From Enthusiasm to Execution: Why Operational Rigor Will Define Climate Tech’s Next Chapter

-

December 11, 2025

DownloadsDownload Article

-

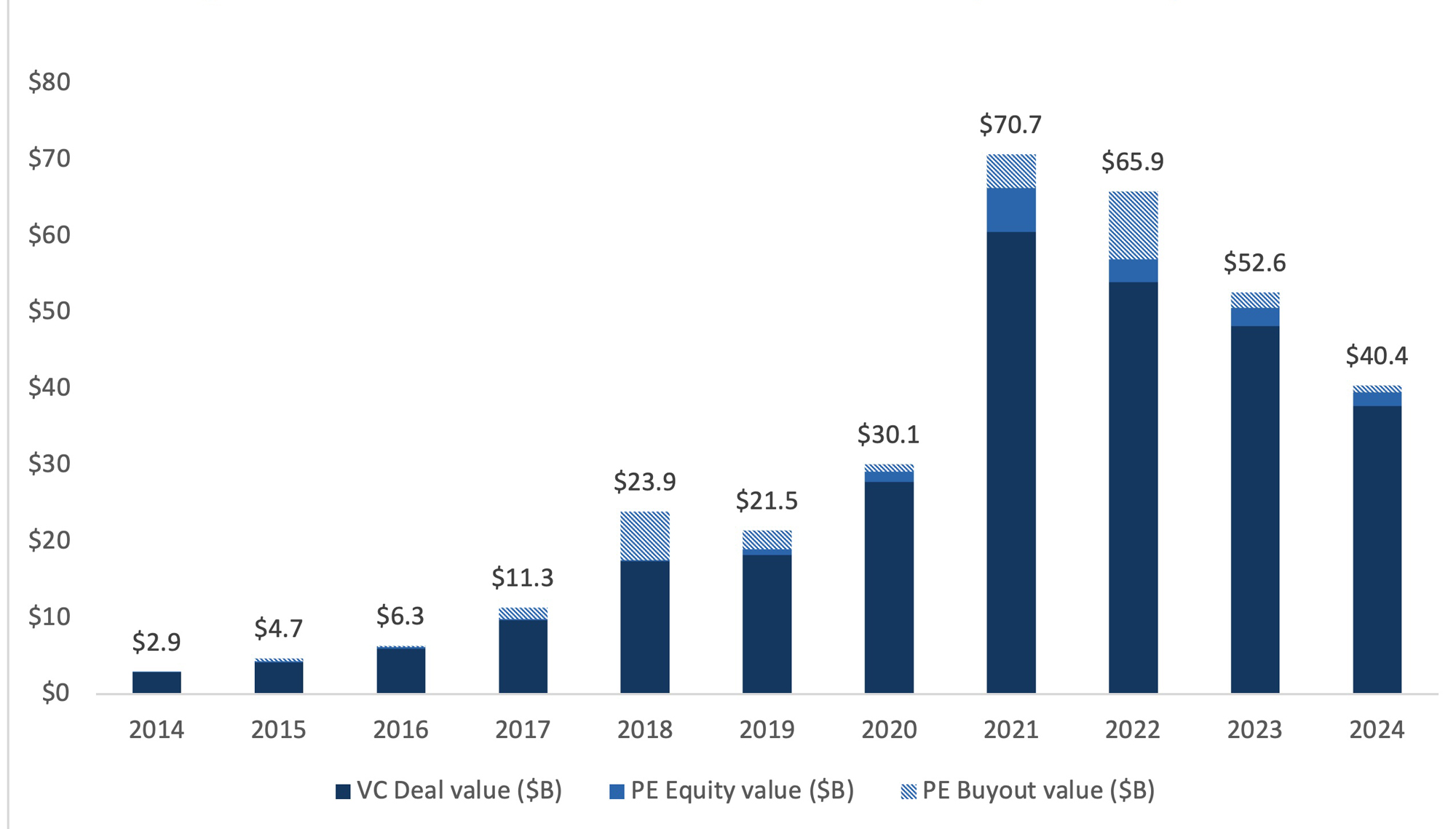

Climate technology has attracted over $312 billion1 globally from venture capital and private equity between 2014 and 2024, marking its emergence as a core pillar of the energy transition. These sectors are still evolving, and while investment has accelerated, operational discipline has not kept pace. The result: ideas often outpace execution. Despite prior policy support through vehicles such as the U.S. Inflation Reduction Act (“IRA”), investors have faced high-profile setbacks from scaling missteps, supply chain bottlenecks and cost overruns. As policies shift, the urgency to pair capital with operational rigor has only grown. This landscape is testing assumptions, exposing fragile models and demanding sharper risk strategies.

The State of Climate Tech Investing

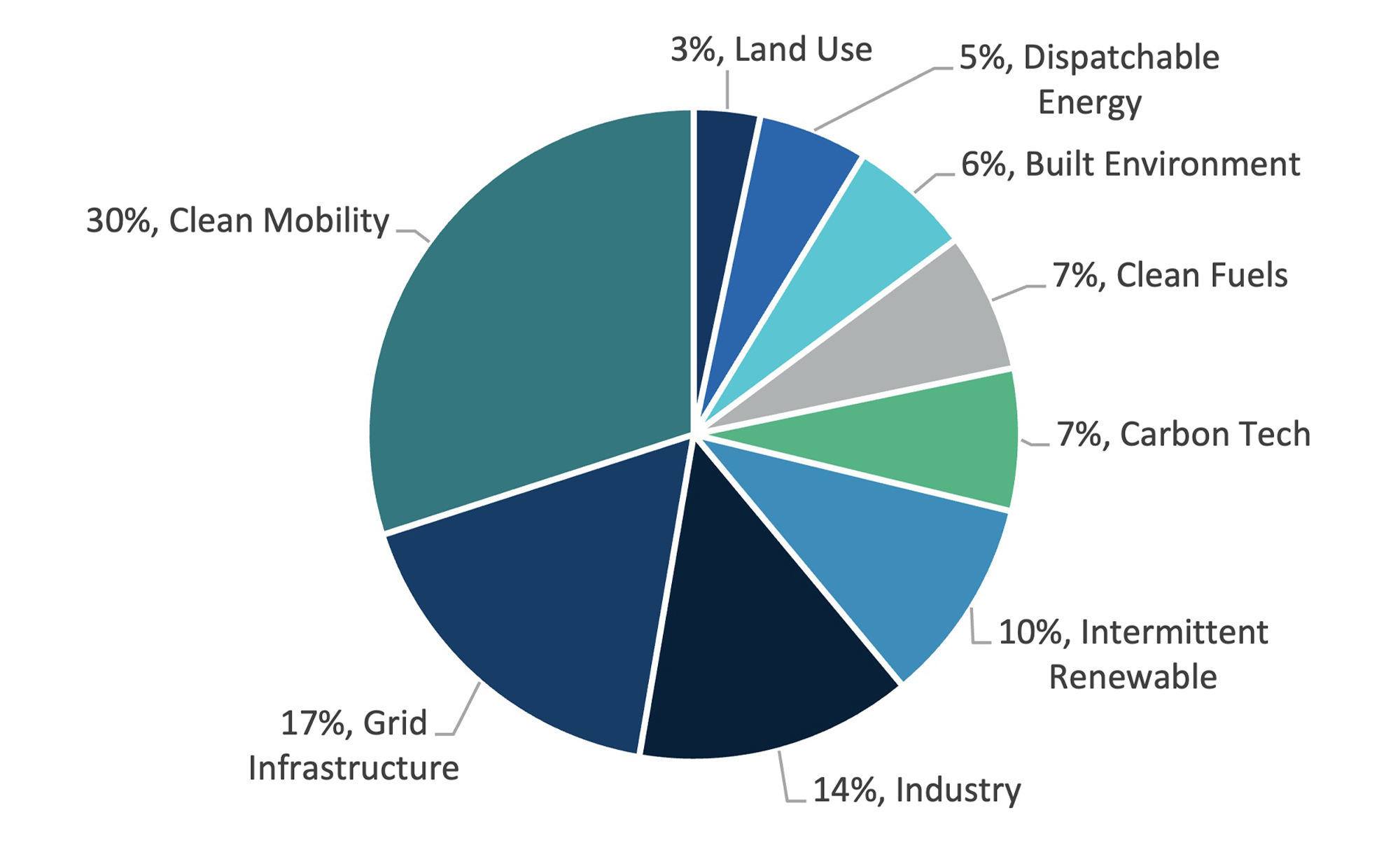

Climate technology spans energy, transport, industry, buildings and infrastructure and agriculture and carbon. North America has emerged as the largest regional source of climate venture capital, accounting for about 45 percent of global VC deal value over the past decade, about $129 billion.1 Investment surged in 2021 and 2022, driven by an alignment of later stage capital, favorable exit conditions, accelerating policy signals, heightened energy security concerns, momentum from COP26, growing ESG demand, and a wave of $100 million-plus mega deals particularly in clean mobility.1

Figure 1 - VC and PE Climate Tech Investment (2014-2024)1

Note: VC deal value and PE growth deal value represent equity invested in rounds that closed during the period. PE buyout deal value represents total transaction value for leveraged buyouts, including sponsor equity and acquisition debt. The buyout series is not directly comparable to equity invested series. For equity-only comparison benchmark VC deal value against PE growth deal value.

Funding has cooled since 2021 as rising interest rates and tighter exit markets weighed on investor appetite, with climate-tech investment declining by an average of 31 percent year over year.1 Even so, the United States remained the leading climate-tech financing market in 2024. More broadly, segment-level trends indicated a rotation of capital toward energy storage, nuclear and geothermal and away from clean mobility.1

Figure 2 - VC Investment by Segment (2014-2024)1

Note: Climate tech share of $282.2 billion total.

The market sits at a crossroads. On the policy front, segments tied to grid expansion, storage and power equipment are benefiting from U.S. tools that convert incentives into cash flow, such as elective pay, transferability of clean energy credits and the finalized Section 45X manufacturing credit. Yet the passage of the One Big Beautiful Bill Act of 2025 has introduced uncertainty for new capacity and factory buildouts, with economists projecting a 53 to 59 percent reduction in clean power additions through 2035 under the law.2

Against this shifting policy backdrop, the AI buildout is creating a powerful new source of electricity demand and flexibility requirements. Markets are responding in kind. Venture capital is rotating toward grid, storage and power-equipment adjacencies where demand visibility and policy tailwinds align.3 Private equity is channeling growth capital into storage and grid infrastructure while concentrating buyouts in power assets with durable cash flows, as AI-driven load growth accelerates sector M&A.4

The Gap Between Capital and Execution

Across the climate technology landscape, recent case studies reveal a recurring theme: investors often overlook the fundamentals of operational resilience. Supply chain robustness, customer diversification and disciplined capital expenditure are critical but frequently sidelined in the pursuit of rapid growth and valuation milestones. Take Northvolt, once celebrated as Europe’s great battery manufacturing hope. The company filed for bankruptcy in Sweden on March 12, 2025, after years of ambitious scaling across Sweden, Germany, Canada and Poland. Its vertically integrated model strained under production bottlenecks, cost overruns and overall shifts in EV demand, but the true breaking point came in June 2024 when BMW withdrew a €2 billion5 order, citing delivery delays. This collapse triggered a failed capital raise and an ensuing liquidity crisis, underscoring the risks of scaling ahead of execution.

The residential solar sector offers a parallel cautionary tale. Even before policy uncertainties, SolarZero’s subscription-based model exposed structural fragilities. Its failure underscored a mismatched cash flow profile, a lack of cost discipline and heavy dependence on continuous capital inflows rather than self-sustaining operations. Backed by BlackRock and a debt facility of NZ$365 million extended by several international banks and the government green bank, the company collapsed in November 2024,6 highlighting that externally fueled expansion cannot substitute for a fundamentally viable business model.

Nextracker, the global leader in solar tracking systems, offers a compelling counterexample. Public since 2023, the company has consistently held the largest global market share in solar trackers, capturing about 26% of worldwide shipments in 2024 (28.5 GW). In FY 2025, it generated a strong $622 million in adjusted free cash flow, up 46% from the prior year.7 Its order backlog exceeded $4.75 billion as of Q1 FY 2026,8 providing ample visibility into future collections and working capital management. Driven by disciplined execution and strong operational performance, Nextracker has sustained robust growth while maintaining financial strength.9

Key Issues Investors Must Address To De-risk Climate Technologies

Rigorous Cash Management

Climate tech start-ups often chase rapid growth without financial guardrails, borrowing from the software playbook. Yet unlike pure software, most climate technologies are hardware intensive and capital heavy, with long lead times before revenues. Financial discipline is a survival requirement: cash should be tied to technical and commercial milestones, not unchecked expansion. The specific pressures vary by business model. For example, OEMs and EPCs face working capital crunches from large inventories and project receivables, while developers grapple with financing long construction cycles before cash inflows. By contrast, data and AI-driven climate firms may resemble software companies, with lower capex but higher upfront R&D and scaling costs. In today’s tighter capital markets, liquidity shortfalls are fatal. Regardless of sector, burn-rate monitoring, working capital control and forward-looking planning remain essential but how these tools are applied must reflect the company’s underlying model.

Pilot Versus Premature Scale-up

Prematurely chasing scale is one of the costliest mistakes in climate tech.10 It can show up not only in manufacturing, but also in project development, deployment models and digital platforms. Moving too quickly exposes companies to unresolved technical flaws, inefficient processes and fragile supply chains and, for developers, it can mean locking in unproven project economics or regulatory assumptions.

A phased approach using pilots, demonstration sites and staged commercial rollouts enables validation, operational refinement and stronger supplier, regulatory and customer relationships before major capital is committed. This also reassures investors and lenders, who are more likely to back expansion once early success is demonstrated. For example, Form Energy piloted its iron-air battery in Pennsylvania before committing to a $760-million plant in West Virginia,11 while geothermal innovators such as Fervo Energy have staged their technology validation through progressively larger well demonstrations before full-scale commercialization.12

Supply Chain Security

Climate technologies often rely on critical materials and specialized components, leaving developers structurally exposed to trade disputes, export controls, and price volatility.13 China’s dominance in rare earths and critical mineral processing underscores this fragility. But vulnerabilities extend beyond raw materials: limited global manufacturing capacity for batteries and electrolyzers, congestion in logistics networks, shortages of skilled labor and permitting pathways all constrain scale-up. Disruptions in any of these areas can derail production schedules, erode margins and damage customer trust. Investors should press companies to lock in long-term contracts, diversify sourcing and build alliances with domestic or allied suppliers, while also assessing exposure to broader manufacturing, workforce and permitting bottlenecks. Treating supply security as a core element of diligence is essential to de-risking growth.

Commercial Diversification

Overreliance on one major customer leaves climate tech firms dangerously exposed. As discussed earlier, Northvolt’s unraveling accelerated when BMW withdrew a €2 billion order, crippling its liquidity position. For early-stage ventures, a first offtake may validate technology but also create a single point of failure. Similar risks arise when companies hinge their economics on a single policy incentive or subsidy, leaving them vulnerable to regulatory shifts or political turnover. Securing a flagship partner or leveraging policy tailwinds should be viewed as entry points, not end goals. Investors must push companies to diversify their commercial base across customers, sectors, geographies and incentive structures to build resilience that endures beyond any one contract or policy cycle.

Talent and Leadership Teams

Even the strongest technology can fail without a team able to scale it. Visionary founders often lack experience in manufacturing, supply chains or regulatory navigation, all of which are essential for industrial rollouts. Weaknesses here lead to delays, cost overruns and missed milestones. Investors must assess whether management has operational depth, not just vision. Where gaps exist, adding seasoned operators as advisors or executives can anchor execution and help to reduce risk.

How We Can Help:

FTI Consulting’s Power, Renewables and Energy Transition Practice (“PRET”) brings together a team of seasoned financial advisers, ex-industry operators, regulators, and former utility executives. We combine deep operational expertise with sector specific knowledge across nuclear, mobility, storage, alternative fuels, recycling, agriculture, waste-to-energy, hydrogen and carbon management.

In an environment where investors face challenges around execution risk, capital discipline, supply chain fragility and leadership gaps, our team delivers hands-on support to bridge the gap between capital deployment and operational success. We help investors and portfolio companies de-risk growth strategies, unlock trapped value and navigate the complexities of scaling climate technologies.

Footnotes:

1: FTI Consulting analysis based on licensed subscription data (2025).

2: King, Ben et al., “What Passage of the ‘One Big Beautiful Bill’ Means for US Energy and the Economy,” Rhodium Group (July 11, 2025), (“The OBBB will cut the build-out of new clean power generating capacity by 53-59% from 2025 through 2035.”).

3: FTI Consulting analysis based on data from “Global Investment in the Energy Transition Exceeded $2 Trillion for the First Time in 2024, According to BloombergNEF Report,” BloombergNEF (January 30, 2025).

4: French, David, Isla Binnie, Mrinalika Roy, “AI to fuel bumper year for M&A in US power sector,” Reuters (March 13, 2025), AI to Fuel Bumper Year for M&A in US Power Sector - Energy News, Top Headlines, Commentaries, Features & Events - EnergyNow.com (“Dealmakers expect 2025 to be a bumper year for mergers and acquisitions in the U.S. power industry, with a voracious appetite for assets as the sector gears up to meet massive demand growth from data centers for artificial intelligence.”).

5: Segal, Mark, “Northvolt Files for Bankruptcy,” ESG Today (March 12, 2025), (“Shortly before the launch of Northvolt’s strategic review in July, BMW revealed that it had cancelled a €2 billion contract with Northvolt”).

6: Brettkelly, Sharon, “Behind SolarZero’s collapse,” Radio New Zealand (December 10, 2024).

7: “Nextracker Reports Q4 and Fiscal Year 2025 Financial Results,” Nextracker Press Release (May 14, 2025).

8: “Nextracker Reports First Quarter Fiscal Year 2026 Financial Results,” Nextracker Press Release (July 29, 2025).

9: “Nextracker Reports First Quarter Fiscal Year 2026 Financial Results,” supra n. 18 (“Our GAAP operating margin of 22% reflects the benefits of disciplined execution”).

10: FTI Consulting analysis based on licensed subscription data (2025).

11: Samora, Sara, “Form Energy to build first US battery plant in West Virginia,” Utility Dive (January 10, 2023).

12: “Fervo Energy Announces Technology Breakthrough in Next-Generation Geothermal,” Fervo Press Release (July 18, 2023).

13: FTI Consulting analysis based on licensed subscription data (2025).

Related Insights

Published

December 11, 2025

Key Contacts

Key Contacts

Global Practice Leader Power, Renewables & Energy Transition (PRET)

Managing Director

Senior Director

Senior Consultant

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About