Four Predictions for Private Equity in 2026

-

January 22, 2026

-

As private equity (“PE”) heads into 2026, uncertainty, valuation pressure and selective liquidity are reshaping the market. AI adoption, interest-rate dynamics and evolving exit and sector strategies are becoming critical differentiators. Despite this uncertainty, there are clear opportunities emerging, with four predictions that we believe PE firms and portfolio company (“PortCo”) leaders should be watching closely as the year unfolds.

One: AI as a Driver of Premium Valuations

In 2025, AI was a sustained focus, with 65% of respondents marking it as a top priority in the 2025 Private Equity Value Creation Index.1 AI is now embedded across the PE lifecycle, shaping portfolio value creation and exit planning, influencing sell-side differentiation and playing an increasingly important role in buy-side diligence and capability assessment. As AI capabilities mature, there are some key areas in which their impact is likely to be seen in 2026:

- Greater Focus on AI-Driven Business Model Transformation: While cost optimization and EBITDA focus will remain front and center in 2026, PE firms will increasingly leverage AI for revenue and business model transformation. To build competitive advantage, PE firms should focus on how AI is disrupting the value chain, as well as on designing new AI-enabled products and services, new pricing models, adapting to changing customer expectations and incorporating AI into emerging sales channels.

- Increasingly Complex AI Orchestrations: A majority of AI deployments in PortCos have so far been focused on tactical use cases and task-level automation. There will be broader AI adoption that will move beyond narrow tools and use cases to more complex workflows and orchestration across the enterprise through maturing and more cost-effective agentic AI platforms, protocols and paradigms.

- Longer Term Core Infrastructure and Capability Investments: A prevailing pattern with AI deployment in PortCos has been a bias for short-term realization of AI gains. However, some of the more strategic and longer lasting value creation requires more mid- to long-term capability and infrastructure. As such, an increase in more significant infrastructure investments is expected in 2026 to support scaling AI deployments such as data infrastructure, security, product R&D and governance.

- Better Planning for Workforce Adoption and Operating Model Shifts: As many PortCos launched AI projects and implemented use cases, the usefulness of AI was evident but the financial gains were mixed. There has been a realization that proper gains from AI deployment, particularly more sophisticated implementations, will not be possible without proper workforce upskilling, adoption management and rethink of the organization and operating model around a shifting paradigm where AI labor increasingly augments the human workforce.

- Greater Centralized AI Coordination at Fund Level: We are seeing funds take a more active role, creating repeatable AI playbooks and infrastructure patterns that can be deployed across multiple PortCos to allow for scale, consistency and cost efficiencies at the fund level. This will be further driven by the increased hiring of AI talent and leadership to better support AI strategy and execution as well as improve maturity in measuring the impact of AI.

Two: Thawing IPO Markets and New Liquidity Pathways

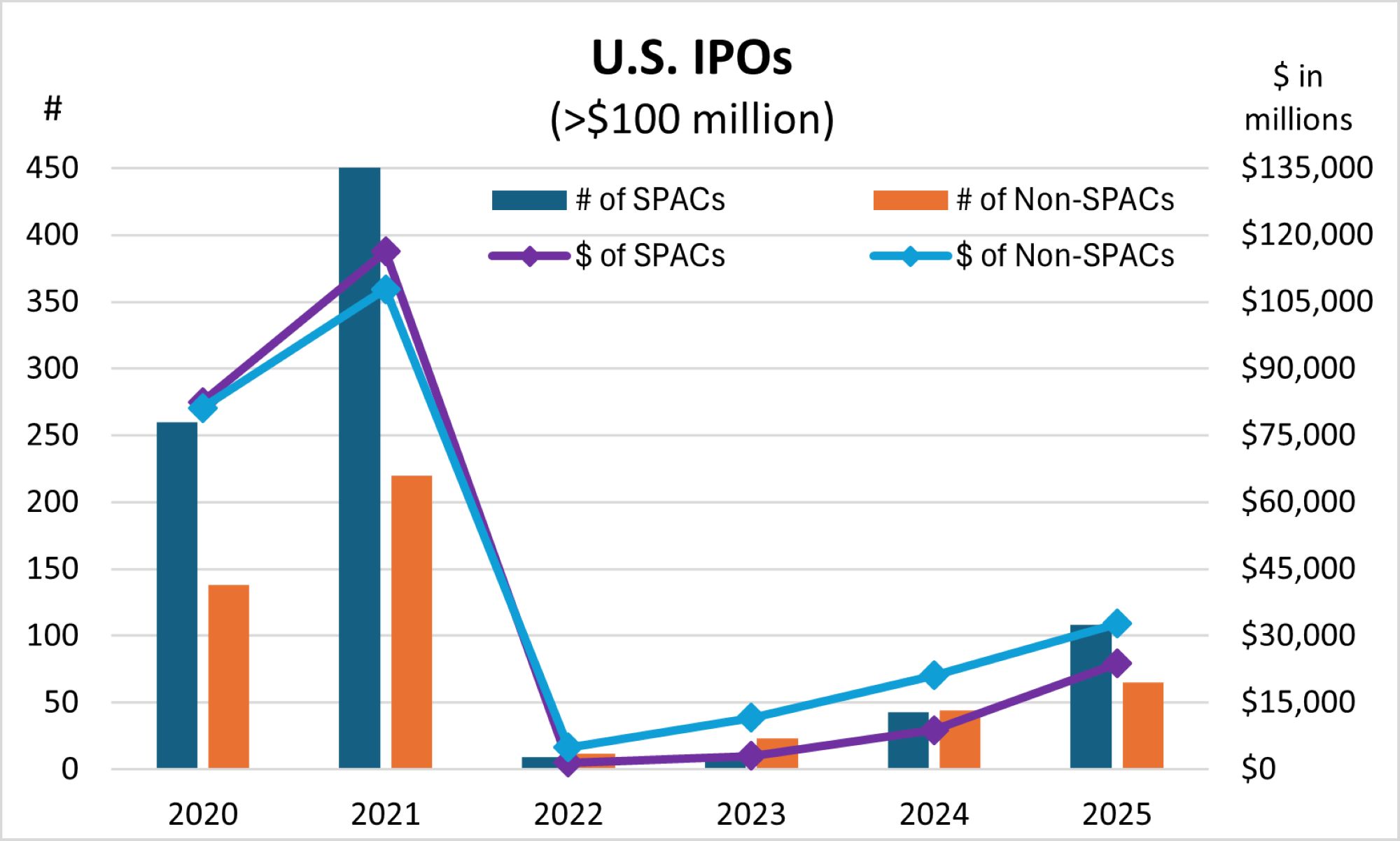

Predicting that U.S. IPO activity will improve in 2026 is like saying the Colorado Rockies will be a better baseball team next season. Practically speaking, the only direction is up. But how far will that be? IPO activity made a surprising comeback in 2025, driven in part by a resurgence in SPAC listings, which accounted for 62% of U.S. IPOs by number and 42% by volume. Excluding SPACs, traditional IPO activity rose roughly 50% YoY, suggesting momentum heading into 2026.2

Some market pundits believe 2026 could be poised for a breakout year for IPOs, and there is good reason that such optimism might be realized. Many of today’s high-profile private companies in leading tech sectors could go the IPO route but are choosing to remain privately owned given the huge financing commitments and sky-high valuations that private capital markets are affording them. However, these standout companies will eventually need an off-ramp into public markets so that early-round investors can monetize their holdings — and 2026 could be that year for some marquee names.

Consequently, it is conceivable that certain companies will IPO in 2026 at unprecedented equity market valuations in the vicinity of $100 billion or more. Such mega-IPOs could boost market sentiment and encourage other offerings among more gravity-bound names. The key question is whether investor appetite for large deals will spill over to the broader IPO market.

Recent regulatory changes are also widening the range of deal structures available, giving firms greater flexibility. Companies that structure deals creatively and use recent IPOs as market validation will likely be better positioned to enter the public markets successfully. PE firms should pay close attention to early S-1 and F-1 filings to see which structures clear regulators and at what valuations. This will offer critical signals on timing and approach and could create an early-mover advantage before valuations begin to normalize.

Ultimately, the strength of the IPO market in 2026 will depend greatly on whether equity markets can remain frothy and in full risk-on mode. Mega-IPOs won’t materialize without appropriate public market valuations, especially if private markets continue funding these boundless growth stories. Either way, by exploring creative routes to maximize value through an IPO, firms are finding new paths to value creation.

Source: S&P Capital IQ

Note: 2025 figures are annualized based on YTD data through 3Q25.

Three: Sustained Valuation Pressure and the Search for Untapped Sectors

Private capital investment in nontraditional sectors has expanded in recent years and looks to continue in 2026, evidenced by growing discussions of what PE ownership of law firms could look like. Despite apparent organizational and cultural obstacles, firms have pent-up dry powder due to sustained valuation pressure and are ready to invest in untapped sectors.

The recurring revenue, high profitability, operational inefficiencies ripe for improvement and stable growth trajectory of financial, accounting and professional services companies have attracted private capital since 2020.3 Law firms operate on a similar model and, despite regulatory hurdles and the need for alignment, there is growing momentum around connecting private capital to the legal world — the rising YoY M&A activity in the U.S. legal market supports this stance.

Firms with falling revenues and talent loss can benefit most from this shift, as private capital can fuel growth activity and transform highly fragmented law firms through M&A and AI-powered innovation. The ability to retain and reward partners could also be enhanced through PE. Under traditional partnership structures, partners generate long-term value or “goodwill” through brand reputation, client relationships and institutional know-how, but have limited mechanisms to realize this financially. PE ownership enables this goodwill to be formally monetized, allowing partners to convert accumulated enterprise value in tangible economic returns rather than relying solely on annual profit distributions.

Furthermore, we’re seeing PE firms explore a model in which more commoditized elements of law firms are carved out as managed services organizations, leaving client-intensive elements untouched by non-lawyer investors. Some leading law firms have shown interest in this strategy, specifically related to outside investment as part of restructuring.

These opportunities have the potential for tremendous upside. However, obvious risks should not be ignored. Some areas to be aware of include:

- Culture: Partners may be resistant to non-lawyer shareholders. Dissatisfied partners can walk and their clients may well follow.

- Brand: Adoption of AI and a managed services organization could threaten premier pricing, brand positioning and bespoke client relationships.

- Growth: Merging law firms requires careful cultural diligence and a distinct understanding of each firm’s economics.

- Legal/Regulatory: Law firms and lawyers are subject to unique and strict ethics and conflicts rules that can prevent or complicate taking on specific clients and matters, despite the economic opportunities at play.

Firms must evolve their investment strategy to ensure long-term value realization. With dry powder at the ready, PE investors are increasingly likely to target the legal services sector in 2026, leveraging consolidation opportunities and innovative structures to capture value from this historically untapped sector.

Four: Carve-Out Strategy Evolution: From Price to Performance in 2026

Despite more deal-friendly levels, high valuations and compressed returns have positioned carve-outs as one of the most active deal strategies, a trend that looks to continue in 2026.4 With constrained leverage and extended exit timelines, value creation has become central to investment strategies. 5

Staying ahead of shifting trends in the carve-out market will be crucial, with purpose-driven carve-outs increasing, driven by corporate balance-sheet repair, activist pressure, regulatory intervention and conglomerate breakups responding to profitability pressures. Technology separation remains a critical path in the vast majority of carve-outs, with legacy Enterprise Resource Planning (“ERP”) entanglement, shared data and cyber risks driving the adoption of more comprehensive pre-sign IT separation blueprints, interim tech stacks and fit-for-purpose standalone solutions. Additionally, management depth and readiness will increasingly influence investment decisions as people risk — particularly leadership retention, cultural reset and capability gaps — are also significant blockers in a carve-out transaction.

Pre-deal diligence and Day-1 readiness have evolved beyond hygiene factors into critical levers for both value protection and value creation. Execution failures such as payroll disruption, billing delays or supply-chain breakdowns can derail momentum and the investment case. As a result, diligence should shift from a narrow focus on parent-company entanglements toward the proactive design of the optimal standalone operating model, with separation planning embedded directly into the investment thesis.

Given the complexity of carve-outs, buyers should treat Day-1 readiness as a full program rather than a checklist; those that do so will likely be better placed to quickly realize value creation potential. Rather than focusing too heavily on what aspects of the business are shared, the focus instead should hone in on what the standalone business should look like, with the priority on building a credible Day-1 to Day-100 plan. Firms with repeatable carve-out capabilities that lean on standard playbooks and internal muscle memory can reduce execution risk and position themselves to pursue more complex, higher return opportunities while ensuring separation planning is integrated into the investment thesis. As carve-outs transition from special situations to operational transformations, firms with proven playbooks can capture early value while maintaining focus on Day-100 and Day-365 execution milestones.

Positioning for the Future

Taken together, these trends underscore the need for PE firms and PortCo leaders to be more deliberate and forward-looking in 2026. Investing in AI-enabled capabilities, taking advantage of the potential for mega-IPOs, exploring untapped sectors and preparing early for multiple exit scenarios will be increasingly important as competition intensifies and capital remains selective. Firms that align investment strategy with operational execution, as well as portfolio companies that build scalable, differentiated platforms, will be better positioned to unlock value and navigate an evolving PE landscape.

Footnotes:

1: “2025 Private Equity Value Creation Index: Recalibrating Value Creation Levers,” FTI Consulting (October 2025)

2: “SPAC and US Total IPO Activity,” SPAC Analytics (accessed January 9, 2026)

3: Salsberg, Brian, and Puja Sood, “Weighing Opportunities, Risks of PE Investment in Law Firms,” FTI Consulting (November 24, 2025)

4: Barnes, Oliver, and Ivan Levingston, “Companies line up $1tn of asset sales as activists push break-ups,” The Financial Times (December 31, 2025)

5: “The Hidden Costs in Carve-Outs: What Private Equity Often Misses in Diligence and How To Find Them,” FTI Consulting (June 24, 2025)

Published

January 22, 2026

Key Contacts

Key Contacts

Senior Managing Director, Leader of AI & Digital Transformation

Senior Managing Director, Global Head of M&A

Senior Managing Director

Managing Director

Managing Director

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About