Rising Regulatory Scrutiny of RAF Scores

-

August 22, 2022

DownloadsDownload Article

-

In this article, we highlight the heightened regulatory environment associated with RAF scores and the importance of documentation and other related processes to ensure accurate RAF scores.

RAF model purpose

The Risk Adjustment Factor (RAF) model is used by the Centers for Medicare & Medicaid Services (CMS) to estimate the health status and associated costs of Medicare Advantage (MA) beneficiaries and Accountable Care Organization (ACO) members. The RAF Score, comprised of demographic factors (age, gender) and health status, is the actual weight applied to a county benchmark rate to generate the monthly capitated rate paid to a health plan. 1 The documentation supporting a RAF score is of interest to the Office of the Inspector General (OIG); an estimated 8.1% of payments are improper. 2

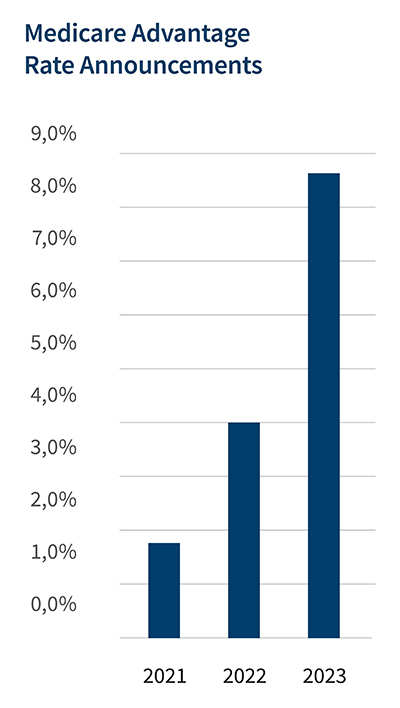

Medicare Advantage rate increase of 8.5%

Approximately 26.4 million people over the age of 65 or with significant disabilities, or 42% of Medicare beneficiaries, are enrolled in MA plans, also known as Medicare Part C. 3 Coverage usually includes not only hospital (Part A) and provider (Part B), but also “primarily health related” benefits such as vision, hearing, dental and wellness. 4 Enrollment is concentrated with the 5 leading organizations representing 77% of market share. 5 The Congressional Budget Office (CBO) (conservatively) projects MA penetration to reach 51% by 2030. 6

The Managed Care Year End Recap 2022 Read Now

CMS pays MA organizations the anticipated (capitated) cost of providing Medicare benefits to a given enrollee, depending on such risk factors as the age, gender and health status of that individual. Capitated incentives have been shown to lower rates of hospitalizations, observation stays, and ED visits, i.e., improve patient outcomes. 7

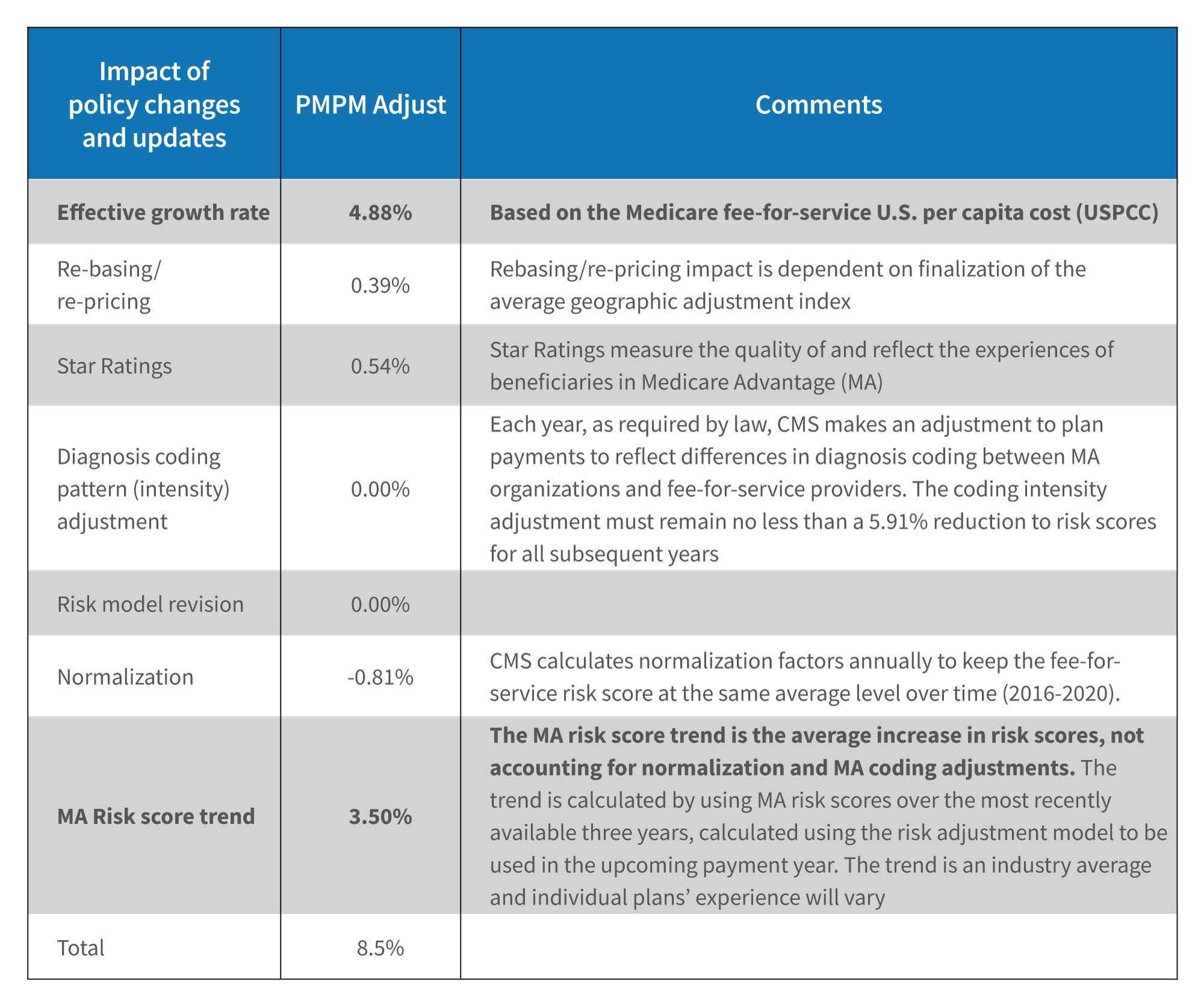

The 2023 MA rate increase of 8.50% was announced on April 4, 2022. 8 The rate is more than double the 4.08% increase of 2022 and a multiple of the 1.66% increase of 2021. 9,10 Of note are the higher effective growth rate, which reflects rising healthcare costs (e.g., nurse staffing, supplies), and the increase in average risk scores. Higher OIG scrutiny is likely, given the latter.

RAF Scores also used by Accountable Care Organizations

A common structure used by CMS to manage value-based initiatives is an Accountable Care Organization (ACO), “comprised of groups of doctors, hospitals, and other health care providers and suppliers who come together voluntarily to provide coordinated, high-quality care at lower costs to their Original Medicare patients.” 11 As of January 2022, there are 483 Medicare ACOs serving over 11 million beneficiaries participating in Medicare Shared Savings Plans. 12 The next- generation ACO model with 35 participants was concluded in December 2021. 13

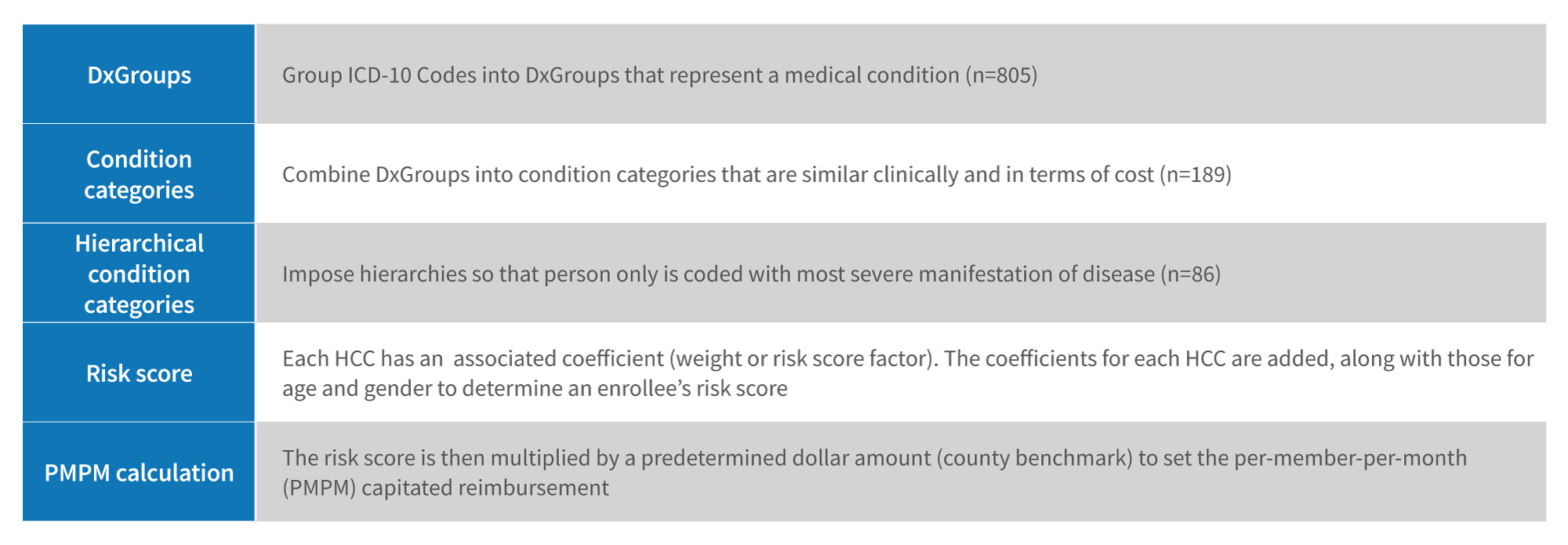

Calculating the RAF Score

The calculation of the risk adjustment factor begins by grouping ICD-10 codes into diagnostic groups (DxGroups) that represent a medical condition. 14 The DxGroups are then combined into condition categories (CCs) that are similar clinically and in terms of predicted costs. 15 Hierarchies are imposed such that a person is coded with the most severe manifestation of disease. 16 A Hierarchical Condition Category (HCC) weight (based on the sum of the individual risk- adjusted factors) is used to risk-adjust Medicare Advantage base rates, the lower of a plan’s bid or benchmark (the average fee-for-service Medicare spending in each county adjusted for demographics and geography).

Medicare Advantage rate driven by effective growth rate and risk score trend

Source: 2023 Medicare Advantage and Part D Rate Announcement. CMS.gov Newsroom (April 4, 2022)

Source: CMS releases 2022 Medicare Advantage and Part D Rate Announcement. CMS.gov Newsroom (January 15, 2021) Source: News: Medicare Advantage plans to get a 1.66% payment increase in 2021. CDI Strategies. (April 9, 2020).

Risk Adjustment Factor methodology

There were 72,616 ICD-10 Clinical Modification codes in 2021. These are mapped to 9,700 ICD qualifying diagnosis and placed into 805 Diagnostic Groups, 189 condition categories and 86 HCC codes, arranged into 19 categories. The HCCs are weighted, to reflect expected beneficiary expenditures.

Source: Medicare Advantage Payment Validation Fact Sheet. Better Medicare Alliance (January 2021).

Aging population, chronic disease and the projected RAF score

The U.S. population is aging rapidly, with an anticipated increase of the 65+ population from 54.8 million in 2020 to 72.1 million in 2030. 17 Growth is highest for the 75-84 cohort, at a compound rate of growth (CAGR) of 4.5%, followed by the 85+ (2.8%) and 65-74 (1.9%) cohorts. 18

The 65+ population will make up approximately 20% of the total U.S. population by 2030. 19

Medicare expenditures are forecast to reach $1,495.1 billion in 2028, with spending per enrollee reaching $20,369; in 2020, total expenditures were $829.5 billion and spending per enrollee was $13,490. 20 The forecast Medicare expenditure compound annual growth rate (CAGR) for 2020-2028 is 7.6%. The rapid rise in spending per enrollee primarily reflects the rising chronic disease burden, i.e., the number of chronic conditions as well as their severity. The RAF score will likely increase during this period.

CMS Center for Program Integrity Audits

The Improper Payments Information Act of 2002 (IPIA; Public Law 107-300), as amended by the Improper Payments Elimination and Recovery Act of 2010 (IPERA; Public Law 111- 204), requires government agencies to identify, report and reduce erroneous payments in the government’s programs and activities. 21 In the process of implementing IPIA/IPERA requirements, CMS conducts Medicare Advantage Risk Adjustment Data Validation (RADV) activities for the purpose of ensuring the accuracy and integrity of risk adjustment data and MA risk-adjusted payments.

RADV audits are conducted retroactively to ensure the accuracy of diagnoses codes, i.e., “verifying that diagnosis codes submitted for payment by a Medicare Advantage plan are supported by medical record documentation [from a face- to-face encounter].” 22

A subset of health plans is selected for audit and a sample of the enrollee’s records is reviewed. The year of data collection (date of service) lags the year of payment, i.e., data from 2021 is used for payment determination in 2022. 23 Medicare Advantage Organizations (MAOs) have 20 weeks to request medical records from providers and prepare a submission. 24 Discrepancies such as an unconfirmed diagnosis, documentation not supporting a diagnosis, and failure to include the provider’s signature (or credentials) are identified and noted. “Misrepresentation of diagnoses clinically and the recapturing of diagnoses erroneously that were never present” may also occur. 25 Improper payments are expected to be refunded, whereas fraud is subject to penalties. 26

Heightened OIG activity noted

Heightened regulatory activity involves myriad factors, including retrospective chart reviews that failed to notify the plan of unsupported codes (triggering false claims liability), in-house assessments by a mid-level credentialed practitioner and reasonableness of diagnosis, electronic medical record features leading to higher-value codes (e.g., auto-populate templates), the issuance of coding guidance inclusive of financial incentives and the use of data mining to identify new patient diagnosis. 27

In April 2021, the Office of the Inspector General announced an investigation into a leading Medicare Advantage plan for not submitting “some diagnosis codes to CMS for use in the risk adjustment program in accordance with Federal requirements.” 28 The OIG assessed the risk scores for a sample of 200 beneficiaries; 1,322 (86.7%) of the 1,525 HCCs had documentation (diagnosis codes) supportive of the classification and 203 HCCs did not. 29 Another 37 HCCs were either misclassified or not considered. 30

In February 2022, an audit performed by the OIG of another Medicare Advantage plan found only 58 (27.4%) of the 212 sampled HCCs had validated documentation, whereas the remaining 154 had diagnosis codes that were unsupported in the medical record. 31

Coding accuracy integral to medical record documentation

As Medicare Advantage enrollment continues to increase and ACOs continue to evolve, it’s important for providers to obtain the appropriate reimbursement for high-risk, chronic care patients. This requires effective “capture” of patient diagnoses at the point of care, as well as proactive risk mitigation.

There are 9,700 ICD-10-CM (Clinical Modification) diagnosis codes categorized into 86 HCC codes. The CMS methodology uses the diagnostic coding history for a patient over the previous calendar year, along with demographic data, to predict future financial utilization and risk. 32 Diagnostic combinations for multiple conditions are either additive or have their own RAF score. 33

The CMS model is refreshed every January 1; documentation requires an update at least once per year. Patients must be seen by a qualified provider in a face-to-face visit annually to identify medical conditions. Chronic conditions are not consistently captured in subsequent years. 34

Insufficient documentation and inaccurate coding represent common provider challenges. 35 Documentation should include MEAT – monitoring signs, symptoms, disease progression, disease regression; evaluating test results, medication effectiveness, response to treatment; assessing ordered tests, discussion, review records; and treating with medications and other modalities. 36 Preparing physicians prior to a visit with a complex, chronic-care patient enhances patient management and documentation. Electronic health record (EHR) tools exist “to better capture, organize and visualize clinical data.” 37 Physician enablement (training) at the point of care may be required.

Rise of in-home care delivery

In the context of an aging U.S. population and rising Medicare Advantage (“Part C”) enrollment, Medicare Advantage Organizations partner with contracted healthcare services organizations to conduct in-home assessments (IHA) in a member’s home or alternative provider setting. IHAs assist plans in the early detection and prevention of chronic conditions, have the potential to identify higher-risk members for care management (i.e., social determinants of health), and offer an added benefit to improve quality and member outcomes. 38 IHAs complement, not replace, the member’s relationship with their primary care provider (PCP).

There are several major organizations capable of conducting IHAs. The competitors in this space continue to evolve and employ solutions leveraging technology-enabled clinical documentation platforms for real-time capture or recapture of HCC risk-adjusted chronic conditions. 39

Common focus areas of IHAs include:

Quality-focused opportunities for members with open gaps in care

- HgA1c control for patients with diabetes (HBD), blood pressure control with diabetes (BPD), eye exam for patients with diabetes (EED), kidney evaluation for patients with diabetes (KED), statin therapy for patients with diabetes (SPD)

- Colorectal cancer screening (iFOBT Kit

- Peripheral artery disease screening

- Obesity screening (BMI)

Mental/Behavioral

- Depression and mini-mental status screening

Functional/Medication

- Care for Older Adults (COA) (e.g., medication review functional status assessment, pain assessment)

Environmental

- Social Determinants of Health (SDOH)

- Direct clinical observations that impact the member’s safety and health risks

Utilizing IHAs comes with some compliance considerations that MAOs must manage:

- Ongoing provider training and education, specifically on the use of screeners, disease-specific criteria, and diagnostic testing (i.e., QuantaFlo alerts and waveform recognition)

- Clinical guidance should be evidence-based or represent best industry practice updated regularly, instructive and non-leading

- Clinical documentation should be robust, and QA audits should be performed on a timely basis to ensure the documentation is accurate and reflects the member’s current clinical picture, and the clinical evidence supports the capture or recapture of the condition

- Best practices are to ensure the member’s PCP is informed after the visit, and potential care gaps and care coordination efforts are clearly communicated

Bottom line

The United States invests tremendous resources into the Medicare Advantage program, and given the population and medical cost trends, that investment will materially increase, inviting more and more regulatory oversight.

Payers, providers and service organizations operating in the Medicare Advantage marketplace need to effectively balance being fairly compensated for the health care risks being managed while remaining fully compliant with CMS regulations. Investments in both analytics and in compliance and control processes drive insights into performance optimization opportunities and yet allow organizations to effectively manage the risks inherent in Medicare Advantage and other governmental healthcare programs. The financial incentives associated with a successful risk-adjustment operation are so significant that most cost–benefit analyses require small performance gains to easily meet corporate investment hurdles.

Organizations that invest in processes and insights are also the most prepared for overall success in Medicare Advantage and are best prepared to navigate potential regulatory audits and/or investigations.

Footnotes:

1: Matt Westfall. Risk Adjustment and the ABCs of HCCs. Lightbeam Health Solutions. (Last visited June 3, 2022). https://lightbeamhealth.com/risk-adjustment-and-the-abcs-of-hccs/

2: Christi Grimm, Principal Deputy Inspector General. Medicare Advantage Compliance Audit of Diagnosis Codes That Humana Submitted to CMS. (April 2021). https://oig.hhs.gov/oas/reports/region7/71601165.pdf

3: Meredith Freed, Jeannie Fuglesten Biniek, Anthony Damico, Tricia Neuman. Medicare Advantage in 2021: Enrollment Update and Key Trends (June 21, 2021). https://www.kff.org/medicare/issue-brief/medicare-advantage-in-2021-enrollment-update-and-key-trends/

4: Meredith Freed, Anthony Damico, Tricia Neuman. Medicare Advantage 2022 Spotlight: First Look (November 22, 2021). https://www.kff.org/medicare/issue-brief/medicare- advantage-2022-spotlight-first-look/

5: Meredith Freed, Jeannie Fuglesten Biniek, Anthony Damico, Tricia Neuman. Medicare Advantage in 2021: Enrollment Update and Key Trends (June 21, 2021). https://www.kff.org/medicare/issue-brief/medicare-advantage-in-2021-enrollment-update-and-key-trends/

6: Ibid.

7: Suhas Gondi, Yong Li, Dana Drzayich. Analysis of Value-Based Payment and Acute Care Use Among Medicare Advantage Beneficiaries. JAMA Network (March 17, 2022). https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2790209

8: 2023 Medicare Advantage and Part D Rate Announcement. CMS.gov Newsroom (April 4, 2022). https://www.cms.gov/newsroom/fact-sheets/2023-medicare-advantage-and-part-d-rate-announcement#_ftn1

9: CMS releases 2022 Medicare Advantage and Part D Rate Announcement. CMS.gov Newsroom (January 15, 2021). https://www.cms.gov/newsroom/press-releases/cms-releases-2022-medicare-advantage-and-part-d-rate-announcement

10: News: Medicare Advantage plans to get a 1.66% payment increase in 2021. CDI Strategies. (April 9, 2020). https://acdis.org/articles/news-medicare-advantage-plans-get-166-payment-increase-2021

11: Next Generation ACO Model. CMS.gov (Last visited May 5, 2022). https://innovation.cms.gov/innovation-models/next-generation-aco-model

12: All About ACOs. National Association of ACOs. (Last visited June 3, 2022). https://www.naacos.com/about-acos

13: CMS’ Next Generation Accountable Care Organization (NGACO) Model Set to End in December 2021. The National Law Review. (June 2, 2021). https://www.natlawreview.com/article/cms-next-generation-accountable-care-organization-ngaco-model-set-to-end-december

14: Understanding Medicare Advantage Payment and Policy Recommendations. Better Medicare Alliance (September 2018). https://bettermedicarealliance.org/wp-content/uploads/2020/03/BMA_WhitePaper_MA_Bidding_and_Payment_2018_09_19-1.pdf

15: Ibid.

16: Ibid.

17: 2017 National Population Projections Datasets: Projected Population by Single Year of Age, Sex, Race, and Hispanic Origin for the United States: 2016 to 2060. United States Census Bureau (2017). https://www.census.gov/data/datasets/2017/demo/popproj/2017-popproj.html.

18: Ibid.

19: Jonathan Vespa, Lauren Medina, and David M. Armstrong. Demographic Turning Points for the United States: Population Projections for 2020 to 2060. United States Census Bureau (last revised February 2020). https://www.census.gov/content/dam/Census/library/publications/2020/demo/p25-1144.pdf.

20: National Health Expenditures, Projected; Table 17. Centers for Medicare & Medicaid Services (last visited March 1, 2022). https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsProjected.

21: HHS Compliance with the Improper Payment Elimination and Recovery Act. U.S. Department of Health & Human Service Office of Inspector General. (Last visited May 24, 2022). https://www.oig.hhs.gov/reports-and-publications/workplan/summary/wp-summary-0000443.asp#:~:text=The%20Improper%20Payments%20Information%20Act,that%20may%20be%20susceptible%20to

22: Medicare Advantage Payment Validation Fact Sheet. Better Medicare Alliance (January 2021). https://bettermedicarealliance.org/wp-content/uploads/2020/03/BMA_OnePager_Medicare_Advantage_Payment_Validation_2017_06_29_Updated-2021.pdf

23: Medicare Advantage Risk Adjustment Data Validation (RADV) Training. CMS (Last visited May 6, 2022). https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-Risk-Adjustment-Data-Validation-Program/Other-Content-Types/RADV-Docs/RADV- Industry-Slide-Deck.pdf

24: Ibid.

25: Planning Ahead For Strict HCC Compliance Protocols: Key Findings From 400 RADV Audits, 2011-2021. DoctusTech (Last visited May 9, 2022). https://www.doctustech.com/wp-content/uploads/2021/07/DoctusTech-RADV-Audits-Whitepaper.pdf

26: Improper Payments Fact Sheet. CMS.gov Newsroom. (November 15, 2021). https://www.cms.gov/newsroom/fact-sheets/improper-payments-fact-sheet#:~:text=Improper%20 Payment%20Reporting%20Criteria,payments%20greater%20than%20%24100%20million.

27: ulie Nielson, Steven Hamilton. Medicare Advantage: Reimagining Risk Mitigation for Medicare Advantage Organizations. Blue Cross Blue Shield National Summit 2022.

28: Christi Grimm, Principal Deputy Inspector General. U.S. Department of Health & Human Services Office of Inspector General (April 2021, A-07-16-01165). https://oig.hhs.gov/oas/reports/region7/71601165.pdf

29: Ibid.

30: Ibid.

31: Report in Brief. U.S. Department of Health & Human Services Office of Inspector General (February 2022, A-01-19-00500). https://oig.hhs.gov/oas/reports/region1/11900500.pdf

32: Medicare Advantage Payment Validation Fact Sheet. Better Medicare Alliance (January 2021). https://bettermedicarealliance.org/wp-content/uploads/2020/03/BMA_RiskAdjustment_WhitePaper_2018_02_27_v2a.pdf

33: Ibid.

34: D. Scott Jones. HCC’s and Providers: Get Paid for What You Do! Augusta Care Partners, Slide 15 (December 2, 2019). https://assets.hcca-info.org/Portals/0/PDFs/Resources/Conference_Handouts/Regional_Conference/2019/Richmond/04_HCCs%20and%20Providers.pdf

35: Get the right reimbursement for high-risk patients. A proven strategy for managing Hierarchical Condition Categories (HCCs) in your EHR. Intelligent Medical Objects (Last visited May 9, 2022). https://go.imohealth.com/rs/699-LAE-696/images/Get%20the%20right%20reimbursement%20-%20White%20Paper.pdf?mkt_ tok=Njk5LUxBRS02OTYAAAGEOqb8x4RrR7Rao6I9p3jJNBeajRBqnm_rGB7BP1XJFcda6FvH2nsC2TcxQRA_qz2Glu0guLP1Z8vpejLHIQnSKyjDcN-5azqfT1NhJQQWDg

36: Michelle Dick. Include MEAT in Your Risk Adjustment Documentation. AAPC (March 5, 2018). https://www.aapc.com/blog/41212-include-meat-in-your-risk-adjustment-documentation/

37: Get the right reimbursement for high-risk patients. A proven strategy for managing Hierarchical Condition Categories (HCCs) in your EHR. Intelligent Medical Objects (Last visited May 9, 2022). https://go.imohealth.com/rs/699-LAE-696/images/Get%20the%20right%20reimbursement%20-%20White%20Paper.pdf?mkt_ tok=Njk5LUxBRS02OTYAAAGEOqb8x4RrR7Rao6I9p3jJNBeajRBqnm_rGB7BP1XJFcda6FvH2nsC2TcxQRA_qz2Glu0guLP1Z8vpejLHIQnSKyjDcN-5azqfT1NhJQQWDg

38: In-home health Evaluations: Identify Risk Factors and Close Gaps in Care. Signify Health. (Last visited June 3, 2022) https://www.signifyhealth.com/solutions-in-home-health-evaluations

39: 3M CDI Innovation Webinar Series: Leveraging Technology to Capture HCCs Across the Continuum. (May 27 & 28, 2020) https://multimedia.3m.com/mws/media/1845666O/3m-webinar-leveraging-technology-to-capture-hccs-across-the-continuum-attendee-handout.pdf

Related Insights

Related Information

Published

August 22, 2022

Key Contacts

Key Contacts

Senior Managing Director

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About