Losing Confidence in Consumer Confidence

-

July 19, 2022

DownloadsDownload Article

-

With the U.S. economy lumbering towards a possible recession and financial markets experiencing their worst first-half in decades,1 it might be an opportune time to understand how consumers are feeling currently since their spending accounts for more than two-thirds of domestic economic activity. Unfortunately, the two preeminent gauges of consumer sentiment, The Conference Board’s Consumer Confidence Index (CCI) and the University of Michigan’s Index of Consumer Sentiment (ICS) are telling us very different things currently.

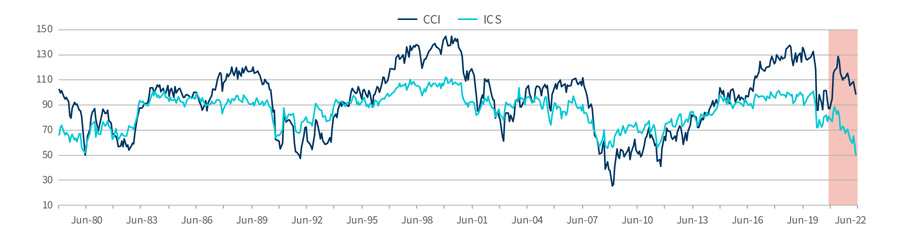

Both indexes attempt to measure consumers’ views on the economy and their personal financial conditions — and have a current conditions component as well as an expectations component looking ahead 6-12 months. The surveys field five primary questions strictly pertaining to the economy and personal finances; there are no questions on political or social issues. The indexes have been around for decades and employ similar methodologies and survey questions in their respective polls. They have mostly moved in tandem over the last 40 years, with the CCI being a bit more volatile than the ICS over time, so there is no obvious reason why they shouldn’t both be telling us the same story this time around. However, the two indexes began to diverge in mid-2021, and today the gap between the ICS and CCI readings is at its widest level ever (Exhibit 1). More confounding, neither index reading at mid-year seems patently “more reasonable” or “better” given current and prospective economic conditions. It’s a head-scratcher.

The ICS is currently at its lowest level ever dating back to 1978 (Exhibit 1), meaning that consumer sentiment is worse today than it was during the height of the COVID-19 pandemic, the global financial crisis and Great Recession of 2008-09, the immediate aftermath of the 9/11 attacks, the recession of 1990-92, and the multi-year bout with runaway inflation and recession in 1979-81. If you’re old enough to have lived through these wrenching episodes as an adult, it seems incomprehensible that current sentiment has surpassed the lows associated with all of them. For whatever challenges the domestic economy faces in the months ahead, the U.S. economy seems to be in far better shape than it was during any of these previous crisis moments, while consumers’ balance sheets are in reasonably good shape coming out of the pandemic. The ICS index reading of 50 in June2 compares to a long-term average of 86 and a pandemic low of 72 in April 2020, when pandemic shutdowns hit with full force. In fact, all previous lows for the ICS occurred amid extreme conditions or crisis situations, which is not where we are positioned today by most economic measures. Clearly, consumers are concerned about what lies ahead, given high inflation, a war in Ukraine that continues to negatively impact global commodity prices, and the determination of the Fed to slow the U.S. economy. However, the current conditions component of the ICS has fallen just as sharply as the expected conditions component, meaning that respondents are not just expecting economic adversity in the months ahead; many say it’s already here. But it’s hard to fathom that the ICS index is flashing its lowest reading ever at this moment. Things just don’t seem that bad — and certainly such deep pessimism isn’t yet reflected in consumer spending trends.

Exhibit 1 – Consumer Confidence Index vs. Index of Consumer Sentiment

Source: University of Michigan Surveys of Consumers and The Conference Board

Conversely, the CCI is only 14% below its 2021 year-end reading, when economic conditions and expectations were considerably stronger and financial markets were much higher; the June reading of 98.73 remains above its long-term average of 95 and its pandemic low of 86 in April 2020. There is a distinct difference though. CCI respondents are much more upbeat regarding the present situation component, and it is entirely the expectations component of the index that has pulled down the CCI in recent months. CCI respondents say that business and employments conditions are fine now but expect them to deteriorate markedly in the months ahead. In fact, the numeric difference between CCI’s Present Situation Index and Expectations Index is at its widest level since early 2001, right before the dot-com stock crash. In contrast to the pessimism reflected in the ICS Index, the CCI reading seems a bit too upbeat.

So, why all the fuss about this? Some retail pundits are generally dismissive of such types of surveys, claiming that shoppers don’t spend consistently with the way they say they feel. This might be true in any given month or quarter, but over longer stretches of time consumers’ feelings and their spending are directionally correlated to a fair degree, so there is insight and value for retailers and other consumer-facing companies to gauge and track these sentiments by relevant customer cohorts when formulating spending expectations.

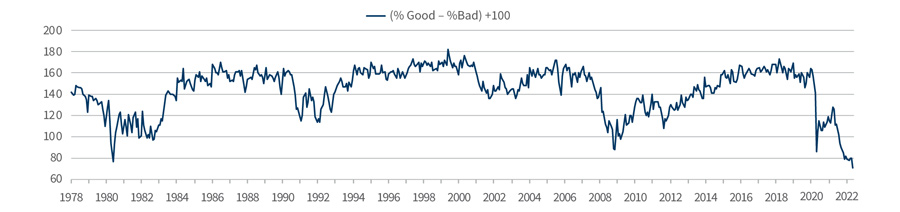

After doing some digging, we believe that inflation is the reason why the ICS and CCI indexes have diverged so much in recent months. The ICS survey asks a direct question regarding inflation for its Current Conditions Index (How Are Buying Conditions for Large Household Durables? Good time to buy/Bad time to buy/Uncertain or don’t know), while the CCI does not have an explicit primary question on inflation. Consequently, the ICS survey likely better reflects consumer attitudes about inflation — and, boy, are they horrific right now. The time series for this question dating back to 1978 is at its lowest level ever — even worse than 1979-1981 when inflation was out of control — having swung lower by nearly 60 points (% Good Time minus % Bad Time) since March 2021 (Exhibit 2). The precipitous deterioration in responses to this question coincides with the sharp divergence between the ICS and CCI since last year, meaning that this almost certainly is the reason for the widening gap. In short, respondents are panicked about inflation and the CCI might not adequately be capturing this reality.

Now, is inflation so bad as to justify an all-time low in the ICS? It’s not, but let’s not forget we are dealing with a large segment of the adult population that has never had personal experience living in a high-inflation environment, with many accustomed to a 2% annual inflation rate for most of their adult lives. This is a shocking time for many Americans even though it became more likely such a moment would arrive, given the unprecedented monetary stimulus and financial assistance carried out since COVID-19 hit. Moreover, with too many households living paycheck to paycheck, a monthly cost-of-living increase of $300-$400 just for food and gas inflation is a budget-killer. Finally, financially vulnerable Americans also recognize that the days of generous financial relief are likely over, and this also contributes to their growing anxiety.

Exhibit 2 – Good Time to Buy Household Durables?

Source: University of Michigan Surveys of Consumers, May Data Booklet, May 27, 2022

Consumer spending growth is slowing, and recent downward revisions to the consumer spending component of 1Q22 GDP make it clear that this deceleration began earlier than first thought. Monthly retail sales gains (nominal YoY) remain positive but are weakening, so we don’t want to overstate the case. However, 1Q22 results for many large retailers were peppered with cautionary comments and downward earnings guidance due to margin compression that’s expected for the balance of the year. There was also plenty of anecdotal commentary about lower- and middle-income shoppers pulling back or trading down. It’s often hard to see these struggles from a lofty perch where higher income earners and more affluent consumers continue to experience a fairly benign economy and mostly prosperous times. As the ICS Index reminds us, most Americans don’t see it that way. Their deep pessimism is either perplexing or concerning, depending on whether you buy into it. Time will tell whether the ICS or CCI was the better gauge of this moment, but both are signaling consumers expect tough times ahead.

For more expert insights download our 2022 Online Retail Forecast

Footnotes:

1: Warner, Bernhard. ‘A horror story’. These 3 charts show just how historically bad markets performed in the first half of 2022. Fortune, 2022.

2: University of Michigan. Final Results for June 2022. University of Michigan, 2022.

3: The Conference Board. Consumer Confidence Falls Again in June. The Conference Board Press Release ,June 2022.

Related Insights

Related Information

Published

July 19, 2022

Key Contacts

Key Contacts

Global Chairman of Corporate Finance

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About