The State of Play: UK Real Estate Outlook 2026

Slow AI Adoption, Few Expectations of a Recovery in 2026 and Offices Offering the Most Value

-

January 27, 2026

DownloadsDownload Report

-

With an increase in transaction volumes in 2025, can this be seen as a sign of recovery in the real estate sector in 2026?1 Whilst those numbers paint an initial picture, they don’t provide a full one, so we asked those in the industry what they see when it comes to outlook and expectations for the sector in the year ahead. How is activity looking for key asset classes? Is the picture different regionally across the UK? What level of AI adoption will be seen in the industry?

Interest Rates, Cautious Optimism and Tempered Expectations

Though more interest rate cuts are expected, the vast majority of respondents see the sector remaining at current levels. 60% of respondents believe that UK interest rates will be at 3.5% or below by the end of 2026, continuing the downward trend of the last three years and providing further fuel to an expected recovery in the sector.2 However, while 34% of respondents are expecting a cyclical upswing for the real estate sector in 2026, almost twice as many (64%) expect the sector to hover around the same level, with the remaining 2% expecting a downward trend. These findings reinforce the view that for those holding properties back from the market, waiting for interest rates cuts or yield compression isn’t a viable strategy in itself. Instead, investors will have to take active steps to innovate to create value.

Offices Offer Best Value but Data Centres Are Front and Centre

Offices Offer Best Value but Data Centres Are Front and Centre Offices are the top pick in terms of value, but data centres reign supreme when it comes to anticipated levels of investment. With the COVID-19 driven expectations of mainstream working from home now seen as the illusion that many in industry predicted, the office sector is firmly back on investors’ radars with 55% of respondents believing it is the most underpriced asset class and therefore offering the best value. London offices are seen as the most underpriced, attracting 31% of the total, with the balance opting for the regions.

Shopping centres are also displaying phoenix-like characteristics, with 25% of respondents seeing it as the most undervalued, suggesting that this asset class has fully rebased and offers opportunities for value creation for those who make their move.

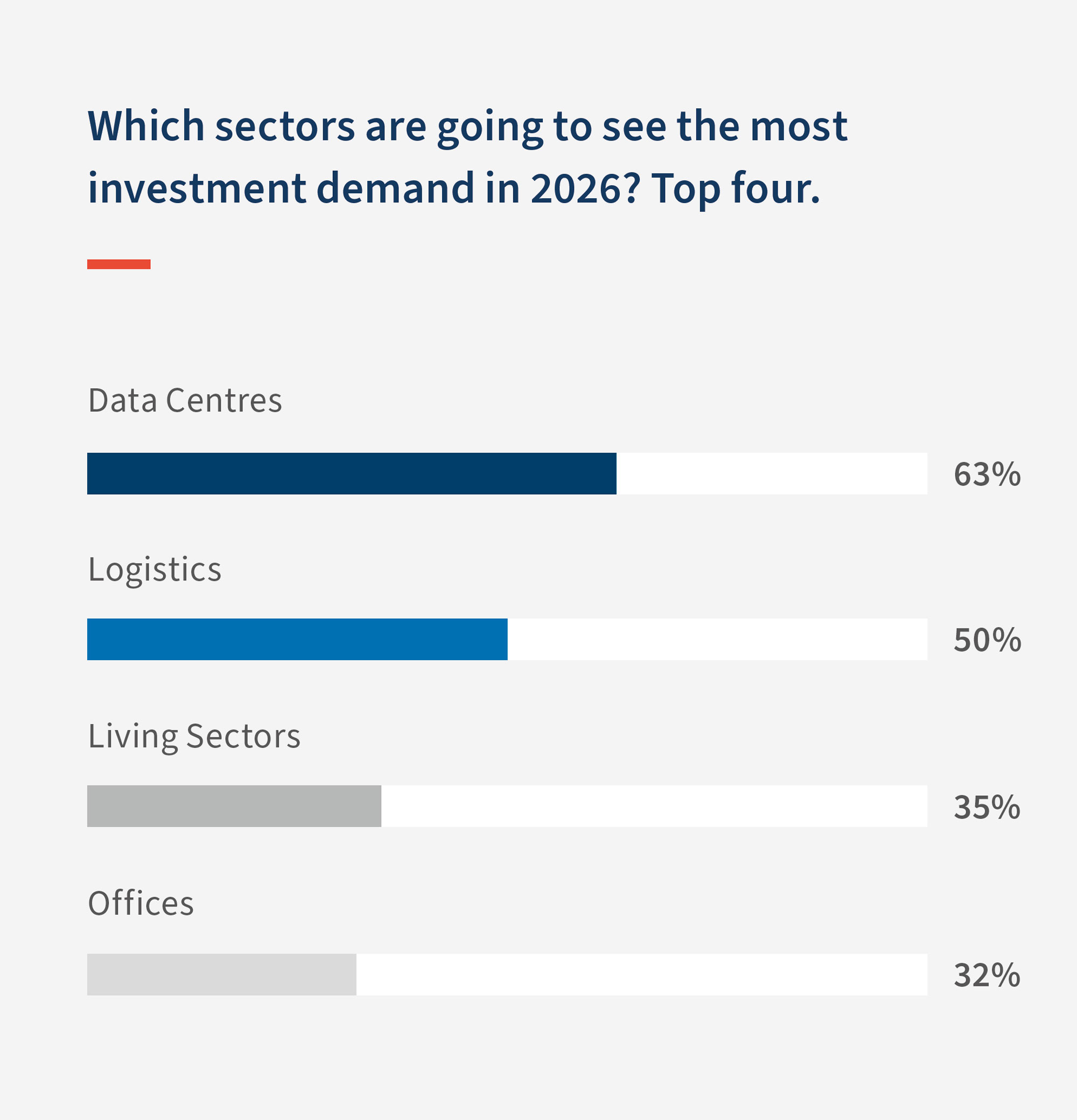

However, confidence in the latent value of the office and shopping centre sectors did not translate into expected investment flows, where despite increasing talk of an AI bubble,3 data centres was the clear winner with 63% of respondents selecting it among the sectors they believe will attract the most investment.

Capital Conundrum, London Is the Investors’ Clear Favourite but Construction’s Potential Achilles Heel

London crushes the regions as the preferred location for investment, but a large minority see the capital’s construction market as a bust. London continues to dominate as investors’ preferred location for investment, attracting a whopping 81% of the vote. Manchester was the clear winner in the regions with 12% of the votes, far outstripping Bristol, Birmingham and Newcastle, which received just 3%, 2% and 2%, respectively. Despite being the destination of choice, the London construction market was seen as being stable by two-thirds of respondents, with 5% seeing it as booming. Perhaps alarmingly however, a signification proportion (29%) see it as a bust.

Is AI N/A?

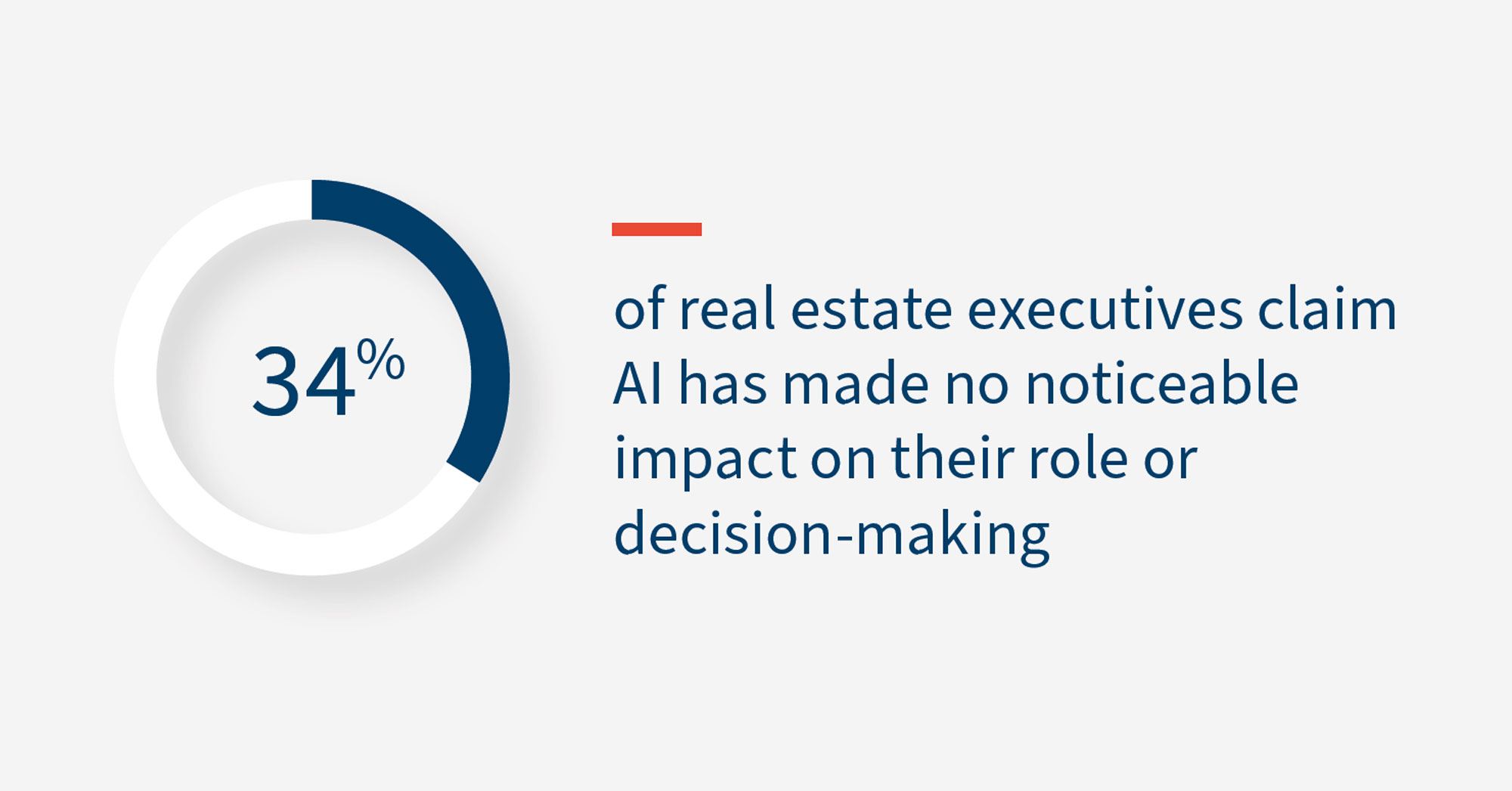

The real estate industry is yet to be convinced by AI with over a third saying it made no difference to their day-to-day job and only around one in ten using it at an asset level. Whilst AI may be attracting billions of pounds of investment elsewhere, the real estate sector is yet to be fully convinced about its impact on day-to-day work, with 34% of respondents saying it has made no noticeable difference to their role or decision-making in 2025 and 3% noting they didn’t use it at all. Of those that were using it, the majority (52%) said it increased efficiency for market research and due diligence, with 29% using it for improving forecasting and analysis. At a real estate operational level AI adoption was very low, with just 12% saying it streamlined property management and only 5% using it to enhance tenant experience.

Footnote:

1: Noortje Franssen ,“Commercial real estate volume continues to rise,” CBRE (October 14, 2025)

2: “Interest rates and Bank Rate: our latest decision,” Bank of England (December 18, 2025)

3: Ankit Pathak, “Are We Living In An AI Bubble? Why Leaders Can’t Afford To Sit It Out,” Forbes (January 12, 2026)

Published

January 27, 2026

Key Contacts

Key Contacts

Senior Managing Director, Head of EMEA Tax Advisory & Real Estate

Senior Managing Director

Senior Managing Director

Senior Managing Director

Senior Managing Director