those cracks are susceptible to widening further in 2026 if the economic benefits of policies intended to stimulate growth and juice financial markets continue to accrue so disproportionately to the largest corporations and most affluent households while also deepening U.S. fiscal imbalances. That is a recipe for an eventual economic reckoning, but the challenge for forecasters and business strategists is to ascertain when a tipping point will be reached. Here are some reasons to be wary of what lies ahead in 2026:

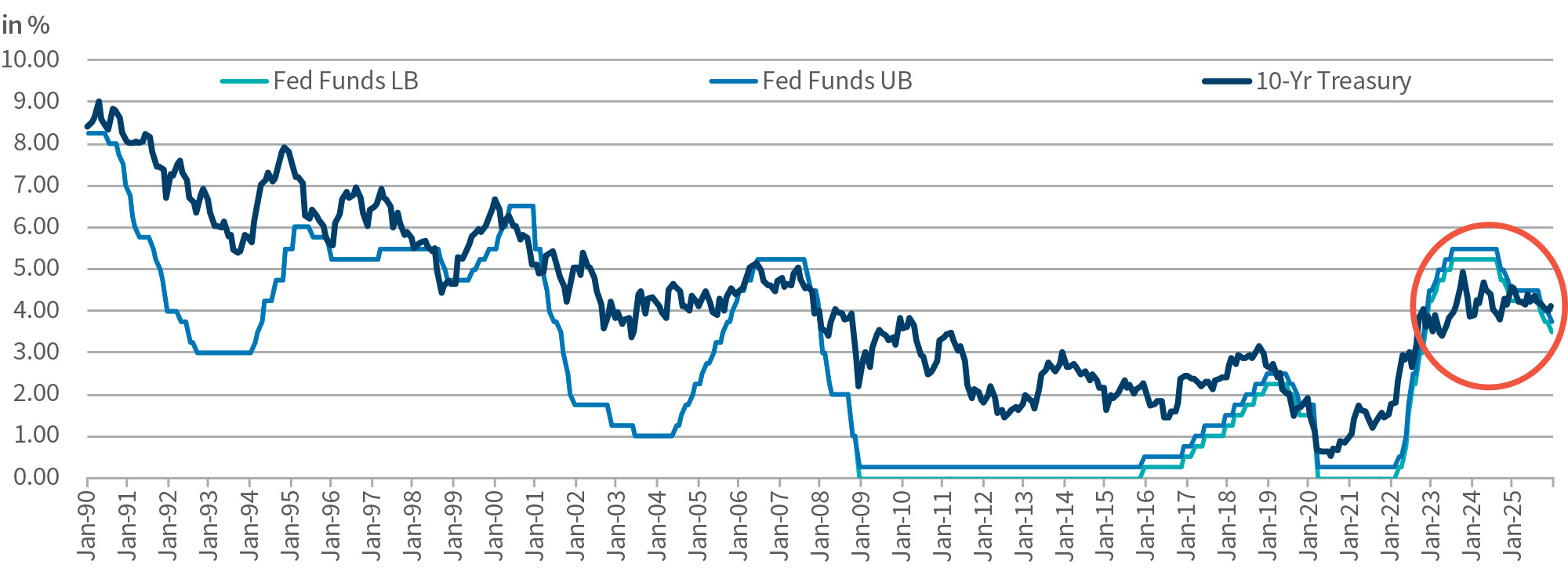

The Bond Market Has Started to Push Back on Profligate U.S. Fiscal Policy: American exceptionalism has allowed the federal government to borrow cheaply and spend excessively for most of this century without consequence. We’re all aware of the daunting figures that these policies have produced: The U.S. budget deficit will again hit 6.0% of GDP in 2025 amid a year of positive economic growth while U.S. federal debt now exceeds $38 trillion — well above the 100% of GDP mark that normally signifies structural imbalances that cannot be remedied without harsh medicine for other nations. Net interest on the national debt has nearly tripled in the last five years and will represent approximately 14% of total federal spending in 2026.3 Most troubling, there is little evidence that elected officials in Washington are willing to confront these imbalances in any serious way — certainly not before the 2026 midterm elections — which is widely viewed as tantamount to political suicide. (Vote for me and I’ll raise taxes and cut discretionary spending!) The only serious voices heard on this issue are traditionally conservative think tanks and out-of-office politicians with nothing at stake.4 However, there is growing evidence that the bond market is no longer willing to play nice on this long-ignored and deteriorating issue. Despite six rate cuts by the Fed totaling 175 basis points since quantitative tightening ended in mid-2024, the market yield on the 10-year Treasury note has only decreased by about 35 bps in that time. The failure of these two key interest rates to move in near lockstep following a series of Fed rate cuts is unprecedented going back to 1990 (Figure 1). At this point, equity markets might be over-estimating the efficacy of more Fed rate cuts, which likely would encourage more speculation, borrowing and leverage within the financial system, but won’t help the real economy much.

Bond investors arguably are demanding a higher yield premium to hold long-term U.S. debt given these unaddressed fiscal imbalances. The bond market remains the singular force most likely to impose discipline on U.S. tax and spend policies given Congress’s inability or unwillingness to act on this increasingly critical issue. So-called “bond vigilantes” have done this effectively with other sovereign debt and foreign currencies, most recently in the United Kingdom in 2022.5 Should the Fed enact rate cuts in 2026 that credit markets perceive to be politically motivated and potentially inflationary, the bond vigilantes will be heard from. However, their ability to meaningfully move financial markets or influence policy decisions in the world’s largest economy remains to be seen. A sizeable and enduring yield premium for U.S. debt would keep market interest rates elevated across the domestic economy, blow larger holes in the federal budget, and would have a sobering impact on the private sector. This might not be a 2026 showdown, but the process appears to have begun.

Precious Metal Prices Have Soared With More Gains Predicted: Gold had its best year since 1979 when inflation truly was raging, while silver prices more than doubled in 2025. Indeed, huge price gains extended across all precious metals. Such price moves are highly anomalous amid times of economic prosperity, especially with inflation seemingly under control, and reflect global investors’ flight to traditional safe-haven investments, a weaker dollar, reserves purchasing for stable coins and diversification away from U.S. based assets. Moreover, many expect price gains to continue, with Goldman Sachs and JP Morgan forecasting gold prices of $4815/oz and $5055/oz., respectively, by the end of 2026.6 This invites an obvious question: If these are such prosperous economic times, why are precious metal prices soaring? Some will say it’s hedging or risk spreading, but shattering record-high prices for these metals likely reflect underlying concerns that current financial market prosperity is ephemeral and perhaps poised to pop.

Figure 1 - Targeted Fed Funds Range vs. 10-Yr. Treasury Yield

Source: Bloomberg

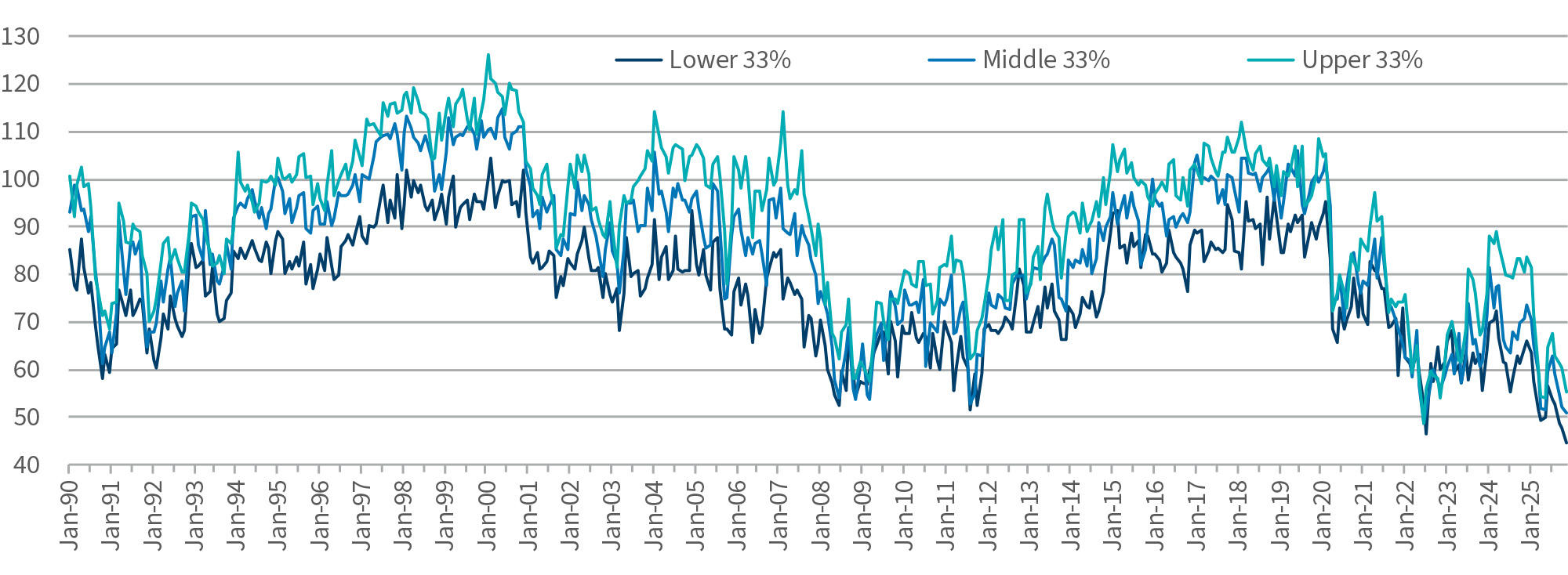

Most Americans Are Dissatisfied With the U.S. Economy: President Trump can proclaim all he wants that the economy is roaring,7 that inflation is tame and that the affordability issue is a hoax, but a majority of Americans aren’t buying it, just as they rejected similar upbeat economic messaging from President Biden in 2024. Their lived experiences continue to tell them otherwise, and that dissatisfaction is poised to increase further in 2026 as social safety net spending cuts included in the One Big Beautiful Bill Act (OBBA) begin to take effect, including more restrictive SNAP eligibility requirements and the termination of enhanced health insurance subsidies for more than 20 million Americans who access healthcare through independent exchanges under the Affordable Care Act. These measures mostly will impact lower to middle-income households but economic dissatisfaction extends across income cohorts (Figure 2).

This economic discontent goes beyond surveys and polling; the 2025 election results for open House seats and gubernatorial races indicated surprising strength by Democratic candidates in districts and states where the Democratic party brand continues to poll unfavorably and arguably represents a small sample size rejection of Trump policies by those electorates. The November 2026 midterm elections almost certainly will be a national referendum on President Trump and the efficacy of his policies on the everyday lives of voters. As unfavorably as the Democratic brand is viewed nationally, congressional Democrats can hardly wait for November to come, and they expect to retake the House as voters continue to express their dissatisfaction with the President’s economic policies.

The affordability issue is far from a contrived argument (as some have suggested) and has been years in the making but it became amplified in the post-COVID period before coalescing into an articulated political platform in 2025 that resonated with many Americans. It’s not inflation per se but high price levels for most products and services that have made middle-class life or aspirations for economic mobility so tenuous for no less than one-half of U.S. households. Most critically, leaders of the affordability argument and its adherents reject the implication embedded in so-called “hustle culture” and other striver attitudes about wealth building that those who haven’t been able to get there or stay there just aren’t trying hard enough. Politicians who are dismissive of the affordability issue increasingly sound out of touch with ordinary Americans, and affordability will be foremost on the minds of many voters in November. This popular buzzword of 2025 isn’t going away anytime soon. Unfortunately, there are few obvious policy measures or business practices that can meaningfully address affordability issues in short order. Households that are highly impacted by affordability issues will remain likely frustrated in 2026.

Figure 2 - Consumer Sentiment Index by Income Group

Source: University of Michigan Survey of Consumers8

However It Plays Out, the AI “Miracle or Bubble” Debate Carries a High Stakes Outcome: It is concerning that so much of the wealth creation, business spending plans, infrastructure buildout and financing commitments of the large corporate sector are connected to the AI ecosystem. We’re talking about hundreds of billions over the next year or so and several trillion dollars through the end of the decade devoted to a technology revolution whose ultimate outcome scenario remains largely unknown. How will success be defined when these contours become visible? Will it be a “winner(s) take all” outcome where the best mousetrap crushes the runners-up? Will AI-related ROI justify the exorbitant amounts of investment and the sky-high valuations? Nobody yet knows the answer with any high degree of confidence, but that hasn’t prevented an all-out arms race to get to a destination. It is somewhat reminiscent of the fiber optic cable buildout of the early 2000’s, when the assumption of endless demand for high speed internet access created conditions for massive overinvestment in fiber optic cable networks that went largely unused, resulting in the dark fiber crash that incinerated hundreds of billions of dollars of market value, caused major telecom bankruptcies and huge job losses.9 In monetary terms, AI is the fiber optic cable buildout on steroids. It could turn out differently, of course; AI might be the greatest innovation in human history. Nonetheless, there will be losers in this epic race and the casualty toll still could be enormous and market disruptive even as the technology prevails — as the dark fiber crash reminds us.

What About Restructuring?

We were surprised to read a recent Washington Post article that stated business bankruptcy filings were running at their highest level since 2010, with 717 companies filing Chapter 7 or 11 through November, an increase (YoY) of 14%.10 Clearly such large numbers include filings by smaller middle market businesses (SMEs) that the large restructuring community tends not to focus on closely. The data (attributed to S&P Global Market Intelligence) indicated an uptick in filings by industrial, construction and trading companies in 2025, mostly due to tariff impacts and higher prices generally. Struggling smaller companies were at a unique disadvantage. While the largest companies can wrangle price concessions from suppliers on tariffs, absorb tariff impacts or pass them on to customers, smaller business don’t have that kind of bargaining or pricing power and are more likely to be price takers. Industrywide stress and distress among domestic small-batch spirit makers, craft beer brewers and their distributors in 2025 embody the essence of these challenges for smaller businesses.

It was a solid year for restructuring activity no matter how these events are tallied up, but it didn’t feel quite as strong as the article’s data indicated. Nonetheless, nobody is complaining. Large Chapter 11 filings (>$50 million) in 2025 barely cleared the 150 mark that looked like a sure thing earlier in the year, down modestly versus 2024 and 2023. S&P rated debt default events were down more markedly (around 20%) versus the prior two years, but there are reasons to believe that the tally of rated speculative-grade default events no longer captures the full spectrum of corporate restructuring activity, as more corporate debt goes unrated, either by choice or smaller size, while LMEs often can avoid getting tagged as default events.

Leveraged lending is too cheap, too plentiful and too easy, and nothing will likely stop that train in 2026 except a brick wall. Idle money earmarked for lending — and there’s plenty of it — must find a home. Anyone who doubts this should consider that lenders continue to give sponsor-owned borrowers many of the same deal term provisions (more or less) that have come back to bite them in recent years, namely around asset and value leakage away from originating secured creditors in executed LMEs. Lenders certainly have tightened loan language around the most egregious borrower-friendly terms, but this cat-and-mouse game continues to give large sponsors the upper hand when negotiating these documents, primarily because capital is so plentiful.

At this point in the business cycle, the backlog of potential restructuring deals in the year ahead is ample even in a similar economic environment devoid of a triggering event, given the steady buildup of old LMEs and other distressed exchanges that were done as quick fixes but will require more remedial solutions. At the risk of sounding unoriginal, the healthcare sector, industrials and consumer-facing businesses will remain challenged by specific factors associated with those industries that took root in 2025. Lastly, buyout deals done from late 2020 through 2021 are likely the worst deal vintage in years, done at the highest purchase price multiples and leverage employed, and the worst of that cohort remains ripe for restructuring of some sort. This is a baseline “steady as she goes” expectation. Any economic disruption would send that expectation considerably higher. Let the chips fall where they may.

Footnotes:

1: Copeland, Joseph, "Most Americans Continue To Rate the U.S. Economy Negatively As Partisan Gap Widens," Pew Research Center (3 Oct. 2025).

2: Montgomery, David, "What Americans Think About the U.S. Economy," YouGov (8 Sept. 2025).

3: "National Debt Hits $38.40 Trillion, Increased $2.23 Trillion Year Over Year, $6.12 Billion per Day," United States Congress Joint Economic Committee (5 Dec. 2025).

4: "Mitt Romney: Tax the Rich, Like Me," The New York Times (19 Dec. 2025).

5: Dunn, William, “Meet the Bond Market Vigilantes”, The New Statesman (19 Nov. 2025).

6: "Will Gold Prices Break $5,000/Oz in 2026?" J.P. Morgan (16 Dec. 2025).

7: Caputo, Marc, "Trump’s Article of Faith: Economy Will Soar in ’26," Axios (15 Dec. 2025).

8: “Surveys of Consumers: The Index of Consumer Sentiment,” University of Michigan (Dec. 2025).

9: Hecht, Jeff, “Boom, Bubble, Bust: The Fiber Optic Mania”, Optics & Photonics News, The Optical Society, (Oct. 2016).

10: Gregg, Aaron, and Jaclyn Peiser, "Bankruptcies Soar As Companies Grapple With Inflation, Tariffs," The Washington Post (27 Dec. 2025).

Related Insights

Related Information

Published

January 22, 2026

Key Contacts

Key Contacts

Global Chairman of Corporate Finance

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About