U.S. Renewable Energy M&A: Review of 2021 and Outlook for 2022

-

January 24, 2022

DownloadsDownload Article

-

In a year in which both global and U.S. M&A activity in aggregate reached record levels1, renewable energy M&A contributed to the mix in terms of high deal volume and landmark transactions. Robust demand in the sector was supported by persistently low interest rates, Environmental, Social and Governance (“ESG”) considerations, and aggressive renewable energy and decarbonization targets. The market for renewable energy assets, portfolios and platforms remained hot, despite industry headwinds that included disruptions to supply chains, trade developments that negatively impacted the sector and policy uncertainty.

As we move into the year ahead, we expect deal flow to remain strong as sector incumbents consolidate their positions while new participants seek viable entry points. Realizing acceptable risk-adjusted returns will become all the more challenging given the hypercompetitive market, tightening (though still accommodative) monetary policy, the supply chain overhang from the pandemic and the worsening trade situation with China. As investors vet opportunities, they will consider new business models, sub-sectors and emerging technologies, and approaches that go beyond traditional norms as they seek to optimize returns.

2021 Review

Established technologies continued to comprise the bulk of M&A activity in 2021, led by solar, with utility scale solar at the forefront but also including important deals in the distributed space. Importantly, solar transactions including a storage element were prevalent. The volume of wind assets trading hands was also strong and, as expected, dominated by onshore projects, with limited but notable deals in offshore as the sector continued to rapidly develop and incumbents sought out partnerships to enhance expertise and financial strength. Of particular note, while asset and portfolio acquisitions were prevalent, platform acquisitions defined renewable energy M&A in 2021 as strategic and financial players consolidated the developer space seeking to enhance their presence in the market and access higher returns relative to those in the highly competitive project market.

The number of investor participants and volume of activity in the renewable energy sector continued to expand. While strategic and financial players including utilities, IPPs and investment funds continue to lead the sector, others such as oil & gas majors, insurance companies, and pension and sovereign wealth funds are entering the market on an accelerated basis. From a corporates standpoint, large U.S. technology companies, such as Amazon, Google, Microsoft, Meta and others, continue to have a major presence in sustainability and renewable energy procurement, but new corporate entrants across retail, telecommunications, pharmaceuticals and other industries are emerging in greater numbers with renewable energy targets of their own. And although corporates have historically focused on procuring renewable energy from offsite utility-scale projects through offtake arrangements, Apple2 and others have announced plans to invest directly in renewable energy projects. We anticipate more announcements along these lines in 2022 and beyond as corporates expand their participation from offsite renewables procurement to direct ownership of projects and portfolios of projects.

While net-zero commitments from utilities and corporations are at record levels, U.S. federal energy policy continues to be an area of uncertainty. The recent passing of the Infrastructure Investment and Jobs Act3 in November 2021 included $7.5 billion to build out nationwide electric vehicle (“EV”) charging stations and over $65 billion to upgrade and expand transmission capabilities. However, lack of passage by the Senate has put Biden’s flagship Build Back Better Act (“BBB”) in limbo as we transition into 2022. The proposed bill included $555 billion for climate change and clean energy, with $320 billion allocated toward the extension and expansion of tax credits, as well as a direct pay mechanism. While renewable energy investment and M&A activity is likely to thrive without the passing of BBB, there is still the possibility that the bill will pass in some form in 2022 that includes substantial support for clean energy. If so, this would supercharge growth, investment and M&A activity in the space.

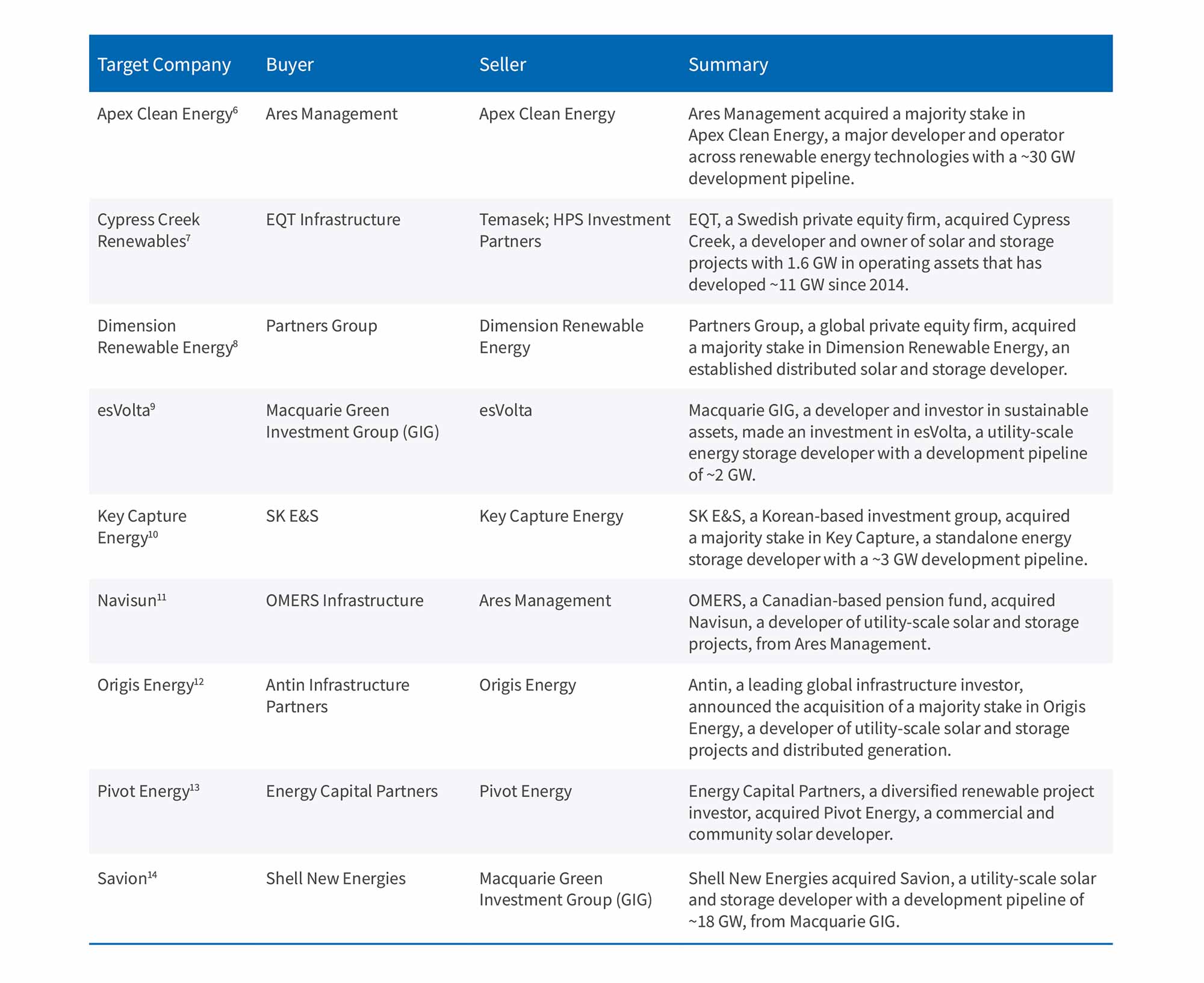

Development Platforms

In what was arguably the most prolific trend in 2021 renewable energy M&A, the market witnessed a significant uptick in well-known and diversified renewable energy developer platform acquisitions, predominantly by financial investors. There are numerous factors driving this trend; key among these are the desire to access development expertise as well as large portfolios of early stage-stage projects and the potential for attractive returns. Downward compression on implied returns from the purchase of mature, de-risked renewable energy projects, primarily by well-funded core infrastructure funds, has made this alternative all the more compelling. With investors looking for means to optimize returns, acquiring developer platforms has become a common strategy. Notable 2021 platform acquisitions are outlined in the table on the following page.

In addition to 2021 deals, the new year got off to a strong start with major investments by Blackstone4 in Invenergy and by Global Infrastructure Partners (“GIP”)5 in Brightnight, a solar and energy storage developer. Other platforms, including Blue Wave, were in the sales process as of print, and the list of prominent independent developers with large portfolios of projects continues to shrink. Notable names that could garner significant investor interest include 8minute Solar Energy, and Summit Ridge Energy. We see track record and scale being key drivers, with experienced management teams that have large, high-quality project pipelines commanding valuation premiums. Time will tell if the platform investment theme lives up to investor expectations, with entry price, structuring considerations and successful execution on development portfolios all key considerations. We do see some embedded risk given what appear to be relatively elevated valuation levels combined with the inherent uncertainty associated with development.

Residential

Last year included notable residential solar deals, driving both industry consolidation and vertical integration. On the latter, in December 2021, ADT closed its acquisition of Sunpro15, which designs, installs and maintains solar panels for residential and commercial customers in the United States. Significantly, this deal combines complementary services for residential homeowners by integrating home security, automation and energy management — including solar and energy storage — into a single platform. Given that ADT currently has over 6 million U.S. customers, the transaction creates significant potential revenue synergies through the cross-sale of solar and energy storage offerings to ADT’s existing home security clients.

With respect to consolidation in the residential solar space, deals involving household residential solar names include SunPower’s acquisition of Blue Raven Solar16 and Sunnova’s acquisition of SunStreet. Blue Raven expands SunPower’s geographic footprint, and the acquisition was announced in conjunction with SunPower exploring strategic alternatives for its Commercial & Industrial Solutions division in order to further enhance its focus on the residential segment. With SunStreet, which was previously a subsidiary of Lennar, Sunnova is able to leverage its existing residential platform to offer solar and storage to the high-growth new home communities space, as well as to provide battery storage to SunStreet’s existing customers. Each of the three highlighted residential M&A deals represent unique opportunities to access growth via new markets and to offer customers an expanded portfolio of service offerings. We expect continued M&A activity in the residential space as the popularity of EVs and home solar and storage grows in the coming years.

Energy Storage

In FTI Consulting’s 2020 M&A Spark Note, we noted hybrid and standalone energy storage projects as one of the fastest-growing renewable energy subsectors of 2020. This trend continued into 2021, a strong year for installations, and a substantial development pipeline will support growth going forward. M&A activity in the sector kept pace with significant deals in the hybrid and standalone segments, and more broadly as developers and investors sought to capitalize on the increased need to address grid stability and renewables intermittency, capture incremental revenue streams and pursue outsize returns. On the capital markets side, the successful listing of Fluence further underlined the breadth of investor interest in the sector.

Notable deals in 2021 included several platform investments referenced in the section above as well as acquisitions on the project and portfolio side from strategics and financial players, including Hanwha Q-Cells, Capital Dynamics, Axium Infrastructure and others. In addition, there was significant activity across the value chain, with examples including Trilantic North America and Energy Impact Partners taking a controlling stake in Powin18, a major battery storage integrator, and Eos Energy Enterprises’ purchase of the remaining stake in HI-POWER19, a U.S.-based multi-GW manufacturer of zinc batteries for industrial-scale energy storage. We expect to see significant additional investment across the energy storage value chain, propelled by the sector’s dynamic growth prospects and continuing decreases in levelized costs. The potential emergence of tax credits for standalone storage projects through the BBB or other legislature is also a potential gamechanger that the industry will be monitoring closely.

Energy Transition and Oil & Gas

The energy transition is prolific across many industries, but oil & gas majors continued their commitment to an increasing focus in the area in 2021. We are seeing a strategic shift by energy majors to allocate more capital to renewable and clean energy technologies, evidenced by landmark announcements of sustainability and clean energy commitments, and the build-out and acquisition of low-carbon assets and businesses. The strategy is driven by a number of factors, including pressure from ESG investment trends and acknowledgment by the majors that the long-term viability of their businesses requires an energy mix transition toward renewables. For example, (1) ExxonMobil committed20 to invest $15 billion through 2027 in a lower-carbon future, including projects that reduce greenhouse gas emissions and increased investment in its Low Carbon Solutions business, and (2) Shell committed21 to net-zero emissions by 2050 through the reduction of investments in upstream oil production and increased investments in low-carbon businesses.

In recent years, the investment focus within the clean energy space for both European- and U.S.-based energy majors has primariy been on solar and wind, but that is now expanding further into adjacent areas. On the M&A front for energy majors in 2021, we saw Shell acquire Inspire Energy Capital22, a renewable energy residential retailer, and BP acquired both AMPLY Power23, a U.S. EV charging and energy management provider for vehicle fleets, and a 9 GW pipeline of U.S. solar development projects from 7X Energy24. As energy majors work toward their energy transition and sustainability commitments, expect to see further investments in renewable energy, particularly offshore wind, and more broadly in the energy transition including hydrogen, biofuels, E-mobility, and carbon capture and storage projects.

Outlook for 2022

The pursuit of financial returns

With an ever-increasing flow of capital into the sector — both debt and equity – investors continue to move up the value chain to find value and opportunity to quickly scale operations. As noted above, developer platforms provide expertise and a pipeline of projects in various stages of maturity that make them an attractive centerpiece, especially for financial investors. This trend will most certainly continue in 2022 with a rapid consolidation of the remaining marquee development platforms. As the pool shrinks, we also expect less-well-known names to become targets along with earlier-stage development projects. For many investors, this approach offers a short bridge into the solar, hybrid solar plus storage and standalone storage arenas, as they continue to scale in 2022.

Supply chain and other challenges for project developers

Supply chain disruption continues to impact many industries and is certainly affecting the U.S. renewable energy sector due to its heavy reliance on foreign raw-materials sourcing and components manufacturing. These vulnerabilities have been intensified by degrading trade relations with China, including President Biden signing the Uyghur Forced Labor Prevention Act into law in late December. The law gives the U.S. government additional tools to prevent goods originating in the Xinjiang region from entering U.S. markets and will further impact the solar supply chain given the volume of polysilicon sourced from Xinjiang. The predictable results of these supply chain issues are project delays and increased costs for developers that further lead to disruptive effects on contractual arrangements and financing commitments. As these challenges continue in 2022, we will see developers possibly seek alternative suppliers and different sourcing strategies and looking to pass on some of the risk and cost to other parties in the value chain. These supply chain issues will affect small developers more, given they lack strong purchasing power, capital and material resources.

Other issues continuing into 2022 include rising costs of many critical raw materials utilized in the industry. Polysilicon, the main raw material in PV manufacturing, saw a 300% price increase25 since January of 2020. Lithium, the main resource used in battery storage, has increased approximately 400% since the start of 202126. These dramatic price increases have reignited debate on expanding mining operations in the United States for resource alternatives. Over a longer time horizon, many of these renewable energy technologies may need to adapt or even pivot to employing alternative technologies, supply chains or business models that solve such disruptive or scarcity issues affecting the overall value of renewable energy projects.

Policy environment will support a favorable renewables market in 2022

As discussed above, Congress passed the $1.2 trillion Infrastructure Investment and Jobs Act focused on modernizing the power grid and paving the way for new clean energy sources. Importantly, we will start to see the associated flow of federal dollars into state and regional projects having the desired effect on the U.S. economy and the energy sector specifically. As an example, utility grid upgrades will include the expansion of EV charging across the United States along with opportunities for hydrogen fueling, which will help accelerate the transition to EV transportation and alternative fuels. Climate change remains a top priority for the current administration, and we do not see any letup in the effort to pass federal legislation, utilize executive authorization and put pressure on the private sector to enact policy towards decarbonization. The renewable energy market would see significantly enhanced tailwinds if some version of the BBB or a similar legislative package were to become law. Encouragingly, the climate measures in the BBB do not appear to be divisive, which bodes well for the industry.

In addition, at the local level, many states and municipalities have implemented policies that encourage a transition to renewable energy. We expect this trend to continue as the cost advantages, availability and need become increasingly apparent to the public at large and as more states, localities and corporations commit to a renewable energy future. Given that the current renewable generation mix in the United States is 20%, we are encouraged by the factors that will make this trendline continue its upward slope.

Transaction activity will continue to be robust through 2022

Due to many of the same market forces that drove an active 2021, the new year portends to be exceedingly busy with M&A transactions and capital-raising activities across the renewable energy space. A significant amount of this activity will continue to focus on solar, wind and related energy-producing assets. These assets continue to perform well for investors, providing an attractive long-term value proposition, and may contain other important elements such as Renewable Energy Credits (RECs), ESG qualifications and portfolio diversity. Other factors such as improving technology, operating and financial efficiencies, and low-cost capital will contribute toward another year of strong M&A activity.

With an eye toward expansion, investors and capital market participants are gaining comfort with relatively new sectors, including standalone battery storage, carbon sequestration and hydrogen projects. New technologies and their application are forcing new business models and capital structures to contend with noncontractual revenue streams, shorter project life cycles and new valuation methodologies. All of this spells opportunity for those capital market participants that can be innovative, flexible and apply new thinking to these new and expanding market opportunities.

How FTI Consulting’s Power, Renewables & Energy Transition Team Can Help

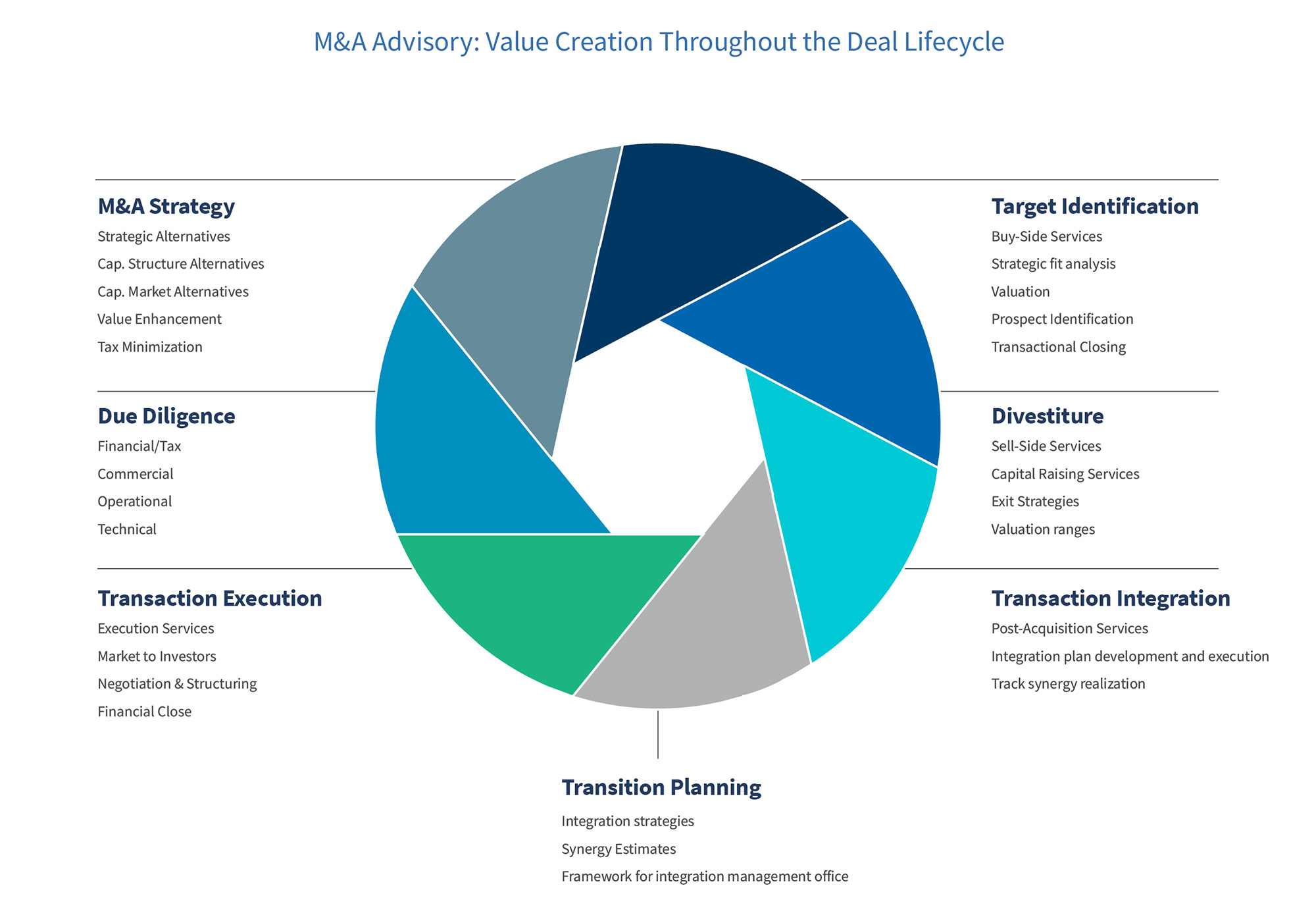

FTI Consulting’s Power, Renewables & Energy Transition professionals have functional expertise across the life cycle of renewable energy transactions. Our seasoned team provides tailored services for strategic and financial investors, creditors and corporates and has deep experience with renewable energy platforms, projects and portfolios.

Through our wholly owned investment banking subsidiary, FTI Capital Advisors, we provide tactical strategic advice, buy- and sell-side advisory and capital-raising services. Our seasoned investment bankers have significant transactional experience in developing solutions and executing assignments in the U.S. capital markets for a wide variety of clients. As an independent investment bank, we are free of conflicts, enabling us to provide clients with unbiased and uncompromising advice and execution capabilities.

In addition, our FTI Consulting team members have deep experience in transaction advisory, financial due diligence, strategy and operations. We assist leading strategic and financial investors across all stages of the transaction life cycle, including the evaluation of strategic alternatives, transaction due diligence, deal execution and transaction integration.

Footnotes:

1: https://www.mergermarket.com/pdf/M&A_highlights_FY_2021.pdf

7: https://ccrenew.com/news/cypress-creek-announces-close-of-sale-to-eqt/

13: https://www.pivotenergy.net/blog-company-expansion-ecp-and-pivot-energy/

14: https://www.shell.com/media/news-and-media-releases/2021/shell-acquires-savion.html

Published

January 24, 2022

Key Contacts

Key Contacts

Global Practice Leader Power, Renewables & Energy Transition (PRET)

Senior Managing Director

Managing Director

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About